Building Great Finance Teams

What does a great finance department look like?

Today’s Sponsor: Xero

Xero’s smart tools help small businesses and their advisors manage core accounting functions like tax and bank reconciliation, and complete other important small business tasks like payroll and payments.

Xero’s extensive ecosystem of connected apps and connections to banks and other financial institutions provide a range of solutions from within Xero’s open platform to help small businesses run their business and manage their finances more efficiently.

OnlyCFO readers get 90% off for six months!

What does good look like?

Bad finance departments can have a surprisingly huge (negative) impact on the entire business.

The problem is that many founders/CEOs don’t actually know what a “good” finance department looks like. Many founders haven’t previously worked directly with a true CFO or they haven’t worked with a “good” one.

Pro Tip: Founders should have strong mentors/advisors to help them know what good looks like (especially in areas where they are weak).

Below are the things that will make your finance org great:

Right people at the right time

The right tools for current needs

Stage appropriate processes

The Right People

Like any team, building a great finance department starts with hiring the right people. But what many folks forget is that building great teams requires the right people at the right time. “Right time” is especially important for finance teams.

Who a company needs at $5M in revenue is very different than the finance team needed at a $200M revenue company.

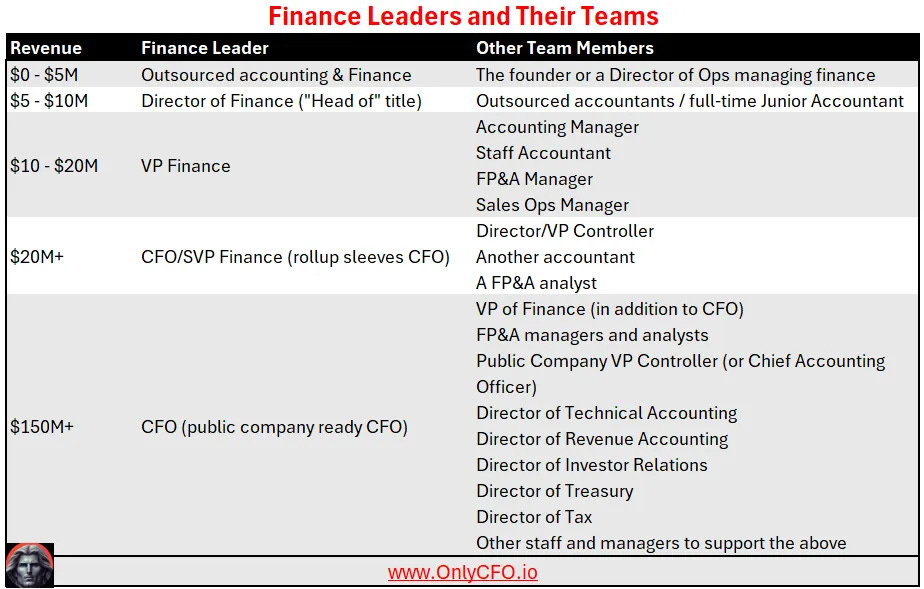

I wrote an article for SaaStr last week on the topic of When To Hire a CFO where I discuss hiring the top finance leader. In summary, the top finance leader you need can change dramatically as a company scales (same with the broader finance team).

Below is my cheat sheet for building finance teams at SaaS companies. Every company is different but this is my rule of thumb for the standard company.

*If you need a referral for a fractional CFO and/or bookkeepers, I partner with an amazing firm (send me an email - onlycfo@onlycfo.io)

The Right Tools

Similar to people, the right tools will change as the company scales and/or the business needs change.

Regardless of what a finance software sales rep may tell you, finance teams DO NOT need a software/AI solution for every process through every stage of the company. As you scale, then maybe you eventually need all of them….but the layers should be added over time.

I once saw a one-person accounting team using a $25k/year month-end close tool. Not only was it a complete waste of money, but it was unnecessary, added basically no value, and took way too much time so this one person couldn’t do other important things.

Purchasing too early or too late can both be destructive.

CJ (MostlyMetrics) just released a fantastic finance tech stack survey that helps illustrate my point. Below are a couple of highlights from the report:

ERP Software:

The ERP is the most important software tool for finance to get right. Below are the most popular ERPs by stage of revenue. As you can tell, different tools do better at different stages.

Truth #1: Accountants love to complain about their ERP. Doesn’t matter which one it is, they love to complain about how things are the ERP’s fault.

Truth #2: Nobody wants to change ERPs. These are important systems that can take a LONG time to implement and are risky to change.

Pro Tip: Before anyone decides their current tool is not working and they need to change tools, they should re-evaluate and fix their processes first. I have seen many controllers too quickly decide they need a new ERP because 1) they used a different in their past (bad reason) or 2) the current ERP has issues (good reason). The problem is that they don’t fix their processes before making the decision. And then they discover it was really their processes that was the issue (or at least a big part of it) and not an ERP issue.

FP&A Software:

On the finance side, Excel still dominates. I love Excel as much as the next finance nerd, but the tools today are very good. Excel still usually makes sense in the very early days, but more FP&A teams should be running on a dedicated finance tool today.

The transparency and visibility you can get from a tool becomes really important as you scale.

The Right Processes

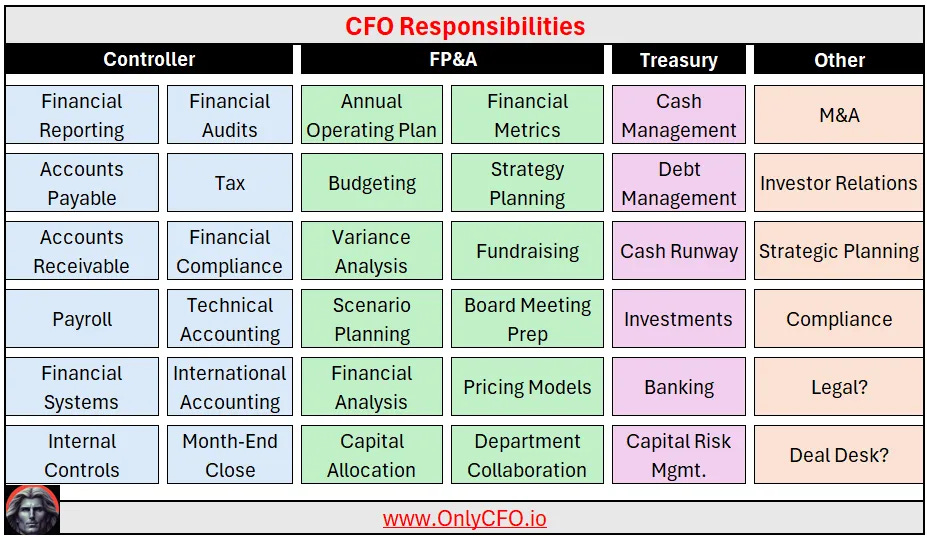

The “Office of the CFO” is responsible for a lot of areas that impact the entire company. Given the nature of their responsibilities, there are also a lot of processes that they create and manage.

Like people and tools, the right processes will change as the company scales.

I am all about process and controls…But if they are put in at the wrong time or in the wrong way, then it can truly destroy a business.

Slowing things down for the entire company with bad or stage inappropriate processes

Not putting in needed process and the company spins out of control (over spends, runs out of money, fraud, etc)

Summary

Building a great finance team is a continual process that is never done. And a bad finance org can be disastrous for a company.

What got you here won’t take you there

While the above isn’t always true, it is true enough on this topic that you should continually re-evaluate all three of these variables (people, tools, processes) to make sure they are still great for your company’s current state.

Footnotes:

OnlyCFO readers get 90% off Xero for six months!

Need Fractional CFO support? Reply to this email with what you need.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Love it, I’ll be subbing for more as someone who works with finance/data teams!

Great insights on both people and systems