Cloud IPO Performance | A New Tech IPO!

Cloud performance in 2024, how IPOs have performed, and a new tech IPO with a unique term

Today’s Sponsor: Leapfin

Ever wonder how to NOT screw up a $900M fund raise?

Alex MacGillivray, CPA wishes he’d known a few things before he became a first-time VP of Finance. Now in his role at Clio, the unicorn legal tech company that just closed a $900M round, Alex wants to share why the industry is failing accounting operators pursuing leadership roles.

Join Leapfin’s live 15-min talk to learn: 2 things they never teach about accounting and finance leadership, how to handle a massive fund raise, and the MVP outside of your Accounting team.

Cloud vs Market Returns

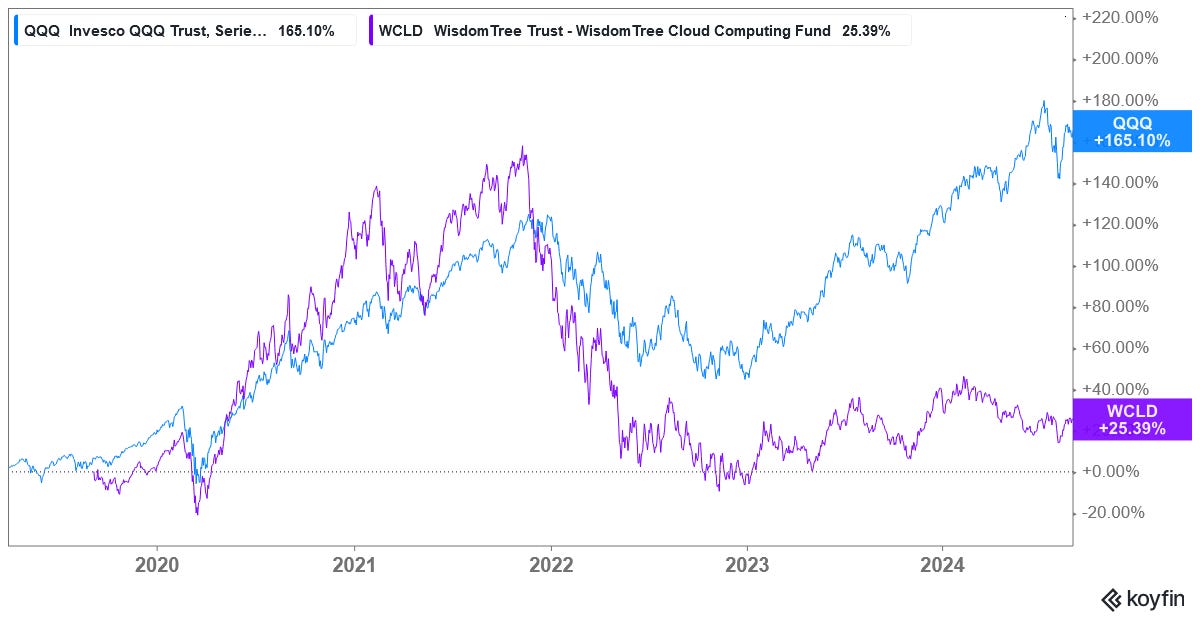

Cloud companies continue to significantly underperform the broader market.

Below shows the price movement of two ticker symbols representing the general market versus cloud companies:

The purple line is the QQQ ETF which represents the broader market (with a weight toward technology)

The blue line is Bessemer’s cloud index (stock ticker WCLD), which is an ETF that tracks public cloud companies

You would have had a 140% higher gain if you invested in the broader market rather than cloud companies over this period of time…

How have cloud IPOs performed?

Now let’s look at cloud IPO performance. To fully answer the above question though we need to consider, “The performance of what type of investor?”

Investor types:

Pre-IPO investors: Venture capitalists (VCs), Private Equity (PE) firms, and sometimes institutional investors.

Institutional investors - this group may get to buy the stock at the "IPO price”. These are mutual funds, banks, hedge funds, etc.

Retail investors (you and me) - who get to buy the stock on the normal stock exchange.

Today I am going to focus on public market investors— #2 and #3.

Institutional Investors

Institutional investors may participate in funding late stage private companies, but they are also the ones who primarily invest in the IPO (primary market) and get the “IPO price”. In limited circumstances retail investors can invest here too but it is generally small and very limited on who, if any, can participate.

Companies work with their investment bankers to set the IPO price based on demand from these investors. Setting the price is a balance between getting the highest price, ensuring they get the investors they want, there is a nice “pop” in price on day 1, and the stock trades at a price above the IPO price (i.e. it doesn’t “break issue price”).

The key point I want to make is that retail investors (you and me) usually cannot buy shares at the IPO price, but rather we have to wait until the stock trades on the open stock exchange. There can be a big difference between what the IPO prices at and what retail investors can buy at.

This is the “IPO pop” that gets headlines like the below. Your typical retail investors aren’t getting this amazing stock gain on day 1 because they are buying the stock post-pop.

The “pop” benefits the institutional investors. Some of these institutional investors may sell on day 1 but most will be long-term investors that plan to hold the shares.

Below is a great chart from Jamin Ball that shows cloud company day 1 pops — the median IPO pop is 38%!

Retail Investors

These are the normies (you and me) who can only buy on the secondary market via the stock exchange.

We don’t get to benefit from those juicy IPO pops with a median 1 day gain of 38%. Rather we are the suckers who buy at the post pop price…

How have software IPOs performed?

Rushing to buy the latest IPO has not historically been a great stock winning strategy. Here are some facts about the 70 public cloud companies I track and their performance within their first 6 months of being public:

35 of them fell below the day 1 closing price 6 months later (after most lock-ups expire)

41 of the 70 IPOs underperformed the QQQ ETF over the same period of 6 months

The average return of these companies after the first 6 months is -1%…The average QQQ return over the same IPO periods of all these stock IPOs was 6%

So only in ~40% of cases was investing in software IPOs (at the day 1 closing price) allowed you to beat the market. But remember, institutional investors are still happy because all of the above calculations have been off of the day 1 pop. So if the median pop is 38% then institutional investors are still pretty happy 6 months later.

IPO Performance through 2024

IPO Class: 2021 & Later

Of the cloud companies I am tracking, 24 of them IPO’d in 2021 or later. Below is the performance of these IPOs using the closing day 1 price (post IPO pop).

Only three of them have outperformed QQQ…

While the average and median cloud IPO has done MUCH worse.

IPO Class: 2018 & Later

If we go back even further before valuations got crazy in 2021 then we still only have 8 of 48 cloud IPOs doing better than QQQ. And the best performing one, Palantir, was actually a DPO…

All Cloud IPOs

The really big cloud IPO winners are found even earlier.

Not sure if additional time though is going to get most of the more recent IPOs near these levels though.

Small Floats

It’s important to remember that typically the only shares tradable on day 1 of the IPO are the shares just barely purchased by the institutional investors (and potentially some “friends and family” who were allocated shares).

The rest of the stock held by prior investors and employees is typically locked up for 180 days (referred to as the lock-up period), which means they can’t sell their stock until the lock-up expires. This is done so existing shareholders don’t flood the market and sell. The 6 month lock-up period gives time for the stock to find a somewhat stable price without as much volatility (at least that’s the theory)

The “float” refers to the tradable shares. Because most IPOs restrict all equity held previous to the IPO, the float is often quite small (as seen below).

The other caveat is that the float is total potential tradable shares, but many of the institutional investors that purchased IPO shares are holding long-term so the actual % of shares actually trading hands can be REALLY small. This can create volatility and unexpected movements in the first 6 months until the lock-up expires and all shares are tradable.

New Tech IPO!!

Unusual Lock-up Period Clause

There is a new tech IPO coming soon - Cerebras. While not a cloud IPO, I am excited we are at least having a broader tech IPO.

One thing that caught many investors’ attention is the fairly unusual lock-up period “early release” clause.

Management of Cerebras will get to sell *some* their stock early if the stock exceeds 125% of the IPO price for at least two of the first five full consecutive trading days after the date of their Q3 (ending 9/30) earnings announcement. And since we are past 9/30, the results are already known.

This means that Cerebras just needs a 25% IPO pop (and maintain that after their earning release) and management will get to sell much earlier than the standard 180 lock-up period. This could cause weird incentives…

If management thinks the future is bad, then they can just price the IPO extra low so they guarantee hitting this clause so they can dump their shares on the retail investors. Not saying that is what is happening, but obviously the optics to investors don’t look good.

*Note that depending on the shareholder type, they can only sell 10% or 20% early. But that can still can be a significant amount of shares for executives. Will be interesting to watch who sells early if this early release is triggered.

CEO with a history of accounting fraud

Another potential red flag for IPO investors below…Was a long time ago, but is something investors might be concerned about if any of Cerebras accounting practices appear aggressive.

Footnotes:

Check the webinar from today’s sponsor (Leapfin) - How the Industry is Failing Future Accounting Leader

Fill out this form if you want to be automatically invited to all future OnlyCFO webinars (next one up is on Sales Tax)

Check out OnlyExperts for to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

Lock-up period has many flavors -

1. Market standard - Fixed 180 lock-up (93% of IPOs fall here); not to forget, a large number of Tech IPOs will execute a follow-on offering within 180 days.

Alternative structures

2. 180 day with blackout pull forward - 180 days with the ability to accelerate if the blackout window falls within the lock-up period (3% of IPOs). This allows pre-IPO shareholders to sell pre-blackout period (Crowdstrike, Datadog, Peleton, Cloudflare, Lyft, Bill.com)

3. Price triggered - this is basically standard 180 day with early price trigger release (~2% of IPOs). Companies use a combination of time, performance and %ge holding to optimize (Lemonade - 33% price trigger and 33% holding, Zipcar - 50% price trigger and 33% holding, elastic - 33% price trigger and 25% holding, Stitch fix - 25% price trigger and 35% holding)

4. Extended release - Different shareholders or groups of holders allowed to sell at various dates post IPO ( 1% of IPOs). This allows smooth transition of stock (Etsy - 180, 270, 360 days, Alibaba - 90,180, 365 days, facebook - 90, 150-179, 180, 210, 365)

Vibhor

well, with respect to Fraud, wouldnt Rippling fall in the same bucket? the CEO of Rippling has the same challenge.

https://sites.law.berkeley.edu/thenetwork/2017/11/11/sec-fines-zenefits-and-former-ceo-parker-conrad/