Are we in an AI-driven bubble?

Maybe...but that doesn't mean the party can't keep going

Today's newsletter is brought to you by Brex, the intelligent finance platform.

Your guide to faster AI results.

“So what’s our AI strategy?” Every board asks it, every LinkedIn post oversells it, and CFOs are left to separate hype from reality. Brex’s CFO Guide to AI Strategy gives it to you straight: the real strategy is faster adoption — cutting busywork so finance teams can focus on impact. Learn how to plan, budget, and accelerate AI in finance to automate 71% of expenses and close the books 3x faster.

Are we in a bubble?

Duh…but the more useful questions are what stage we’re in and what to watch. Are we early-2021 or late-2021 software market, and how long can it run before something breaks?

Maybe we are just getting started…

Do you want to know where someone smart has called a bubble over the past five years? At basically every point on the chart below, someone “smart” said we were entering a bubble.

The market is up 100%+ over the past five years...

What are the typical signs of a bubble?

Easy Money + New Story:

Loose credit/liquidity meets a compelling narrative (new tech, new market, “this time is different”).

While not everyone is getting huge valuations and funding in 2025 (RIP legacy SaaS), AI platforms are raising unprecedented capital at rich valuations as if it were 2021 all over again.

Some leaders have strong margins (Palantir, Oracle, etc.), but many (especially in private markets) are burning lots of cash. High-margin names can absorb multiple compression; low- or negative-margin names are far more exposed if the cycle turns.

New Financial Plumbing:

Fresh market structures let more people/speculation in. We have created many financial instruments for degen gamblers and other instruments to enable more speculation (from even more people). Below are a few things:

Enabling degen gamblers:

“Prediction markets” = gambling (at least in 99% of situations). Polymarket just launched “earnings prediction markets”—tradable event contracts on whether public companies will beat/miss specific earnings outcomes

Robinhood’s 24/5 trading and the SEC-approved 24X venue (23 hours on weekdays) expand thin-liquidity windows where moves can amplify.

Short-dated options (0DTE) now dominate index option flow. This is a sign of leverage packed into the shortest horizon.

Significant increase in leveraged trading + margin debt (see next section)

Multi-layer SPVs with stacked fees to access hot AI names. And pushing a lot more people to invest

Tokenized access: Robinhood’s tokens referencing private companies (e.g., OpenAI, SpaceX) are derivative exposure without shareholder rights. This pulls in retail investors into opaque, illiquid assets where pricing is subjective and spreads can widen fast.

Leverage

Rising prices enable more borrowing, which pushes prices higher. At least until a shock reverses the loop and the unwind is violent.

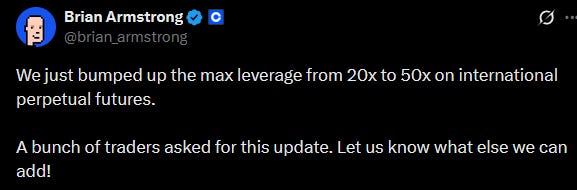

Coinbase International raised max leverage on perpetual futures from 20× to 50×.

What are we doing offering 50× leverage? Call me old-fashioned, but almost no retail investor should touch leverage. And does anyone really need 50x?

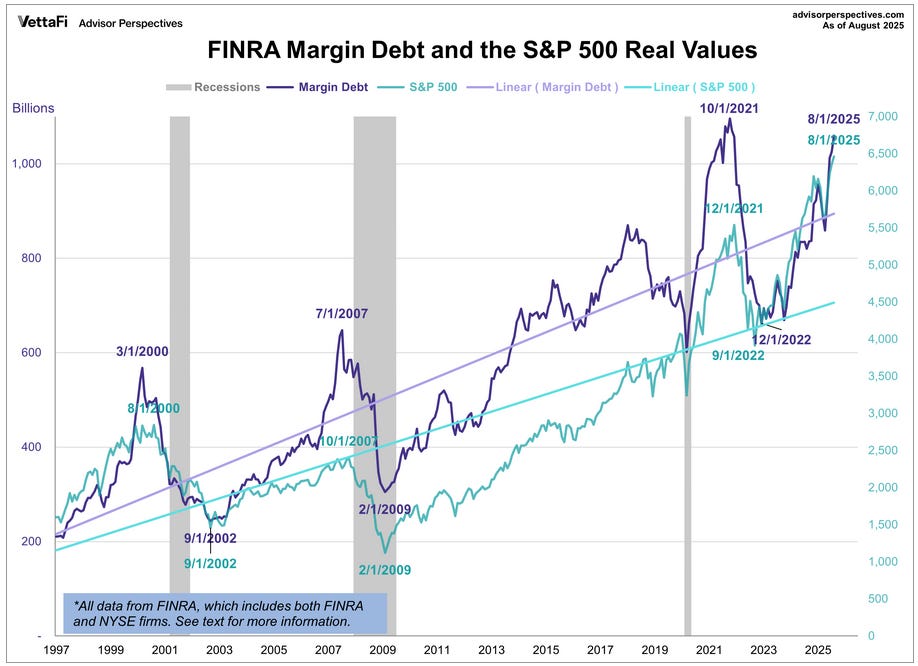

Margin Debt

Margin debt is the amount of money an investor borrows from their broker via a margin account. When adjusted for inflation, the debt level was up 3.3% month-over-month, reaching its highest level since November 2021, and is up 29.2% year-over-year.

Consumer Cracks

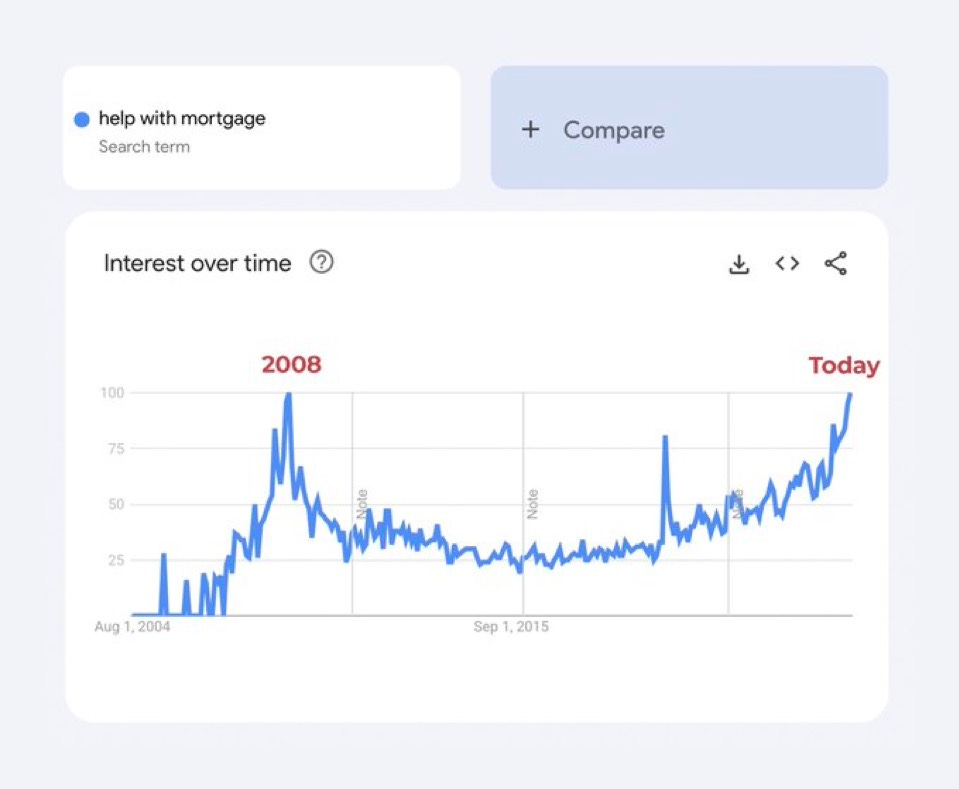

And maybe there are signs of cracks in the consumer. Not sure what the below means, but probably something. Lots more people looking for help on mortgages…

The job market is also weak and credit card debt (and number of delinquencies) is rising.

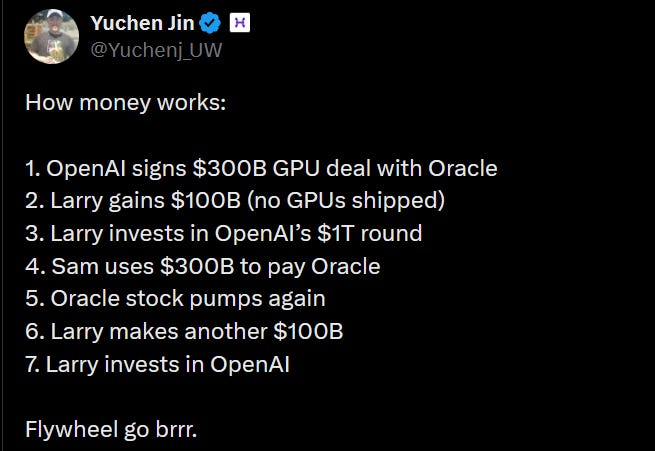

Balance-Sheet Daisy Chains and Related-Party Stuff

Is AI a house of cards? Are vendor financing, capacity pre-pays, and cross-contracts recycling capital in a way that looks like demand?

Narrative Dominance

There are plenty of narratives being told to justify high valuations today. Maybe some of them will be true, but…it certainly adds risk to a bubble:

AI will take over the vast majority of the labor budget so the TAM is expanding rapidly

If growth rates continue like this for a few years then….

If costs come down by X%, then our gross margins will be amazing

We are trusting that many things will be true in the future to justify the valuations today. And that creates risk.

Extreme concentration:

“Mag 7”/top-10 weights at ~30–40% of the S&P 500. That is extreme concentration risk to the broader market.

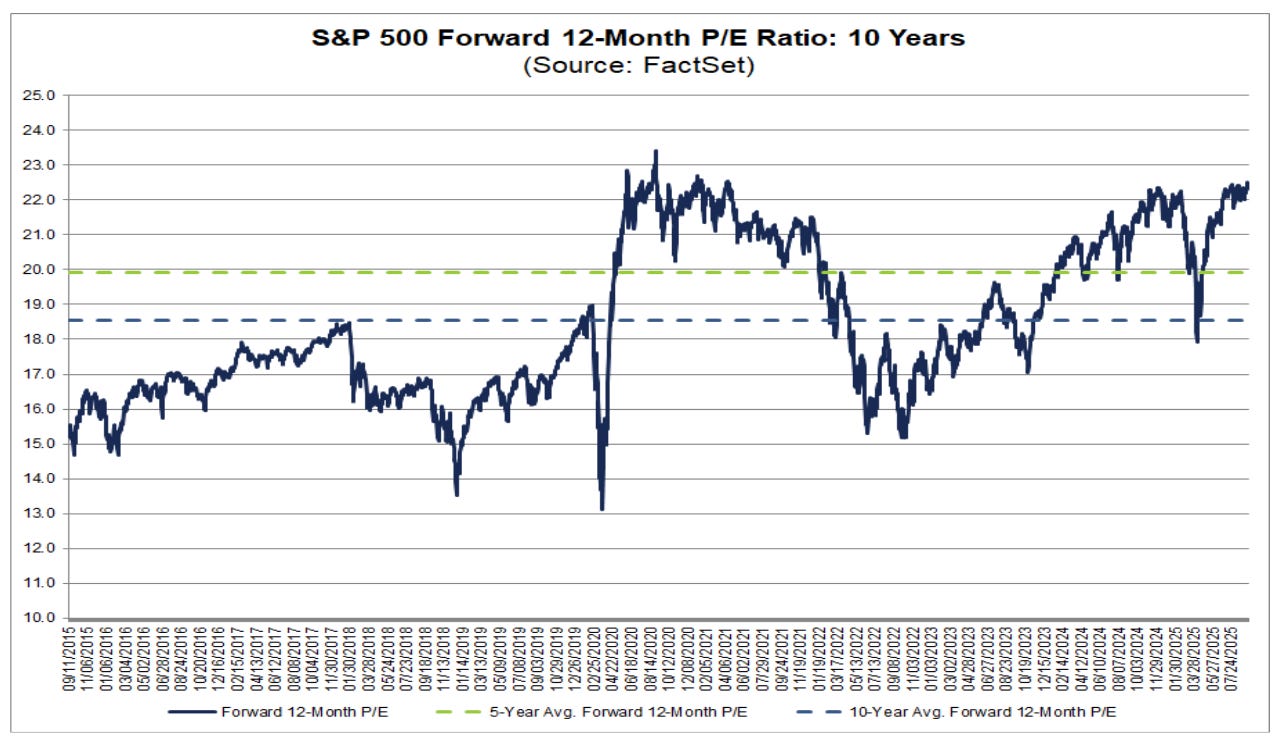

Rich Valuations

Public market P/E ratios have risen significantly and private market AI companies are getting revenue multiples we haven’t seen since the glory days of 2021.

Counterarguments: why this is not a bubble

The obvious argument against a bubble is that “this time is different” 😎. But here are a few more reasons:

Real Earnings:

Before the Dotcom bubble burst, the major companies (Microsoft, Cisco, Lucent, Nortel, and AOL) had an average P/E ratio of 82x. Compare that to the 28x P/E ratio of today’s MAG7 (or 27x of the Nasdaq 100) and it starts to not look too bad.

The rally has been earnings-driven (there are real cash flows), unlike the late-1990s melt-up that was mostly multiple expansion. And there is a compelling story why growth and FCF will continue.

Interest rates

A common reason for a bubble popping is the raising of interest rates.

The Fed raised interest rates by 1.75 percentage points between June 1999 and May 2000. And that was the major trigger that started the dotcom crash.

The current monetary setup is different. The Fed is starting to lower interest rates so there is still room to run and make the money printer go brrr. History says that when rates get cut when the stock market is strong then the market will keep ripping higher.

Real-world CapEx is surging

Data-center construction and AI infrastructure spending are hitting record highs, indicating tangible investment and adoption rather than pure speculation. (Whether ROI ultimately matches spend is the open question.)

Earnings and growth could continue to boom based on all the CapEx and other AI spend projections over the next 5 years.

Real TAM Expansion

If AI can successfully take human labor budget then that can be an actual HUGE TAM expansion.

The job market may be negatively impacted, but companies earnings will benefit.

The Point?

Not investment advice obviously… I’m not smart enough to time the market. If I were, I’d spend my time placing highly-levered macro bets (many retail investors think they are smart enough to do that…)

There are always be arguments for 1) why we are in a bubble and 2) why we are not in a bubble (or are early).

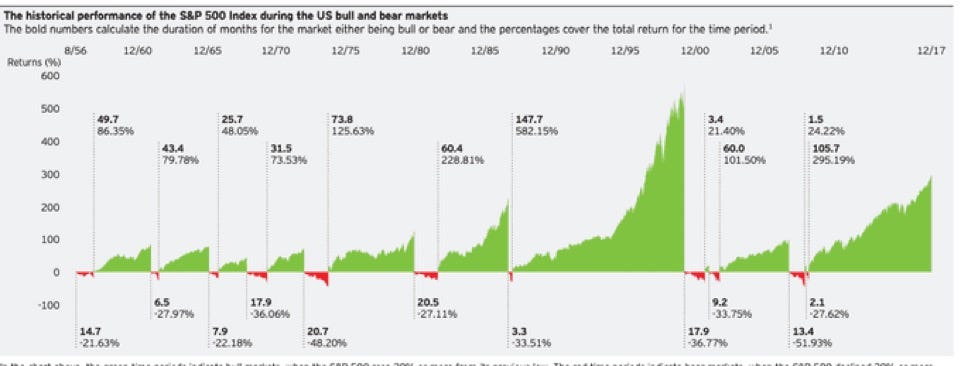

History says investors shouldn’t try to time the market. You will make a lot more in bull markets than you will lose in bear markets. But the crashes are always more quick and dramatic so they feel more painful.

There likely isn’t too much you should change if you are building a company, but there are potentially some things you can take advantage of:

Use less cash and more stock if you think your stock is overvalued (M&A, employee comp, etc)

Raise money while you can and extend runway

Make sure you have a plan to get to higher efficiency (and profitability). Plan A might be to grow faster and raise money, but always have a Plan B

Let’s hope we can get the party going!

Footnotes:

Download this free CFO Guide to AI Strategy (from Brex)

Go check out OnlyLawyer and send to your legal team

*Nothing in this article constitutes legal, tax, or investment advice.