Building Sales Commission Plans

Best practices, trends, and insights on how to create an effective sales commission plan for 2025.

👋 Join the other 28K readers and subscribe for trends, metrics, and insights on the technology industry! Also, sign up for the OnlyCFO webinar series - we have a sales commission planning webinar coming up.

Today’s Sponsor: Jellyfish

Jellyfish, the go-to source for software engineering intelligence, wants you to never track down time sheets again.

Are you still struggling with the tedious back-and-forth between engineering and finance when it comes to software capitalization? It doesn’t have to be that way. Download the 4 communication best practices for streamlining cost capitalization…and start speaking the same language with ease.

Building 2025 Commission Plans

It is that time of the year again - finalizing planning for 2025. And part of the planning process is sales commission planning so I wanted to provide an update to my guide for sales commission planning for 2025.

The problem with many sales commission planning process is that they are frequently built by just one team without cross department collaboration and/or the folks involved don’t understand the below concepts.

Everyone involved in commission planning should understand the below concepts so your company can create effective commission plans. *Share this post with your team!

Outline:

Purpose of Commission Plans

Sales Rep OTE

Setting Quota

Quota Period

Accelerators

Ramp Time & Draws

Creating Team & Company Targets

Renewals & Expansion

Usage-Based Pricing

Paying Commissions & Clawbacks

1. Purpose of Commissions Plans

Understanding the objective of commission plans is a critical first step. The purpose is NOT to simply close as much sales as possible. Most cloud companies lose money in the first year of a customer’s life. So the faster a company grows the more money they will burn during the years of growth.

It’s only after all the customer acquisition costs are paid back that software companies can really start to be a cash flow machine and can generate 25%+ free cash flow margins — see Cloud Unit Economics for a deeper dive on this topic.

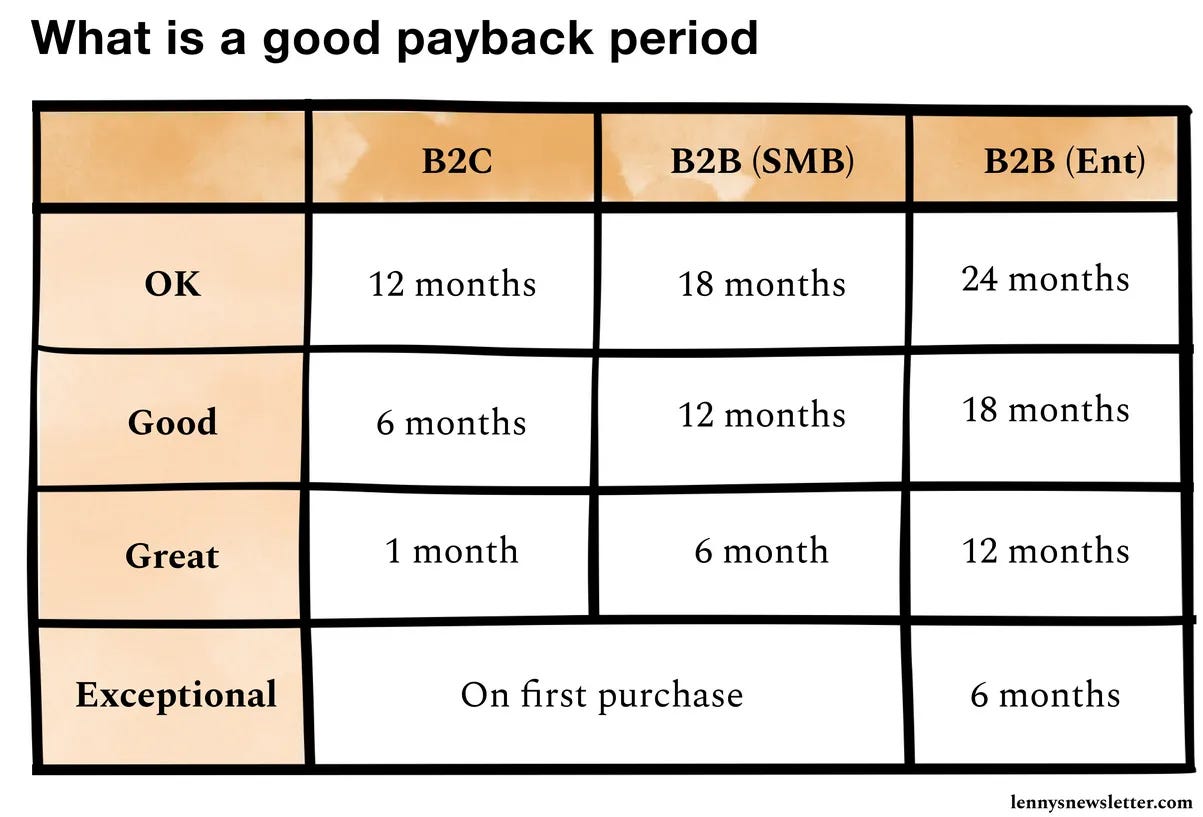

The customer acquisition cost (“CAC”) payback period tells you how long it takes to pay back the sales & marketing costs to acquire a new customer.

If a customer churns before the CAC payback period then company loses money on that customer. CAC payback periods have gotten much worse over the past few years because of the slowdown in sales (while costs remain high) and increased churn.

Below is the median CAC payback period from ICONIQ portfolio companies (which are generally top-tier companies). For the first half of 2024, the median CAC payback is nearly 3 years!

The CAC payback period simply shows how long it takes to breakeven on just the sales & marketing costs, but revenue also needs to pay back R&D costs (engineering, product, and design) and G&A costs (finance, legal, IT, security, etc) before the company can generate any profits…

What is the primary objective of sales comp plans?

To properly incentive sales reps to win customers that achieve successful outcomes and generate strong lifetime unit economics.

Successful Outcomes: If you sell shelfware (software no one uses) then eventually customers will churn, but even worse is that they will tell their friends about your bad software. If customers are not successful with your solution, then eventually you will have a sales problem.

Strong Unit Economics: In order to be profitable, software companies need to retain customers for a period much longer than the CAC payback period — the higher the better. Super high sales this year means nothing if all the customers churn before the CAC payback period.

There can also be secondary objectives of a sales comp plan such as:

Retain top sales rep talent

Enter a new vertical

Increase Fortune 500 logos

Cross-sell a new product offering

2. Sales Rep OTE

OTE = “on target earnings” which is a fancy way of saying what a sales rep would earn if they hit their targets at 100% (includes base salary + commission)

The best sales reps should be the highest paid people (on a cash basis) at the company. This does not mean all sales reps should be crushing their quota and making massive amounts of money (more on attainment below)

The below graphic from ICONIQ shows the standard split of base/variable and the OTE by stage and segment.

🚨Title and role requirement inflation: Companies think they need an “enterprise rep” so they look at comps and say we must pay $300K OTE (or whatever is it). But in reality, they need mid-market reps and should be paying $220K. These companies will hire mostly mid-market reps but pay them as if they are enterprise reps and that they will close a lot more business. I have seen a lot more of this in the past couple of years.

3. Setting Quota

Setting quota is one of the hardest parts of creating commission plans. While it generally gets easier as a company matures, quota targets should always be evolving.

When I set quotas I take a few different approaches of looking at the data to triangulate the optimal numbers:

Quota Context

A historically good target Quota:OTE ratio is 5x (i.e. sales rep brings in 5x more sales than their total compensation). I have seen many companies proud about this ratio because they believed they had a best-in-class metric, but when I started asking some questions their attitude changed pretty quickly…

What does attainment look like?

What does your GTM pod look like? I want to know how many SDRs, Solutions Consultants, CSMs, etc help your rep close and manage a deal.

How much churn do you have?

What are gross margins?

AI Impact: Remember that one of the primary objectives of commission plans is strong unit economics. Many AI products have lower gross margins and/or the sales motion is very different than traditional cloud so make sure you consider AI product’s impact to quota.

Target Attainment

You don’t want all your reps hitting quota (bar is not high enough), but you don’t want most reps to miss quota (bad for morale and will cause rep attrition). Companies have to find the Goldilocks zone of rep attainment that keeps reps motivated and grinding hard while also weeding out the weak reps. There are a few different thoughts on what this ratio should be:

Some say 80% of reps at 100%

Team-wide quota at 75%

And many other versions of the above

But the reality of AE attainment has been much worse….The average attainment has come down a lot over the past few years, but we have started to see it bottoming out and slightly increased over the past couple of quarters.

The chart below looks at the average percentage of Teams hitting their quota. While we see improvement, we are very far away from any of the desired attainments above like 80% of reps at 100% attainment.

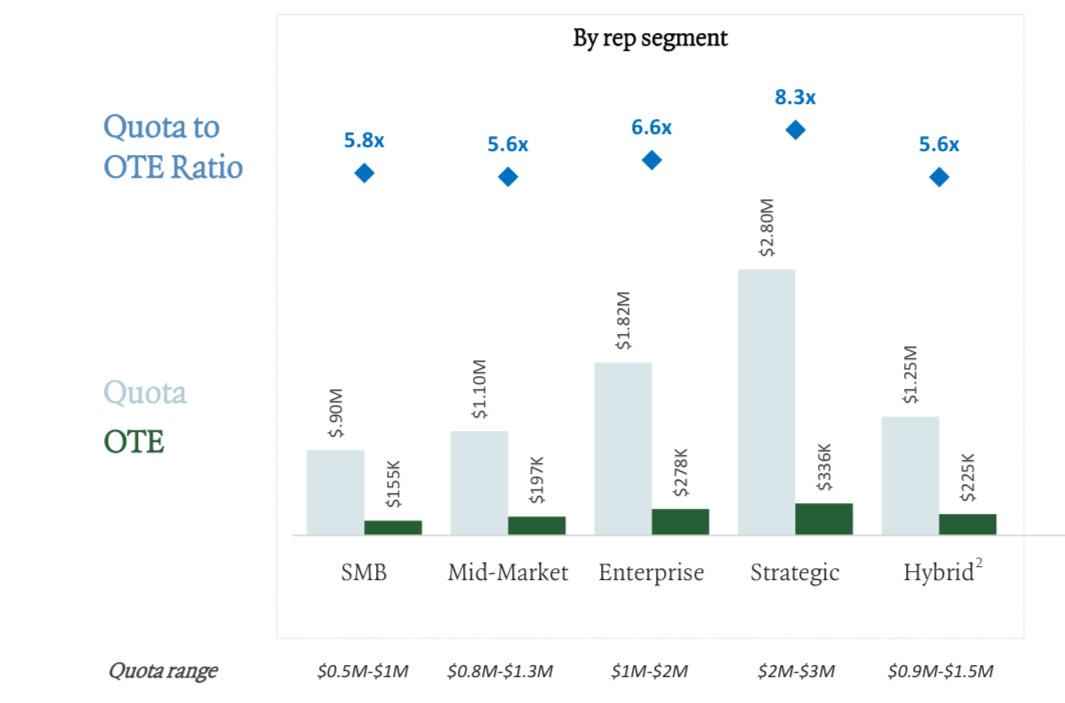

Quota : OTE Ratio

The standard advice is that the quota:OTE should be somewhere around 4 - 6x. In other words, AEs bring in 4-6x their total compensation in sales.

The below report from ICONIQ shows benchmarks from their portfolio companies broken down by rep segment. Note - ICONIQ has some of the best companies so their ratios will be higher than most.

Smaller companies typically have a relatively smaller quota:OTE ratio and as companies mature this ratio expands as the sales process becomes easier - brand is built, referrals are plenty, etc.

As I mentioned previously though, these benchmarks need context! They may work for some and not others if the other costs and headcount varies a lot.

Ultimately what you should be concerned about is maximizing the LTV:CAC ratio and all of this math helps you triangulate how to do that.

4. Quota Period

Setting shorter quota periods is better for companies with a shorter sales cycle and/or more volatile environments. Startups selling to SMBs in a volatile market is one extreme while larger companies selling to enterprises in a stable market is the other extreme.

I come from an enterprise software background, so I am generally used to annual quota periods. However, during high volatility and high uncertainty I have seen many companies move to semi-annual or even quarterly plans — launching new AI products makes commission planning really hard.

The quota period generally shouldn’t be shorter than the average sales cycle otherwise it feels out of the reps’ control.

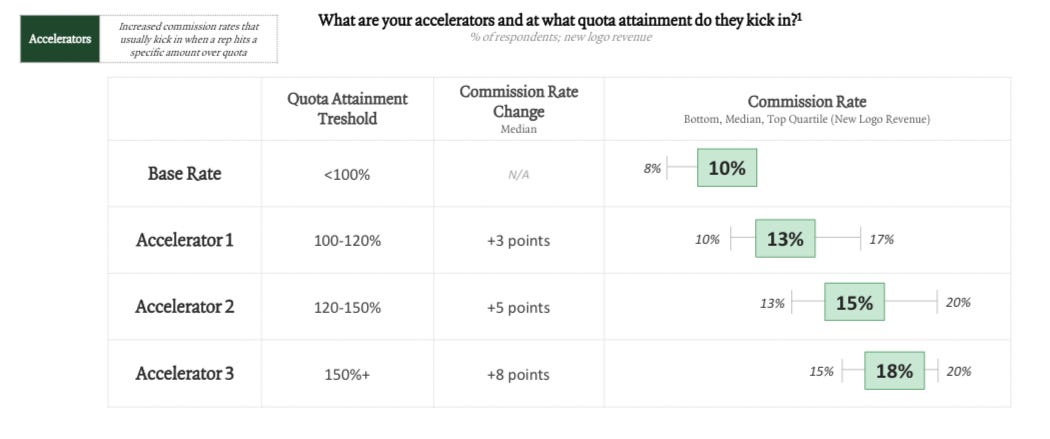

5. Accelerators

ICONIQ’s benchmark data below is directionally what I have used in sales comp plans. Remember, only a small % of reps should ever hit accelerator 3.

Over the past couple of years, I know many companies though that lowered quota targets because of the tough environment. This also caused accelerators to kick in a lot earlier, which broke unit economics a bit. Make sure your based and accelerator rates make sense today.

Commission Caps. I am typically against capping commissions because it is demotivating and discourages over performance. Only a minority of companies actually have an explicit commission cap. But many plans have a whale deal clause that allows management to review deals over a certain size (this should be set at a very high bar) to add management discretion to adjust the commission check if it makes sense. This should rarely be used but is there to protect the business in unusual circumstances.

6. Ramp Time & Draws

Ramp time represents an expected adjustment to quota while sales reps are learning, building pipeline, etc. The more complicated the product and the longer the sales cycle should equate to a longer ramp period because it will take more time for reps to close deals. Which is why companies selling into the SMB segment have smaller ramp times than the Enterprise (as seen below)

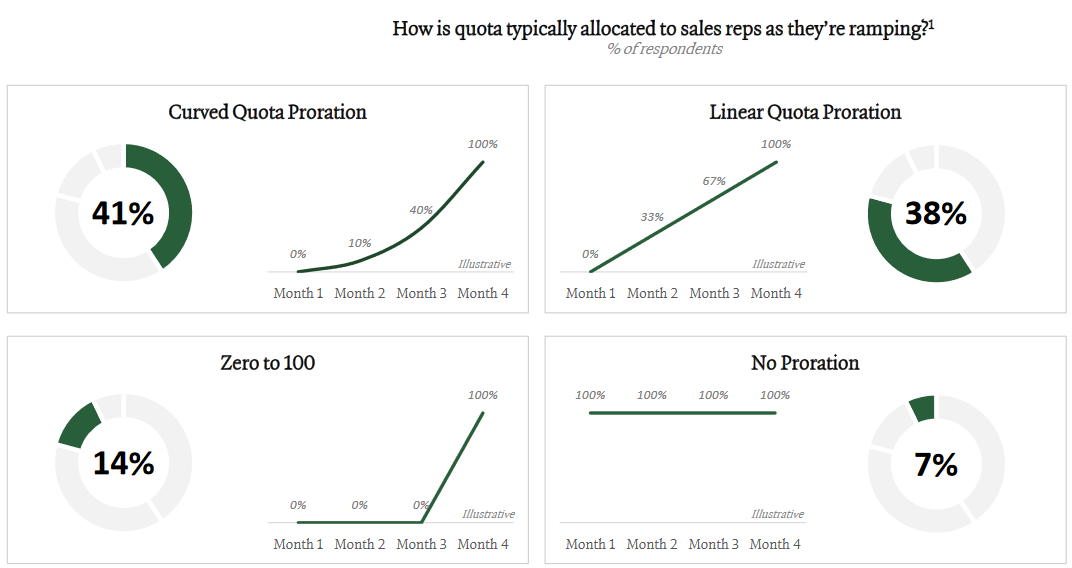

During the ramp period quota can be adjusted in a few different ways. Curved and linear proration are by far the most common in my experience.

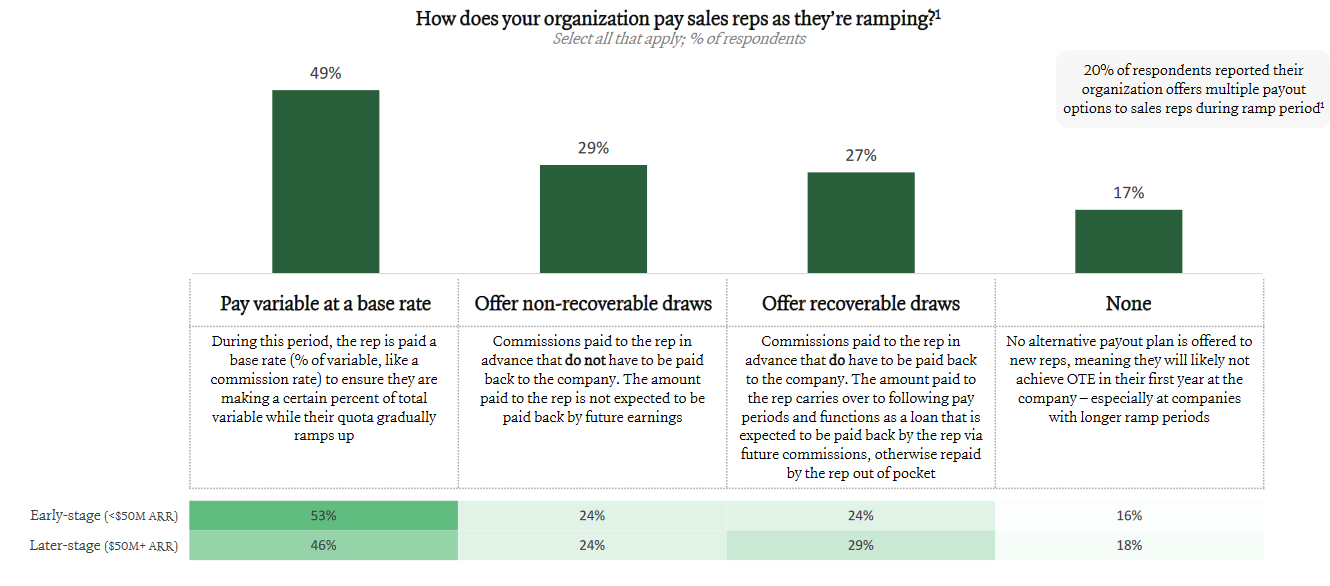

There are also multiple ways the reps can be paid during the ramp period.

7. Renewals & Expansion

Renewal

In most cases I don’t like comping reps very much on renewals (a SPIF or very small % is OK). But this decision is also dependent on your company structure.

Does the company have a CSM team or does it rely on AEs for retention?

Is expansion/renewal somewhat in the AE control? Do they actually have responsibility to get the customer successful?

I will not debate a right/wrong answer to company structure, but the answer here depends a bit on the org structure and responsibilities.

Expansion

There is a lot of debate and diversity in practice on how this is handled. The two most important questions are:

How long does an account stay with the sales rep?

What is the commission rate on expansion?

David Sacks’ answer to this question is below, but I don’t think it is always so straight forward.

I like to let an AE keep the account for 12 months from the initial close to incentivize “land and expand” deals. Any expansion in the account during that time is considered New ARR for which the AE receives full quota credit. —David Sacks

I think the right answer is much more company specific though. Two main questions I ask are:

How long does it take to get to full usage of the product?

How impactful is the sales rep for expansion after customers are implemented?

8. Creating Team & Company Targets

What I have talked about previously is the sale rep (or AE) quota. This is the amount of quota assigned to all the reps (aka “street quota”). When quota is assigned, we don’t expect everyone will hit it. Maybe 80% will hit quota. If that is the case, your company target should not equal the street quota because most of the time you will miss that goal. A rule of thumb I used is setting company targets so that I can hit 8 or 9 times out of 10.

Over-assign = excess street quota assigned over company target

In my experience a typical over-assign percentage is ~15-25%. Example: Street quota of total assigned rep quota is $10M, but with an over-assign of 20% the company target is $8M.

If over-assign is too high, then the company might hit its number but the entire sales team is miserable because no one is hitting target (which is bad). If it is too low, then there may not be enough buffer for unforeseen circumstances such as high rep attrition, macro environment pressure, etc. The more mature and predictable the business, the smaller the over-assign can be.

The same concept of over-assign is applied to the various sales management layers — i.e. VP of Sales has 20% over-assign, RVP has 15% over-assign, and Sales Manager has 10% over-assign. Over-assign increases until you have the VP of Sales number tied to the company goal.

9. Usage-Based Pricing (UBP) Commissions

Commission plans with a usage-based pricing product are harder, but ultimately should follow the same concepts as above. As more companies add AI products some form of usage-based pricing will be very common.

Usage-based pricing requires a lot more trust within the company because sales reps can’t just rely on their sales ability to land large deals rather they must partially rely on others (implementation services, CSMs, product, etc) to get customers successful so they will expand since that is where a lot of the money will be in UBP.

Traditionally SaaS has been sold on a seat basis or flat fee basis — i.e. the amount of revenue is committed over the term of the contract. With UBP companies charge customers as the product is used so there is a lot more unknown in revenue when a deal is closed. Many UBP companies require customers to commit to an amount of usage upfront to make it similar to traditional SaaS sales.

There are three ways I typically see quota retirement in a usage based pricing model:

Upfront payment for commit and true up for actual consumption. Sales reps typically need some sort of instant incentive for closing a deal, so this allows for some upfront payment that it trued up on actual consumption, which aligns incentives for the rep to ensure the customer is successful.

Consumption only. Commission payments are made based on actual consumption run rates. For example, a company may pay a commission after the first quarter based on consumption run rate and true up again after the second quarter.

Commit only. Commission is only paid on the annualized committed amount. This generally only works well when it is annual deals and the committed amount must be used within that period.

10. Paying Commissions & Clawbacks

My answer to when commission should be paid and whether to do clawbacks is “it depends”.

For enterprise SaaS, I prefer to pay commissions in the month after the deal is closed and not wait for the payment to actually be received. But for more transactional sales reps selling to the SMB/VSB space I think waiting until payment can make sense because there is a lot more risk of non-payment.

My answer to clawbacks is similar. For enterprise SaaS with annual contracts I would only clawback if the customer never pays, which should be fairly rare in the enterprise.

Should sales reps be penalized for churn?

Again, it depends. If they have responsibility and control over churn then potentially yes. When penalizing for churn I prefer to see a secondary quota for renewals that are a smaller percentage of the reps variable.

Footnotes:

Download the 4 communication best practices for streamlining cost capitalization (today’s sponsor)

Sign up for the OnlyCFO webinar series! Our first webinar is on how your annual planning might break in 2025.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

This is such an informative article with tons of practical advice! Question: is how does the total incentive comp work considering others such as customer success. For e.g how are expand and renew compensation divided between AE and customer success? Any best practices? (besides the David Sacks hueristic?)