Biggest Winners in Cloud | Lessons from Weave

Lessons of a little known software company stock that has quietly gained 150% in the past year

Weave when public on November 11, 2021 at $1.5B valuation ($24/share) while raising $120M. Before going public Weave raised $168M with its last round in 2019 valuing the company at $1B.

Weave was very fortunate in their IPO timing as they IPO’d at the very peak of software valuation multiples.

Before diving into the learnings of Weave a word from our sponsor…

Brought to you by: NetSuite

CFO's Ultimate KPI Checklist: 50 Step-By-Step Checklists to Drive Your Company's Success

Sponsor OnlyCFO and reach 17k+ finance leaders, CEOs, and other software leaders.

Weave’s stock price quickly fell immediately after its IPO. It holds the record for largest IPO day drop amongst software companies — dropping 22% on its IPO day. The overwhelming majority of tech IPOs see a pretty sizable “IPO pop” because they are priced in a way to generate a decent stock price jump on the IPO day.

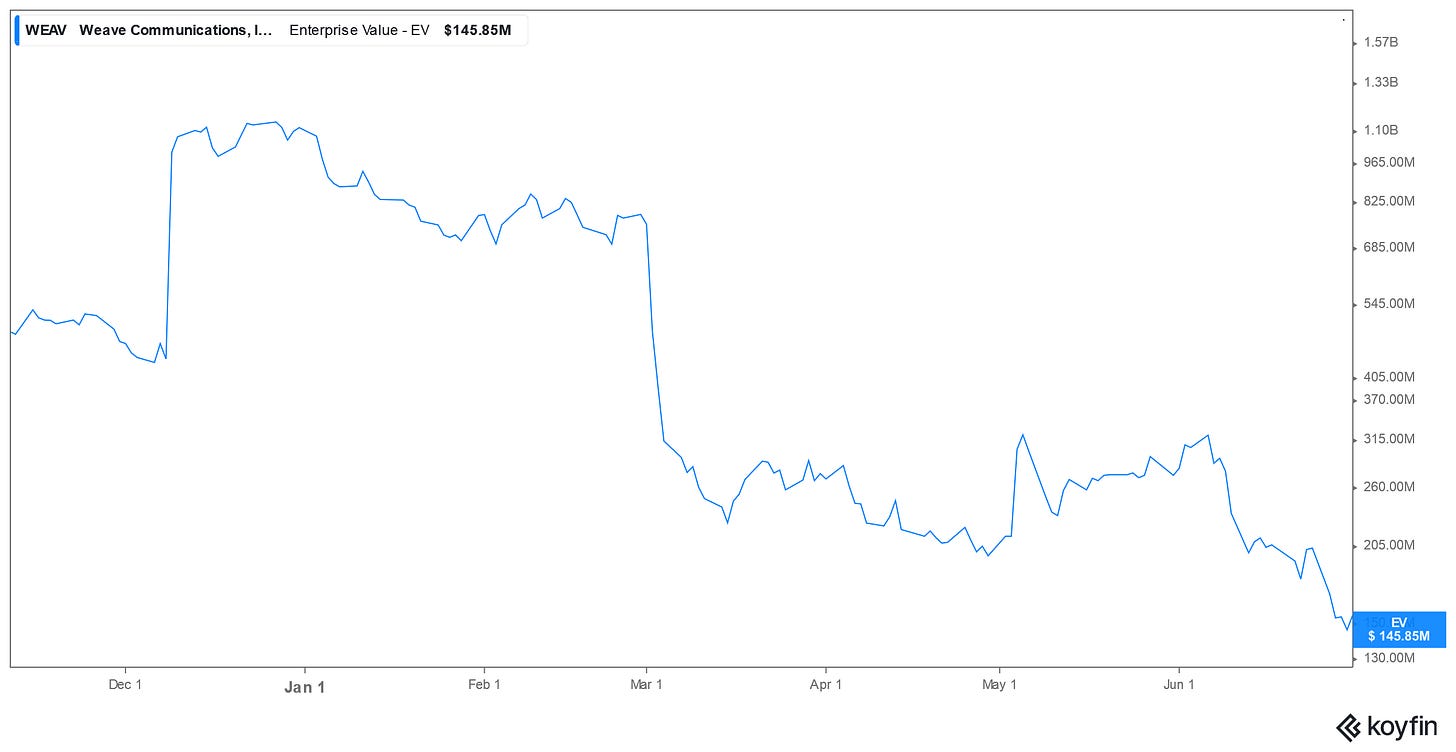

From the IPO date, Weave’s stock price followed an even more extreme trajectory then the software multiples chart above. Between its IPO and June 2022, the stock price dropped to $3.55, which was an enterprise value of just $145M — almost as much cash as they raised in their IPO 8 months earlier…

But then things started to turn around for Weave’s stock. Even after Weave’s stock price drop today from its earnings release, Weave’s stock is the 5th best software stock performer since January 1, 2023.

Lessons from Weave

Weave is a vertical software company that began as a dental ERP and communication platform but have expanded into similar undeserved verticals as they have scaled.

Weave’s Small IPO

Weave was just barely above $100M in ARR at the time of their IPO, which would make it one of the smallest software IPOs ever. Most software IPOs happened at $200M+. The small market cap often means more volatility in the stock price.

Slowing Revenue Growth

At the time of Weave’s IPO they were growing at a decent 55%, but similar to other software companies, growth started to fall in 2022:

2020 revenue growth - 75%

2021 revenue growth - 45%

2022 revenue growth - 23%

2023 revenue growth - 20%

While growth started falling pretty fast through 2022, growth remained relatively flat in 2023 compared to 2022 which was a positive sign. The concern in its most recent earnings release this week is that it expect revenue growth to continue to slow at 14-15%.

Improvement of Gross Margins

Investors care a lot about gross margins because they represent a ceiling on how profitable a company can become as gross margins are the direct variable costs associated with each additional dollar of revenue.

At scale gross margins are very hard to improve, but companies can get a lot of leverage out of operating expenses. In other words, all operating expenses (sales, marketing, engineering, etc) should start to meaningfully decrease as a % of revenue while gross margins likely remain relatively flat.

Weave had 58% gross margins at the time of its IPO. The average public software company has 75% gross margins, so Weave had one of the worst gross margins.

But one reason for its significant rise in stock price over the past 1.5 years is from its improvement in gross margins. It’s current gross margins is almost 69%, a 11 percentage point increase in a relatively short period of time.

One reason why Weave’s gross margins aren’t great is because it also sells hardware. While a relatively small amount of Weave’s total revenue (3%), software combined with hardware is generally much harder and often loses money on the hardware. If hardware is required, then revenue growth becomes a lot harder to maintain.

NRR & GRR

Net revenue retention (NRR) represents the change in annual revenue of customers from one year ago versus today. It is inclusive of churn and expansion but excludes new customers. So if all your customers had $1M of revenue one year ago and today that same group of customers has $1.1M in revenue then NRR would be 110%

Gross revenue retention (GRR) is the same as NRR except that it also excludes expansion revenue so the highest it can be is 100%.

In 2023 Weave had NRR of 95% and GRR of 92%. Is this good or is this bad?

When most people think about benchmarks of these metrics they think of something like the ICONIQ report below. In today’s tougher market many people will say that 110% NRR is good.

So Weave’s NRR must be bad right?

Not so fast. Weave does not sell enterprise software. They sell software to SMBs which should operate by a completely different set of benchmarks. Another warning of blindly following “benchmarks”….you need the appropriate context and understanding first.

For SMBs I would say 100% NRR would be pretty amazing right now. And GRR is often closer to 85%. So while Weave’s NRR has come down a bit it is still pretty good based on its segment it sells to. And it’s GRR at 92% is really solid.

Expansion is just really small. With GRR of 92% and NRR of 96%, its expansion at 4% is pretty small. If Weave can hold GRR where it is but increase its expansion opportunities, then a higher revenue growth rate will be significantly easier.

Concluding Thoughts

Weave has no debt, $110M in cash, and has been consistently generating free cash flow. It has made a lot of efficiency improvements while keeping revenue growth relatively stable over the past couple of years.

A lot of private unicorn companies are in a similar position — they have slashed the cash burn a ton but growth is still fairly slow.

But most of these companies NEED to reaccelerate revenue growth to justify their valuations or become radically more profitable. 20% revenue growth at breakeven free cash flow is generally not an interesting business. And the big looming question for investors is if these types of companies can actually generate the expected software free cash flow margins of 20%+.

Footnotes:

Sponsor OnlyCFO Newsletter and reach 17k+ CFOs, CEO, and other leaders in the software industry.

CFO's Ultimate KPI Checklist: Check out this great checklist of KPIs that companies and CFO’s should be tracking

Subscribe if you haven’t and share my newsletter with your friends!