Bad Commission Plans are EXPENSIVE

What are the right incentives for sales rep?

Today’s Sponsor: Leapfin

Finally! Your Stripe <> NetSuite integration solved the right way!

Would it help your Accounting team if Stripe billing and payment data could be reconciled and integrated with NetSuite automatically?

I’m not talking about connectors like Celigo or SuiteSync, or even Stripe Rev Rec. I’m talking about Leapfin.

Leapfin helps companies like Canva, Poshmark, and SeatGeek automate rev rec and reconciliation, plus Leapfin fixes their Stripe <> NetSuite data problem.

👉 Get a demo or watch a quick video

The Power of Incentives

Humans use the "carrot and stick" approach to influence behavior — you receive rewards (carrots) when you do what you are supposed to and punishments (sticks) when you do the wrong things.

I regularly use this approach with my kids (mostly carrots :).

But the effectiveness of various types of carrots (or sticks) with sales reps can vary wildly depending on the circumstances and how they are used.

💡»Get my free Sales Commission Calculator

I have personally used this model for up to ~100 sales reps. Get the calculator by subscribing to my new website (CFOPilot.com). More to come on what I am doing with the new site…

Defining Commission Plan Goals

The primary goal of commission plans can vary slightly depending on company stage and circumstances. But…ultimately the goal is to capture as much customer lifetime value (LTV) as possible for the least amount of customer acquisition costs (CAC).

We use commissions and other incentives to get sales reps to do what we want. But not enough time is spent thinking about the behavior we want to drive with these incentives.

Some goals may include:

Primary Goals

Increasing ARR

Increasing cash flow

Decreasing churn

Increasing ACV

Long-term contracts

Secondary Goals

Increase new logos

Improve gross margins

Reduce sales discounts

Increase expansion revenue

Increase sales on a specific product or geography

Get rid of poor performers and keep the best performers

The Basic Commission Structure

There are plenty of benchmarks to tell you the basics of sales rep compensation:

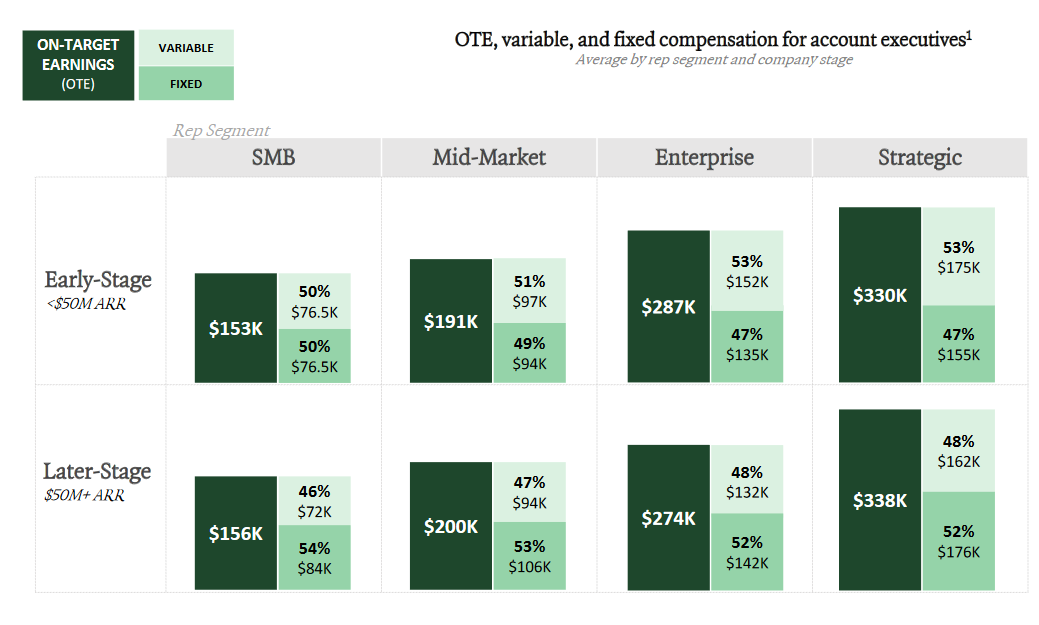

Almost everyone pays sales reps on a 50/50 comp plan where 50% is base and 50% is variable. And the more up market the segment the higher the OTE.

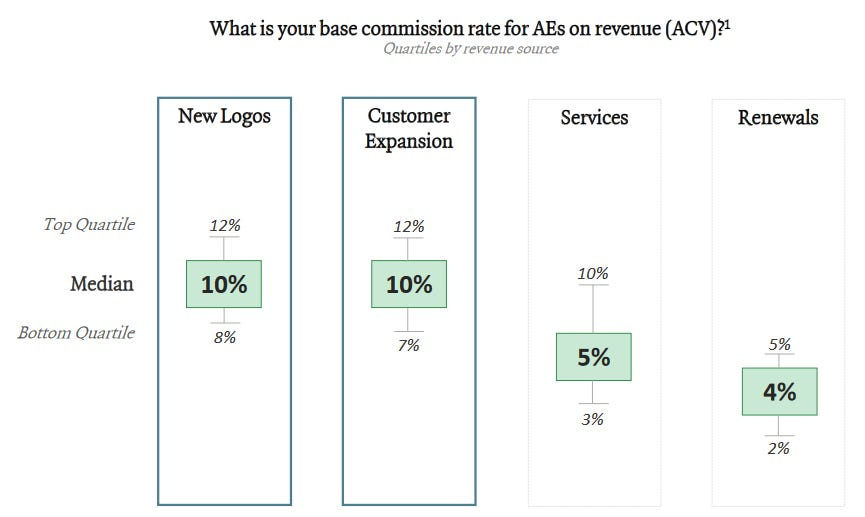

Based on sales rep quotas, the variable piece of the commission plan works out to be about 8 - 12% of revenue closed. Expansion ARR is usually at the same rate as new logo ARR.

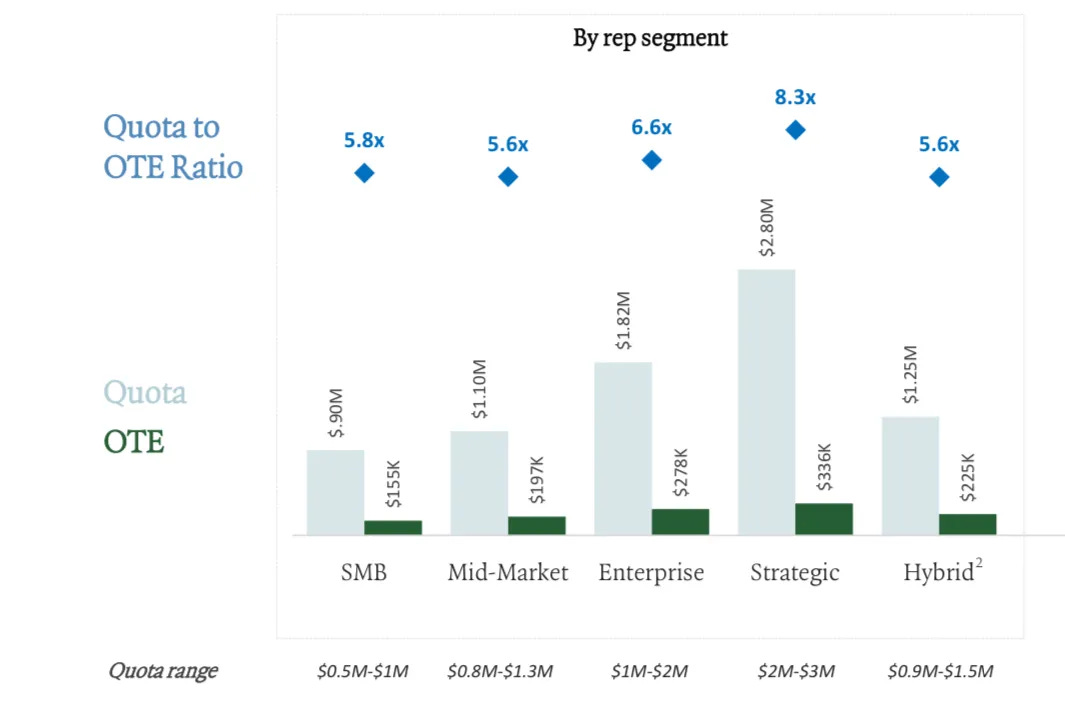

Based on the above, the quota to OTE ratio should hopefully look something like the below. The below is probably best-in-class benchmarks given these reports are from ICONIQ.

These basic comp structures are fairly determined by the market (what is everyone else paying), but…it doesn’t mean it shouldn’t be questioned given your circumstances and the hiring market.

Other Key Comp Plan Considerations

1. Losers are Expensive

Do you know the MOST expensive part of the sales budget?

The losers — the sales reps that close <30% (or whatever) of their quota.

This took me a really long time to actually understand.

The “losers” are the source of the biggest waste of money. I know many of you are questioning why we are paying some sales reps 2x more than the CEO (and maybe rightfully so), but it’s the losers that are the most expensive people on the payroll. Relative to the revenue dollars they are bringing… the losers’ OTE is VERY expensive!

Creating incentives and processes to get the bad reps (losers) out is critical. I have seen way too many plans that pay the losers too much and the great reps not enough.

How do you remove the losers?

There are two methods you can use to kick out the losers:

Tight processes to monitor/report on performance so you can fire the poor performers quickly

Comp plan that punishes poor performers and rewards over performance

Both are important, but lots of companies only do one of these (often #1) and they don’t do it very well.

I know it’s hard to fire people for multiple reasons (a big one is the belief that you need the ramped sales capacity to hit targets), but I promise that you will be better off getting rid of the losers quickly.

2. Ramp Time & Draws

Ramp time represents an expected adjustment to quota while sales reps are learning, building pipeline, etc.

Ramps and draws have an unintended consequence of also keeping the losers for too long. They are used to be competitive with what everyone else is doing, but the good reps don’t care as much.

In general the more complicated the product and the longer the sales cycle equates to a longer ramp period because it will take more time for reps to close deals (i.e. SMB reps have a smaller ramp time than Enterprise reps)

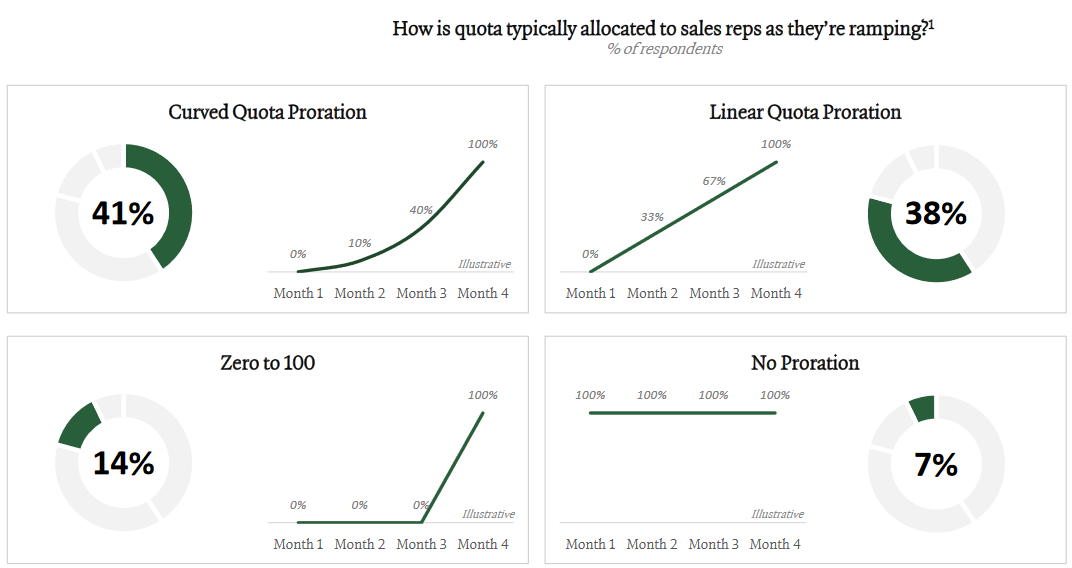

During the ramp period quota can be adjusted in a few different ways. Curved and linear proration are by far the most common in my experience.

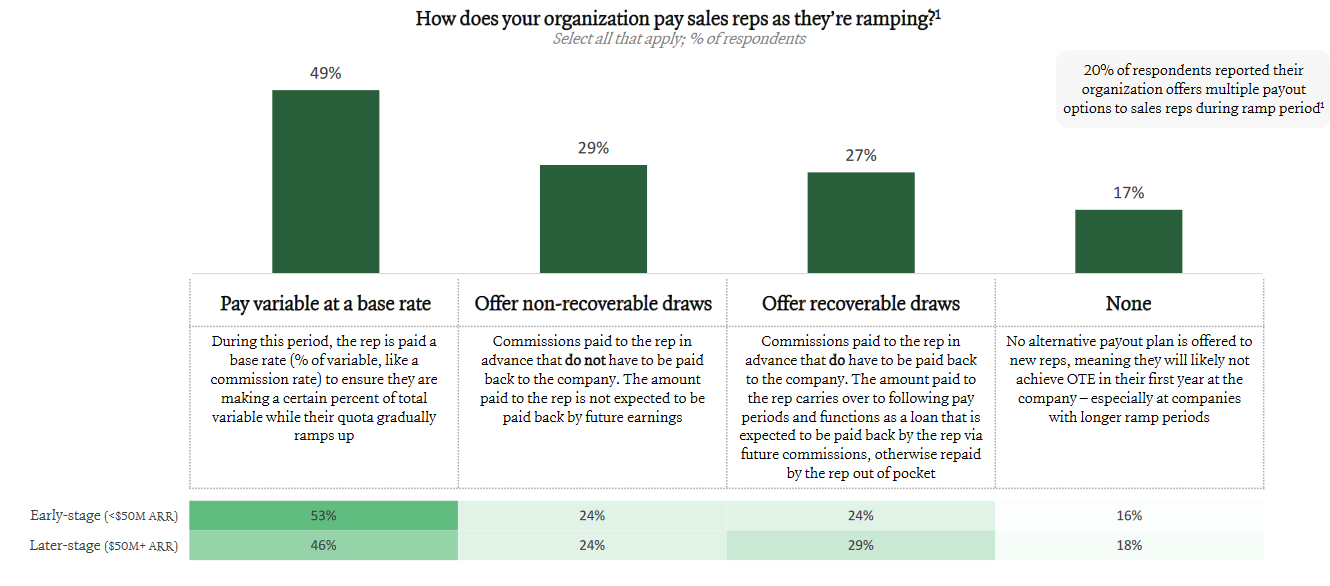

There are also multiple ways the reps can be paid during the ramp period.

Being too generous here will pay the losers way too much and not make reps hungry. I have seen some VERY generous plans that stack a lot of these components…

3. Usage-Based Pricing (UBP) Commissions

Commission plans with a usage-based pricing product are harder but ultimately should follow the same concepts. As more companies add AI products some form of usage-based pricing will be very common.

There are three ways I typically see quota retirement in a usage based pricing model:

Upfront payment for committed spend and true up for actual consumption. Sales reps typically need some sort of instant incentive for closing a deal, so this allows for some upfront payment that it trued up on actual consumption, which aligns incentives for the rep to ensure the customer is successful.

Consumption only. Commission payments are made based on actual consumption run rates. For example, a company may pay a commission after the first quarter based on consumption run rate and true up again after the second quarter.

Commit only. Commission is only paid on the annualized committed amount. This generally only works well when it is annual deals and the committed amount must be used within that period.

Whatever you decide, the commissions paid have to make sense relative to the actual money brought in. And it’s incentivizing the right behavior. A lot of companies are screwing the up as they add UBP and spent too little time on the comp plan for it.

4. Clawbacks

My answer to when commission should be paid and whether to do clawbacks is “it depends”.

For enterprise SaaS, I prefer to pay commissions in the month after the deal is closed and not wait for the payment to actually be received. But for more transactional sales reps selling to the SMB/VSB space I think waiting until payment can make sense because there is a lot more risk of non-payment.

For enterprise SaaS with annual contracts I would only clawback if the customer never pays, which should be fairly rare in the enterprise.

5. Churn

Should sales reps be penalized for churn?

Again, it depends.

If they have responsibility and some control over churn then potentially yes. When penalizing for churn I prefer to see a secondary quota for renewals that are a smaller percentage of the reps variable.

6. Multi-Year SPIF

Often a 1-2% additional commission is given closing a multi-year deal.

I have a love/hate relationship with multi-year contracts. I almost always HATE them as a buyer, but I love them on the sales side in theory. I say “in theory” because there are unintended consequences of incentivizing them:

Longer sales cycles

Excessive discounting

Upset customers that get stuck in the contract

Customers are neglected because they are locked in

In an ideal world, multi-year deals only happen what you get pulled in by customers and it is never pushed by the sales rep.

7. Accelerators:

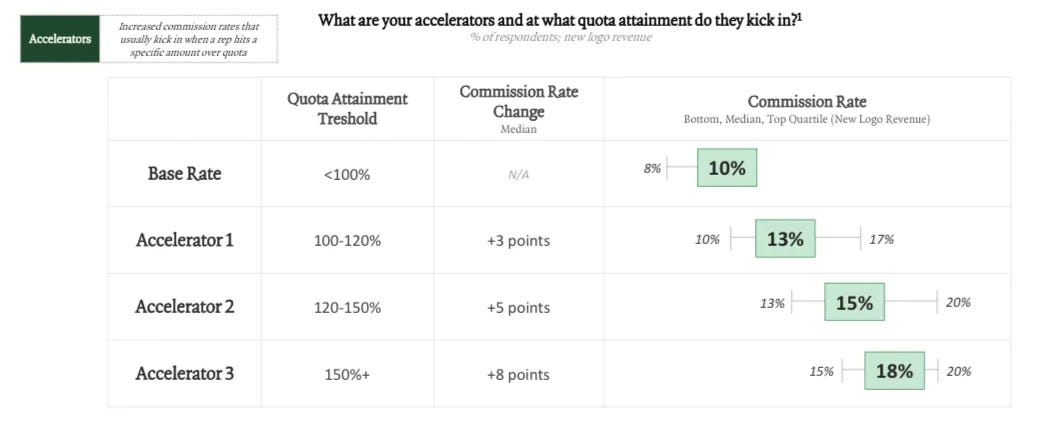

Accelerators are increased commission rates after quota is hit.

ICONIQ’s benchmark data below is directionally what I have used in sales comp plans. Remember, only a small % of reps should ever hit accelerator 3.

Over the past couple of years, I know many companies though that lowered quota targets because of the tough environment. This also caused accelerators to kick in a lot earlier, which can break unit economics a bit. Make sure your base and accelerator rates make sense today. Maybe you should just have less reps instead of lowering quota….

Footnotes:

Check out Leapfin to get your Stripe <> NetSuite integration solved the right way

Get my free Sales Commission Calculator and Sales Capacity Model