Did I Commit Insider Trading?

A trader made $18M in a few days from the OpenAI-AMD deal...

Today’s sponsor: Brex, the intelligent finance platform.

CFOs are building for 10 scenarios, not one.

Can resilience be a strategy? Brex CFO survey data says it is now. Tariffs, AI, and global uncertainty have made stability a moving target and adaptability the next big edge. But 69% say their finance stacks are too complex to move fast, and 75% feel pressure to accelerate AI results. See how CFOs are making flexibility, automation, and speed their new KPIs.

Dads at the Playground

While visiting a park in the Bay Area nearly 10 years ago with my kids, I began chatting with another dad. Most people in San Francisco have severe social anxiety if they don’t talk about work within 30 seconds of meeting someone new, so that’s what he quickly started talking about.

He was a VP of Eng at a publicly traded tech company. It didn’t take long before he told me how he was dreading the next week because after they reported earnings he was going to have to tell his team that they wouldn’t be getting much of their annual bonuses because the company had a huge miss on revenue targets for the year.

They were reporting earnings the following Tuesday. I had just received some very interesting (and valuable) insider information.

Would this be insider trading if I traded on it?

Could I even be caught?

When the company reported earnings the following Tuesday the stock dropped 30%…

Keep reading to find out what I did 👇

What is Insider Trading?

Trading in a company’s securities by individuals who possess material nonpublic information (MNPI), in violation of a fiduciary duty or relationship of trust and confidence.

This includes both direct insiders (officers, directors, employees) and outsiders who receive tips (“tippees”) when they know or should know that the information was disclosed improperly.

Material nonpublic information is any information that:

Is not publicly available (i.e., hasn’t been disclosed through official filings, press releases, or other public channels)

Would be considered important by a reasonable investor in making investment decisions.

Dads at Park Example: I was clearly given MNPI. The info I was given meant a major miss on revenue, which was not publicly known yet. And the information would definitely have a significant impact on the stock price (which it did). I am no stranger to MNPI….but I usually don’t get it from complete strangers about other companies.

10 Ways Insider Trading May Happen

Some insider trading is obvious, while others may be less obvious to some. When in doubt…don’t trade on it.

Trading your own company while aware of MNPI

Obviously this is insider trading. This happens when you buy/sell around earnings, guidance updates, financings, layoffs, product, a big customer loss you already know about, etc.

Remote-work leaks

Spouse/roommate overhears M&A diligence calls, sees financial decks on the printer, or sees key metric dashboardsTipping family/friends (or trading on a tip)

“Don’t tell anyone, but…” followed by a relative or friend trading.“Shadow trading” in peers or partners

Learning your company will be acquired and then trading a related company you expect to pop (or crash).Abusing or timing a Rule 10b5-1 plan

Adopting/canceling a plan when you’re aware of MNPINDA leaks

You (or an advisor/vendor) sign an NDA for M&A/partnership, then trade before the news is public.Using customer/vendor MNPI

A major customer cuts spend or a supplier shares confidential order data.Cyber incidents & security findings

Before a breach is publicly disclosed (or while the company is still assessing materiality), trading the issuer or key partners.Vendors & professional services leakage

Printers, IR firms, ad agencies, cloud/SaaS admins, outside counsel. Trading by them (or their friends) = misappropriation.Overheard in the wild (planes, co-working, ride-shares)

If you reasonably know it’s confidential and market-moving (e.g., specific earnings, signed M&A), “I just overheard it” rarely protects the trade. These types of cases can be hard to catch and prosecute tho…

Insider Trading at Private Companies

Insider trading is just a concern for public companies, right?

Wrong!

While 99%+ of people at private companies don’t have MNPI, insider trading rules apply to private companies too. Especially today when companies are going public MUCH later, may have a very active secondary market, or hold material info about public companies.

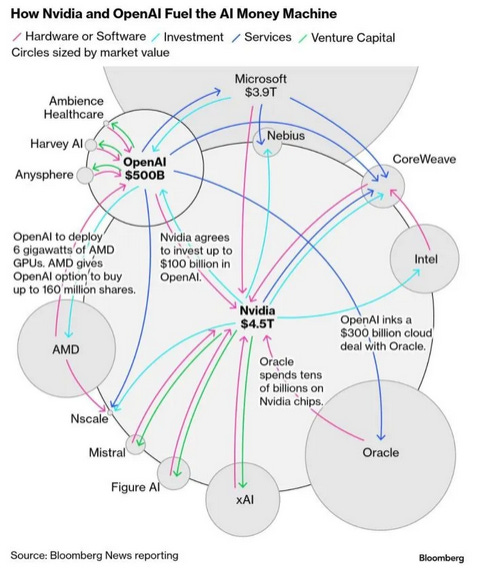

OpenAI, for example, is now the most valuable private company in the world, has a very large secondary market for its shares, and is deeply integrated with many large public companies. OpenAI has the ability to significantly impact a lot of public company stock prices (and it does).

Below is a fascinating chart on OpenAI’s influence….

Earlier this week OpenAI announced a huge deal with AMD that sent AMD stock soaring. One trader bought $6M of AMD call options just a few days earlier and made $18M. This is the type of trade that the SEC might investigate for insider trading…

Insiders often get busted because they use large leveraged trades (like stock options) to maximize profits.

Preventing Insider Trading

Most private companies don’t even talk about insider trading because almost no one has MNPI. If there is some sort of event (like M&A), then those “in the know” should be informed about the rules/policies.

But as a private company gets bigger with a more active secondary market and closer to an IPO then more policies and processes get rolled out.

Public Companies:

Insider Trading Policy: public companies have to disclose their policies in their 10-K

Insider Trading Training: Education is critical because a lot of folks just don’t know this stuff

Quarterly blackouts: Frequently this is set as ~2 weeks before end of quarter through two full trading days after earnings release

Event blackouts: For one-off MNPI (M&A, financings, material customer wins/losses, layoffs, cyber incidents) until public disclosure + 24–48 hrs buffer

10b5-1 plan governance: Pre-set trading instructions (administered by a broker) that provides a solid defense against any insider trading. The rules for 10b5-1 actually got stricter 2 years ago. Such as:

Cooling-off periods: the greater of 90 days for officers/directors or 2 days after filing financials. So execs must wait a pretty long time before the plan can go into effect.

Limits on overlapping plans and single-trade plans.

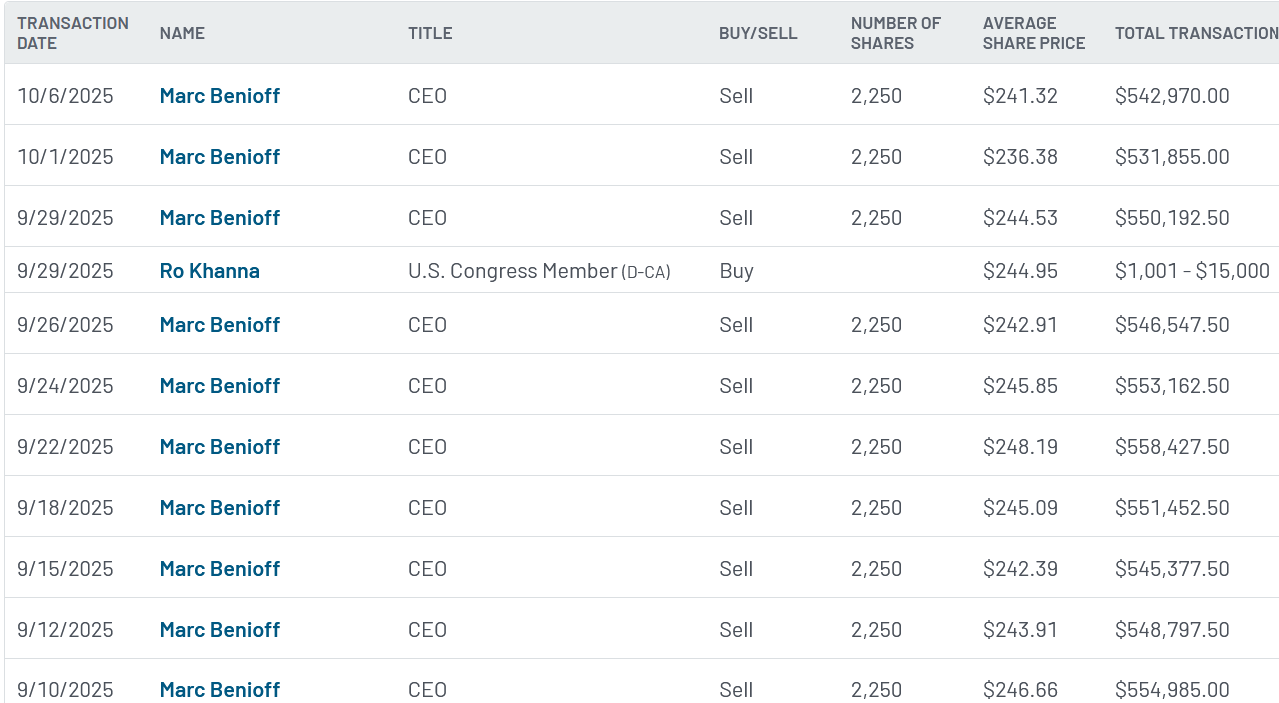

For example, Marc Benioff (CEO of Salesforce) has consistently sold shares for a really long time. Recently he has been selling $0.5M every couple of days. But in years past he has sold nearly $2M nearly every single day. Benioff increased his sales when the Salesforce stock was high and then decreased his sales in 2022 when the stock fell a lot. As long as he follows the 10b5-1 rules then this is completely fine.

Penalties & exposure

Insider trading can come with prison time (up to 25 years), payback of gains from the trades (obviously), and a lot of fines.

Two Actual Examples:

1. Netflix Subscriber Growth Metric Insider Trading

Crime: A software engineer gave subscriber growth numbers to his brother and a friend before the earnings release. After he left Netflix, someone else gave him the same information. They all made money off the trades.

Sentencing: The employee at the center of it got 2 years in prison, a $15K fine, and $0.5M of returned profits. The tippees (brother and friend) got 13-14 months in prison, small fines and much larger returned profits since they made more money.

2. Overhearing Wife’s M&A Deal

Crime: Tyler Loudon overheard his wife’s confidential BP M&A calls about acquiring TravelCenters of America (TA). He then bought 46,450 TA shares and immediately sold the stock after the deal announcement. He made ~$1.8M profit on the trade…

Sentencing: 24 months in prison, 1 year supervised release, and $1.8M forfeiture of profits. BP also apparently fired his wife because of the whole thing too…

Final Thoughts

No, I did not trade on the information that a random dad gave to me at the park. I like to sleep at night….

But a lot of people don’t feel the same way. Insider trading happens a lot without any consequences. It can be really hard to prosecute when it’s not a direct insider or immediate family member doing the trading.

My only advice is for folks to ask themselves how they would feel if it came out that they traded on the information they received. Stay ethical my friends.

And companies need to have strong policies and education. There are lots of people outside of finance who many not understand what is allowed or not. The VP of R&D at the park certainly didn’t think anything of it…I am confident he wasn’t trying to give me a hot tip so I could make a lot of money.

Footnotes:

Download this CFO survey data on top concerns and priorities in 2025 (from Brex)

Check out OnlyLawyer (cousin to OnlyCFO) for all things legal for tech companies