AI is Coming for Audit Fees | KPMG Just Proved It

KPMG presses their auditor to reduce fees because of AI...so you should do the same.

Today’s Sponsor: Deel

Global payroll costs extend far beyond salaries. This guide breaks down international payroll expenses, compliance costs, and hidden fees so you can forecast accurately, reduce risk, and improve cost efficiency as you scale. Built for finance leaders managing multi-country operations.

KPMG Inadvertently Tells Audit Clients They Are Being Overcharged

Oh, the irony….KPMG reportedly negotiated lower fees from their auditor, Grant Thornton, by arguing that AI should be making them more efficient. I am imagining it went something like, “If you are more efficient because of AI, then you need to pass on some cost savings to us!”

KPMG reportedly threatened to change auditors if they didn’t reduce their fees. And it looks like KPMG’s tactics worked. Fees paid for KPMG’s 2025 audit decreased by 14% from the prior year ($416K to $357K).

But their hard negotiations may backfire in a major way. KPMG just gave every single audit client the playbook for re-negotiating audit fees in 2026.

I started my career working in audit at the Big 4 firm in the Bay Area. And now I am on the other side (at companies being audited by Big 4). So I am familiar with how they price, their economics, how inefficient they can be, and how disruptive AI can be to their current business model.

Are the Big 4 accounting firms dead?

Nope. Big 4 firms have one of the strongest moats possible in an AI world. But their economics will definitely change as a result of AI.

Matt Levine explained the irony of KPMG’s negotiations nicely:

“Ehh auditing can basically be done by AI so why should we pay for it” is not a crazy thing for most companies to think, or to say to their auditors, but it is a crazy thing for an auditing firm to say to its auditor.

So did KPMG admit that their business model is being disrupted?

Of course audit firms know that AI is disruptive. All of them are working internally to adopt it. But like all professional service industries, no one wants to cannibalize their revenue by passing on cost savings from AI. Until they have to.

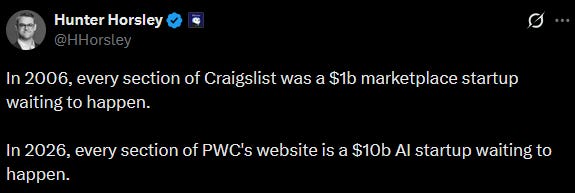

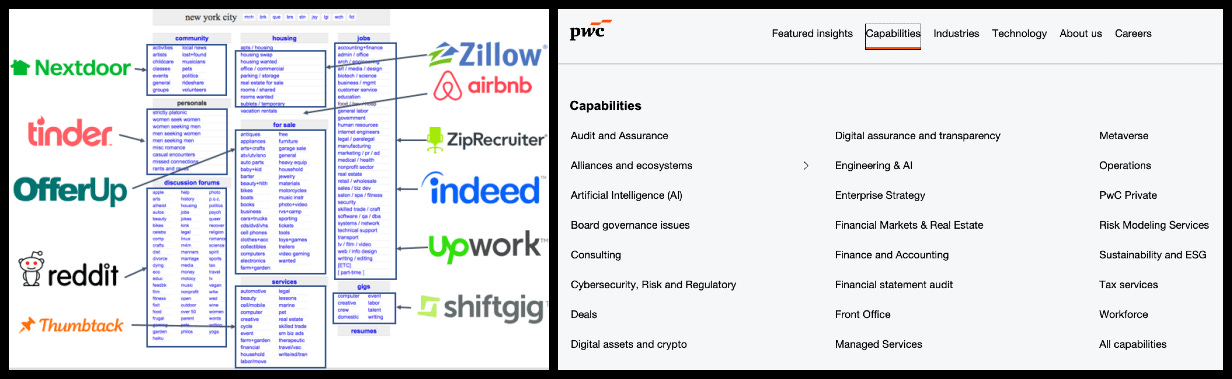

The professional services industry is a market that is ripe for disruption by AI agents. Accounting firms are no exception. I thought the below comparison was interesting.

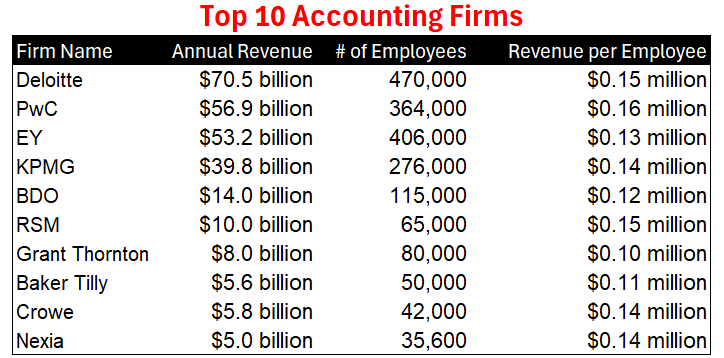

The accounting firm market is huge…Massive AI-native companies are being built by attacking the accounting firm markets.

Even if we didn’t have AI, I think most of these firms could have 20%+ less headcount and get the same job done. And if they fully implemented the AI that we already have today? Significantly smaller headcounts…

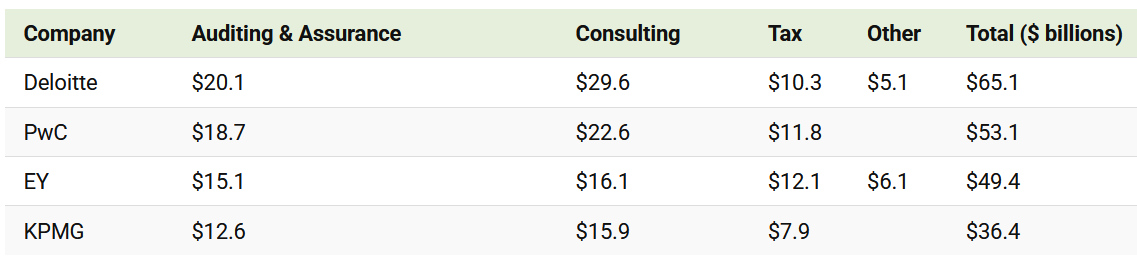

Accounting firms generate ~50% of their revenue from audit and tax, which are both easy targets for AI. The business breakout below is from 2023 (similar breakouts today as well).

With current AI tools and processes, I could easily see 60%+ of audit work being automated that is currently done by humans. Why do I think that? Well, 60% of the work is done by Associates and Senior Associates (0-4 years of experience) and the work they do could easily be done by a monkey…

Having worked on both sides of financial audits for many years, I can tell you one thing — the inefficiency of some audits is incredibly painful to watch. AI should be able to do soooo much.

But just because audit firms can be inefficient and may charge too much, doesn’t mean their clients are going anywhere…Big 4 audit firms have a beautiful moat. A trusted brand.

Big 4 Pricing Power:

The Big 4 firms have a trust monopoly. So if you want to go public, then there is a lot of pressure to choose them (and most do). A new AI-first audit firm isn’t going to topple the Big 4.

No one got fired for buying IBM” (or Big 4 in this case).

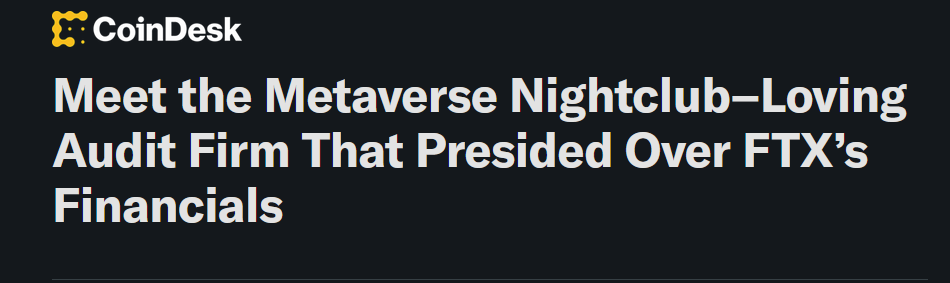

But there is a big difference between a 2nd tier audit firm and the auditors that FTX chose…FTX’s auditor prided themselves on being the first audit firm to open a HQ in the metaverse lol. How auditors miss billions of dollars in an audit is beyond me…

While Big 4 firms have a strong trust moat, I do expect to start seeing interesting competition amongst the top 10 firms. A couple of these firms will adopt AI in a big way and significantly cut fees while also performing better audits. I think we could see some shuffle in the biggest firms…

The big question is how much of their cost savings will be passed on to clients. They are all investing a lot in their AI systems and that took upfront investments.

Should you pressure your auditors on fees?

Of course you should. Especially if KPMG is your auditor 🤣. Just send them the article and say “You guys bring up an excellent point. Will you also be passing on your cost savings from AI as well?”

But seriously…talk to them about their fees. Audit firms (and most professional services firms) are slow to change how they price. They live off increasingly higher billable hours and higher fees. But the IPO market is slow, their consulting/advisory practice is hurting, competition for audit clients is high, and AI should be making them more efficient.

If you are stuck with high fees from a Big 4 auditor and you have no IPO in sight (at least in the near term), then threaten to switch to a tier 2nd firm. Get some bids to negotiate.

Audit Fee Benchmarking

Public company audit fee benchmarking is easy because it’s a required disclosure. Benchmarking for private companies is obviously harder, but I talk to a lot of CFOs and audit folks so I have some general benchmarks.

There is a lot that goes into audit pricing, but I am simplifying it and making some general guesses based on what I know about these companies.

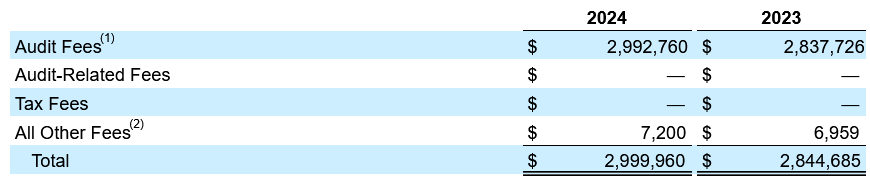

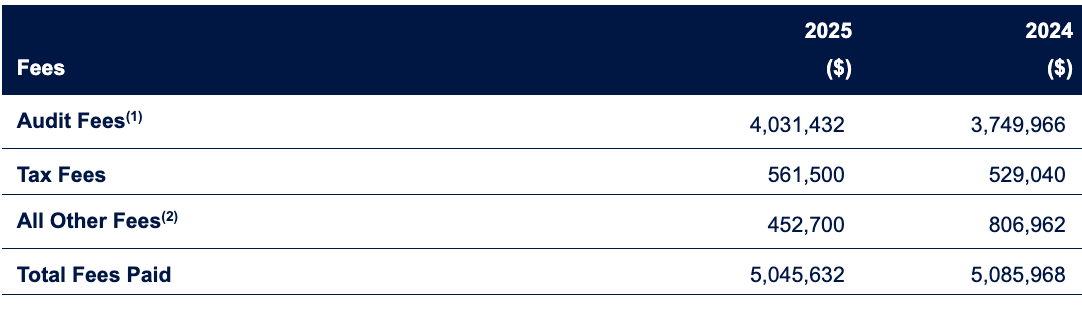

Expensify - public company with $140M 2024 revenue

It’s actually insane that a $140M revenue company that is as simple as Expensify is paying $3M in audit fees. If they were private, I would guess that Expensify would be paying ~$250-300K for a Big 4 audit. I can’t understand what their auditors are spending $3M of billable hours on…

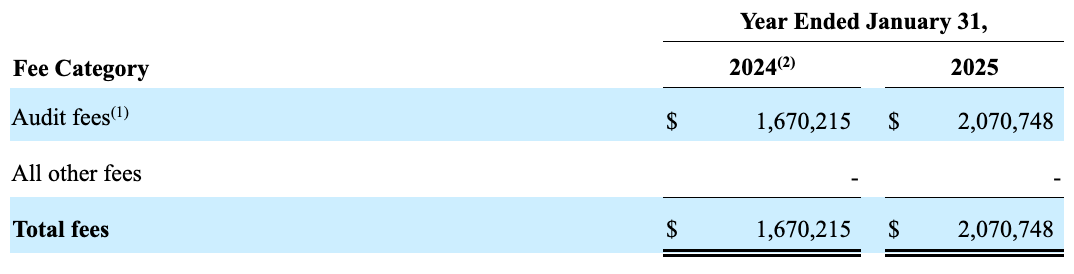

Domo - public company with $317M 2025 revenue

Domo, also a small public company, is paying $0.8M less than Expensify at 2.6x the revenue scale (and I think a little bit more complex than Expensify). Seems like a really high variance in pricing…

When you get bids from different firms you will often see a pretty large variance in their pricing as well.

Zscaler - public company at a $3B revenue run rate

Zscaler is significantly more complex than both companies above and pays $4M. Obviously, audits don’t scale linearly with revenue scale.

Private Companies

Back in the good old days, Big 4 auditors could actually be cheaper than tier 2/3 firms for early-stage companies if they were hot companies that they thought had a strong chance of eventually IPO’ing. They would set the price low for several years and then slowly raise the prices to market and then get the REALLY big audit fees that went with an IPO and being public.

Most don’t do that today. Too few IPOs and too much money was likely lost on audit clients that never really went anywhere.

For a Big 4 audit, the starting price seems like it’s $100K+ even for small, simple companies. While midsize software companies in the $150M - $250M revenue range, will be $250K - $500K+ depending on complexities.

2nd/3rd tier firms are often be ~15%+ cheaper than Big 4.

Always get a few bids and include a couple non-Big 4 firms.

Startup Audits

If you are <$25M of ARR then audits are almost always a glorious waste of money and time. Just send your board the bank statements.

When you raise VC money the agreements often state you must do an audit by a certain date. You can/should ask to push that out. Then if revenue growth ends up being slower than expected, you should ask your board to delay the audit requirement.

You do NOT need to be audited by Big 4. It’s often not the right choice. They are more expensive and usually take more time/resources. If things really work out and it looks like you are ~3 years from an IPO then you can switch to the Big 4 if you want.

Footnotes:

Want to know the cost of offshoring? Check out this International Payroll Guide that breaks down all the costs you should be considering.

Maybe all of the above won’t even matter if what Microsoft’s AI CEO recently said is right :)

*Nothing above is legal, tax, investment or any other kind of advice. Educational only.

The irony. For instance, startups are coming after internal audit and SOX testing in a real way.