Are Public Market Valuations "Brutal"?

Nah...they are reality. A lot of private company valuations are just pipe dreams.

Sponsor: Redefine planning with Abacum’s AI-native FP&A platform.

Check out this guide for how the best CFOs more accurately forecast cash flow, runway, revenue, and expenses. It’s packed with practical examples and the details that software/AI companies need to forecast better.

Are Public Markets “Brutal”?

No, the public markets are NOT “brutal”. They are just a more honest reality of current expectations with less irrational behavior than private companies.

However, the valuation resetting can certainly feel brutal in the public markets when the growth story changes…

Here is what I will cover in this post:

Who deserves valuation premiums?

Power of revenue growth endurance

Cloudflare vs Figma valuations

PagerDuty’s ugly 2x ARR valuation

ServiceNow’s epic growth endurance

Who Deserves Valuation Premiums?

Investors should only pay a valuation premium (high revenue multiple) when it’s an appropriate risk-adjusted discount on the future.

Hint: this is a discounted cash flow (DCF) model

As much as people love to hate on DCFs, they are theoretically perfect. It’s the investors that completely ignore the DCF mental model and only focus on shorthand valuation metrics that get in trouble. A company’s valuation today should reflect the present value of ALL future cash flows.

The impact of sustained high revenue growth compounding over a long-period of time is what can make software companies so valuable.

But it’s a double-edged sword…

As soon as that revenue growth story changes, public market investors will eat you alive.

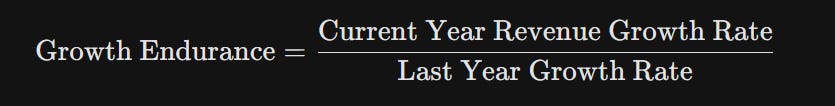

This is where my favorite metric comes in: revenue growth endurance

Power of Revenue Growth Endurance

Revenue growth endurance is a measure of the sustainability of revenue growth rates (i.e. revenue growth stamina).

High revenue growth today is pretty meaningless if it falls off a cliff in a couple of years. We love using short-hand valuation metrics like revenue multiples. We take enterprise value divided by NTM (next 12 months) revenue. It saves us from doing a full discounted cash flow model.

But NTM revenue doesn’t say anything about the next 10 years. And its the compounding of revenue over time that makes software so valuable.

This is where you can get some huge differences in NTM revenue multiples for companies with similar near term growth rates.

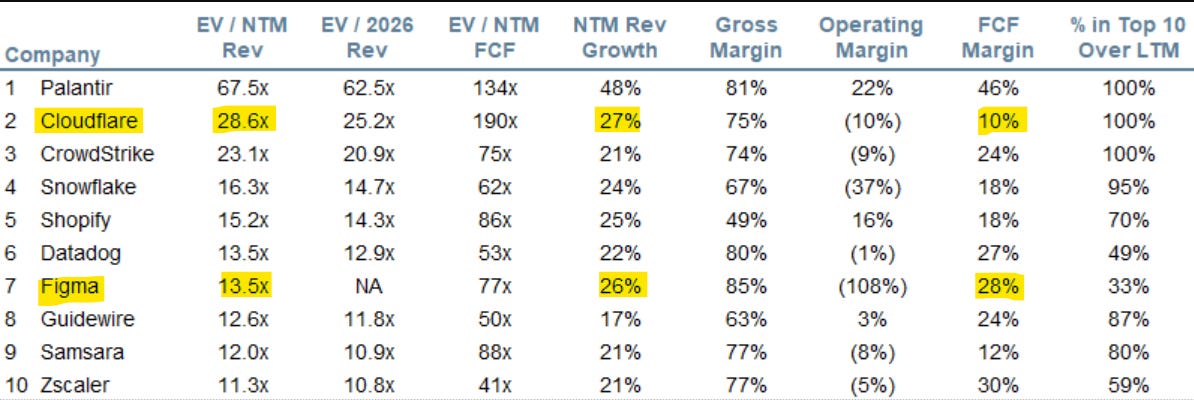

Cloudflare vs Figma

Cloudflare is growing 27% (just 1% higher than Figma) and even has smaller FCF margins. But Cloudflare is trading at a 2x higher revenue multiple. That’s a massive difference.

Why?

Long-term expectations. Maybe Figma is undervalued, Cloudflare is overvalued, or something in between…but there is a long-term investor expectation difference in revenue growth.

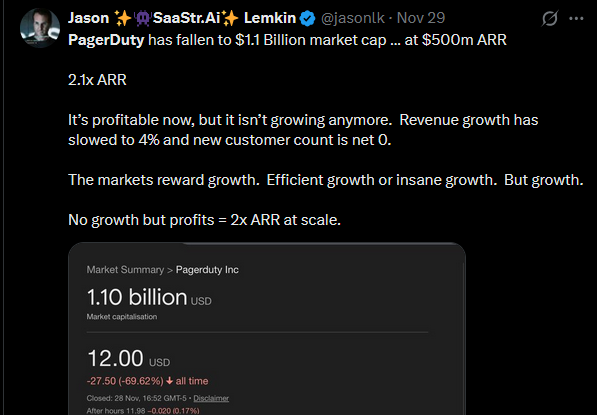

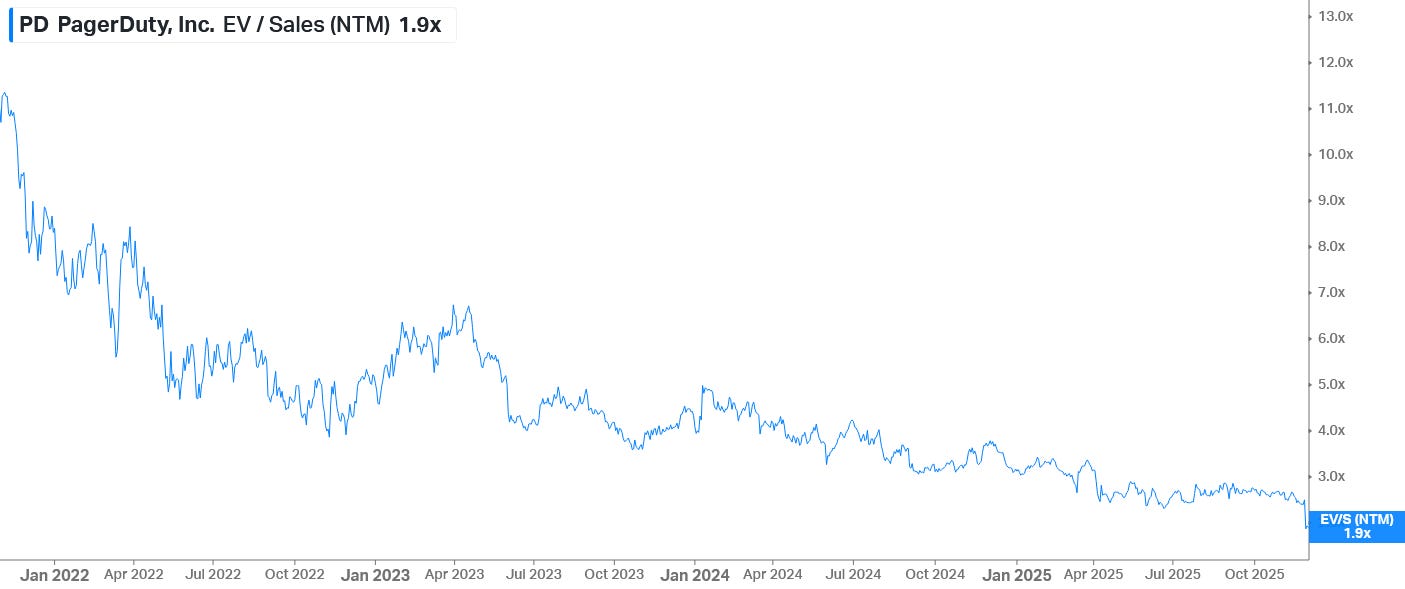

PagerDuty’s Ugly 2.1x ARR Valuation

The post below from Jason got a lot of people talking about public market valuations. With many folks saying the public markets are “brutal”.

What happened to PagerDuty? Why isn’t PE acquiring them? Is it cheap?

The real reason no one wants to touch PagerDuty?

Revenue growth endurance is abysmal.

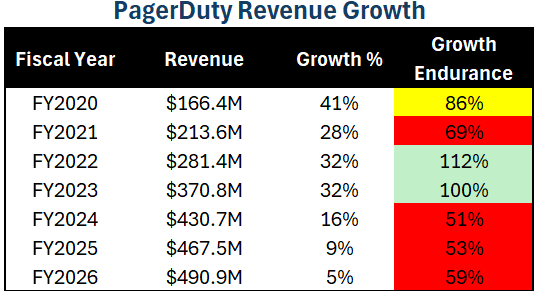

In the chart below I show PageDuty’s growth endurance in the far right column. It’s color coded for how I view growth endurance performance (green = great, yellow = OK, red = bad). It had a few good years, but there is a lot of red…

PagerDuty has one of the worst growth endurance performances of any public cloud company and its revenue multiple decline reflects that. Growing less than 5% with high stock-based compensation is a death sentence…

PageDuty’s 2x revenue multiple should be considered the baseline for private companies that are also barely growing.

If PE isn’t immediately swooping in and buying PagerDuty that has $500M ARR and decent FCF margins then it’s going to be even worse for smaller scale and unprofitable companies. And guess what? It is. Many of companies have ZERO M&A interest right now because revenue growth is weak and getting worse.

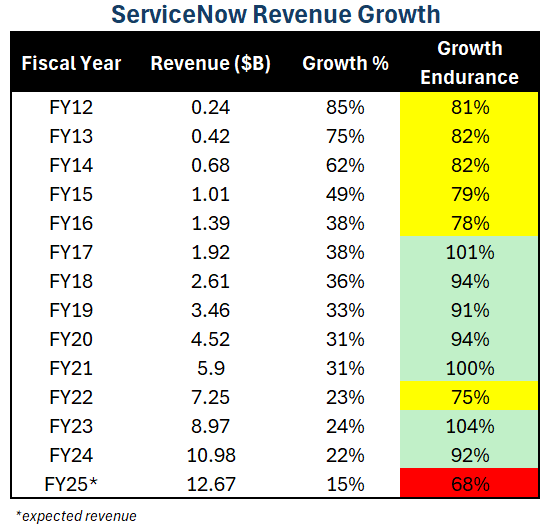

ServiceNow’s Epic Growth Endurance

Now compare PagerDuty to a company that just kept delivering year after year for over a past decade.

ServiceNow is an absolute beast and a model for what high revenue growth endurance can do. Almost no other company comes close.

I highlighted the growth endurance similar to PagerDuty to be consistent, but the story is different. Growth endurance of 81% while revenue growth is 85% should still be green. A company’s revenue scale and revenue growth rates matter for what good growth endurance looks like.

Relative to growth rates and revenue scale, ServiceNow’s growth endurance has been incredible since its IPO.

I might be a bit concerned about the current year of only 68% growth endurance, but at 15% growth on $12.7B revenue….that is still incredible.

In October 2012 ServiceNow had a 15x NTM revenue multiple. I know lots of folks who thought that was really expensive at the time.

Given ServiceNow’s absurd $4.7 billion market capitalization, when compared to its projected 2012 revenue of $239m, we think NOW’s share price is poised to collapse. — Kerrisdale Capital

Well, annual revenue is now 52x higher and the stock is now up 2,100% since Kerrisdale’s short seller report. This is the power of high growth endurance over a long period of time. And speaks to the team’s ability…

Final Thoughts

Public markets are not brutal. But some private company valuations are pipe dreams relative to the public markets and the valuations they could get in an IPO or M&A.

Many investors are getting long-term growth endurance expectations wrong right now.

A lot of AI companies are getting a massive pull forward in revenue right now as everyone is experimenting with AI, have a mandate to leverage AI, and the competition isn’t too bad yet.

But all of that will change soon. People will buy tools and settle in. And the competition is exploding.

A LOT of companies are going to hit a revenue growth wall in 2026. And it’s going to be a harsh reality for those companies and their investors that expected really high revenue growth endurance.

Footnotes:

Download this guide (from Abacum) to better forecast and partner across departments.

Want to sponsor OnlyCFO and reach 35,000 finance and other tech leaders? Email onlycfo@onlycfo.io