🚨 Deel Raises $300M at $17.3B Valuation!

When will they IPO? What does this mean for the Rippling vs Deel legal battle?

Today’s Sponsor: Nominal

APM is already at work inside modern finance teams. Matching Agents clear discrepancies in seconds. Flux Agents monitor anomalies as they happen. Trigger Agents execute tasks across ERPs automatically. This is the workforce built for modern accounting: always-on, precise, and scalable.

→ See Nominal Agents in action

Deel’s Series E

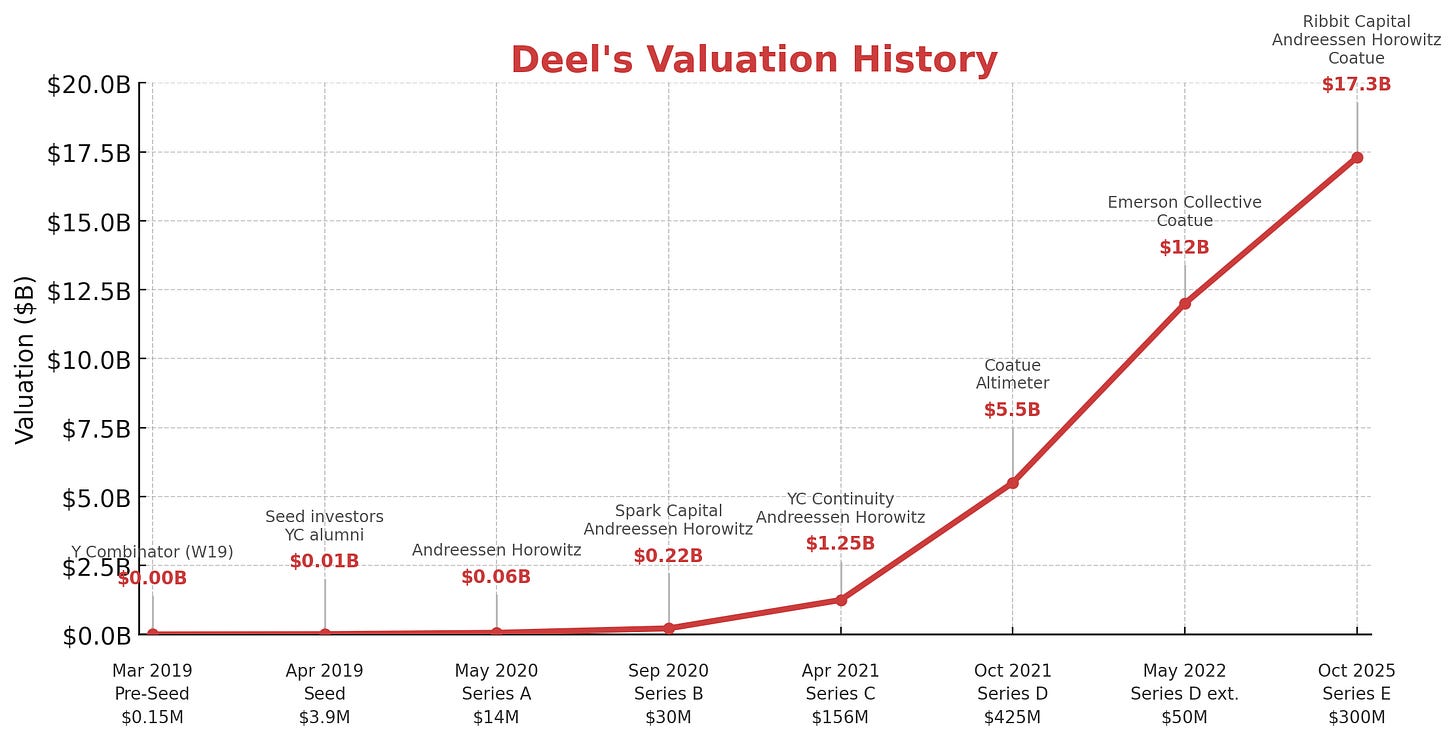

Deel announced last week that they raised a $300M Series E at a $17.3B valuation!

$1.2B in annual run-rate revenue in 6 years 🤯

Growing nearly 70% YoY

~16% EBITDA margins and has been profitable for three years

Below is Deel’s fundraising history. Their Series E valuation is a 44% jump from their last raise in 2022 that was at a $12B valuation.

Deel’s Financials

Insane Revenue Growth

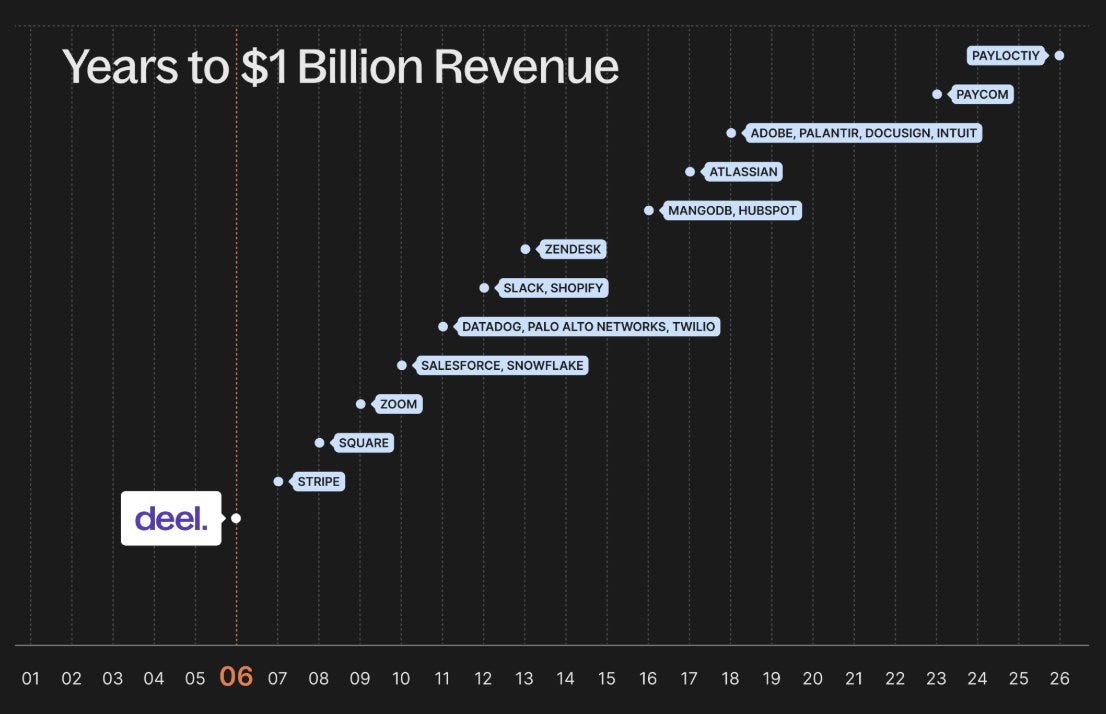

What Deel has accomplished is unprecedented. They hit $1B of ARR in 6 years AND they are profitable! 🤯

Honestly insane…

When I first saw how fast Deel hit $100M ARR several years ago, my initial thought was:

Sure…I bet they have some very aggressive definitions of ARR. No way that is real.

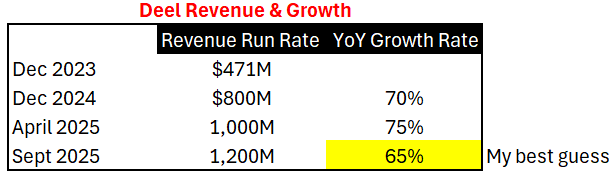

Well, I was wrong. And Deel is still cooking (as the kids say). Growing ~65% YoY (my best guess) at $1.2B in revenue run-rate is bonkers. Below are all the revenue numbers publicly disclosed by Deel in the past.

In connection with Deel’s Series E they said September was a $100M revenue month.

In anticipation of an IPO in their near future, they have recently tightened what they consider “ARR”. I’m told that ~9% of revenue isn’t considered ARR by their current definition (stuff like one-time SaaS fees and Visa fees). Either way, that would mean they are currently at ~$1.1B in ARR. Incredible.

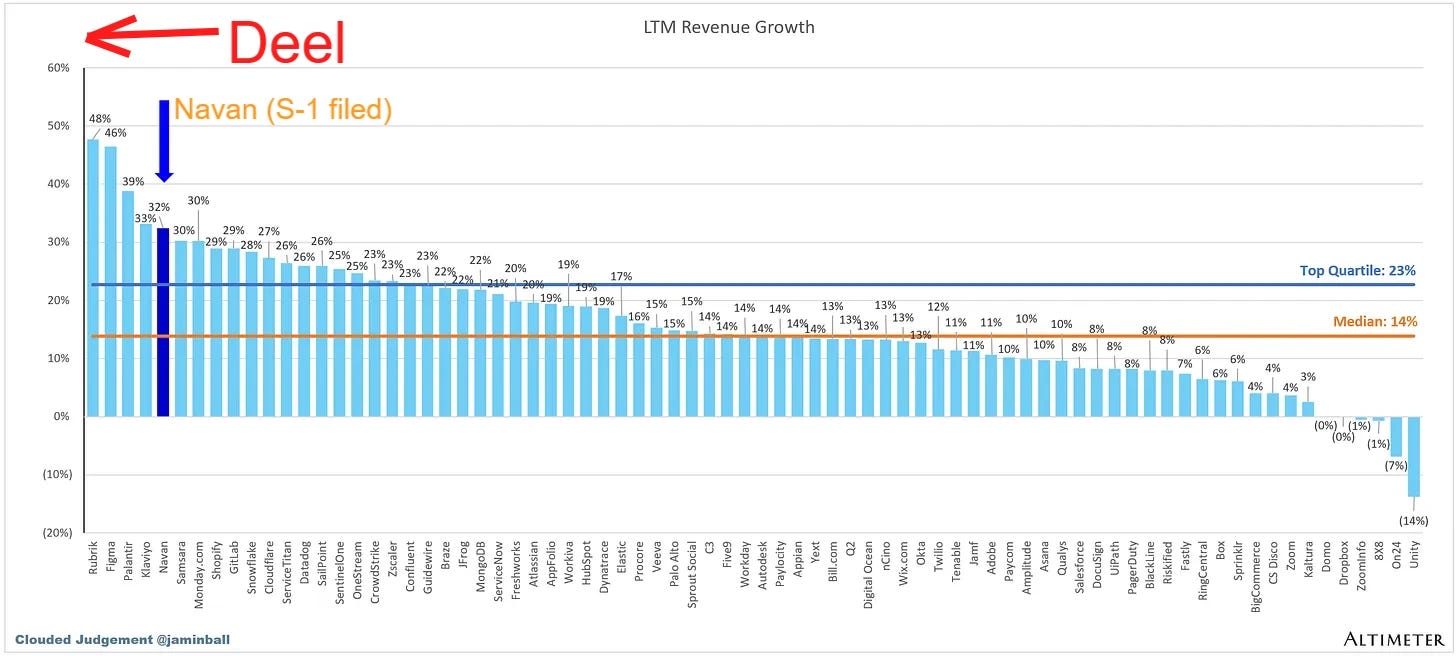

If Deel were public, they would be the fastest growing public software company by a mile.

And Deel is already at significant revenue scale. The median public software company is ~$1.1B in LTM revenue, which is right around where Deel is at.

I have heard several $150M(ish) ARR companies talk about being slightly better than the average public company revenue growth and they think that means they are on the IPO path. Wrong. Unless you can reaccelerate revenue growth (very hard), then your growth will likely continue to slow down by the time you are at IPO scale, which means you won’t have the metrics to be a good IPO candidate. Hard truth for many.

But How Profitable is Deel?

My second thought when hearing about Deel’s insane growth:

Even if “ARR” is that high, Deel is fintech. I bet their margins are garbage and they are burning through cash.

Well…I was wrong again!

Deel’s EBITDA Margin: 15–17%

15–20% EBITDA margins are *really* good for fintech companies at scale. But Deel already has those EBITDA margins while growing nearly 70%. Which means they will have more gross margin expansion coming.

Deel hasn’t publicly disclosed their FCF margins, but I am told that they are very close to their EBITDA margins. So Deel is generating decent amounts of free cash flow at $1B+ of revenue!

Deel’s Gross Margins:

Fintech usually has lower gross margins and therefore lower FCF margins, but Deel’s overall gross margins look like a traditional SaaS company (from a trusted source).

Which means that eventually Deel should also become a “cash printing machine” when revenue growth starts to slow down. Gross margins represent the ceiling on profitability so with SaaS-like gross margins there is still a lot of FCF margin expansion available for Deel.

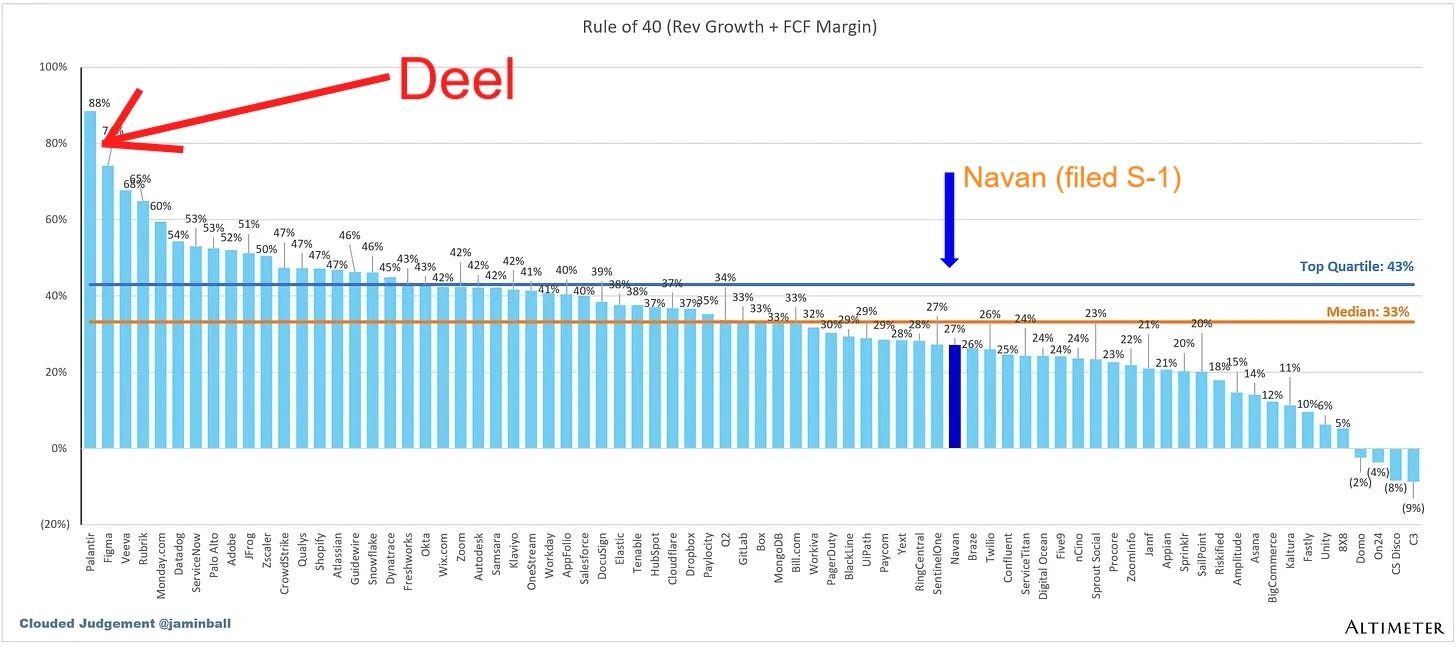

Rule of 40 Score of 84

ARR growth (68%) + EBITDA Margin (16%) = 84

I am using the midpoint of the EBITDA range that has been disclosed.

If Deel were public, its Rule of 40 Score would be the second highest (only Palantir is higher).

Caveat: I am using Deel’s EBITDA margin as a proxy for FCF margins since they haven’t disclosed FCF but as I mentioned above, their FCF margin is similar.

Rule of X Score

We also know that the “Rule of X”, which weights growth ~2x+ more than profitability, is more highly correlated with valuation.

Since Deel has the highest growth rate, they would have the highest Rule of X Score of any public company.

Valuation

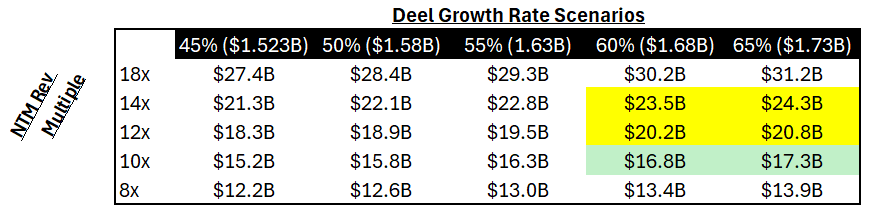

Given all of the above, I am actually a bit surprised that the valuation is “only” $17.3B, which is a ~10x - 11x NTM revenue multiple based on my estimates (green cells below)

If they went public today, I could see them getting a 12x-14x NTM revenue multiple (yellow cells).

I don’t have Deel’s full financials but here are a few reasons why the revenue multiple may be closer to a 10x (which is obviously still great):

Potential concerns with revenue:

More conservative longer-term revenue growth

Concerns of AI’s impact to revenue growth durability

Fintech revenue (such as FX, float, etc) is more susceptible to market changes.

Hitting a profitability ceiling. Deel needs to show they can get higher than 17% EBITDA to deserve a 12x+ revenue multiple. Fintech is generally lower margin, so can FCF margins continue to increase? This seems likely given they have SaaS-level gross margins.

Risk from the Rippling lawsuit (see more on this below)

Dilution is small on the Series E so Deel is less focused on price and more focused on getting the investors they want. With plenty of upside for them in a 2026 IPO.

Many investors have discounted fintech relative to their SaaS peers, but I am increasingly convinced that this might be the wrong move for many fintechs. Fintech can be a strong moat and these companies can fairly easily expand into more traditional high margin software. The reverse path is A LOT harder.

Ongoing Rippling vs Deel Lawsuit

Let’s talk about the elephant in the room…

I previously wrote about the lawsuit Rippling filed against Deel. There were a lot of juicy accusations of corporate espionage. Deel denied wrongdoing and is countersuing Rippling for defamation, libel, deceptive trade practices, etc.

I don’t know what is fact or not. I am not an investigative journalist and I don’t know what will happen with these lawsuits.

But…here is what I do know:

Deel’s Series E would not have happened if the new investor (Ribbit) and existing investors like Coatue and Andreessen Horowitz didn’t feel REALLY good about the likely outcome. They looked at all the evidence, talked to management, got lawyers involved, etc, and they feel good that Deel will be just fine.

The lawsuits have definitely been distracting for both companies

If Deel can grow this fast while dealing with a significant lawsuit, I assume they will only improve once the lawsuit is behind them.

Why Raise More Money?

Deel is growing incredibly fast and generating cash with strong FCF margins. So why do they need another $300M?

Be in a strong cash position leading into a 2026 IPO

Perhaps Deel will do a Direct Listing so a larger cash balance now is more important.

M&A opportunities. Deel has said they have budgeted ~$500M for acquisitions. There’s sooo much untapped space that Deel can expand into.

Final Thoughts

I am guessing an IPO is in Deel’s near future (2026?). They have all the metrics to be an outstanding public company.

Here is what investors will want to see in a Deel IPO:

Growth endurance can remain high. Every quarter leading up to a 2026 IPO needs high growth endurance.

There is a strong AI story (with revenue to back it up).

Fintech story is a moat but they can be more than just fintech. Fintech/Software + AI = continued high growth and higher FCF margins

Put an end to the Rippling lawsuit. Seems too major to have hanging over an IPO.

Congrats to the Deel team!

Footnotes:

Finance/accounting folks need to see what AI agents can do: See Nominal Agents in action (today’s sponsor)

Want to sponsor? Send me an email: onlycfo@onlycfo.io

**Nothing here is investment, legal, or tax advice. The views expressed are for informational purposes only. I do not guarantee the accuracy or completeness of any information discussed.

I was so fascinated with your post on Rippling vs Deel that I remember sharing it with my wife... But even more impressed with Deel's growth rate. Curious to see how the lawsuit evolves and how much of this growth is real.