Cloud's Biggest Winners & Losers

Biggest revenue multiple changes and the importance of growth in 2025

Today’s Sponsor: NetSuite

How to Navigate Tariffs with Data

The current tariff situation is complex—affecting companies' supply chain management, pricing, and long-term planning.

Download this guide to access practical tools and insights you can leverage to navigate tariffs and choose the right strategy for your business.

Top 10 Winners & Losers

One of my favorite public market things to look at is the relative valuation changes of cloud companies and see what insights/trends I can learn from those movements.

The Winners

Below are the companies that had the biggest revenue multiple gains YoY. For example, Rubrik went from having the 32nd highest (out of 75) to having the 8th most richly valued revenue multiple.

The Losers

There were also several companies that fell out of investors’ favor. Braze tops the list for biggest revenue multiple loser - growth expectations certainly changed over the past year for them.

Public Markets

Recent IPO performance has been strong and the public markets are at all-time highs. Lots of folks are feeling more confident and less uncertain about the future.

And there are many companies looking to go public soon. And A LOT more waiting and seeing how these next batch of IPOs go before they kick off their IPO process.

If you want a successful IPO in 2025 then you need high revenue growth AND efficiency.

But revenue growth is increasingly rare in the public markets. Only 5% of public cloud companies have greater than >25% growth.

But I have heard many late stage software companies say something like “We are growing 25% so we growing faster than most public companies!”

Not so fast. Are you close to their revenue scale? Are you as profitable as them? If not, then you better be growing a lot faster.

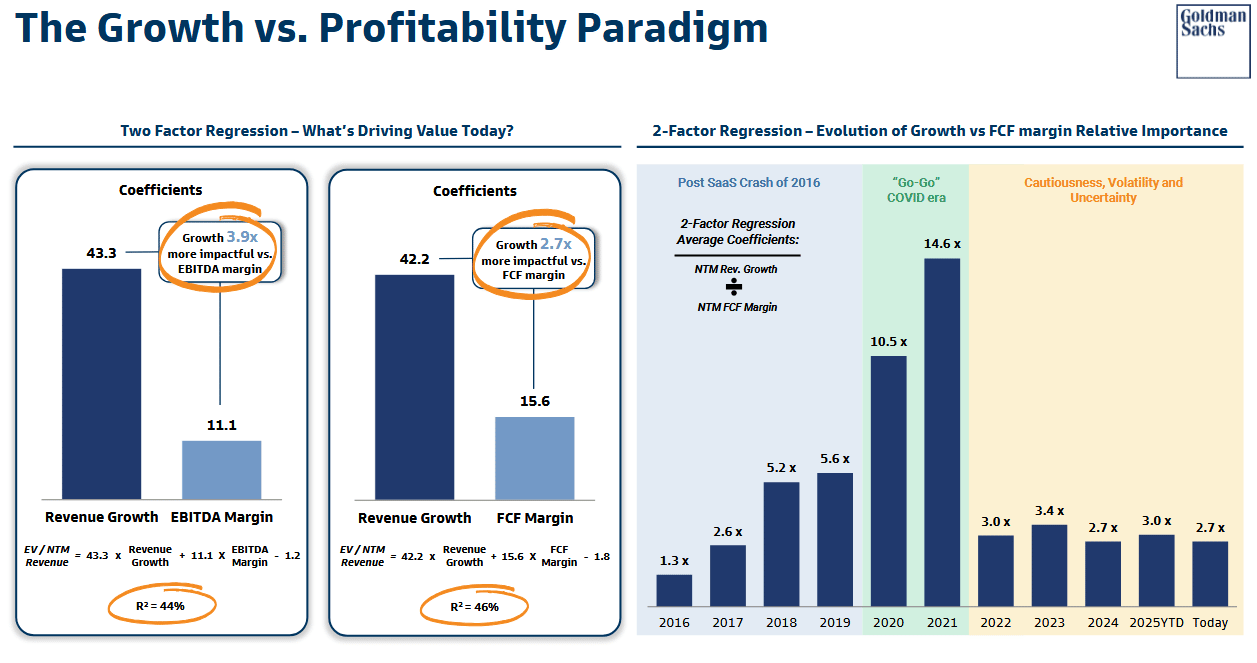

Growth is still what matters. High-growth companies get a huge valuation premium.

And revenue growth is way more important than profitability — 2.7x more important.

Takeaway

As there is less volatility and uncertainty in the market the value of revenue growth rises. Growth has always been the #1 driver but it becomes an even stronger component in valuations when uncertainity is lower. If uncertainity rises again then the relative importance of profitability will rise.

Growth will always be way more important for VC-backed companies because the outcomes VCs need aren’t possible without high growth.

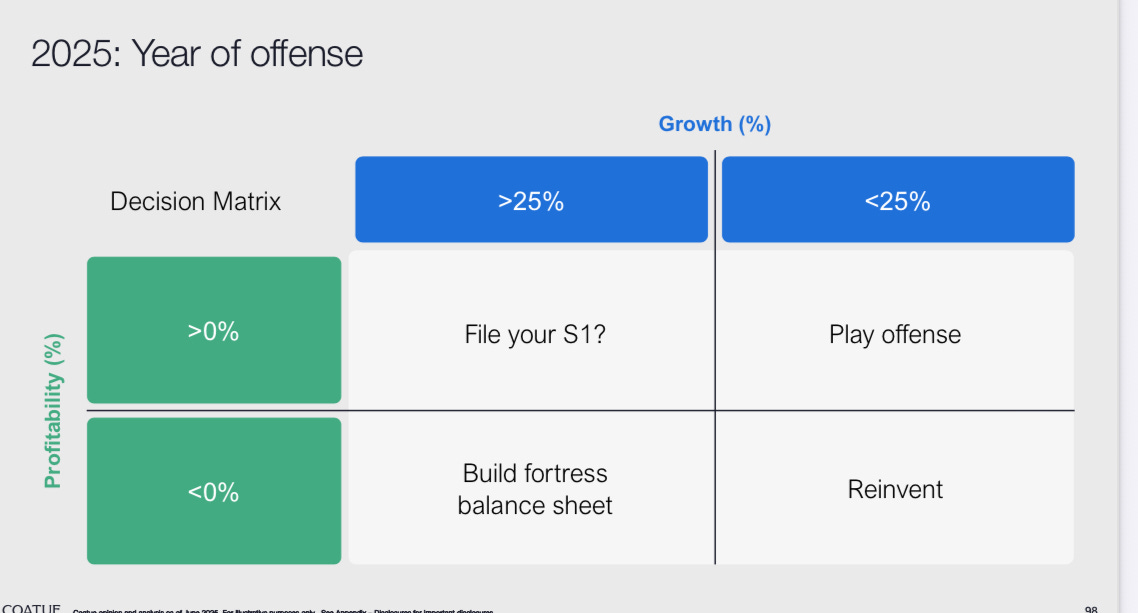

Below is a good chart for late stage private companies…MANY companies are in (or very close to) the bottom right decision…

The same concept should apply to early stage companies but the percentages are different — MUCH more growth is needed.

Footnotes:

Download this guide to access tools and insights to navigate tariffs

Get my ARR Waterfall Dashboard Template. This is what I use to report ARR

Get the Coatue State of the Market deck

Get 20% off with OnlyExperts to find offshore accounting resources