Bullish: Vertical & Compound Software

In a world of AI, companies need to be more multi-product and vertical to win.

Today’s Sponsor: NetSuite

Hiring finance talent is more challenging than ever—300,000 US accountants left the field between 2019 and 2021, and 28% of large companies lack a CFO succession plan.

Future-proof your team with AI. Download our latest guide, 6 Steps to Build an AI-Ready Finance Team, to learn how.

Death of Point Solutions

You either die a point solution, or you live long enough to become a platform. — Kyle Harrison

The above quote remains one of my favorites and it has never been truer than today. There are plenty of reasons to be bearish on the software industry in 2025, but I am relatively bullish on two types of software over the next few years:

Vertical software: designed for use by a specific industry or business vertical. Focused on solutions for industries that are often poorly served by general software providers.

Compound Software: addresses a range of point solution systems all at once to build a broad portfolio of interoperable products. Parker Conrad, CEO of Rippling, coined the term “compound startup”, but I broadened it to include all sized companies because its not just a startup thing.

Vertical software can/should also take a “compound software” approach, but a compound software company doesn’t have to be vertical software. The issue is that being a simple point solution isn’t enough today.

So why am I bullish on these types? 👇

Vertical Software Performance

Public cloud stocks are down 21% since the end of January of this year (similar to the rest of the market).

Stock Prices: But public vertical software companies have “only” declined by 12% since January— showing higher resilience than their horizontal software friends.

Revenue Multiples: The trend in vertical software revenue multiples relative to the overall cloud industry is also very interesting.

Back in the glory days of 2021 when all revenue multiples were high, vertical software traded lower than the overall software market, but fast forward to today and the median vertical software company trades at a 53% higher revenue multiple than the broader market!

Growth & FCF Margins: Vertical software only has slightly better FCF margins and basically the same revenue growth as the broader cloud market though…

Given revenue multiples are materially higher for vertical software, I interpret this difference as investors banking on: 1) vertical software revenue will be more durable and/or 2) longer-term FCF margins will be higher with vertical software companies.

In other words, there is an assumption that vertical software will be more resilient than the broader software market. Not only do I think this is true, but…the power of vertical software is probably still not fully baked into the relative valuations.

Point Solutions No Longer Work

For 90%+ of companies starting today I think you either need to take a “compound software” approach or vertical software (which should also be a “compound software”) to succeed. Most companies start as a point solution but to be successful today requires an acceleration to multi-product that takes a compound software approach (see below section on multi-product versus compound software).

There are too many benefits of using a compound software vendor that customers would prefer to choose one of those vendors versus using 100s of point solutions.

Point solution software was great when building software was hard and there wasn’t much competition. But that is NOT the current environment in 2025.

Competition is off the charts intense. The software market maps are blowing up and now with AI and acceleration of point solutions the competition is insane.

Point solutions are more limiting. Building differentiated products is near impossible in 2025 with point solutions since you have limited ability to be different from the 100s of others out there.

Pricing disadvantages: Being in a niche or multi-product gives you more pricing power. Software companies are already seeing huge amounts of pricing pressure as a result of the commoditization of software. Those with multiple products can absorb pricing pressure a lot better and keep higher gross margins.

I asked Nick Tippmann who recently founded TipTop (a VC fund focused on vertical software/AI) what he thought. Seems like he agrees:

The future belongs to founders who build multi-product, agentic platforms inside verticals from day one. Wedges are important, but point solutions alone just won’t cut it anymore.

Vertical Software & Compound Software

These two paths are very similar for the reason that matters. Both of these approaches can discover untapped areas of product-market fit.

Below are a few of the benefits of these approaches:

Seamless integration across workflows

Familiar UX for customers across workflows

Price optimization - there are less mouths to feed in a multi-product organization and the expansion opportunities are easier.

Data - Applications are all built on top of the same underlying data, so they all seamlessly integrate with each other. And further data enrichment can happen which makes the data even more valuable.

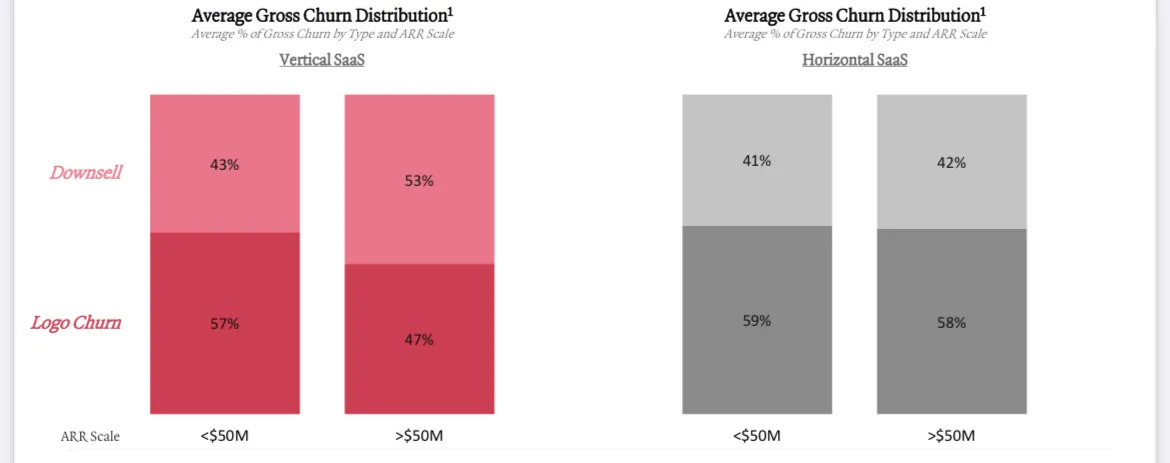

Less churn - Vertical (and multi-product) software companies often get deeply embedded into customers as more products are layered on (known as a “layer cake”). Fully churning becomes much more difficult. High retention is what makes the software model work.

Failed to render LaTeX expression — no expression found

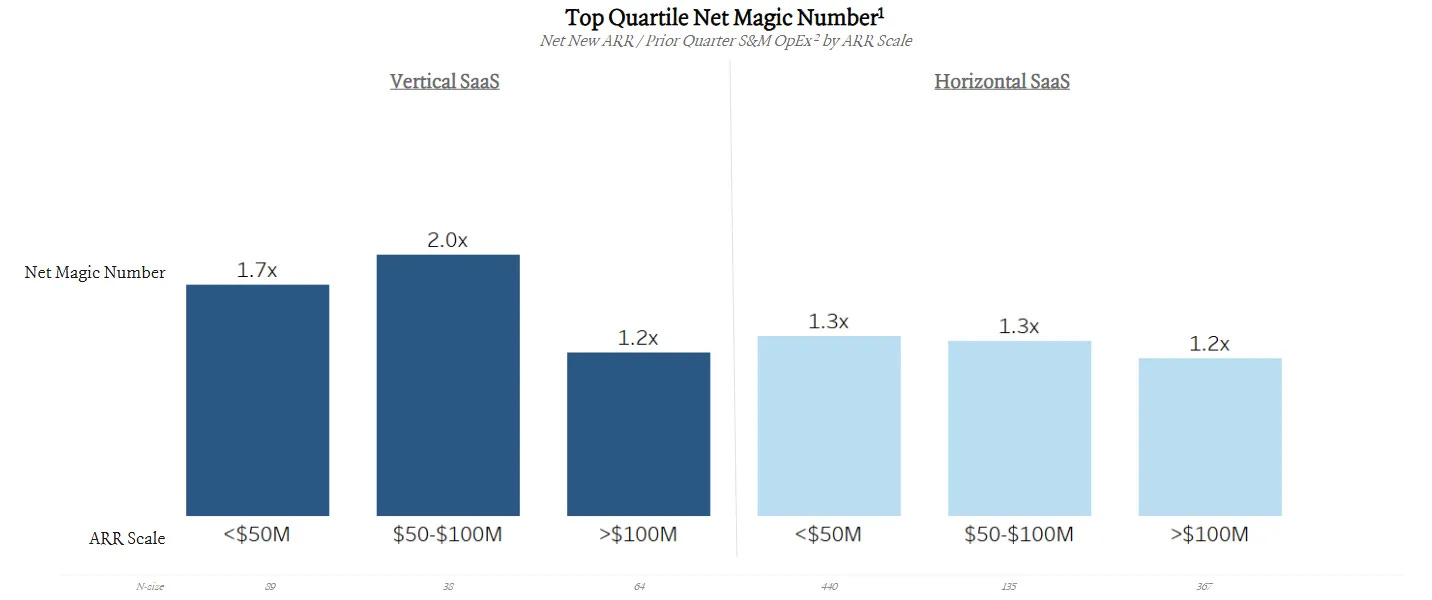

Higher GTM Efficiency - you can get higher GTM efficiency in a multi-product org because expansion revenue is faster and cheaper. And in vertical software the ideal customer is much more narrowly defined so it is typically more efficient.

Unlock New Product-Market Fit

I really like the below quote from Parker Conrad, CEO of Rippling:

We’re never going to win on these “head-to-head” features; our goal is always to tie.

Having the best individual features is not what makes compound software special. Rather the additional product-market fit that it unlocks by having multiple products/features across the company. This is where the magic is created.

The product-market fit that comes from a “compound software” approach is still significantly undiscovered for a lot of software areas.

Compound Software vs Multi-Product

There is an important distinction between “compound software” and simply being multi-product that many folks don’t understand.

A compound software approach is multi-product BUT…just because you are multi-product does NOT mean you are also have compound software.

A company can be multi-product by having a dozen different point solutions. While that may add some benefits to customers, it usually isn’t significant. The real magic of compound software is the shared data, further data enrichment, and interoperability that comes from owning multiple pieces that interact with the same data. This is where new product-market fit is unlocked.

Don’t just be a product factory. Build a compound software company from the start.

Final Thoughts

If you want to build a startup today then there is a good chance you should take a “compound software” approach and be more verticalized.

The commoditization of software due to AI is requiring it for most companies. The number of moats in software are decreasing, but I remain bullish on vertical and compound software.

Footnotes:

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

💯AI allows everyone to build software quickly now, so vertical software has a leg up because the magic is in understanding the complexities of your customer better than competitors. I love the compound software angle, and it probably shows up in retention. Everyone building software = more competition so you almost have to be compound to create massive switching costs as new solutions come to market.

Great article and view on the topic