🌶️ 3 Predictions for 2025

Growth vs profitability, importance of gross margins, and the M&A environment in 2025

Today’s Sponsor: NetSuite

Download the CFO Agenda for 2025: An array of ever-changing regulations, technologies, and trends have CFOs wondering: What do I need to prioritize this year to set my team and company up for success? We’ve got you covered with 25 actionable ideas to help CFOs dive into 2025 without missing a beat.

In last week’s webinar (recording available on Spotify at The Cash Flow Show) we had a discussion with metric pros — CJ Gustafson (writer of MostlyMetrics.com) and Ray Rike (CEO of Benchmarkit.ai).

It was an awesome discussion that you should listen to, but I want to highlight and expand on a few important topics that were discussed.

1. Growth vs Profitability

The Rule of X metric was created to capture how revenue growth is valued relative to profitability, which is a failing of the more simple Rule of 40 Score.

Rule of X = (Growth Rate * Multiplier) + FCF Margin

The “Multiplier” is how much more revenue growth is being valued relative to FCF margins. The growth multiplier has changed significantly over the past few years, but we are never going back to 2021 levels.

Ray said that the multiplier is currently at 2.5x but moving toward 3.0x and he predicts that we will end 2025 with a growth multiplier closer to ~4x by the end of 2025.

Bold prediction from Ray! This would imply a ~60% increase in the growth multiplier from today’s levels.

I think valuation multiples between low and high revenue growth companies will widen even more in 2025. The low growth companies need to show REALLY strong FCF support for a decent valuation multiple while the high revenue growth companies likely need to show at least baseline FCF margin support but high profitability is less critical for high growth companies to get a really strong revenue multiple.

In the below chart David Spitz plots out the Rule of X based on a 2x growth multiplier. The chart shows the median revenue multiple by different Rule of X buckets.

A 75% increase in the Rule of X score equates to a 300% increase in the revenue multiple 🤯! This is why it can be so painful for companies that are currently high growth but quickly move to the low revenue growth bucket because their revenue multiple can drop real quick with relatively small changes.

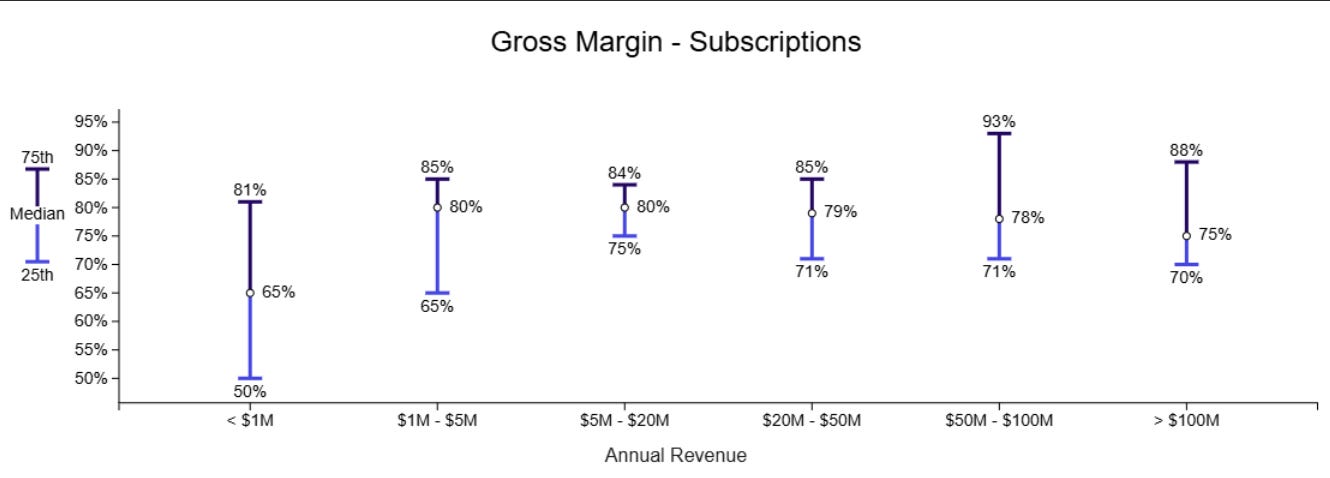

2. Gross Margins

In the webinar we also discussed where gross margins are today, their importance and where they are headed.

Ray predicted that gross margins will fall by 3 - 8 percentage points for many cloud companies in 2025 as a result of introducing more AI products that are both more costly to run and may take more time to fully monetize. While the median gross margins for cloud companies won’t fall this much, AI heavy companies will likely be closer to the 60%-70% range and drag the median down a bit.

If you are introducing AI products, make sure to consider the lower gross margin impact.

Ray’s spicy take on gross margins is that he doesn’t think gross margins are very important for valuations if growth is high. This aligns to the above point that growth will increase in importance for valuations in 2025.

OnlyCFO Thoughts: Gross margins are really important, but that doesn’t necessarily mean gross margins have to be high today as long as revenue growth is high AND there is a clear story about how gross margins become great. For a fast growing company there is often a tradeoff between fixing gross margins and shipping product to accelerate growth. You should usually ship the product, but eventually you’ll need to address gross margins.

3. M&A in 2025

The next topic on the OnlyCFO webinar series is M&A, so sign up now!

We NEED company exits to pick up in 2025 and M&A will be the biggest piece of that. The chart below is bonkers and clearly shows the problem — the public market is near all-time highs while tech exits have fallen off a cliff.

Investor liquidity through IPOs and M&A is what makes the VC world go round.

During the last webinar discussion we talked about the likelihood (hope?) of acquisitions accelerating in 2025. There are two types of M&A that will accelerate in 2025.

Bottom quartile: The desperate companies. These won’t be good outcomes but they at least get some money back to investors.

Companies that are running out of cash. There will be lots of fire sales where companies sell for pennies on the dollar. They may try to raise more VC money or get to profitability, but it doesn’t work out so they are forced to sell.

The board/leadership is burnt out and growth is slow. These companies are not necessarily running out of money. They may even have enough money to last several years. But…the metrics are so bad that it doesn’t seem worth continuing. These likely can be acquired for better valuations than #1, but still won’t be great outcomes.

Top companies looking to expand product and AI product features. These are the ones we want!

Top companies with lots of cash (or public stock M&A currency) will seek out companies with adjacent products and AI feature gaps that they have. More companies will want to go deeper and own more of their customer processes so they will look at M&A.

The recovery of the public market acquirers is step 1 of M&A to rebound. I really hope we see an increase of M&A deals with favorable outcomes. Without more liquidity coming soon there will be a lot of VCs in trouble, which then impacts the fundraising environment.

Footnotes:

Download the CFO Agenda for 2025 from Netsuite.

Sponsor OnlyCFO — Email me at onlycfo@onlycfo.io

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Growth will increase in relative importance to operating profitability as measured by a two-factor analysis of growth rate vs FCF Margin against Enterprise Value to Revenue multiples...

....though it is important to note that having positive Free Cash Flow is critical, and with a combination of a 10% - 20% FCF Margin with 20%+ growth rates will yield the highest EV:Rev multiples