AI Eats Moats

Only 5 moats remain. Where are companies spending money to build moats?

👋 Welcome to the OnlyCFO newsletter! Join 36,000+ smart tech folks getting stories and insights about finance, strategy, operations, and more. Subscribe here:

Today’s Sponsor: NetSuite

EBITDA Doesn’t Pay the Bills

EBITDA is a popular metric, but it doesn’t reflect the complete financial health of your business. Cash flow, on the other hand, reveals your real capacity to cover expenses and invest in growth.

Download this guide to learn why operating cash flow is key for every CFO and receive your go-to checklist for optimizing financial operations.

Moats Create High Growth Endurance

Revenue growth endurance is the single most important factor for long-term valuation creation.

Conversely, low revenue growth endurance is the leading cause of unicorn deaths…Inefficiency creeps in, unit economics break, and then all of a sudden there are no good exit outcomes. You can’t IPO and potential acquirers are scared that revenue will continue to bleed out.

A friend’s company got a ~$500M acquisition offer during a period of high growth. They turned it down because they raised money at nearly a $1B valuation. A few years later revenue, growth fell off a cliff. Now? They want to sell, but there is literally zero interest at any valuation that makes anyone any money.

What enables companies to have high revenue growth endurance?

A strong moat.

The concept of a moat comes from old-school warfare. The moat surrounded the castle and was meant to slow down enemies from storming and taking over. The enemy could still get to the castle, but it slowed them down so the castle defenders had more time to react and defend.

The same idea applies to competitive industries. Moats prevent a company from being quickly overtaken by the competition. They help you win and retain customers. Strong moats also enable you to generate high profit margins because you are protected.

Below is what you get with a strong moat:

Durable revenue growth

Strong retention

Pricing power and profit margin protection

Much higher valuation

The strength of moats is determined by two variables. In the warfare example, a wide moat that is only two inches deep won’t slow down the enemy very much. Similarly, a very deep moat that is only a foot wide won’t help that much either.

Moat depth: How easily can the competition copy you?

Moat width: How important is the barrier? If customers don’t really care about the difference, then it’s not a very wide moat.

Your moat needs depth and width for it to matter.

What Moats Are Left?

Technology is NOT a moat in 2026. It never really has been…at least not a long-term moat.

We have all heard about the commoditization of software from AI, but that reality is getting insane…

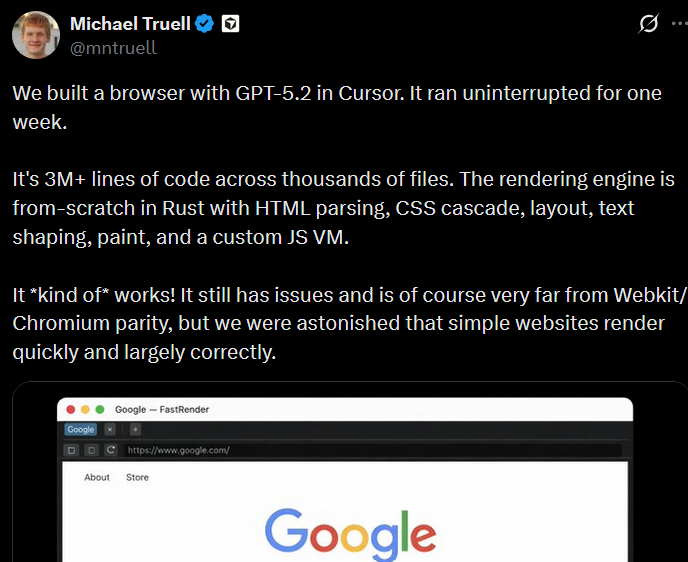

Below is Cursor’s CEO saying they just built a browser clone by letting Cursor run uninterrupted for one week straight. It created 3M+ lines of code…And it works! 🤯

I am sure they spent a lot of money on AI tokens, but that’s basically nothing compared to the salaries of all the engineering time that would have been required to do this before.

And the memes about prompting Claude (or other AI tools) to build clones of stuff have been amazing.

Alex, founder of Hello Patient, called out a YC company for directly copying their software. Apparently it’s such a blatant copy that they left all the custom images and content that Hello Patient put on their website.

I imagine Alex’s meme below is a pretty accurate representation of what happened. And I imagine it’s how a lot of software is being built today…

Expect your software to be copied.

AI tools (like Claude or Cursor) are making this incredibly easy. And it will only get easier.

So if your technology can be copied over a weekend, then what moats do you have left?

Below are the 5 remaining moats in 2026:

Distribution

Trust

Data

Scale

Network effects

What about speed? People keep talking about speed as a moat.

Your team’s ability to have speed in execution, hiring, building, distributing, adapting, etc. is really important. The opportunity cost of time has never been greater thanks to AI. But speed alone doesn’t guarantee you long-term growth endurance.

A good example is AI adoption. Your AI features are NOT a moat.

Being early to something is not a moat. It can potentially help you build one though…

All Roads Lead to Distribution

All of the moats I mentioned above lead to a stronger distribution moat.

Customers trust you? Then customers will buy more stuff from you and tell their friends too.

Have proprietary data? Then customers will want to send you more data so they get more value. You get more data and more potential customers want access.

Large company with multiple products? Then new products are easier to add on and that reinforces other moats.

Network effects? Distribution flywheel that brings in more customers.

Superior distribution can hide many product sins. The best product doesn’t always win. But if you have superior distribution and win the market then that will unlock more budget to spend on innovation. Then the only way to lose is to have an inferior team that doesn’t continue to execute on the opportunity.

Distribution > Product

Let’s look at the numbers. Where are public companies investing? How much should you be spending on distribution versus innovation?

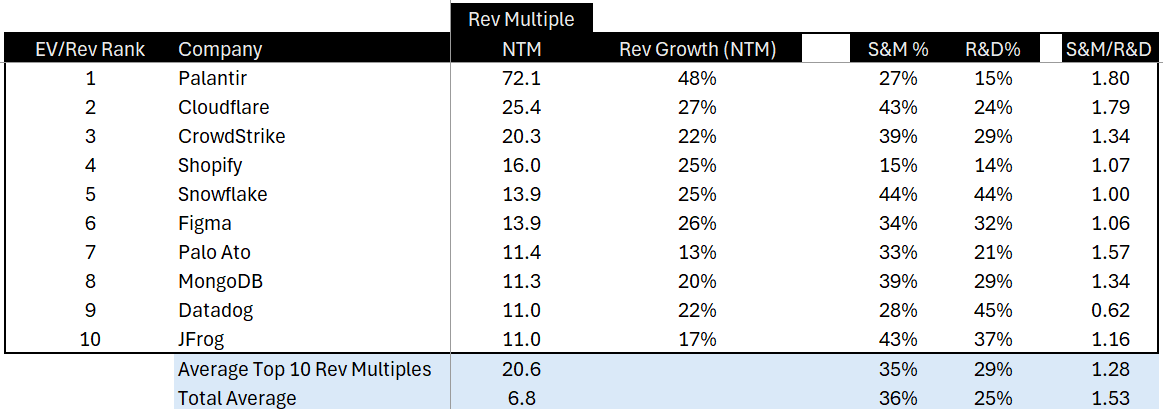

Highest Revenue Multiples:

Below are the companies with the highest revenue multiples. On average they are spending 1.3x more on S&M (distribution) than on R&D (innovation). But even this understates the focus of these companies on distribution. Most of the companies with higher R&D spend on this list are from the pursuit of distribution — engineer time spent on creating flywheels, product-led growth (PLG), etc.

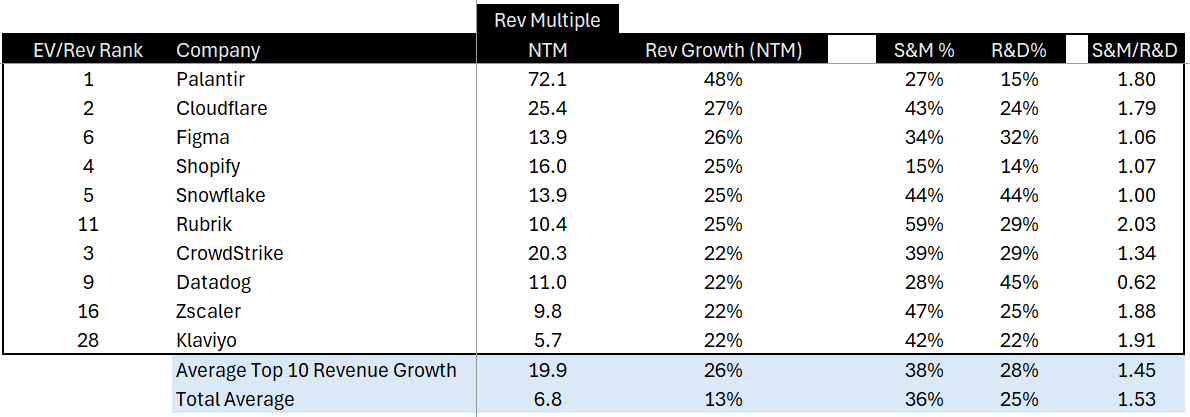

Highest Revenue Growth:

There is a similar story for the companies with the highest revenue growth. Even more is spent on S&M relative to R&D.

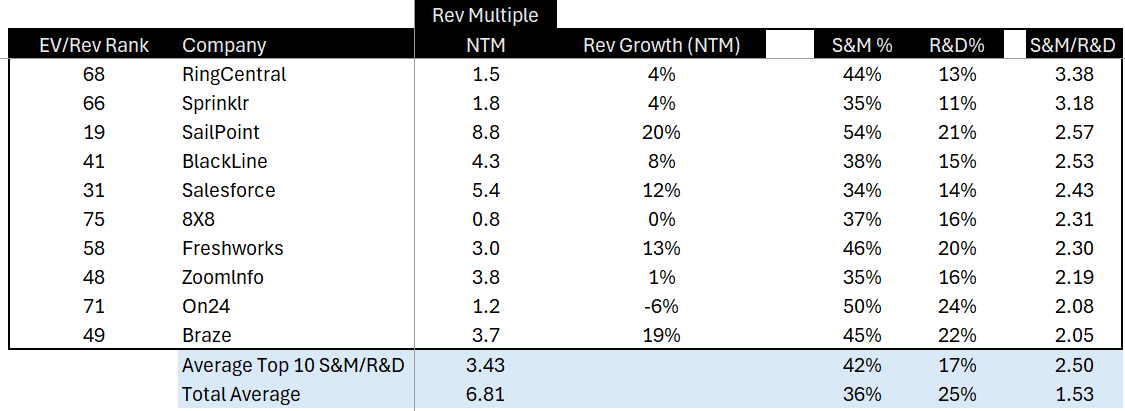

Highest S&M/R&D Ratio:

While distribution > product, at some point the higher the relative S&M spend is actually a potential red flag.

The companies with the highest S&M spend relative to R&D have a much lower valuation multiple (3.4x) than the general average (6.8x). These 10 companies on average spend $2.50 on S&M for every $1 on R&D!

This often happens when growth becomes weak and/or the company becomes desperate to grow and puts product on the back burner.

A good (bad?) example here is Expensify. They recently spent an estimated $12M (~10% of their market cap) on the Brad Pitt F1 movie that was released 6 months ago. I am pretty sure I have seen single LinkedIn posts or tweets (which are free) that generated more revenue than that movie probably did.

When the right distribution from a trusted brand hits the ideal potential customer, magic happens. Otherwise, you are just lighting money on fire. Many companies are burning endless amounts of money in the pursuit of distribution.

Company Stage Matters

After $25M in revenue, companies spend more in distribution than on innovation. AI is accelerating this.

Typically you can’t sell without a somewhat good product…although I know some sales reps who have sold products that don’t even exist🤣.

But the more revenue you have, the more money (in absolute dollars) you can spend on innovation.

Final Thoughts

Moats are not static. They are either shrinking or growing.

AI is chewing away at your moats. Technology is not your moat.

Understand where your more durable moats are and double down on them. In order to win long-term you need durable moats (both deep and wide).

Footnotes:

Check out this guide for a checklist for optimizing financial operations and how CFOs should think about operating cash flow. From my NetSuite friends.

Related good read from OnlyLawyer below

*Nothing contained in this post is investment, legal, tax, or any other kind of advice.

Great framing on depth vs width. Tech keeps getting shallower—distribution is where moats actually compound now.

when software is commoditized, durable advantage shifts decisively to distribution, trust, data, and networks rather than the product itself.