💰$32B Wiz Acquisition = VERY Rich Employees

How much money will Wiz employees make? The insane story of going from $0 to $32B in 5 years.

Today’s Sponsor: NetSuite

I partnered with NetSuite to create an OnlyCFO guide for financial dashboard reporting. This guide is exactly how I have built great financial dashboards for my leadership team and board. Check it out and let me know your thoughts!

Get my free guide and financial reporting dashboard template 👇

Imagine generating $17M in enterprise value every single day for five consecutive years. That’s exactly what Wiz accomplished, growing from $0 to a staggering $32 billion all-cash acquisition by Google in just five years🤯!

This insane growth will also create some VERY wealthy founders and employees (more on this below).

This single acquisition of Wiz is more than all of Google’s other acquisitions combined. While the acquisition price is a relatively small % of Google’s market cap (1.6%), it’s still a REALLY big bet for Google.

Record-Shattering Growth

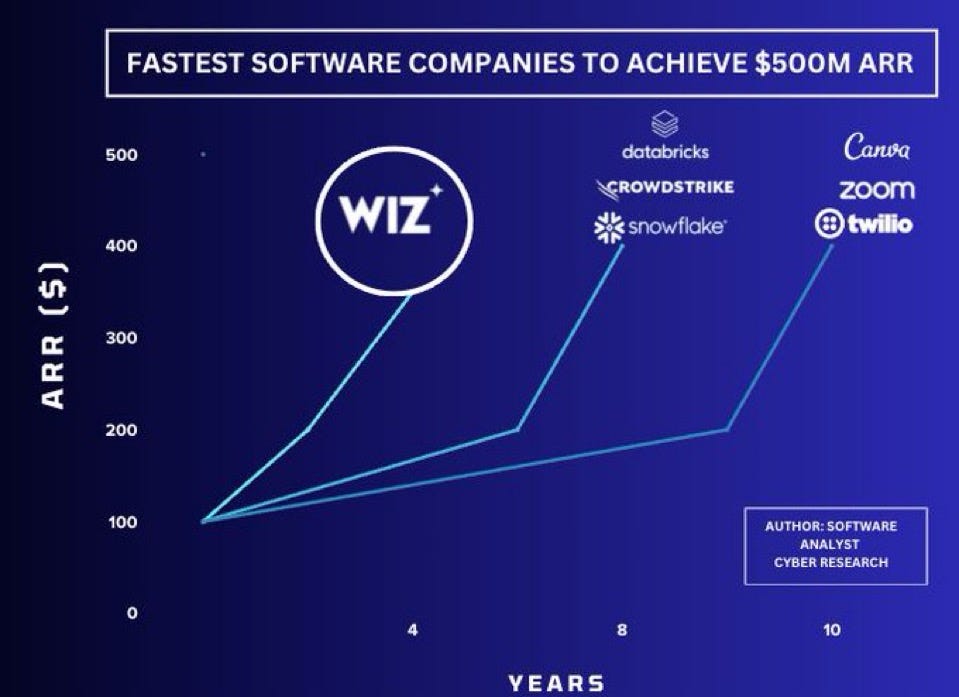

In July 2022, Wiz announced that they hit $100M in ARR in just 18 months of existence. I remember talking with several VCs at the time that said Wiz was likely using a non-standard definition of ARR and that the milestone wasn’t real.

It turns out that Wiz is just an absolute beast and they hit the $100M milestone faster than anyone.

And Wiz never slowed down….Wiz widened its gap even further as it hit $500M ARR in less than 5 years.

I have been at some fast growing companies, but to operate and manage a business with this level of growth requires nearly flawless execution. Annual planning is nearly impossible because everything is changing SO fast.

Google’s Big Strategic Bet

A strategic acquisition from an enormous company like Google is almost always the most lucrative type of M&A exit for an acquired company. And Wiz is definitely no exception.

Google REALLY wanted to get this deal done:

High Revenue Multiple

The below chart shows the comparative multiples in recent cybersecurity acquisitions (from Cole Grolmus).

The only deal close to Wiz was Auth0 being acquired by Okta, but there are a couple of important differences:

Okta announced the acquisition of Auth0 in 2021 when software multiples were MUCH higher than today

The Wiz deal size is significantly larger than Auth0 ($32B vs $6.4B)

$3.2B Break-up Fee

It is common for large deals like this to have a break-up fee where that acquirer must pay if the deal falls apart because of antitrust regulations. The typical break-up fee is 2-3% but can be a bit higher for more contentious deals. For example, the Adobe/Figma acquisition had a $1B break-up fee (or 5% of the proposed acquisition price) that got paid out because it was blocked by antitrust regulators.

The Wiz break-up fee is in a class of its own. The deal has a $3.2B (10% of the deal) break-up fee, which would make it the largest of all time.

So if the deal falls apart, Wiz gets a free $3.2B….Wiz demanded this unprecedented break-up fee in order for the deal to get done because of antitrust regulator concerns.

How Much Will Wiz Employees Make?

Now to the juicy part that we are all curious about….

How much are Wiz employees going to make?

How much are investors going to make?

Before we get into some rough equity payout math you need to understand a few things about joining an early stage company:

Higher equity percentage:

The earlier you join a company the higher the equity percentage employees get given the risk. But at a large enough valuation (or being public), equity is basically like cash.

Dilution from later rounds

The higher equity percentage can be partially offset by dilution from subsequent fundraising rounds and other employee equity grants. Below is the fundraising history and related dilution for Wiz:

Lower exercise price:

Stock options (typical equity type for startups) must be exercised in order to obtain the equity. The exercise price is determined by a 409A valuation. In the early days the 409A valuation is ~25-30% of the preferred price (price you see in the headlines), which means employees theoretically have built in value in the spread of preferred shares and the 409A price. But the common stock price increases as a percentage of the preferred price over time as the company does more secondaries and gets closer to an exit.

Ability to fully vest before an exit

Typically stock options vest over 4 years, so those who join just shortly before an exit may not be fully vested to get the full payout of their stock options. Sometimes in M&A exits certain employees will automatically get accelerated vesting and occasionally, the deal terms will allow employees to accelerate some or even all their vesting (just to be nice).

Below are my example payouts of an exec, a VP and a manager that joined Wiz at different stages (Series A, C, and D). There are a lot of assumptions in here, but this likely generally accurate on amounts and trends in payouts between stages. A few key assumptions include:

Israeli-based companies are typically tighter on equity

The growth of Wiz is unprecedented so it is hard to guess how their equity philosophy changed over time.

At the early stages a VP might really be acting like an exec (like a VP product being the head of their function) so their equity grant might fall closer to the exec benchmark than the VP one.

Series A Employee Payouts

Employees that joined around the Series A get the benefit of larger equity grants, but this is partially offset by higher dilution. In an exit scenario, Series A employees will almost always make more than their later stage co-workers. In this case….they are all easily millionaires.

Series C Employee Payouts

By the time of the Series C fundraising, the equity %’s are going to be a lot lower given Wiz had a $6B valuation at that time. The 409A price is also going up a lot so the net proceeds will be lower for these employees.

Series D Employee Payouts

Same changes as the Series C, but vesting takes a bigger chunk out of employee payouts. I am assuming only 50% of employee equity awards are vested below, which obviously eliminates 50% of the gains.

How Much Did Investors Make?

A LOT.

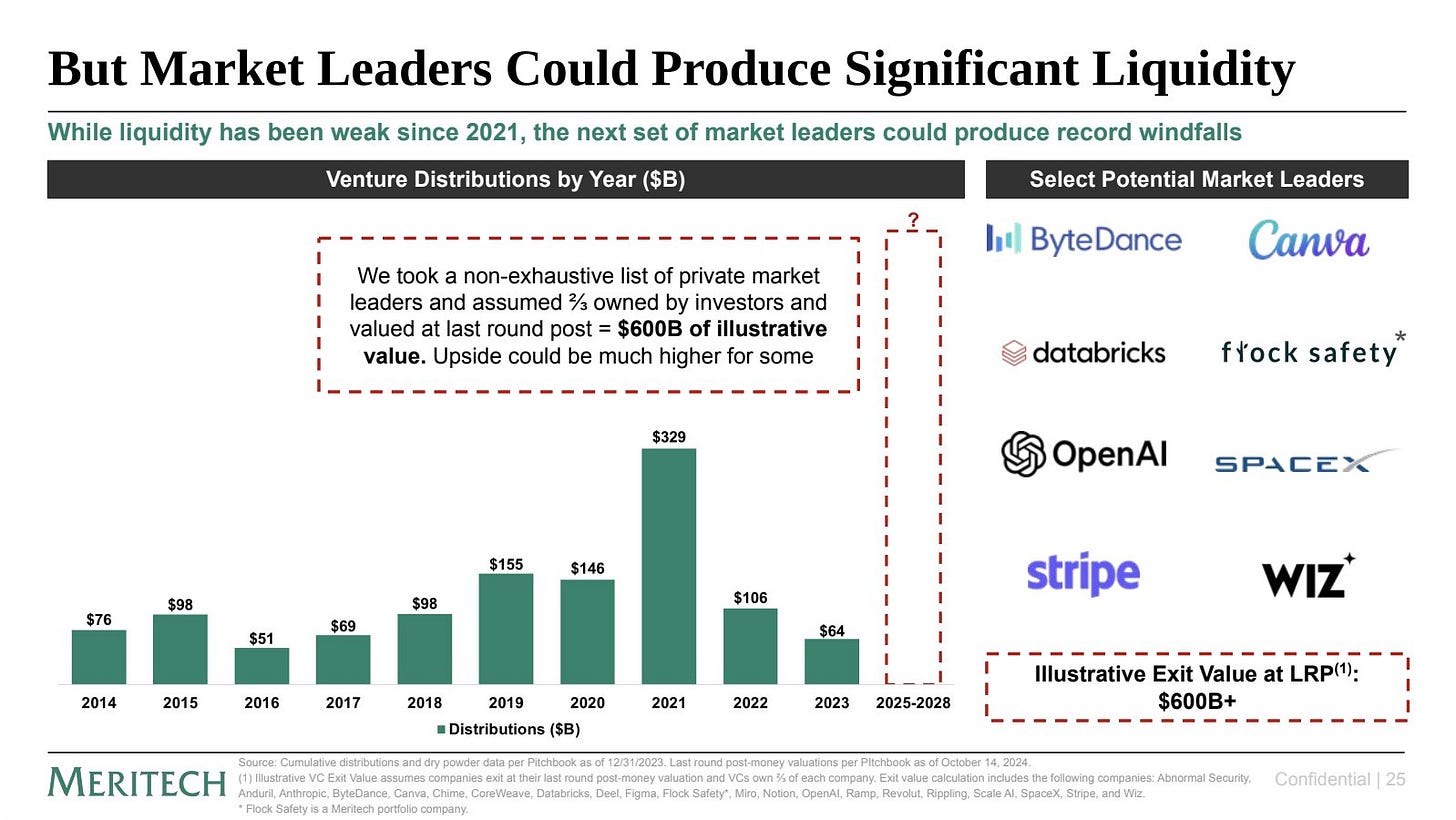

This acquisition will provide some much needed liquidity to investors. Lots of investors made lots of money in a short time.

The most amazing story though is Cyberstarts. They invested $6.4M into the Wiz seed round from a $54M fund. Cyberstarts will net about $1.5B off their initial investment ($1.3B based on their current stake + $120M in secondaries they previously sold).

Cyberstarts will be one of the very best returning VC funds in history (because of this one deal).

Final Thoughts

Your company is not Wiz (basically no other company in the world is), so don’t compare yourself to Wiz.

Joining an early stage startup can be very lucrative if they have a good exit, but the chances of joining a startup like Wiz are very close to 0%. If you like working at startups, believe in the company, and enjoy the people then go work at a startup. Just don’t bank on your equity to be worth much.

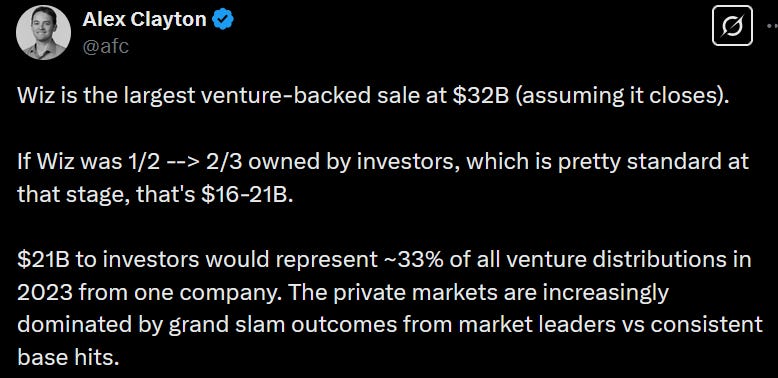

The Wiz exit will be great for the software industry as it provides some much needed liquidity for VCs. And as Alex points out below, this single acquisition would represent 1/3 of all venture distributions in 2023. An amazing liquidity event for investors.

Footnotes:

Check out this episode with Meir Rotenberg (Former VP Finance at Spiff) and David Ma (VP GTM Strategy & Ops at Zip)

Check out the OnlyCFO Financial Reporting Dashboard Guide & Template

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Great analysis! What a great outcome for the Wiz team and investors.

My takeaway is that although Google will hope to see a return from their investment there's long term indirect upside.

They'll pump $billions into the software environment, both through the VCs who will now be cash rich seeking new oppirtunities, and early stage employees of Wiz who will now have the freedom to pursue their own ideas.

Google have also cemented their position as the acquirer of choice.

I would not be surprised to see a whole set of new businesses seeded by this deal, with the cream getting picked up by Google in 5 years.