Executive Compensation Benchmarks

How much do CFOs (and other execs) get paid in salary, bonus, and equity?

Today’s Sponsor: Nominal

AI becomes finance standard in 3 years. 92% of leaders agree. Are you ready?

Nominal analyzed over 50 million AI-processed journal entries and discovered something striking: 89% of finance errors fall into just 12 predictable patterns. Manual processing adds 43 extra minutes per entry, while AI processes them 20x faster and learns your org’s preferences in under 6 months.

The insight: your close bottleneck isn’t people or effort. It’s architecture. See how leading finance teams are using AI to eliminate manual work, reduce close cycles, and scale without adding headcount.

Exec Comp & Equity Benchmarks

There are two primary (and related) things that impact compensation benchmarks:

Revenue Scale

Market Cap

There are also some important differences between how private companies compensate executives versus public companies.

Below is a breakdown of executive comp at 1) private companies from my friends at Pave and 2) public companies from required executive disclosures.

1. Base Salary

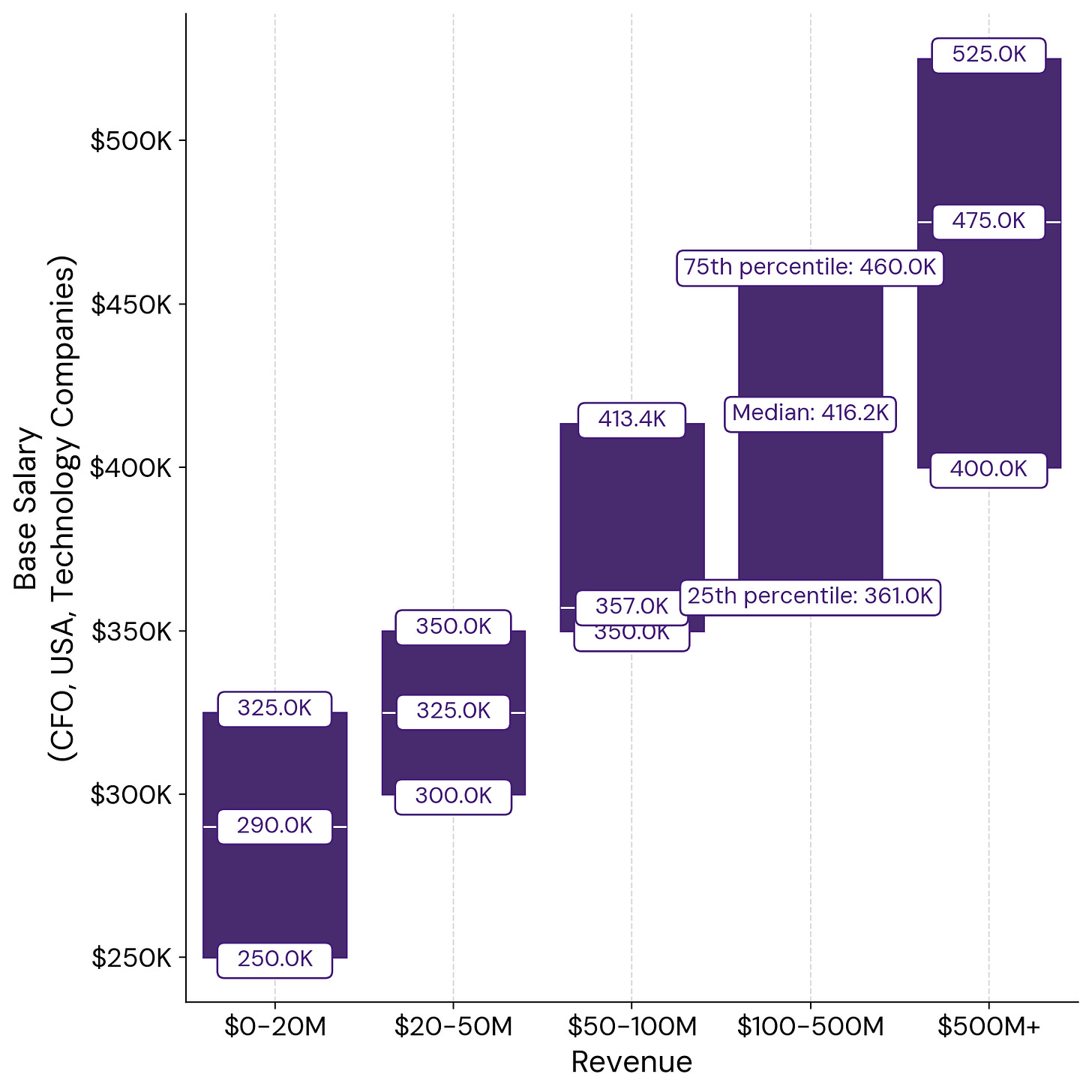

The size of a CFO’s salary is correlated with revenue scale. A larger revenue scale generally requires a more experienced CFO that can command a higher salary.

The CFO you typically need at $25M is not the same one you need at $500M, near an IPO, or at a large public company. Someone can grow into the different phases, but presumably that means they have proven they can scale with the company to the next level and then require a higher salary.

Private Company Base Salary:

The below chart shows base salaries across different revenue sales and salary ranges. Based on my experience, higher growth VC-backed companies are likely going to be at the 50th percentile and above

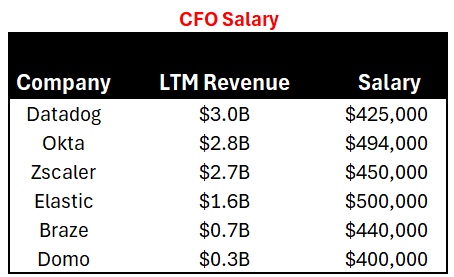

Public Company Base Salary:

Once a company is public, more revenue doesn’t equal a higher salary. Why? Because the salary (and even the bonus) become a fairly insignificant piece of compensation. Equity (which is basically cash at a public company) is where the big bucks are made. More on this further below.

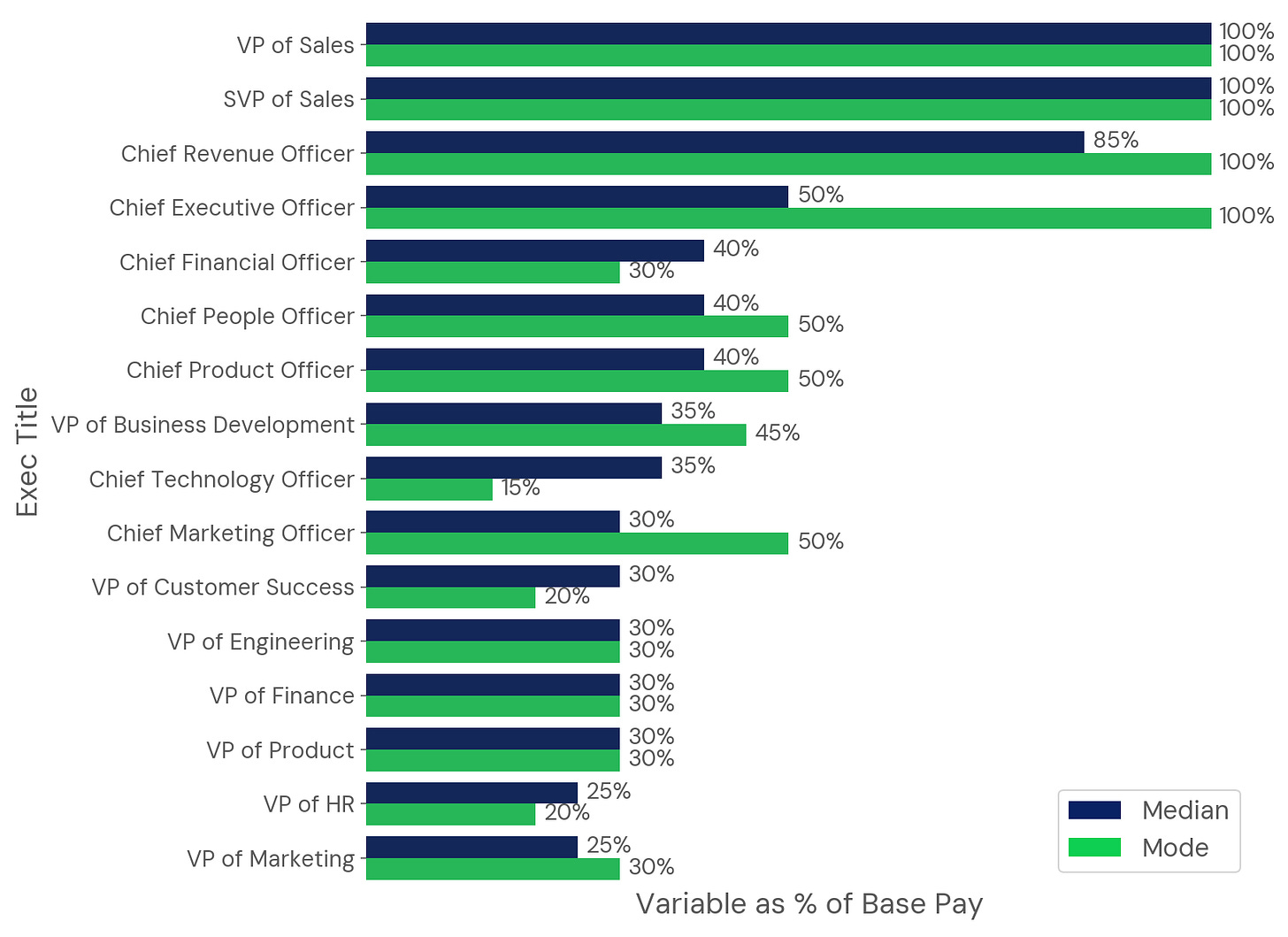

2. Bonus

Almost every executive at a VC-backed company and public company has a bonus plan (even if the rest of the company doesn’t).

Private Company Bonuses:

The below bonus percentages line up with what I have seen for private companies.

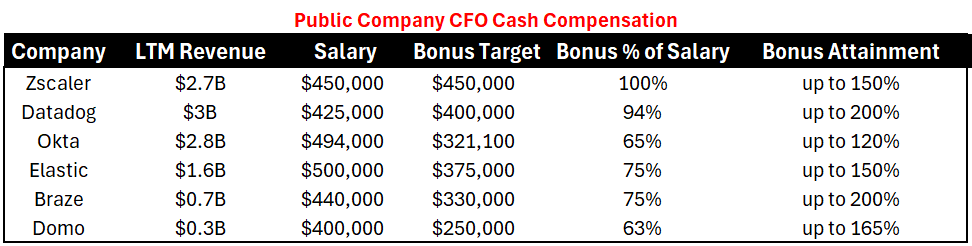

Public Company Bonuses:

For public companies, the bonus percentages for a CFO (and other executives) is usually higher. I usually see target bonuses between 50% and 100% of their base salary.

Below is several public companies with varying revenue ranges and the cash compensation for their CFOs. The bonus attainment column shows the highest possible bonus achievement if the company hits the highest targets.

Bonus Metrics

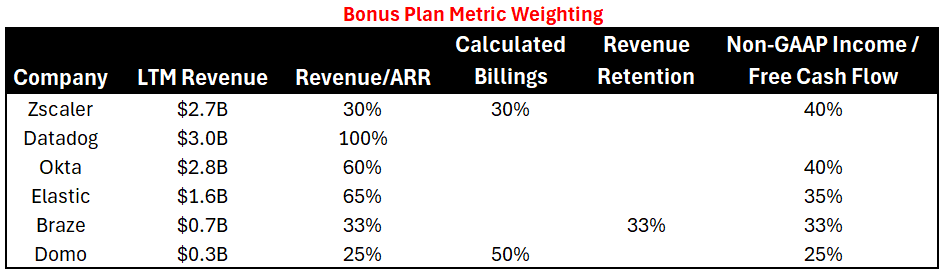

Bonus plan metrics (for both private and public) typically fall into two categories:

Revenue growth (ARR, GAAP revenue, billings, etc)

Profitability (FCF, EBITDA, etc)

Earlier in the company lifecycle it might be weighted 100% on revenue growth, but it often has a cash burn target as well. As a company scales (especially when public) there will almost always be a profitability metric. Typically still weighted more heavily towards growth though. Something like 66% growth and 33% profitability weighting is typical.

Datadog is the only company below with 100% weighting on growth but two notes on that: 1) they are already generating ~28% FCF margins and 2) they have decelerators if non-GAAP operating income falls below a certain target.

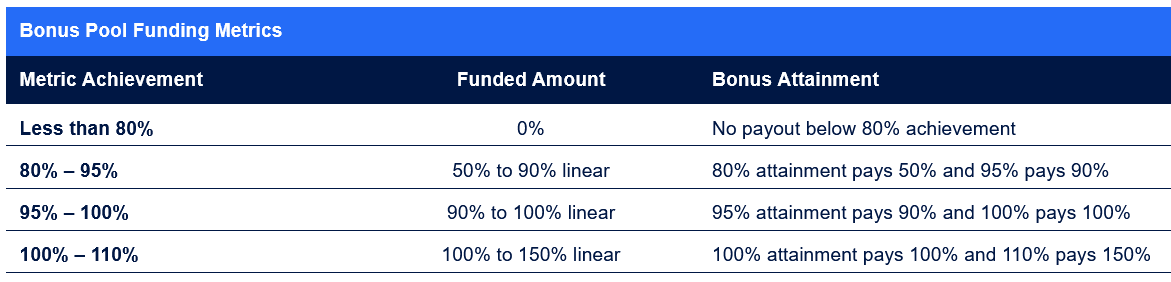

Bonus Payout

Most exec bonus plans allow for over achievement. Based on the public company examples above, bonus overachievement can range from 120% to 200% of the bonus target.

Below is how ZScaler’s exec bonuses get paid out. Something like this is very typical for both private and public companies.

Many companies also include a minimum bonus guarantee (often around 30%). Especially if the first payout floor is aggressive.

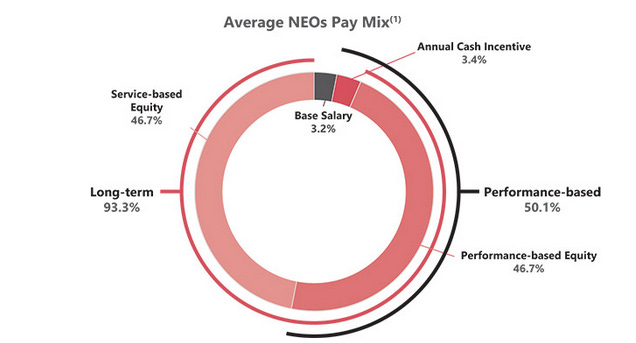

3. Equity

As I said before, executive compensation is heavily weighted toward equity. The below example, from CrowdStrike, shows that <7% of CrowdStrike’s executive compensation is from cash (salary and bonus). If you exclude the CEO, then it’s probably closer to 10%, but the CFO would still have 90% from equity…

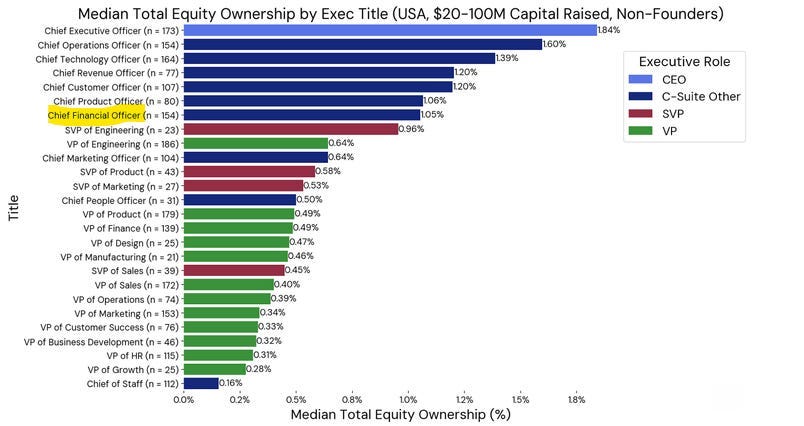

Private Company Equity Comp:

In theory, private companies have a similar mix. But…there is obviously a lot more risk since there is only value if there is either an active secondary market or there is an exit.

Pre-IPO companies usually talk about equity for executives in terms of percentages. When they are close to being public and after public then it is talked about in terms of dollars.

The below breakdown is roughly what I have seen for companies at this stage (roughly 1% of fully diluted). Although the CFO is usually higher than the CCO and often even with the CRO in my experience.

Public Company Equity Comp:

Public company equity is essentially cash. Once a company is public and the company’s market cap is much larger, it is less useful to talk about equity comp in terms of percentages.

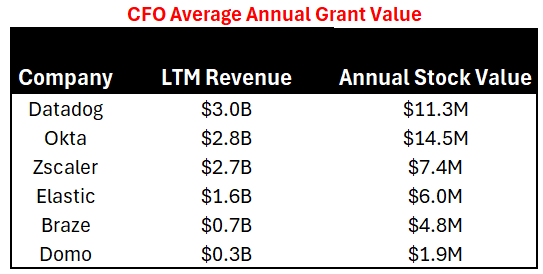

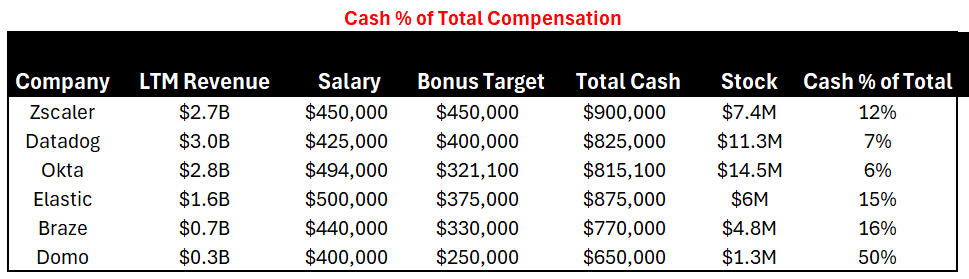

Below is a sample of public company CFO equity comp. The value looks at the average annual grant over the past three years. It’s not going to be perfect, but good enough for this purpose.

Below are these same companies and the percentage of cash compensation relative to total compensation (which just also includes equity).

Private companies typically award equity to executives (excluding the CEO) with just a service condition (are you employed?). But when a company is public then usually there is a mix (often 50/50) between service-based only awards and performance awards based on financial or stock performance.

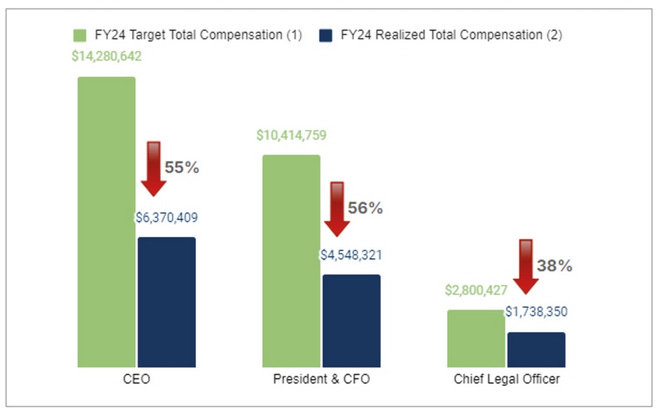

For example, the executives at BILL had PSU targets that were not hit so that equity was forfeited. The PSU targets were set higher than the cash bonus target so the cash bonus target was partially achieved, but he got 0 PSUs.

And the equity award performance miss caused a massive hit to their realized compensation.

In Summary…

Executives make a lot of money (not surprising).

But cash is a relatively small portion of what they are hoping to earn. On a cash basis, I want the top couple of sales reps to be the highest paid people at the company.

When they are killing it then I know my equity is increasing in value.

Footnotes:

See how leading finance teams are using AI to eliminate manual work, reduce close cycles, and scale without adding headcount. » Download the Full Analysis

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for OnlyCFO readers)

Were you able to collect data on retention bonus, signing bonus, relo, and other milestones? We can dig into this together.