Annual Planning Guide - The Overview (Part 1)

The annual planning calendar, tops down model, and common planning mistakes

Sponsor: Redefine planning with Abacum’s AI-native FP&A platform.

Most teams waste 70% of their time wrangling data. Top finance teams use Abacum Intelligence to automate the grunt work and unlock better, faster decisions through scenarios and forecasting.

Get our AI in Finance guide, packed with actionable and tactical real-world examples and proven frameworks.

Annual Planning Series

It’s my favorite season of the year. Annual planning season. If you are doing annual planning right, then you should be on the tail end of the process.

But before you get your plan final approved by the board…follow this annual planning series on several important topics.

Overview & Tops Down Targets - Timelines, objectives, and initial targets

Sales Capacity Model - bottoms up modeling to hit sales targets

AI Use Cases in FP&A - Where to use AI in FP&A and planning

Bottoms Up Planning - building the details with the leaders

Non-Headcount Planning

Headcount Planning

Board Approval - presenting to the board (when, why, how)

I will also be sharing the financial modeling templates that I use. Subscribe to follow along…

Annual Planning Timeline

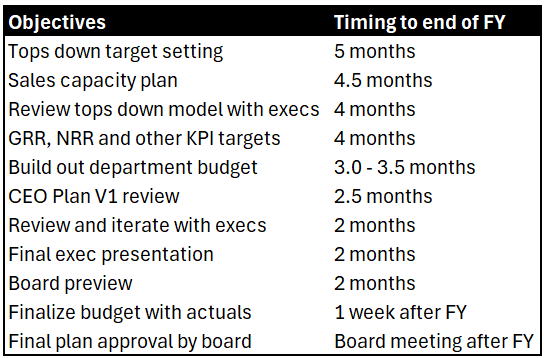

Work backward from board approval. There are two dates I track against:

Preliminary board approval - usually happens in the Q4 board meeting

Final board approval - happens in the Q1 board meeting (after the prior year is closed)

Below is a rough timeline I use for annual planning. The larger (more predictable) the company, the easier it is to start earlier. Earlier-stage companies can/should compress this timeline a bit given how much can change in a couple of months.

Driving Strategy and Key Initiatives

Do you have a CFO or an Excel Monkey?

Any Excel Monkey with some finance experience can throw together a pretty-looking financial model that mirrors what the CEO wants for revenue and burn.

A good CFO drives a strong annual planning process that does much more than that.

Defining key initiatives and objectives

Creating alignment across leadership

Quantify risk and force prioritization

Creating financial targets with guardrails

Annual planning creates direction for the company.

When done right, planning becomes the operating system for the business. The framework that ties together product, GTM, and finance.

Creating Alignment

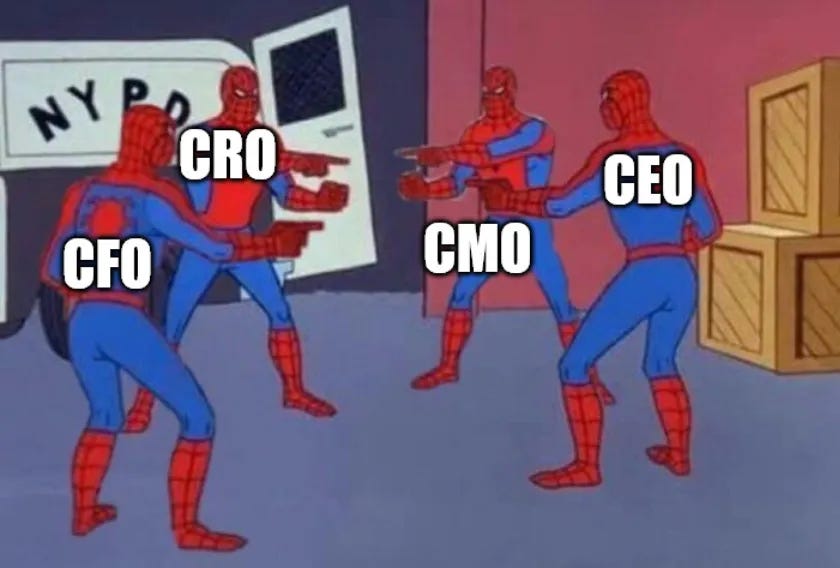

One of the hardest (but most important) outcomes of the annual planning process is to create alignment among leadership (and ideally the entire company).

Too often, the CEO and CFO make a plan and just tell leadership what the plan is. And then the scenario below plays out immediately after the plan is approved by the board and the company starts to miss targets.

Start your annual plan exec alignment meeting with the picture below. And make it clear that this can’t be us. Otherwise, the annual plan is already doomed.

I promise you that a leadership team that has explicitly committed to the plan is MUCH more likely to hit plan.

Tops Down Targets

The first big step in the annual planning process is creating “Tops Down” targets, which is usually created by the CEO and CFO.

The Tops Down plan defines ambition.

This is where the CEO and CFO determine high-level targets such as the following:

What are our financial goals?

revenue growth

gross margins

cash burn

GTM efficiency

What key initiatives will we pursue? Where do we need to invest?

new product launches

AI initiatives

market expansion

IPO preparation

The Bottom-Up plan that follows defines reality. A common mistake I see is starting with a bottoms up plan before there’s tops down alignment. You’ll rebuild your model five extra times if you do.

Iteration is Key

The annual planning process is a loop that reconciles the ambitious top-down sales targets with bottom-up reality. The CFO’s job is to make that loop work and get to the most optimal and realistic (while aggressive) outcome.

Don’t forget to bring leadership along during the iteration….I have often seen department execs sign off on the plan and then their headcount is slashed before the final version, but their targets remain unchanged.

The finger-pointing will continue…

What target are we talking about?

Companies often have two different revenue targets:

Board Target

Internal Target

There are lots of opinions on how these targets should be set, how achievable they should be, and whether there should just be one target.

Regardless of your decision, the company should be aligned on the internal target so everyone is talking about the same plan and numbers.

Long Range Planning

This “one simple trick” can flip an inefficient plan into a very efficient. Your financials will look awesome. And your board will love you.

The trick? Don’t hire sales reps and other GTM team members in H2 because most of them won’t be productive until the following year! You are welcome…

You may be surprised by how often this happens.

And you know what they do next? They hire a ton of reps in late Q4 and early Q1 so they can get capacity to meet the next year’s sales targets. This is a dangerous game that is played too often. And it almost always negatively impacts sales.

I promise that your board will not be happy when you tell them that even though revenue is just barely hitting plan, expenses will need to increase, otherwise next year’s revenue growth is going to be weak.

Every Plan is Wrong

Day 1 of next year, your plan will already be wrong.

That’s OK.

Perfectly predicting the future is not the goal of annual planning. Yes, accuracy in planning is ideal but it will never be perfect. When things don’t go exactly to plan, the annual plan should establish guardrails and help guide conversations on how to adjust.

Annual Planning vs Rolling Forecasts

I really like what Jorge Lluch, Co-founder and COO at Abacum, told me on this topic.

Every few years, someone declares that annual planning is obsolete. They’ll say the world moves too fast for year-long goals, that rolling forecasts have made budgets irrelevant.

They’re not wrong about speed, but they are wrong about exclusivity.

Annual planning and rolling forecasts aren’t enemies. They’re partners. One gives direction; the other gives agility. Annual planning still matters because direction always matters.

Rolling forecasts can help inform the annual plan, but annual planning should be much more than just an updated Excel model.

TLDR

If you take nothing else from this post…

Annual planning is NOT just an Excel modeling exercise. It creates direction.

Build alignment and get exec buy-in along the way

Your plan will be wrong. Use it to create guardrails for next year.

Up Next: Part 2 - Sales Capacity Planning

Footnotes:

Get the AI in Finance guide (from Abacum), packed with actionable and tactical real-world examples

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for OnlyCFO readers)

I learned the hard way that being right is useless if we're not together.

If you are right alone you aren't going anywhere.

If we are wrong together, chances are someone will notice and pivoting won't be as hard because we're aligned.

Collective intelligence is the answer.