Become Efficient or Die

Balancing "default alive" and "default investable"

The myth that every software company will inevitably achieve world-class free cash flow margins is dead. During 2021, revenue growth was all that mattered because there was an expectation that all software companies could eventually become extremely profitable at scale….this is turning out to be less true than anticipated.

At scale, most software companies can still be very profitable but there is a wide range of possibilities. Investors now want to see more efficiency sooner and a shorter time to profitability. The ones that do this are receiving much better valuation multiples.

There are two different but related concepts that I think about in the trade-off between growth and efficiency:

Default Alive - not requiring additional outside capital to run the business. This means a company has a path to cash flow positive before the current cash runs out. Concept created by Paul Graham.

Default Investable - a company’s metrics are good enough to raise another financing round even in the current environment. Concept created by David Sacks.

The reason that there is going to be a bloodbath of VC-backed companies over the next 12-18 months is because of how far default investable and default alive diverged in 2021. Companies that were extremely inefficient but growing quickly were still “default investable”.

While the metrics for default investable have come crashing back a lot closer to default alive, a lot of companies won’t make the necessary changes in time.

No matter how good your growth is, you can never safely treat fundraising as more than a plan A. You should always have a plan B as well. - Paul Graham

While the growth-at-all-costs mindset is dead, growth is still really important if a company plans to fundraise again. Investors just now want strong growth AND efficiency. If a company isn’t ”default investable” based on its metrics then they need to do one of the following:

Extend cash runway long enough to get to “default investable”.

Move quickly to becoming “default alive” before running out of cash.

Costly Mistakes & Inefficiencies

1. Bad Hires and Employees

Some hires are just bad, but sometimes great hires might no longer be a good fit for the company. This often results from the growth and scale of a company. As an example, some people are really great from $0 to $10M in revenue, but not past that.

The most expensive bad hires/employees are executives given their scope of responsibility:

Motivates employees

Trains their team

Delegation of tasks

Sets up organization design (see point #2)

Creates strategic plan

Allocating resources, time, and capital

An executive can cause much more damage than a normal employee, so companies need to fire bad executives as quickly as possible. But “as quickly as possible” usually takes longer than most realize.

2. Bad Organization Design

Bad hires/employees (point #1) are often the cause of a bad organizational design.

Bad org designs can be really expensive and a lot of companies don’t regularly review them. Just like headcount and other spend, org designs should be regularly reviewed and adjusted as needed.

Sometimes bad leaders screw up org designs, but other times the design should be updated based on the stage/scale of the company. Companies are slow to change this because keeping the status quo is easier.

Andy Grove’s formula for high-output management basically says the following:

Exec output = output of Exec organization + the output of the neighboring organizations under his influence.

The idea is that an executive’s output should not be focused on how much work they are able to produce. Rather, it should be measured on how much output their organization outputs.

3. Not Listening to the Customer

I wrote a post a few weeks ago that 2023 is the year of customer success and gross churn. This year is going to be hard for most software companies, but the ones that will thrive are those that take care of their customers and make them successful in this difficult environment.

Hyper-growth during a once-in-a-lifetime bull market is “easy”. But those that show durable growth with low churn during economic headwinds will be the real winners on the other side of this tech recession.

A separate but related point is that the reality of product-market fit (PMF) is going to be tested. Many companies that thought they had strong PMF are finding out that maybe they really didn’t. Companies need to listen to customers and adjust quickly, which likely also means reducing cash burn to extend cash runway to get more time to develop PMF.

4. Inaccurate Forecasting

This should be fairly obvious, but companies that inaccurately forecast are going to waste a lot of money.

Below is a quote that I have been thinking a lot about. More companies should hire slower and wait until employees are actively complaining that they have too much work.

“Large staffs of successful startups are probably more the effect of growth than the cause.” - Paul Graham

How many people like the below do companies have on their team? Might not be as abusive, but given how fast companies have grown headcount there is likely lots of slack. High-growth companies are suppose to be hard.

5. Software Costs

Software has the ability to add significant leverage to a team and allow for more efficiency at scale, but…we must recognize that a lot of companies got a little crazy and wasteful in the number of tools and amount of spend.

When money was free and abundant:

Everyone got a license for every tool even if they didn’t really need it

Seat/usage commitments were made based on high-growth assumptions

Duplicative software was purchased because each team wanted a different tool

Optimizing tools and increasing savings wasn’t prioritized (see AWS cost optimization below)

Best-of-breed point solutions dominated when often cheaper platforms would have worked just fine

Companies with a decent finance team should be able to quickly review all software spend and easily find some low-hanging fruit. IT teams should do regular audits of all software spend to look for areas to save money.

Trends and Reads on Efficiency

AWS Cost Optimization - by Aimably

AWS is often one of the largest costs outside of people. This guide by Aimably is the most thorough guide for optimizing and cutting AWS spend I have seen. Have your CFO and VP Engineering review this!

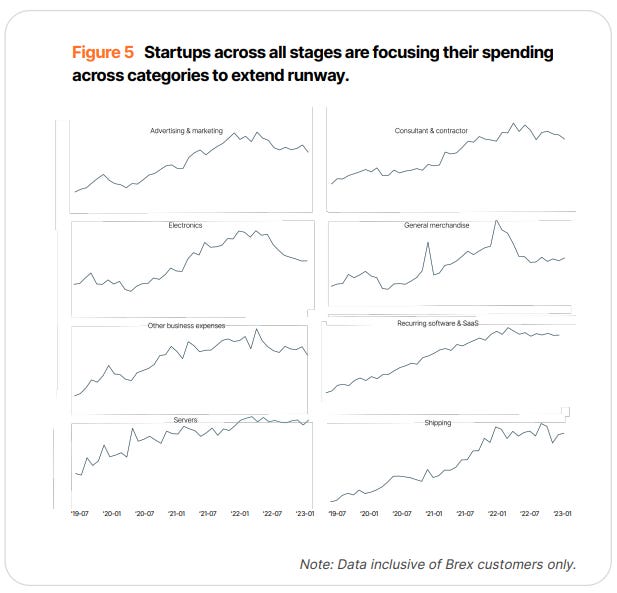

Brex gave me some early data on trends they are seeing in corporate card spend. Across categories, spend is flattening or decreasing.

Check out the full report they release this morning: Brex Startup Review Report

Nick Mehta (CEO of Gainsight) shared the results of a survey they performed. The survey was from Gainsight’s email distro so those folks are the ones likely already more focused on the CS department, but the results are in-line with my expectations.

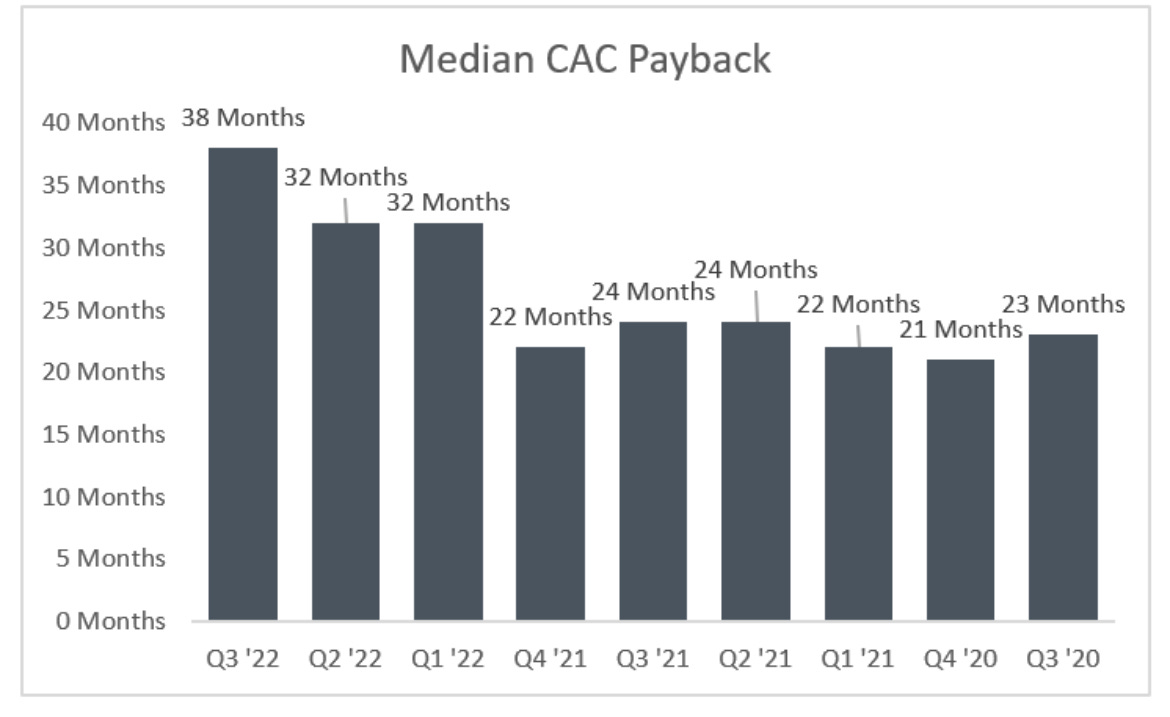

Understanding if a company is “default investable” in the current environment is critical. The goalposts have changed.

Sales and marketing inefficiencies have been on the rise. The chart below is from Jamin Ball

I am hearing lots of CFOs talk about salary freezes, providing more equity vs cash increases, resetting comp benchmarking (e.g. moving from the 75th percentile to something lower), etc.

During the boom times, a lot of companies also switched to country-wide or even worldwide comp bands. Seeing that slow down and even be rolled back.

I would love to hear any feedback or questions on this post. Like or comment on the post and let me know!

This was a good post. I like the concept of default investible. A related idea is when does the company start thinking about being default investible? I'd argue it will depend on whether the next 24 to 36 month's plan is to be default alive or default investible. If the former, focus on efficiency else on metric for next round of funding.