2024 Fundraising & Valuation Insights

Recent fundraising and equity data from Carta and some insights on what companies should be thinking about when fundraising

Today’s Sponsor: Leapfin

Finally! The answer to your Stripe <> NetSuite problem

When it comes to payment processing, Stripe is great. But for revenue reporting and month-end close? Not so great. Getting Stripe data into NetSuite is a struggle. And connecting those tools directly creates more problems than it solves.

“But what about connectors like Boomi and Celigo? Or Stripe Rev Rec?” Yup, I’ve heard from those users too. 12-18 months of headache before realizing it was a huge mistake. Do yourself a favor and check out Leapfin.

Watch this quick video to see how Leapfin fixes your Stripe <> NetSuite problem.

Fundraising Data

Unless your company is super hot, plan as if you will not be able to raise another round of funding. Companies are still getting funded but most investors want one of the following:

An AI founder/team with a previous track record (revenue not required :)

High revenue growth relative to stage AND efficient

Need an AI story (and implementing it) if you are traditionally pure SaaS

Fundraising rounds are still happening (many are at 2021-type valuations), but the volume is WAY down. VCs are willing to give high valuations but A LOT less companies are getting them.

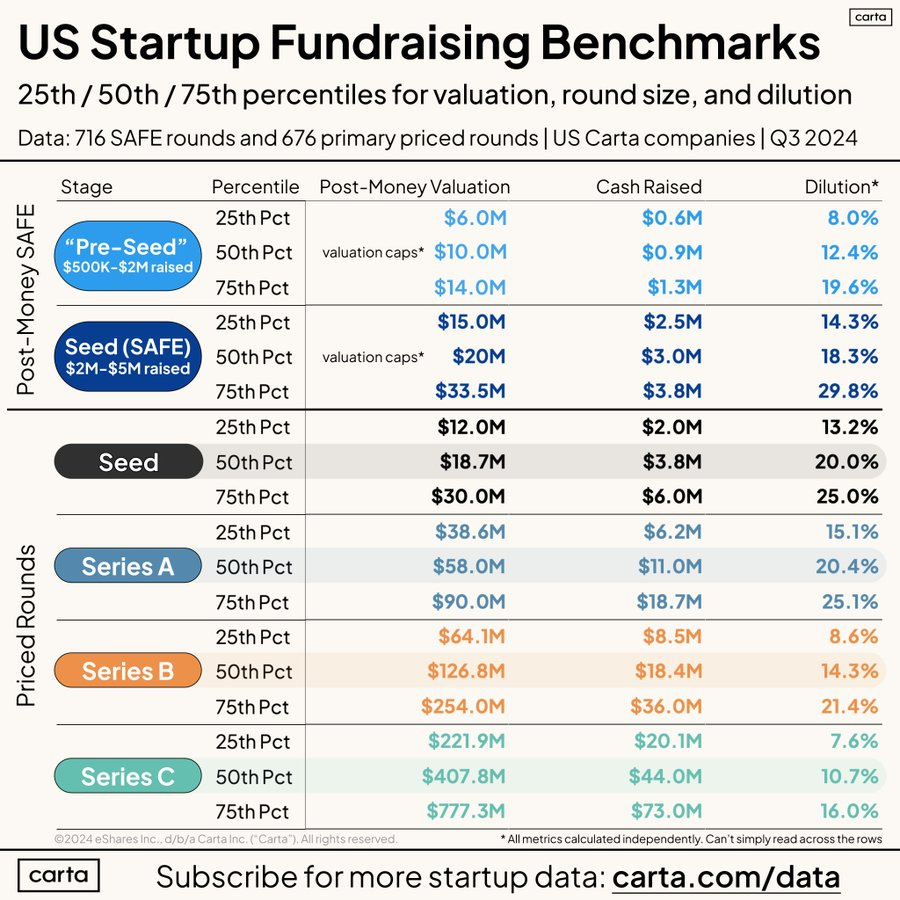

Valuations, Cash Raised, & Dilution

Interesting data for those raising (or thinking about raising). Understand the typical valuations, cash raised, and dilution at each stage for 2024.

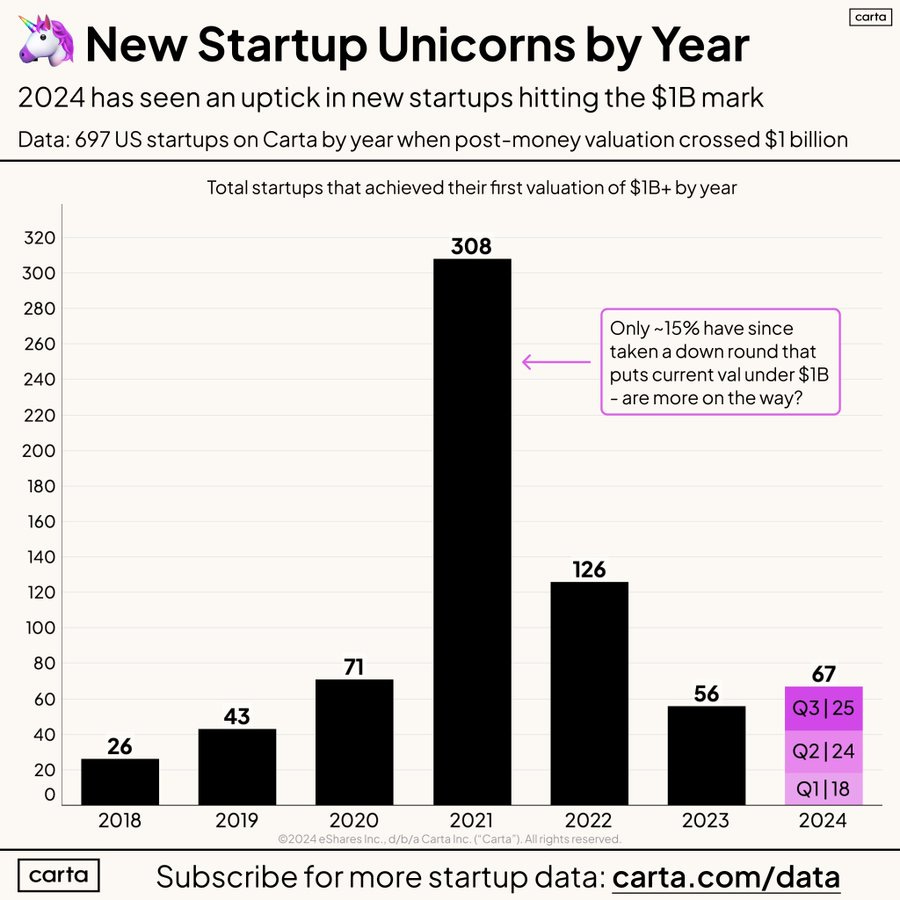

Unicorns are not cool…

“Unicorn” is not a cool term anymore. It has taken on a negative connotation - overvalued and over funded companies with limited (if any) employee equity upside.

It is interesting to see that only 15% of 2021 Unicorns have taken a down round that puts them under a $1B valuatoin. This is probably because a lot of these Unicorns:

Raised so much money they haven’t needed to take a down round yet

Got a flat/up round with a “dirty term sheet” (more on this below)

Slashed cash burn and now they are just coasting (became a “Zombiecorn”)

The number of these Unicorns that will shut down (or sell for pennies on the dollar) in 5 years will be MUCH higher than most think.

2024 is again seeing an uptick in Unicorns being minted (almost all AI startups). There is a good chance that venture returns from the 2024 vintage will be worse than 2021…AI has been so hot that deals are being done at insane valuations with little actual traction.

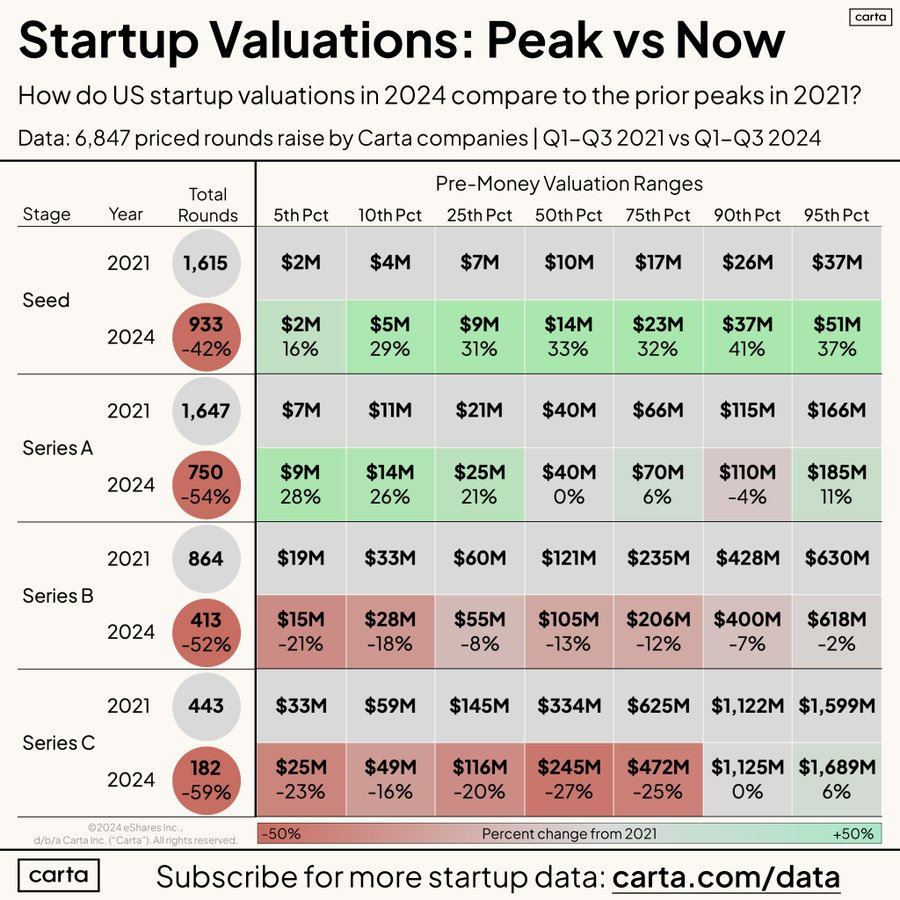

2021 vs 2024 Valuations by Stage

More VCs have moved to investing in earlier stage companies and the valuations at these stages have increased. While overall deal volume has decreased, competition for hot companies at the Seed and Series A rounds have increased. Meanwhile, later stage company fundraising has slow signficantly given the risk/reward profiles of those companies.

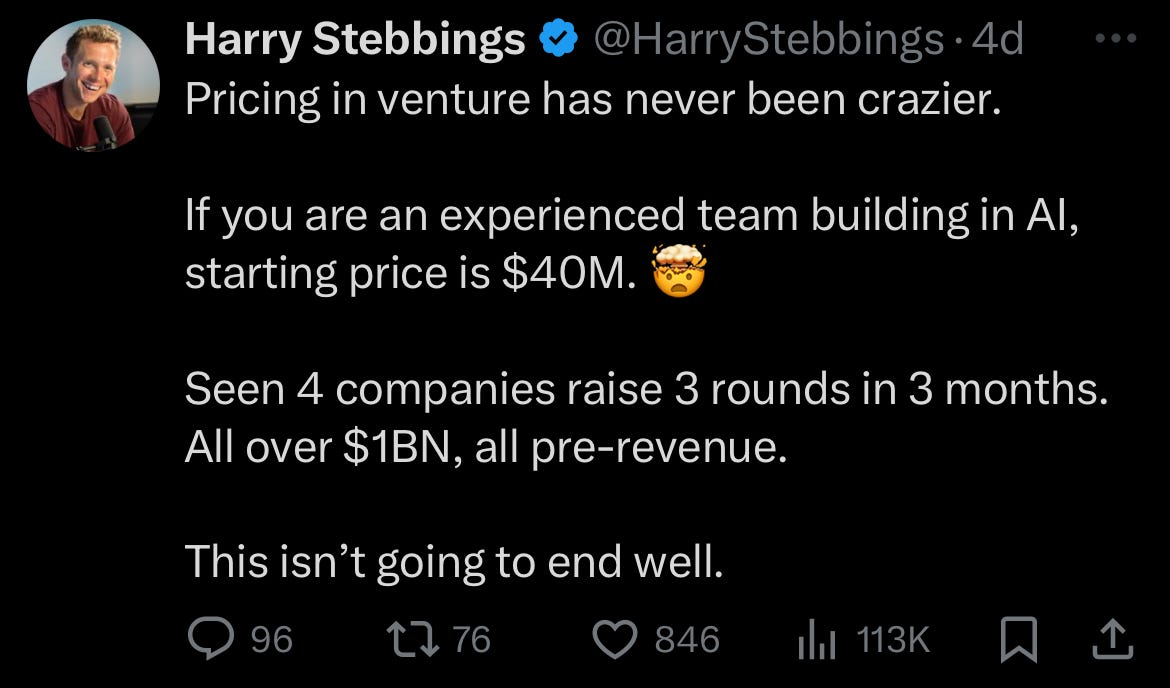

Valuations increased in the early stages and decreased at the later stages compared to 2021. This is what Harry Stebbings was referring to….Pricing in early stage companies is CRAZY today.

But like I mentioned before, the number of rounds is down A LOT. Series C rounds are down 59% while seed rounds are “only” down 42%.

“Hard” Times Will Continue

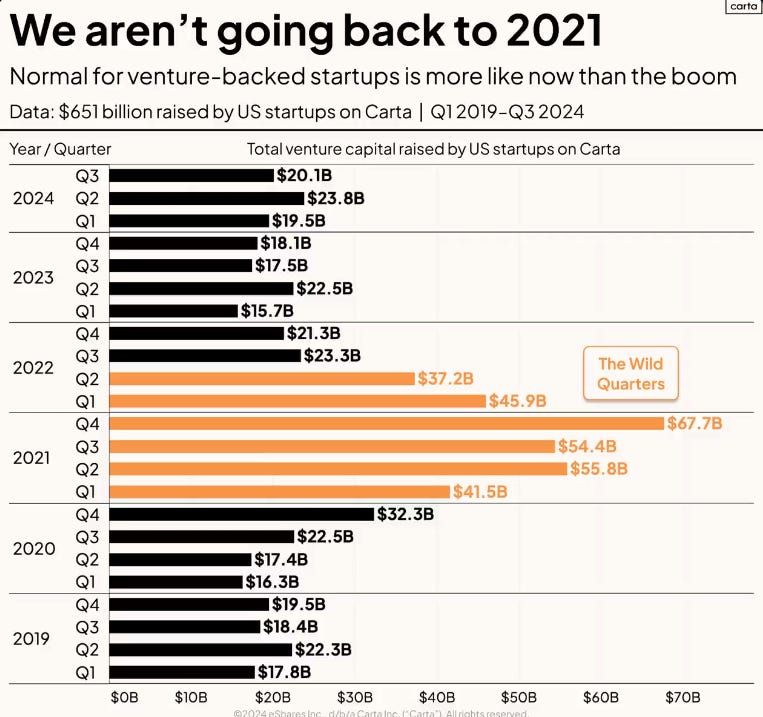

Total venture dollars being deployed is consistent with historic norms if you remove the 2021 period, so if you are struggling to raise money today, don’t expect that to change unless you are able to improve your metrics to be best-in-class.

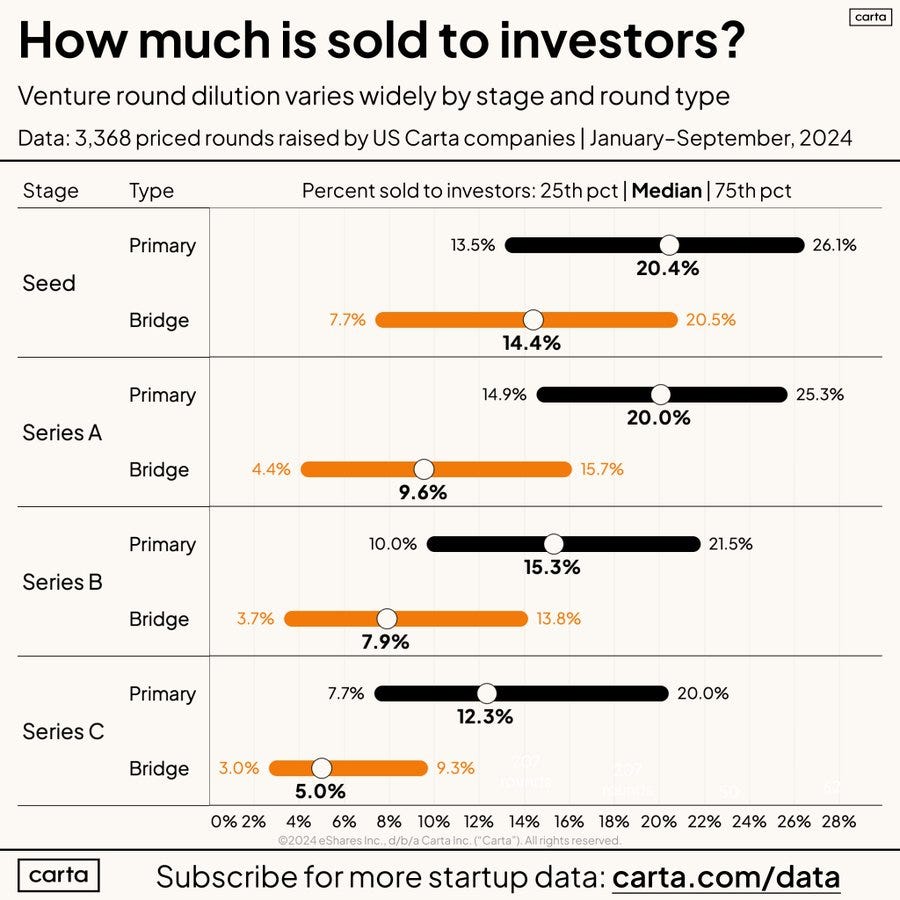

Fundraising Dilution

Interesting chart below that shows dilution by stage between primary and bridge rounds.

Fundraising Structure

During the good times (like 2021) term sheets are almost always “clean”.

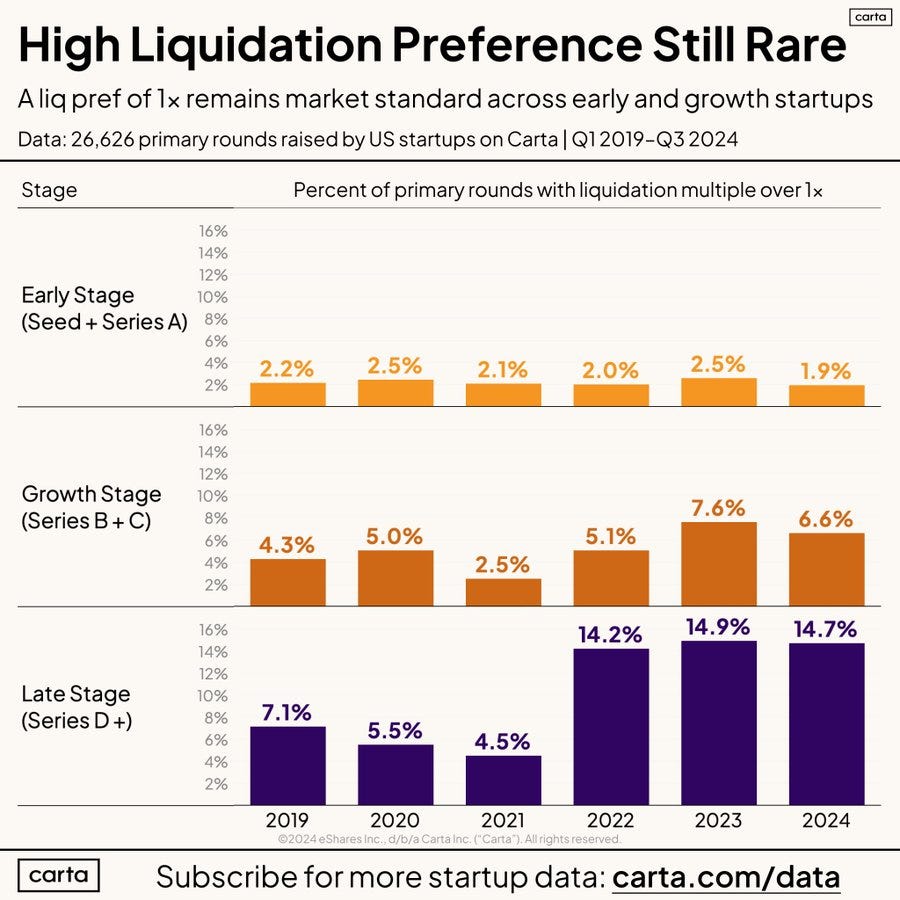

While times have gotten harder for fundraising and “dirty term sheets” have increased, they are NOT the norm. Management teams need to understand these terms and how common they really are because “dirty term sheets” can have major consequences.

Structure at very early stage rounds almost always makes no sense. If VCs are requesting it then it is not the VCs you want. If they are the only VCs you can get then get scrappy and get better metrics first.

Structure at Series B/C stage has ticked up a bit but is still really low.

Structure at late stage companies has skyrocketed — from 4.5% in 2021 to 14.7% today. This increase makes a lot of sense. New/existing investors know the old valuations are not real, management wants to keep valuation appearances, and late stage investors want to de-risk the investment (negotiating power has shifted to investors).

What is structure or a “dirty term sheet””

A term sheet where the investor’s return mechanics and investment risk are partially set in terms other than company valuation. These are terms outside of valuation that increase investor returns and/or reduce risk.

Some more common terms in a “dirty term sheet” include:

>1 Liquidation Preferences: The standard is for investors to have a 1x liquidation preference which means that they get 1x their money back before anyone else. If the company sells for greater than the last fundraise valuation then investors will convert to common and everyone would get their proportional proceeds.

But if the company sells for an amount less than the last valuation then investors get their money back first and whatever is remaining is distributed to equity holders. This will create scenarios for lots of companies that raised too much money where no one can make any money given how much was raised. This is especially true with >1x liquidation preferences. For example, if a company raises $50M with a 2x liquidation preference then the company has to sell for at least $100M before anyone else can make any money.

Anti-dilution protection: a price adjustment in case of a future downround. This reduces investor risk.

Participating preferred stock: investors get their money back and then share in the rest of the proceeds with all other equity shareholders (many refer to this as double-dipping).

Stock Option Pools

Stock option pool by stage below. I don’t see much change here with historicals, but I expect this to come down over the next couple of years as company headcount gets reduced relative to the past averages and companies become more conservative in equity awards (more employer power).

Thoughts on Fundraising

More cloud/AI companies should be raising less money at smaller valuations today. Once you are on the VC merry-go-round it is nearly impossible to gracefully get off.

Too many management teams (and VCs) think that their companies can have a venture-scale outcome. Venture-scale outcomes are going to be A LOT harder over the next decade than they were over the past decade. I don’t think most folks fully understand this.

All management teams should understand the fundraising/validation benchmarks, but don’t let them decide what you should do. Carefully consider what each fundraise means for your exit paths and required metrics to have a successful exit.

Footnotes:

Sign up for the OnlyCFO webinar series! First one is in December on annual planning. Check out the list below of other upcoming topics.

Send an email to onlycfo@onlycfo.io if you want to be a sponsor of the OnlyCFO newsletter or my new webinar series. Get in front of 28K+ finance/accounting professionals

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

Great post👏

Loved the post! 🙌🏻