Buy the dip? | Future of Software Valuations

Are software valuations expensive, cheap, or just right?

Rho gives you access to the highest cashback rates on the market, up to $1M in perks, and 24/7 live support — without any subscription fees. Qualifying signups in Q1 get a free Eightsleep mattress.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” —Benjamin Graham

Everyone wishes they had a crystal ball that showed the future of tech valuations:

Will revenue multiples be higher or lower in 12 months?

Will the value of revenue growth increase or decrease relative to profits?

Should I exercise my private company stock options?

Will 2025 be the year of tech IPOs?

What will the M&A market look like?

It is near impossible to perfectly time the market, but it is equally hard to accurately predict where tech valuations will be at the end of 2025. There are plenty of people guessing where valuations will go but no one really knows.

Below are some ideas for how you can evaluate for yourself how expensive/cheap software valuations are today.

Is Software Expensive?

The Growth Problem

It’s no secret that revenue growth has come down A LOT for cloud companies. Revenue growth and the expected endurance of that growth is a primary driver of tech valuations.

Revenue multiples don’t look very expensive, right?

If you just look at long-term revenue multiples, valuations don’t seem very high. Yes, 2021 was crazy, but if you take a longer time horizon then revenue multiples today look like they are somewhat fairly priced.

The problem is when you adjust those multiples for revenue growth. Then things start to look REALLY expensive (excluding the crazy 2021 days).

The current median growth adjusted revenue multiple is 0.5x versus a long-term growth adjusted revenue multiple of 0.3x. So today, revenue multiples are 67% higher than long-term averages when adjusting for revenue growth!!

This makes SaaS valuations appear CRAZY expensive!

A potential counter-argument is that investors believe that revenue growth can accelerate from here or that revenue growth rates will last longer (higher growth endurance).

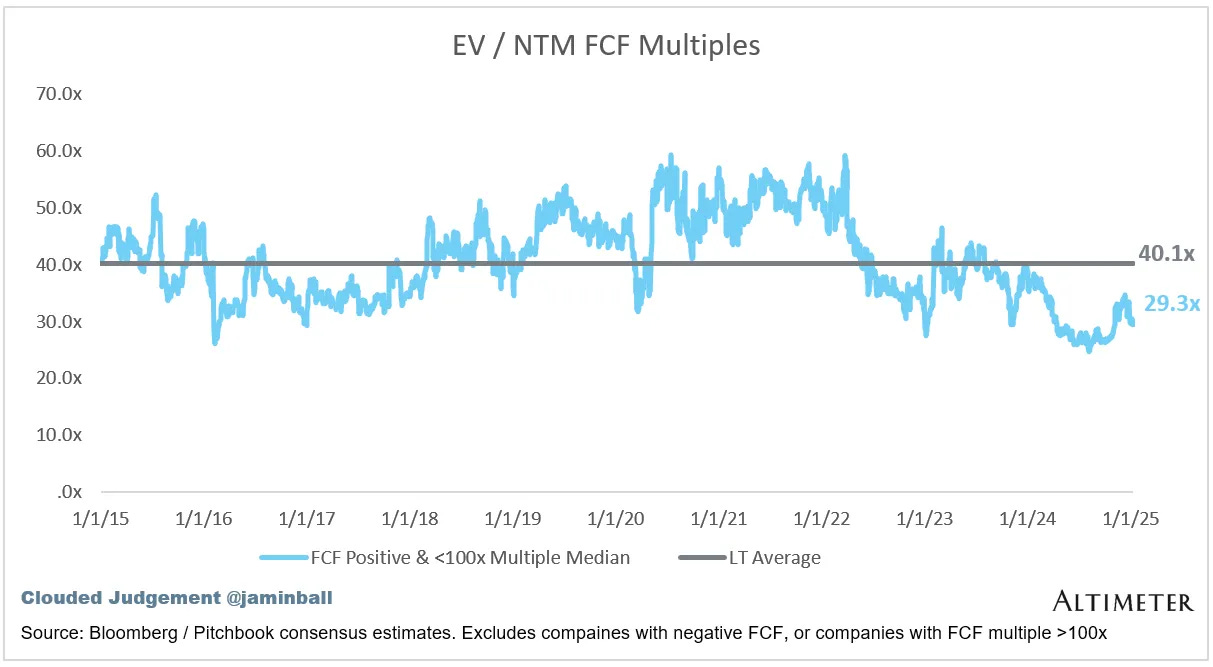

Free Cash Flow Improvement

On a positive note…FCF margins have significantly improved over the past couple of years as companies have shifted to profitability.

FCF multiples for cloud companies are near an all-time low.

Achieving high FCF margins is certainly important and provides support for a relatively higher revenue multiple.

But…many companies have seen revenue growth decimated without an increase in FCF margins that would have previously been expected for a slow growth company. If 25%+ FCF margins aren’t possible at scale (and if it can’t last many years), then perhaps revenue multiples need to go lower.

Uncertain Future

Valuation multiples were crazy high in 2021, but at that time SaaS felt like it was unstoppable. Growth would continue for decades, SaaS would be highly profitable at scale, investors loved the model, etc.

This is not a “SaaS is Dead” discussion, but rather “How will SaaS change in the future?”.

There are a lot of people guessing what happens to cloud companies, but we are still in a transition phase where no one really knows:

Do SaaS companies become huge AI beneficiaries?

Do gross margins and FCF get eroded from intense competition?

Does growth slow as more companies build tools internally?

Valuations should be negatively impacted from higher uncertainty and the future of SaaS is definitely more uncertain today than it was a few years ago.

Is the market baking higher uncertainty into valuations?

State of Public SaaS

Public SaaS companies hit a low point in November 2022. The recovery has been fairly slow and steady except for a large jump in the last few months of 2024.

And there were some really great deals at the low point in 2022 that have been huge stock returners if you bought at the right time!

But not all SaaS companies had a great recovery. Unsurprisingly, the ones that struggled the most are the ones that showed the least FCF support relative to their revenue growth declines.

From peak of 2021 (I am using Nov 2021) to today only 9 SaaS companies outperformed the QQQ ETF.

The biggest losers from peak 2021 remain very painful for investors despite the recent SaaS recovery.

If you had an equal weight portfolio of all SaaS companies at the peak of 2021 then you would have underperformed the broader market by 59%. Ouch!

Final Thoughts

The uncertainty of what comes next for SaaS companies is a large potential risk to valuations today. Valuations may already appear a bit expensive based on revenue growth and relative FCF margin progress, but the uncertainty adds another layer of risk.

The companies with strong proven FCF margins have much better support for their valuations, but if they can’t continue to have strong revenue growth and FCF margins for many years then their valuations are likely expensive as well.

SaaS is not dead. But…it is changing.

I think we continue to see some big winners, but the gap between the winners and losers will widen.

**Nothing here is investment advice. This post is only for educational purposes only.

Footnotes:

Check out Rho to get the highest cashback on the market. And Q1 signups get a free Eightsleep mattress!

Complete CJ Gustafson’s tech survey to get the results → Survey

Check out the SaaS Barometer Newsletter for one of the best sources for benchmarks and data.