Board Members are "Quiet Quitting" | Is T2D3 Dead?

T2D3 isn't good enough today so your board members are giving up on you

Today’s sponsor: Brex, the intelligent finance platform.

CFOs are building for 10 scenarios, not one.

Can resilience be a strategy? Brex CFO survey data says it is now. Tariffs, AI, and global uncertainty have made stability a moving target and adaptability the next big edge. But 69% say their finance stacks are too complex to move fast, and 75% feel pressure to accelerate AI results. See how CFOs are making flexibility, automation, and speed their new KPIs.

T2D3 is Dead?

The CEO of General Catalyst (VC firm) upset a lot of people on social media this week by saying that the prior gold standard for growth (T2D3) isn’t interesting. And if you want to raise VC money today you need to be going to $100M in ~3 years.

Today’s post isn’t about debating whether this makes sense or how it may play out long-term (that post will come soon).

Regardless of your views on his statement, the fact is that many VCs agree with this. Which means they will carry the same attitude to their existing portfolio of legacy software companies where they are board members…Most VCs have invested in some kind of zombiecorn that they know isn’t going anywhere. But now the number of “not interesting” companies these VCs are invested in has skyrocketed if this is the new revenue growth bar.

Something I have been hearing more about over the past year is the “quiet quitting” of board members from their slower growth, non-AI companies.

Here is a definition of quiet quitting.

Quiet Quitting: When someone does the core duties in their job description—no more, no less. They meet expectations but stop offering discretionary effort (staying late, taking extra projects, being “always on,” informal mentoring, etc.)

“Quiet quitting” is typically associated with regular employees who basically see how long they can do the least amount of work without being fired.

Why are board members quiet quitting and how are they doing it?

Why They “Quiet Quit”

Show me the incentives and I will show you the outcome. — Charlie Munger

There are two truths about the VC business that push them to “quiet quitting”:

1. The Power Law

The VC model is built on power law returns. A small fraction of investments generate the vast majority of returns (a few outliers determine the success of a fund).

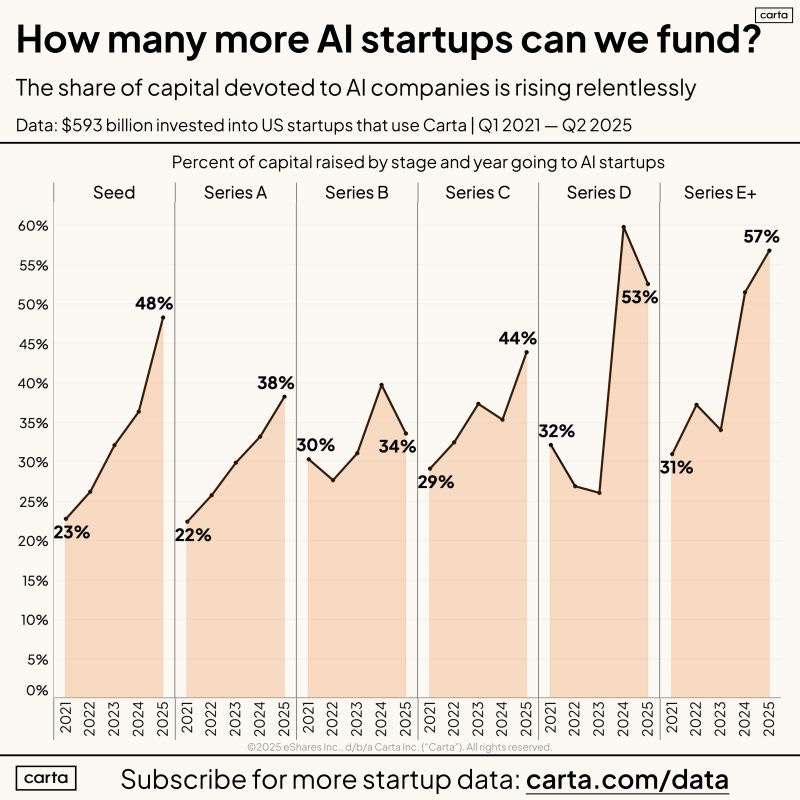

In 2025 they believe that the outliers are going to be in the AI-native, super fast growing companies. And that your <30% growth, non-AI native company will do nothing for their returns.

This general concept has always been true, but this shift to AI has 100x amplified the impact. There are the AI “haves” and the non-AI “have nots”. The difference between them has become massive. VCs have legacy companies struggling for 20% growth while their new AI portfolio companies are growing 300% at a larger scale…Where do they think their outlier returns will be?

Guess where all the new money is going? LPs are pushing VCs to make more AI investments because that’s where they believe outlier returns will be.

2. Associate with Success

VCs are incentivized to tie themselves to success and distance themselves from failure.

VCs need to raise money from LPs for their next fund. And so they don’t want to tie themselves to failures, but rather want to invest and showcase the latest, hottest thing.

VCs pouring money into slower growth, legacy SaaS companies is generally not the strategy to do that in 2025…

How They “Quiet Quit”

Let’s be honest. Board members and VCs don’t do very much for companies anyways…so how can they “quiet quit”?

1. Stop Making Intros

One of the few true value adds from VCs is the connections they can offer. They know people that can be customers, future investors, potential employees, etc. They also share about your company on social media and talk about your success on podcasts.

This is why many VC firms are becoming media companies (see a16z building a media empire).

But…these folks have a finite number of connections and limited distribution. These introductions stop when they quiet quit. Or the quality of those connections will drop significantly.

It’s logical. They are on 8+ boards. Several of those companies are legacy SaaS growing <20% while a couple are AI-native and grew to $100M in 2.5 years...Where do you think their best connections/intros are being sent? VCs are excited to introduce folks to the HOT AI company they invested early in. They are playing the power law game.

Don’t hate the player, hate the game.

2. Stop Asking Questions

I am not talking about the meme about VCs saying, “Let me know how I can be helpful”.

I am referring to VCs/boards asking deep questions that show they actually care:

Are they engaged during the board meeting?

Did they read the pre-read materials? Did they send questions ahead of the meeting?

Do they offer to be included in non-board meeting discussions?

If you see a significant change from when you raised money from them, then they may have mentally checked out.

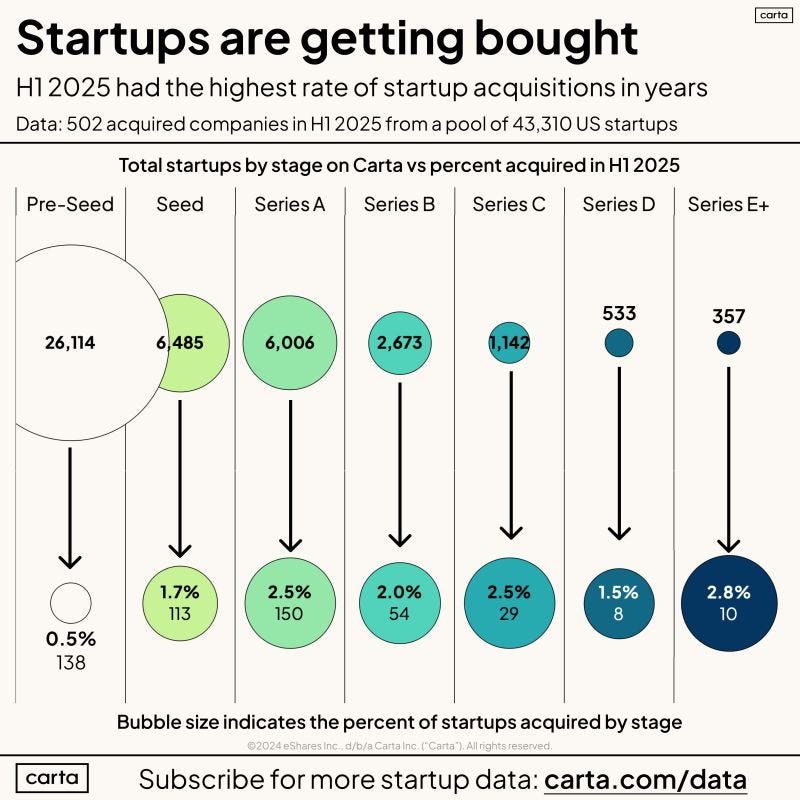

3. Pushing M&A

I am seeing more and more board members and VCs suggest/require that their companies start an informal process to “just see the market appetite”.

Translation: They want to get some of their money back and focus on the current cycle (AI and robotics).

Whether they get 50%, 80% or make a little money doesn’t really matter…they just want to move on.

M&A has heated up in 2025. But…this doesn’t mean founders/employees had good exits. Many of these exits are just a soft landing for the company and a way for investors to get some of their money back.

Now What?

Board members rarely actually quit your board because it’s a bad look for them and the VC firm. But they may quiet quit.

But what should you do if you think your VCs have given up on you?

Ask them. Honestly, what is the downside if you suspect they “quiet quit” anyways? Ask them if they would give you more money today if you wanted to raise (and what valuation)? Follow up with what would they need to see to change their mind?

Don’t change how to manage your board/investors. You should still give them updates, prepare well for board meetings, ask them for help, etc. Why? Because not doing so is a sure way to burn bridges with your investors and potentially their VC friends. They may quit on you but you can’t quit on them…

Focus on building a great business and worry a bit less about what the board thinks…

Don’t expect to raise more money

Don’t expect valuable introductions from them

Don’t expect them to “be helpful”

Focus on building a cash flow positive business that doesn’t need them

Maybe you need to make a big pivot that your VCs may disagree with. If they want you to sell the company to get their cash back then they won’t want you to do this…But just do it if it is the right thing

Selling the company may be the right decision, but just because your board has given up doesn’t mean you should give up too. Have the honest conversation with them so at least you know where they stand.

There are many board members that won’t give up on you. They are invested and committed to help you win regardless of how bad things become. But I promise that isn’t many VCs…

Footnotes:

Download this CFO survey data on top concerns and priorities in 2025 (from Brex)

Get 20% off with OnlyExperts to find offshore accounting resources

*Nothing in this article constitutes legal, tax, or investment advice.

#2 is such a big one. I have been shocked at the lack of engagement from some board members. The way what should be concerning data slides past, slide after slide, and they don’t speak up. Then, before the end of the meeting, they weigh in on inconsequential just so their name is listed in the minutes as having spoken up. And THAT thing is what leadership latches onto to address. The value of a good board - and how leadership addresses their advice - is so important!