Building Lean to Win

Treasury best practices, fraud controls, and how Meow is taking a different approach in a commoditized industry

Today’s Sponsor: NetSuite

Board Meetings & Dashboards: I partnered with NetSuite on a deep-dive on How to Run a Board Meeting where I also give the financial dashboard template I use to walk my Board through the financials.

A great financial dashboard allows everyone to quickly get on the same page and start making important strategic decisions faster. Grab my template!

If someone spends the most building a bloated navy, you win by fighting them in the air and on land. — Brandon Arvanaghi, CEO of Meow

I chatted with the CEO of Meow last week on a few topics that I think all finance leaders and CEOs should understand. Below are some of the topics we discussed and some things I have learned based on my experience.

Treasury objectives and how to not get fired as the CFO

The “VC Treadmill” and Meow’s plan to never raise money again

Disruption through efficiency

The role of crypto today in VC-backed companies

Fraud control best practices (boring but important)

Treasury Objectives

Below is my order of importance when choosing a fintech or banking partner for my company.

Money is safe - will it be the next SVB? Does it have all the necessary controls, compliance, etc?

Ease of use - is it easy to navigate and set up proper controls, run reports, etc

Highest yield - will it offer me the best rates?

But all of these priorities relate to the overall objective — preservation of capital.

I know a company that left $80M+ in a zero-interest checking account for over a year in 2023. That was probably ~$4M in lost interest income! Someone should have gotten fired for that…

These three objectives are table stakes for anyone I would choose. This realization is what drives how Meow is built and it’s why Brandon argues financial services are a commodity.

The VC Treadmill

We realized very early on that in order to win against the giant incumbents it made little sense to do the same thing as a second mover with 1/50th of the marketing spend. We need to be asymmetric to them. — Brandon Arvanaghi

Meow has raised almost $30 million with its latest fundraise being a $22M Series A in 2022. From the outside, it seemed like Meow would follow the typical high-growth, VC-backed company path — grow fast, burn a lot, and continually raise more money.

But then in July 2024 Brandon announced the below…

This is how Meow is building to disrupt all of the legacy players in the space - by building something similar to the “Costco of Financial Services”.

Once you are on the endless VC path, folks run the same playbook — hire too much, spend too much, and see how fast they can grow revenue to hit the next milestone at all costs. All of this spending requires a certain level of product pricing to absorb the waste. — Brandon Arvanaghi

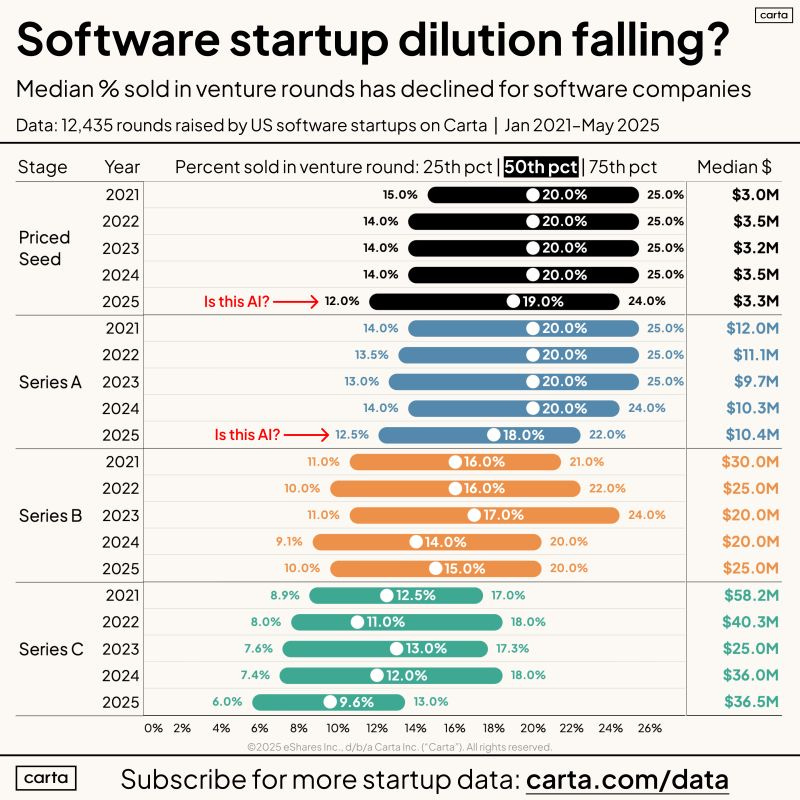

And with each fundraising round comes dilution and more investor pressure to grow faster (and right now).

And as that pressure increases, companies are forced to raise prices (or keep them high). And this is where Brandon believes Meow can disrupt the legacy players.

Disrupting Through Efficiency

Brandon is building the vision of Meow based on what he believes “the last company” in the category will look like — if you look out 20-30+ years in the future what will financial services look like?

If financial services is a commodity, then eventually it’s a race to the bottom and the company that gives back the most margin to the company and has the highest volume will be the winner.

We're disrupting the industry by being the leanest, by far, of all the major players in the U.S. So we're able to give the vast majority of the margin to customers.— Brandon Arvanaghi

But then what happens when everyone else starts playing this same game? Isn’t it a race to the bottom? I think about this a lot for the software world. If anyone can develop software over a weekend eventually then won’t software margins plummet toward zero?

Brandon’s response is interesting and I believe spot on from what I see in other spaces as well:

For the legacy players to play this same game, they would have to dramatically cut headcount, spend, change processes, and maybe most importantly change the culture. This does not happen overnight, especially in financial services. — Brandon Arvanaghi

I think about this concept a lot from the lens of “legacy software” vs “AI-native”. Legacy software companies are having a hard time adjusting fast enough to the rapidly changing environment in the age of AI. This is the advantage of companies building today. Legacy companies need to adapt, but most will be too slow. The AI-native ones are building soooo much more efficiently.

Other Topics

Crypto

I have been to a few finance events where the topic of crypto has come up. Should we have a crypto reserve? Are there actual use cases we should be considering?

Crypto is volatile so most boards aren’t going to suggest it. Remember, the #1 objective is the preservation of capital and not to make money from your idle cash (unless you are MicroStrategy)

Brandon said the biggest use case they are seeing today is the ability to send/receive USDC with international contractors. The recently passed Genius Act is a tailwind for others to participate. People want USD and this operates 24/7.

Fraud Controls

A large number of companies don’t have proper fraud controls in place so I wanted to provide some of the most important ones you should implement. AI related fraud is making these even more important. Meow, for example, has all these controls in place:

ACH Filters/Blocks - Controls unauthorized debits (outgoing payments) with full blocks or filters that allow a list of authorized companies to post ACH transactions to a company’s account.

Companies should block all requests from the AR receivables account since this account should just be for incoming customer payments.

Companies can create ACH filters on the concentration account to only allow authorized vendors to pull money from the account.

Dual Administration - Enforces security controls by requiring setup and modifications to be approved by a second administrator. This mitigates the risk of internal fraud. This generally works best if you have 3 or more administrators since all changes require 2 admins to implement.

Wire Approvals - Set this up immediately. You should have all wires that are initiated by one person require approval by another person. You can also add a 2nd approver for wires over a certain limit (e.g. CEO approves everything over $250K).

Wire Limits: Similar to the above, but you can create $ limits for different accounts for initiating and/or approving.

Alerts: Banks offer a range of alerting options to help companies detect fraud.

Positive Pay - This is a control that provides early detection of fraudulent, altered, or counterfeit checks through daily verification of checks presented for payment against a company’s check register.

Training: Make sure that the folks who initiate or approve wires have received training on best practices and how to prevent fraud. Any “urgent” wire request from the CEO is extremely suspect.

Make sure any financial services product you implement have SOC 2 Type 1 and 2 audits completed. Security and controls in financial services are critical.

Footnotes:

Check out the below article from OnlyLawyer

*Note: Meow is a financial technology company, not a bank.

Appreciated how you tied treasury priorities back to the single goal of capital preservation. TCLM takes the same approach in B2B credit, liquidity, and AR operations — different angle, similar mission. Could be an interesting parallel (it’s free).

https://tradecredit.substack.com/subscribe