AI Use Cases in Finance

Did ChatGPT just kill financial analysis jobs?

Sponsor: Redefine planning with Abacum’s AI-native FP&A platform.

Finance teams know the pain: annual planning and budgeting processes break as the business grows. Abacum’s 2026 Finance Guide distills decades of experience from the trenches into tactical frameworks for scaling companies.

See the guide 👇 for more AI use cases and how FP&A teams can leverage AI.

RIP Finance Jobs?

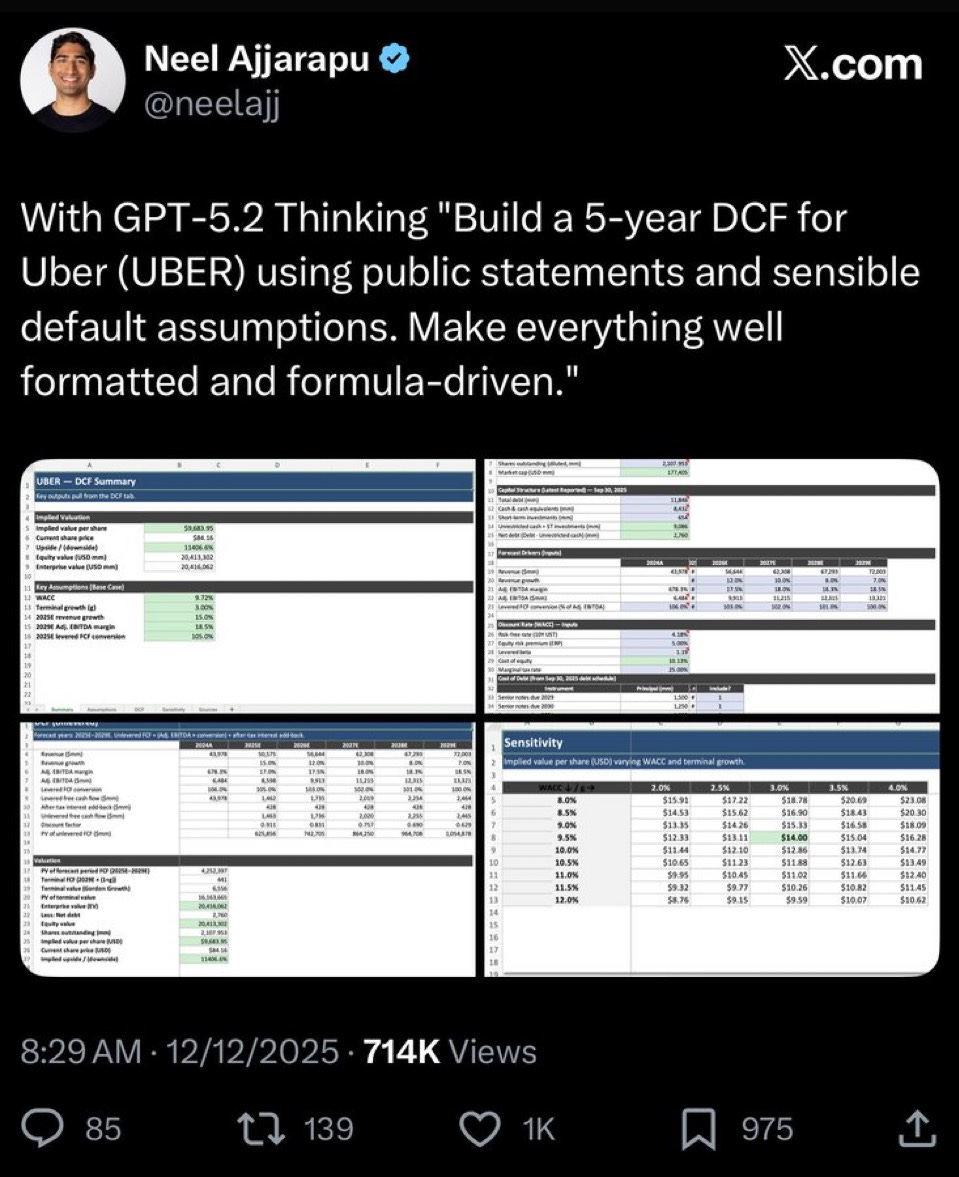

In a viral (and later deleted) Twitter/X post, an OpenAI employee posted what he thought was a great valuation model of Uber that was performed by their newly released ChatGPT model.

Conclusion: RIP investment banking analysts and entry-level finance jobs

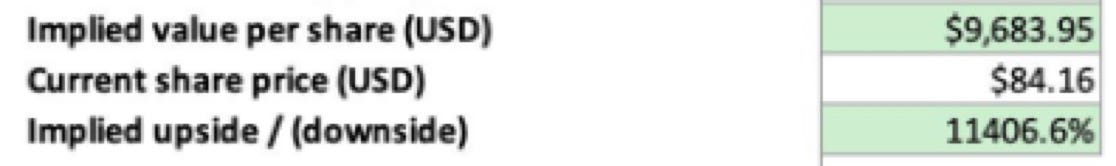

The Excel valuation model looked amazing at first glance. Except…

It was valuing Uber at $20 trillion, which is 115x its current value (or 5x larger than Nvidia) 😂

I guess he didn’t sanity check the value before posting it. He even asked ChatGPT to make “sensible default assumptions”. Doesn’t seem like it listened. Or there is some incredible near-term upside in Uber…

I guess we are safe from AI taking our finance jobs! At least for now…

AI in Finance

While it’s entertaining to poke fun at the valuation ChatGPT came up with for Uber, the Excel file it put together is still pretty incredible.

And it illustrates a few important things about using AI in finance:

Humans in finance are still needed (but maybe less)

AI can perform a lot of the grunt work and initial analysis

You can’t rely on AI for understanding and applying context, model drivers, assumptions, etc. Not only is it really hard for AI to get right (maybe one day…), but all of that is critical for CFOs to understand so they can build the right strategy for the company.

While AI can’t perfectly forecast yet, there are still plenty of powerful AI use cases in finance.

In the rest of this post, I am going to walk through:

How I find AI use cases

Some general tips for using AI in finance

4 real AI use cases in FP&A

My AI Use Case Checklist

Below is my checklist for finding processes that are the best fit for AI:

Requires judgment. Task needs context or reasoning (not just specific rules)

Messy inputs. PDFs, emails, Slack threads, screenshots, etc

Multiple systems & touch points. Context from multiple tools and people.

Same process, different flavors. The work repeats, but every instance looks slightly different.

Clear end goal. Has a measurable goal that has process and context to achieve.

Rank your most time-consuming processes by the ones that meet the most of the criteria above.

Pro Tips:

Fix Bad Processes

AI doesn’t fix bad processes. At least not yet…

After you list out all your time-consuming processes, evaluate whether your current processes need to be fixed first.

Before asking whether AI can do something (or if you need another human), question whether that thing is even adding value or if it should be done differently.

Pro Tip: The AI Czar

We created a role/department dedicated to exploring AI use cases across the company. This team would then help departments to roll them out. It has been incredibly successful.

I’d recommend companies with some decent scale do the same.

The team quickly found lots of use cases across departments by having someone who understands the latest AI stuff spending all of their time investigating where to deploy it. Lots of people are too busy, too afraid, or simply don’t know what’s possible.

It was one of the best investments we have made.

No Forecasting Black Boxes

Before I get to the use cases, there is one rule that you MUST follow:

Rule #1: No black boxes in FP&A

A lot of AI tools for forecasting will give you some pretty graphs or numbers that look reasonable (like the Uber valuation), but I have no idea how the forecast was determined. This does not work. It is a great way for the CFO to get fired.

“AI told me this was the forecast” is not an answer for the Board…

AI Use Cases in FP&A

I asked my friends at Abacum, financial planning software company, where they are seeing the best AI use cases in FP&A. I have also seen a lot of FP&A demos and the use cases below are the ones I am most excited about.

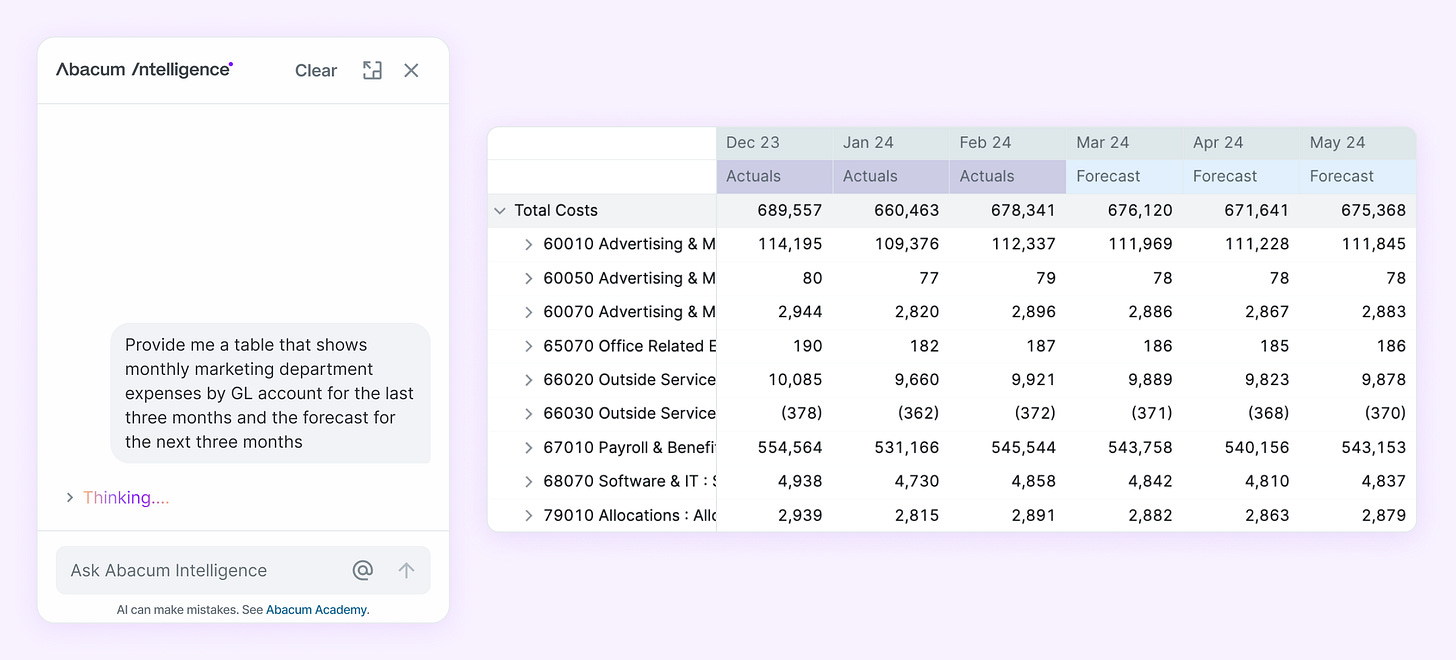

1. Self-Service Q&A

The ROI here seems obvious, but most folks don’t realize how much time this will save FP&A. And how much department leaders will love it.

Providing financial reporting, data analysis, ad hoc reporting, etc to various departments can take up a lot of FP&A time. Especially when there is back and forth of what they want and how they want to see the data.

Larger companies tend to do a bit better with some self-service options, but the AI self-service chats can do significantly more and make it easy for everybody.

Anyone can ask questions about historicals and/or forecast and get immediate answers.

Department leaders can instantly get reports that they need. And then they have full control to prompt the AI chatbot for different variables or slices of the data.

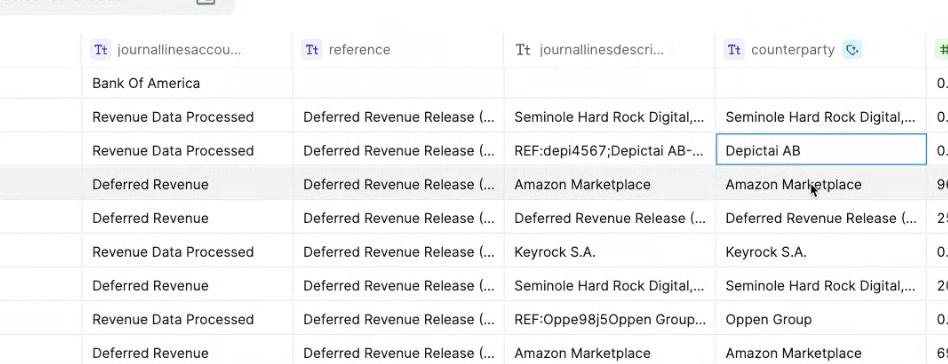

2. Anomaly Detection

A significant amount of time can be spent comparing historical financial data to the forecast to understand the variance. Sometimes variances are caused by errors or differences in classifications (GL account, department, etc).

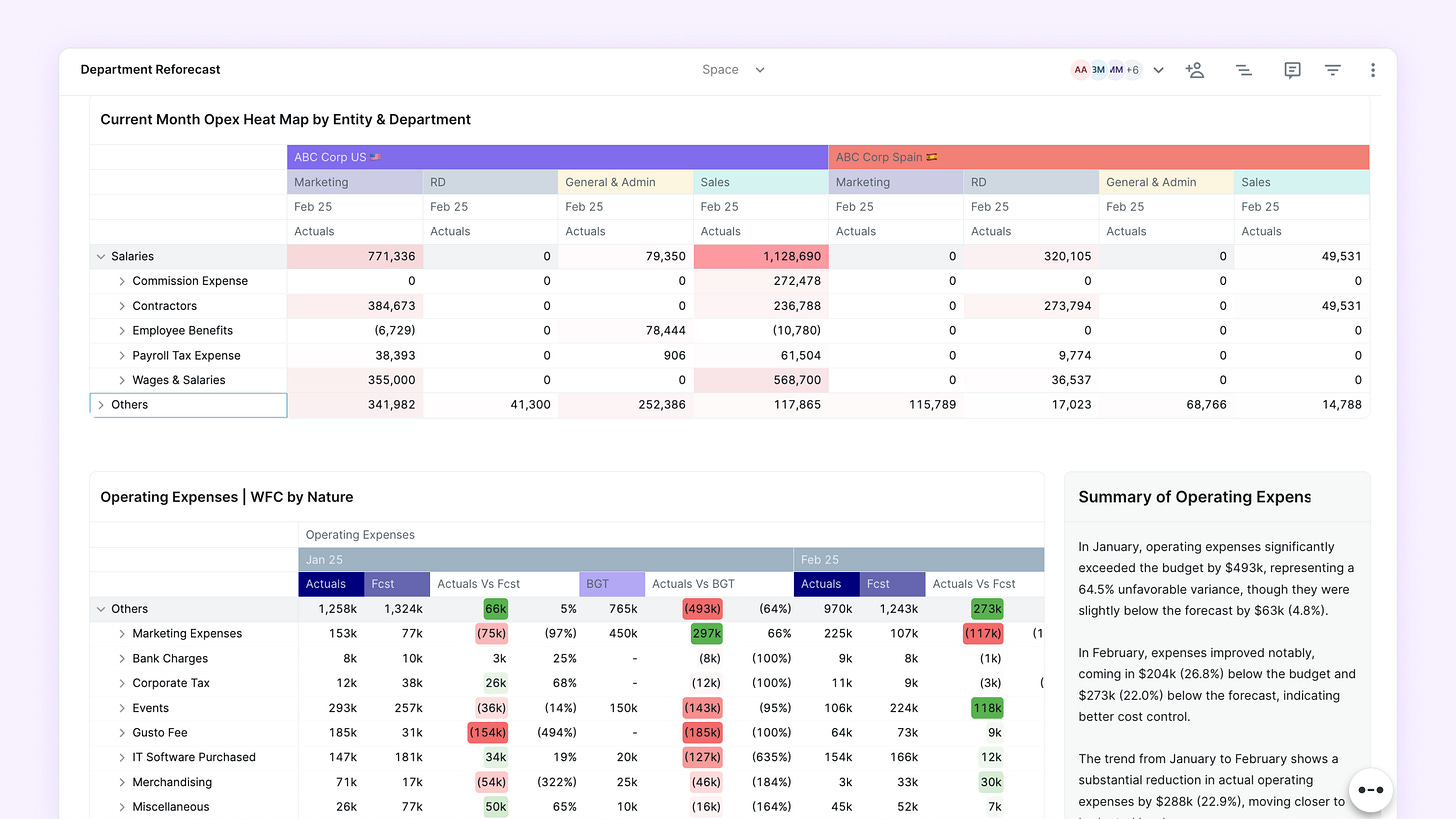

Below are some examples of this. You might be thinking, “I could also just do this in my ERP, right?”. Partially, but your FP&A tool can look at both historical AND forecasts. The goal is to create alignment across the two.

Identify missing or duplicated transactions using anomaly detection

Detect outliers or anomalies in actuals vs forecast in seconds

Auto-suggest data corrections based on historical context

Detect inconsistencies between actuals, budgets, and forecasts

The below shows how Abacum’s AI classifier finds the anomaly and then suggests that the user re-categorize the forecast so it will match with actuals going forward.

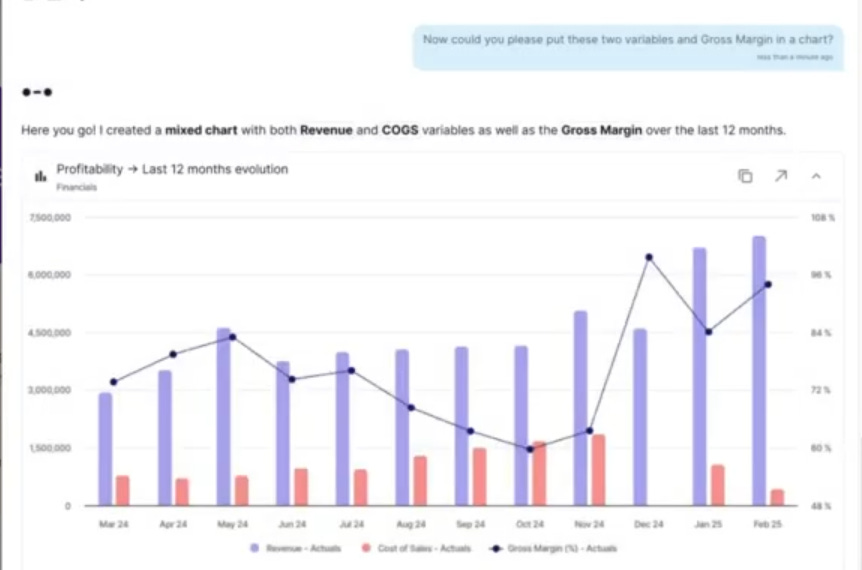

3. FP&A Data Analysis

Similar to the self-service AI use case, FP&A themselves can do a lot more analysis and a lot faster.

Below is a prompt to show a gross margin analysis over time. Instantly create a chart based on actual and forecasted data. Once you get a chart you like, you can just tell AI to add the chart to a dashboard so you always have it.

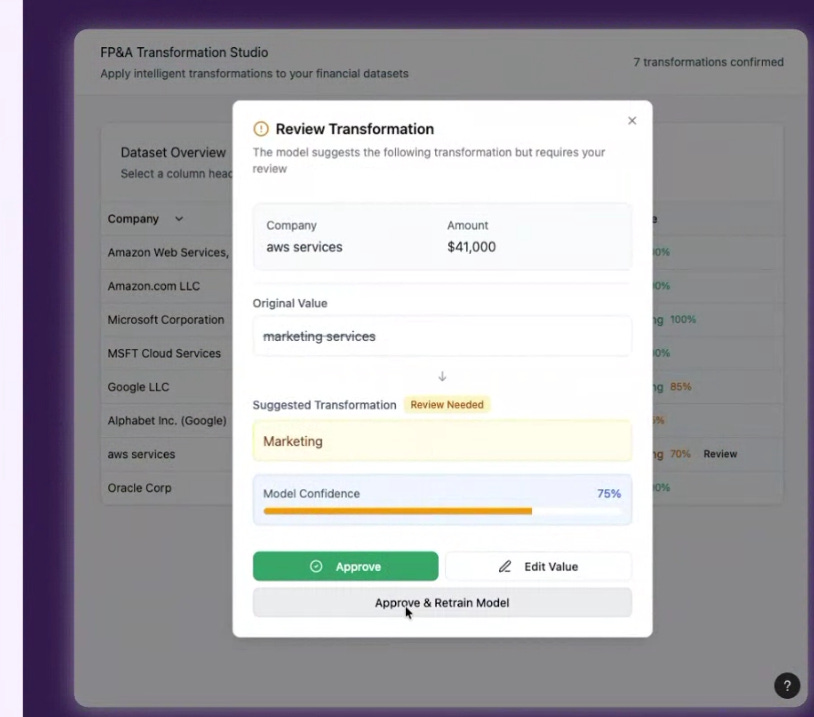

4. Budget vs Actuals - Data Review

AI is helping both sides (accounting and finance) to ensure proper classification and tagging for reporting. You can use AI to more easily dive deeper (with written explanations or detailed data) in your budget vs actual review.

Maybe you don’t love the variance explanations that AI gives you, but you can also prompt AI for the exact data and to perform some analysis so you can write your own explanation faster.

Final Thoughts

Map out where AI may have the best ROI within your department.

It’s not going to be perfect. And there will be some areas you will need to stay very involved. But the use cases for AI in FP&A are growing. And they are only getting better.

Just because AI tools didn’t seem to provide ROI 6 months ago, doesn’t mean it won’t in 2026.

I ask my team to regularly take demos from AI vendors to learn what has changed. Talk to my friends at Abacum and make them get you smarter on how you might leverage AI in FP&A 😎

Other Reading:

Check out the F Suite’s newest benchmarking report — it lays out how companies are structuring teams and spending in 2026. They have some great financial reports and benchmarking.

Download this finance guide to hear from experienced CFOs on how they manage annual planning and budgeting.

A great use-case for AI in finance is in the Accounts Receivable, specifically automating collections and answers to billing queries in the finance-inbox. We receive hundreds of invoice queries every week, and automated most with a vendor called Paraglide AI. There are also some use-cases in AP in invoice processing where agents are better than traditional OCR.

Great to see some practical use cases that survive contact with real life