A $1.7B Failure | PE Buys Zuora

Lessons from Zuora: why they struggled and why a private equity firm is acquiring them

👋 We are at 27k subscribers reading this newsletter! Subscribe to learn more about finance, ops and other tech industry stuff.

Today's newsletter is brought to you by ServiceRocket

Learn how ServiceRocket can help you save millions of dollars and increase your Jira ROI by 277%+ while cutting licensing and maintenance costs and boosting productivity. Discover how to maximize your Jira ROI today.

Unhappy Zuora Shareholders

Zuora is a cloud company that has been around a long time. Zuora raised its Series A of $6.5M in 2008.

But after a nearly two decade journey, Zuora’s $1.7B private equity exit announcement last week wasn’t the outcome that earlier investors were hoping for.

Zuora raised ~$250M before its IPO and then raised another $154M in connection with its IPO in 2018 at a $1.3B pre-money valuation. This month (6.5 years after the IPO) it was announced that Silver Lake is acquiring Zuora in an all-cash deal of $1.7B, which is $10 per share.

$1.7B of value was created and someone is buying Zuora in all cash! That’s a great outcome, right?!?!

Not quite…

How successful an exit is for shareholders is very dependent on how much was raised, at what valuations, and how much dilution occurred.

Let’s just look at Zuora’s IPO investors.

Zuora IPO investors have lost ~30% on their investment since 2018! The IPO priced at $14/share and after 6.5 years Zuora is being acquired at $10/share.

While the market cap increased a little bit, dilution has eaten away investor returns — i.e. the investor pie slices have shrunk faster than the overall pie has grown.

Dilution is a very sneaky destroyer of shareholder returns. Do not ignore it.

The chart below has three lines that show returns since Zuora went public:

Zuora stock returns (blue line): Based on their opening price of $20/share (the stock popped 50% at the IPO). So if you bought day 1 of the IPO you are actually down nearly 50% over the last 6 years

QQQ ETF (orange line): This broader market ETF is up 173% over the same period of time

WCLD ETF (purple line): Even though cloud has struggled recently, this cloud ETF is up 28% over the same period of time.

🚨Compared to the QQQ ETF a Zuora investor is actually 221% worse off (49% Zuora loss + 172% QQQ gain miss) …ouch!

Private Equity Checklist

Will Zuora be a good private equity acquisition?

Zuora wouldn’t have been my first choice, but if executed properly Zuora can be a good outcome for Silver Lake.

Zuora certainly has many of the characteristics that make an attractive PE target.

Low Revenue Multiple

Private equity doesn’t chase high revenue multiple companies. That isn’t the game they play. It is too expensive and too risky for the PE playbook.

At a $10/share acquisition price, Zuora trades at a 3x NTM revenue multiple. Zuora has never traded at insane multiples (although 12x in 2018 looks pretty crazy in retrospect), but its revenue multiple has continued to decline over the years and seemed to have recently found a floor between 2-3x.

Zuora ranks in the bottom quartile for its revenue multiple amongst public cloud companies. At 3x NTM revenue, Zuora trades at half of the median public cloud company multiple.

Zuora Financial Metrics

This shouldn’t be a surprise, but many companies plan their IPO when things are good.

Nothing illegal about this…but just don’t be surprised if those good metrics don’t hold over a longer period of time. A lot of great companies will keep delivering so the extra push at IPO doesn’t matter. But others often see their metrics fall soon after…

Revenue Growth

There is a lot going on in the chart below, but two things to highlight:

Subscription revenue growth (purple line below) has been declining fairly quickly since Zuora’s IPO.

Professional services revenue as a % of total revenue was historically very high, but has been coming down (in large part due to using partners instead of Zuora doing it themselves). More on the challenges of professional services revenue below.

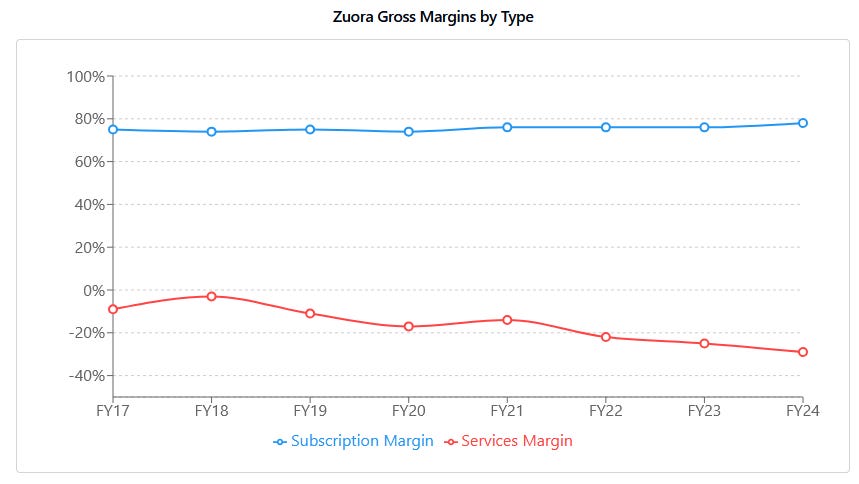

Gross Margins

Most Zuora products require a heavy amount of implementation which is why professional services revenue has been so high.

But professional services revenue is generally considered “bad revenue”:

The margins are typically much worse than software margins

They are not recurring (usually)

A high amount of professional services revenue as a % of total revenue implies that high software revenue growth is going to be REALLY hard because you can only scale as fast as your professional service org (and/or partners) can scale.

Zuora’s professional services’ gross margins are amongst the worst of all public cloud companies — they went from almost break even (-3% in FY18) to -29% in FY24!

This type of decline is likely partially indicative of Zuora giving a lot of professional services away for free to try and maintain some revenue growth and reduce churn.

Efficiency

Cloud companies have to balance revenue growth with profitability. If growth slows, then the expectation is that profitability will go up.

This balance is summarized by the Rule of 40 Score (or other versions of it that place a higher weight on growth).

Rule of 40: revenue growth % + FCF margin %

Zuora’s FCF has been negative for a long time but the FY24 and FY25E forecast has shown A LOT of improvement. This FCF improvement is one of the primary factors that got PE interested in Zuora.

Because of Zuora’s move to much stronger FCF margins, Zuora has a decent Rule of 40 score of 24 — a big improvement from just 6 a few of years ago.

Problems with Zuora

Dilution Death Zone

Zuora’s annual dilution has been 6-7% for the past few years. The chart below from Thomas Reiner shows a company’s dilution compared to its revenue growth rate. It shows what he calls the “Death Zone” as a company with >5% dilution and less than around 5% annual revenue growth.

Zuora isn’t on this map, but with 6-7% dilution and 6% annual revenue growth….Zuora is certainly knocking on death’s door.

But this high dilution is also what has made Zuora an interesting acquisition target. The high dilution has been a further drag on Zuora’s valuation, which means cheaper acquisition price.

But…one thing PE is really good at is fixing a broken stock-based comp model and reducing dilution dramatically through a combination of headcount reductions and significantly less equity grants for employees.

Efficiency & Complex Product

Silver Lake has to do two things really well and in parallel for this acquisition to be successful for them:

FCF margins have to improve to 20%+. And they have to do this while also getting dilution under control. These two things will be hard since public company stock-comp is basically like cash, so doing both will require a lot of trimming.

Simplify implementations and product. Zuora needs to fix this fast. Both are too complex and time consuming.

If Silver Lake can solve #2 then #1 will follow. The complexity of the product and implementations have been a major drag on efficiency for Zuora over the years. They have made progress, but there is still a lot to do.

Having been a part of similar implementations, they take a really long time and involve a lot of people. But many folks aren’t tolerating (or won’t be soon) long implementations that are extremely costly and take a lot of time. Product expectations are increasing fast in the age of AI.

Retention Rates

A positive for Zuora and for this acquisition is Zuora should have relatively good gross retention. At least for now…

Finance teams don’t like changing these systems because they take a long to time to get right. That’s why many of Zuora’s customers sign multi-year deals, which is evidenced by the long-term remaining performance obligations (revenue from contracts that will be recognized after one year).

The risk here though is that new software capabilities (maybe with GenAI) can make the switching and implementation costs a lot smaller with other tools. So while retention is good now, Zuora may experience higher churn rates in the near future if they don’t make things a lot simpler for customers.

Final Thoughts

As long as Silver Lake can execute very quickly on efficiency and reducing product complexity (throw some AI in there to solve stuff) then I think Zuora will be a positive acquisition for them.

But I also think it will be really hard to execute on these things in parallel in the time frame required.

Not all cheap companies are necessarily a good investment. But with the right execution Zuora might be a win for PE.

PS - important to note that you can have a good product that is a bad investment for shareholders. There will be many such cases with the AI startup wave happening now.

Zuora has some great products but given the complexity of the stuff Zuora handles some of their issues make sense. Just wanted to call that out in case Zuora wants to sponsor my newsletter in the future…DMs open :)

Footnotes:

Discover how to maximize your Jira ROI with ServiceRocket (today’s sponsor)

Sponsor OnlyCFO: Reach 30K+ finance/accounting professionals

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

The challenge is likely to be the tech/org debt they've built up around product/ease of implementation. It will take additional R&D investment (or reprioritization of existing) to build the tooling that makes it easier to implement.. that's more pressure on FCF in the near-term.. Product loves to build new features, not this boring stuff even though it can hugely impact margins..

As a repeat CFO and someone who is constantly disappointed about the billing options we have to choose from, I hope they're able to pull this off.