Do Customer Success Teams Add Value?

Guest post by John Gleeson on "The Rising Importance of Customer Success"

I previously wrote an article called 2023: Year of Customer Success & Gross Churn that went over why I thought 2023 would really spotlight the importance of customer success and low gross churn. Based on how 2023 has gone, I think that post holds up really well. I took a pure financial lens on the topic so I wanted to get an customer success operator’s view.

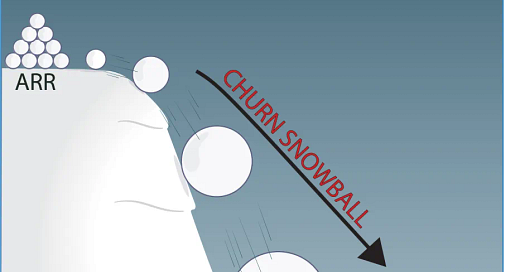

Side note - I still think my visual representation (from the above post) about the financial impact of churn is some of my best work 🤣. The leaky bucket analogy doesn’t do justice to the negative impact of churn.

John Gleeson is a customer success expert. Most recently he spearheaded Motive's Customer Success during an incredible phase of hyper-growth. Under his guidance, the company's ARR skyrocketed from less than $1 million to over $300 million.

Currently John is the managing partner at a venture firm he founded, SuccessVP. SuccessVP is a debut fund that supports SaaS founders with their post-sales journey by engaging with them early in the company-building process. The fund's expertise lies in providing guidance for Customer Success during founder-led sales.

Let’s get to John’s breakdown of the value of customer success from the operator’s perspective.

The Rising Importance of Customer Success — John Gleeson

Customer Success not only supports customers, it supports the entire go-to-market motion.

There is a high correlation between Net Revenue Retention (NRR) and Enterprise Value in public SaaS. Intuitively, it makes sense: investors are willing to pay more for companies that are able to retain their existing customers and grow their revenue from those customers. If your company has taken on any venture capital funding, you have effectively committed yourself to the journey of becoming a publicly traded company—even if you find liquidity in another way. As such, if it isn't already, NRR is a metric that will matter a lot to you.

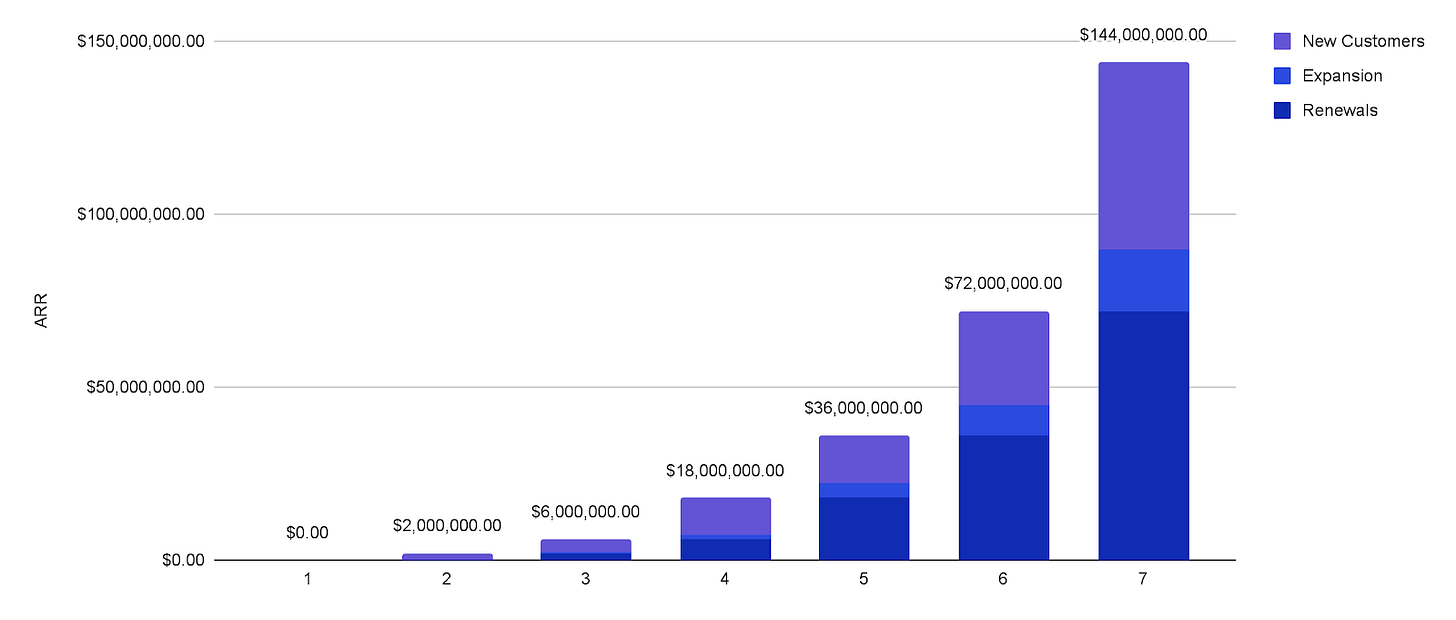

In SaaS, we have three ways to grow our revenue:

Sell to more new customers

Sell more to our existing customers

Do a better job of retaining our existing customers.

While we fixate on the first one—and rightfully so, if you don't have customers you can't retain or grow them—it's the latter, growing and retaining existing customers, that ultimately makes up the hockey stick curve all startups aspire to create. It's customers who not only stay customers but also decide to grow their spend with your company that creates the bend upwards on the growth curve. Formulaically, this is Net Revenue Retention (NRR).

Despite its importance, NRR isn't a great operational metric to run your business on because of its lagging nature. In fact, a company could boast a very high blended retention number while still having a churn problem. Oftentimes, once you start to see NRR decline, it's too late; customers are already churning.

From my experience, it's often very difficult to slow the bleeding and certainly costly to win back a lost customer, if that's even possible at all. Most companies are caught flat-footed when this happens and are ill-equipped to remedy the issue. Oftentimes, companies look to Customer Success, either by hiring their first Head of Customer Success or making changes to their existing team. However, this usually doesn't quickly solve the problem.

In part, this is because NRR is such a dynamic metric influenced by many parts of the business. Changes to pricing and packaging or new product launches can impact NRR as much as improving customer retention can—at least in the short run.

Snowflake, Datadog, and MongoDB, historically some of the highest-valued SaaS public companies, all boast NRR higher than 120% but also leverage a consumption-based pricing strategy, which gives them an additional axis to expand customer spend beyond what traditional seat-based SaaS pricing offers. Famously, Snowflake, with NRR that's often about 150%, redistributed the Customer Success team and did away with this section of the business altogether. Frank Slootman, Snowflake’s CEO is noted for doing the same at ServiceNow, his previous company, although it should be noted the function was quickly reinstated after his departure.

The reality is Snowflake's ability to go without Customer Success, while maintaining such a high NRR number, is a result of its incredible product-market fit with a pricing model that matches this market pull. Most companies aren't like Snowflake – in fact, very few are. For most of us, finding Product-Market fit is a never-ending journey. Keeping it all together as we iterate through changes with living, breathing customers requires finesse that more often than not comes from the Customer Success function. I've come to appreciate good Customer Success not only supports customers but also supports the entire Go-to-market motion.

The common assumption is that Customer Success prevents churn, but phrased like that, one could be led to believe that it's a function responsible for the end of the customer lifecycle. In reality, the best Customer Success teams and leaders I've witnessed are almost like an extension of the founder, thinking far more holistically about the customers' needs and working incredibly broadly across the entire organization.

Through 2022, many CEOs started reaching out to me for help with their churn problems. The generous funding environment of 2021 prompted a lot of companies to prematurely scale their Go-to-market functions before establishing a strong product-market fit. With a certain amount of selling horsepower, it's possible to accelerate growth or at least secure new logos. However, it's a different story to convince customers to renew a product they haven't found value in after a year of paying for it. That's precisely what happened to many companies throughout 2022 and into 2023. They didn't have a strong product-market fit, and the bottom of the bucket simply fell out when the customer didn’t find value. Coupled with layoffs across the broader tech sector that reduced seat counts for many tools, along with tighter budgets overall, it created a perfect storm for high churn.

When faced with the same situation again, many founders would have been slightly more cautious as they accelerated customer acquisition. It's a delicate balance to get right, but what I have heard repeatedly is that these founders regret shifting their focus away from their existing customers. There's a sense of remorse that they didn’t have a deeper understanding of the needs of their customers and that among other things these needs didn't receive the priority they deserved on their product roadmaps until it was too late. Maintaining a strong relationship with existing customers while pursuing growth is paramount. Beyond onboarding, renewals, and expansion, Customer Success can serve as an extension of the founder. At some point, the founders can't be in the room for every customer need, Customer Success fills this crucial gap.

Even at scale, when things are going well, NRR can decline. During my tenure as the VP of Customer Success at Motive, there were periods where, despite very good retention rates, I witnessed our NRR drop. I referred to this phenomenon as "The NRR Curve." In essence, most companies enter the market with a point solution, and as a general rule, it takes time for sales teams to learn how to sell without offering big discounts. Even without significant discounts, startups often employ a "land and expand" strategy, where they initially sell licenses to a subset of customers and then, post-initial sale, work to add more seats or drive consumption. In both cases, if you have a robust expansion strategy and a high retention rate, your NRR will naturally increase.

The challenge that arises is that as you become adept at expanding your existing customer base, your sales team often becomes more skilled at selling higher ACVs (Average Contract Values), leaving less room for expansion in newer accounts. Furthermore, when customers in newer cohorts churn, the churn amount is higher making the loss more impactful. It was during these dips that I often found myself in as many product and pricing and packaging meetings as I did customer meetings.

Beyond Customer Success, few leaders have a comprehensive enough interaction with both customers and revenue to develop a deep understanding of NRR and the underlying factors that shape and propel it. NRR is one of the purest reflections of a company's overarching Go-to-market strategy but despite being a frequent topic of discussion in board meetings, particularly as SaaS companies progress toward going public, it often lacks a clear owner in many organizations.

According to a survey conducted by ChurnZero, ESG, SaaStr, and HubSpot, encompassing responses from 1,250 Customer Success leaders, a mere 17% of SaaS companies have a Chief Customer Officer (CCO) reporting to the CEO. While this falls short of an ideal scenario, among companies between $50M to $249M ARR (about the ARR where companies start to think about going public) this figure rose from 17% to 28% from 2022 to 2023. In a world where companies can build faster than ever, I’m excited for the 28%.

Knowing your customer has never been more important and Customer Success is more critical than ever.

OnlyCFO Final Thoughts

Thanks John for the informative post on customer success and things that founders, operators and investors in software companies should be thinking about.

Customer Success teams can add significant value when done right. BUT…many companies don’t properly use CS teams or they staff the team inappropriately for the company’s specific needs. Because of this I have seen LOTS of money wasted in customer success efforts. Companies need to understand the purpose of customer success, what is appropriate for their company, and the outcomes they should be able to deliver.

*Check out the next customer success meetup in NYC that John helps run