A Controller and Tax Agent Walk Into a Strip Club...

This is not the start of a bad joke…it’s a story about fraud, bribery, and bad controls

Today's newsletter is brought to you by Brex, the intelligent finance platform.

Your guide to faster AI results.

“So what’s our AI strategy?” Every board asks it, every LinkedIn post oversells it, and CFOs are left to separate hype from reality. Brex’s CFO Guide to AI Strategy gives it to you straight: the real strategy is faster adoption — cutting busywork so finance teams can focus on impact. Learn how to plan, budget, and accelerate AI in finance to automate 71% of expenses and close the books 3x faster.

On Tuesday, a public company that operates strip clubs and five of its executives were indicted for their roles in a decade-long bribery and tax evasion scheme.

The executives of the parent company (RCI Hospitality Holding) were allegedly bribing their tax auditor with lap dances in order to avoid $8M+ of New York sales taxes…

The tax auditor received at least 13 complimentary multi-day trips to Florida where he was given up to $5,000 per day for private dances at RCI-owned strip clubs.

That seems like a lot of trips and money at strip clubs...

The stock of the company cratered on the news. When your CEO, CFO, and Controller are all potentially facing prison time your company miiight be in trouble.

👇 Here is the hilarious story and why leaders should care.

Dirty “Dancing Dollars”

“Dancing Dollars” are at the center of the alleged crimes.

Dancing Dollars are exactly what they sound like. It is an in-club currency that the strip clubs sell to customers for private dances.

Below are the two main allegations:

1. Failure to collect sales tax on “Dancing Dollars”

RCI failed to collect/remit sales tax on “Dancing Dollars” and a 20–25% service fee, which prosecutors say are taxable “admission charges” at 8.875% in NYC.

In other words…they did not pay an estimated $8M+ in sales taxes to New York that they should have.

2. Bribing a NY Tax Auditor with “Dancing Dollars”

The strip club executives allegedly bribed their NY tax auditor with at least 13 multi-day trips to Florida, hotel/meals, and up to several thousand dollars/day in private dances at their strip clubs.

They did this to secure more favorable audit outcomes and avoid $8M+ in sales taxes and penalties. Some club records allegedly coded the bribes as “promo” expenses.

The Evidence

This is where the whole thing gets pretty funny…The Controller was the mule that would coordinate the “entertainment” in order to get leniency on sales taxes in exchange, but several other senior folks were also allegedly involved.

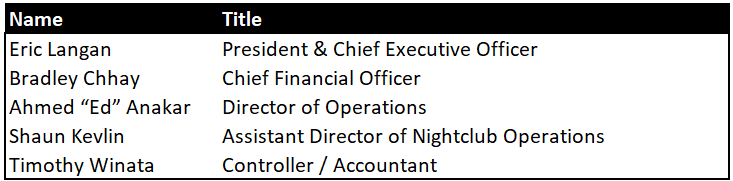

People being charged:

Important to note that this level of fraud would require collusion and need multiple higher-ups to be involved to pull off. One rogue person couldn’t do this much alone, unless financial controls were completely nonexistent.

The Texts & Emails:

Below are a few of the hilarious exchanges between the executives and the unnamed tax auditor:

December 6, 2023, Winata (Controller) texted Anakar (Director of Ops):

Hi Ed. called last night and asked whether I could take him [tax auditor] to FL next week from Dec 12 to 15. Remember in the beginning the tax on Vivid audit was $190K plus interest. We wanted it to be $70K. While we were at Expo I told him that I would take him to FL once if he could get it down to that amount. He asked what it would take for him to go twice. I told him that it cost us $13K - $14K each time we made the trip. So, if he could reduce it by $30K, I would split it. I would take him to FL once more. He managed to reduce it by $35K. We saved $35K in tax or $43K including interest. Are you going to be in Miami next week? Please inform

Uhhh….that seems pretty incriminating, right?

On April 12, 2018, Langan (CEO) texted Anakar (Director of Ops):

“We need to talk about New York and Dance Dollars," saying that RCI was "going to be hit by 3M in sales taxes soon." Later that day, Langan texted Anakar: "I think I got the sales taxes in New York to 350 plus interest possibly. Tim [Controller] is discussing with the auditor tonight ;)."

A personal favorite…On February 23, 2022, the tax auditor texted Winata (Controller)

This was the best trip I had in Florida. The girls were very beautiful and nice. On Thursday night there so many beautiful women. That’s why I do many lap dances instead of going to the room. I hope we can have another trip before the Summer. Thanks again for making the trip great and better before.

The CFO also appears to be involved. He sent the below message after the Controller convinced the tax auditor to significantly reduce what was owed.

On or about September 1, 2023, Chhay [CFO] emailed Langan [CEO] and Anakar [Director of Ops]

Subject line Fwd: NY Sales Tax Audit

Wow. Tim [Controller] is clutch. But it did come with conditions. I’ll tell you when I talk to you. Tim asked if this can be his last one. No more dealing with this type.

I guess the Controller wanted to be done taking the tax auditor to strip clubs every year…

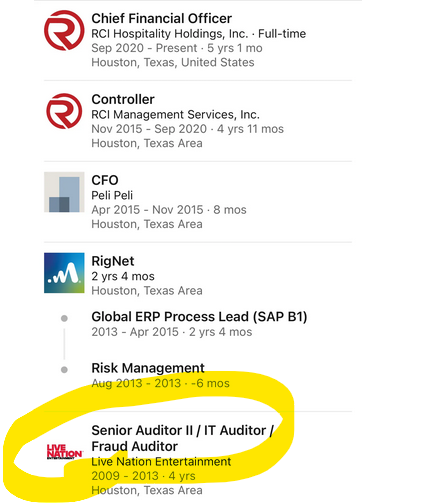

Important to note that the CFO has been with the company for nearly a decade (started as their Controller) so if there was wrongdoing…he would know. And if the allegations are true, then it would be much easier to hide for a long time if the same people are involved the whole time.

Fun fact: The CFO was previously a fraud auditor :)

Financial Controls to Prevent Lap Dances

There NEEDS to be financial controls that prevent fraud/bribery (especially lap dances).

The fraud triangle presents the three things that are present when fraud occurs.

Let’s use the strip club execs and see hypothetically how it may have happened:

Pressure - CEO and CFO ask the Controller to do it. And/or there are financial incentives/pressure to save money. There is always pressure.

Rationalization - “We aren’t giving the auditor money…We are just giving the auditor a closer look at how we make money”. 🤣

Opportunity - Cash-heavy business that probably has poorly implemented financial controls and software. This is the big issue.

Almost every software company I know has had sales tax issues at some point. Usually what happens is they forget (or are late turning on) a state that now has nexus. It happens. But that is why you do regular checks to catch the error, pay sales taxes and penalties, and move on.

Even worse though is collecting sales tax from customers and failing to remit it to the government. That can be a felony charge. This almost always happens because of bad processes and controls at the company (not fraudulent intent).

Final Thoughts

First Cockroach Rule: where there’s one, there’s a family reunion.

They are currently just being charged related to crimes around New York sales tax. If it turns out there is blatant fraud, then you shouldn’t be surprised if there is fraud in many other places as well.

Leadership: The tone at the top matters more than you might think. Make sure you work for people you trust and don’t do anything you wouldn’t feel comfortable being published online.

Create Financial Controls: Don’t be stupid. Implement financial controls. From the moment you raise money (or have a material amount in the bank). You are being negligent if your financial controls aren’t keeping up.

More CFOs and Controllers should be fired for not setting up basic controls and processes.

Footnotes:

Download this free CFO Guide to AI Strategy (from Brex)

*Nothing in this article constitutes legal, tax, or investment advice.

Little did I imagine that the entire world would turn into my humble home town of Las Vegas NV.

The fact that these knobs would memorialize their actions and intentions in emails indicates breathtaking levels of either ignorance or assumed impunity.

I used to have to ride herd on a bunch of Russian “scientists” (spys, more accurately) who insisted upon going to one specific club in Vegas every time they came out to monitor nuclear wep test events (as was the custom back in those days). 😑

My conversations with the owner of that club informed me as to the myriad ways they avoided oversight, taxes, and general accountability for essentially running a brothel inside the city limits (no… it never has been “legal” in Vegas, despite the marketing campaign).

Even they knew not to discuss anything in any environment subject to recording and especially not on telephones.

And, yet… emails.

Incredible.

Thanks for your efforts.

Great article! How did you find this story?