Do Gross Margins Matter?

When and why to care about gross margins. And what is AI's impact on gross margins?

Today’s Sponsor: Ledge

I see so much unnecessarily wasted time and errors with manual reconciliation processes. Clean data and real-time visibility are a Finance leader’s best friend.

Check out Ledge. They automate cash reconciliation with AI, reducing manual work by more than 90% and keeping your financial records updated in real time.

Why are gross margins important?

Gross margins represent the ceiling on profitability.

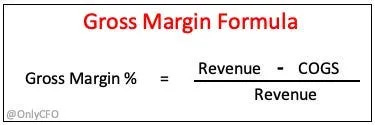

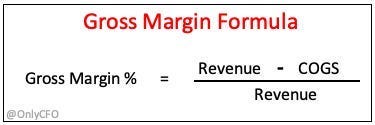

Gross margin is calculated by taking revenue less all the costs to deliver the product (aka cost of revenue or “COGS”).

Since most COGS are directly variable with revenue, a company’s gross margin is the highest profit potential they will ever have since you can’t have revenue without COGS.

SaaS companies have historically been able to obtain high revenue multiples because they can print money at scale with 20%+ free cash flow margins. But if gross margins are weak, the typical VC-backed SaaS unit economics break because high profitability is not likely with low gross margins.

Not all revenue is created equal! A dollar of revenue at a pure SaaS company with 80% gross margins is VERY different than a dollar of revenue at a fintech company with 50% gross margins.

COGS vs OpEx

COGS is different than all the other expenses you see on a typical SaaS P&L (like DataDog’s P&L below).

What many folks fail to understand is how sticky gross margins can be. If gross margins are bad today, it is typically REALLY hard to materially improve them in the future.

So unless you are fundamentally changing your product or have a really good story on how gross margins improve, most investors will assume your weak gross margins will persist for the foreseeable future. And they will discount your valuation accordingly.

But operating expenses are different. Operating expenses can/should rapidly decrease as you scale revenue. This is the power of operating leverage.

The below image shows the average operating expenses as a % of revenue by year and ARR range. While these benchmarks come from high-growth ICONIQ portfolio companies, the trends are relevant for all companies.

There is A LOT of operating expense efficiency improvement as companies move from early to late stage.

Every segment has also been getting much more efficient over the past few years

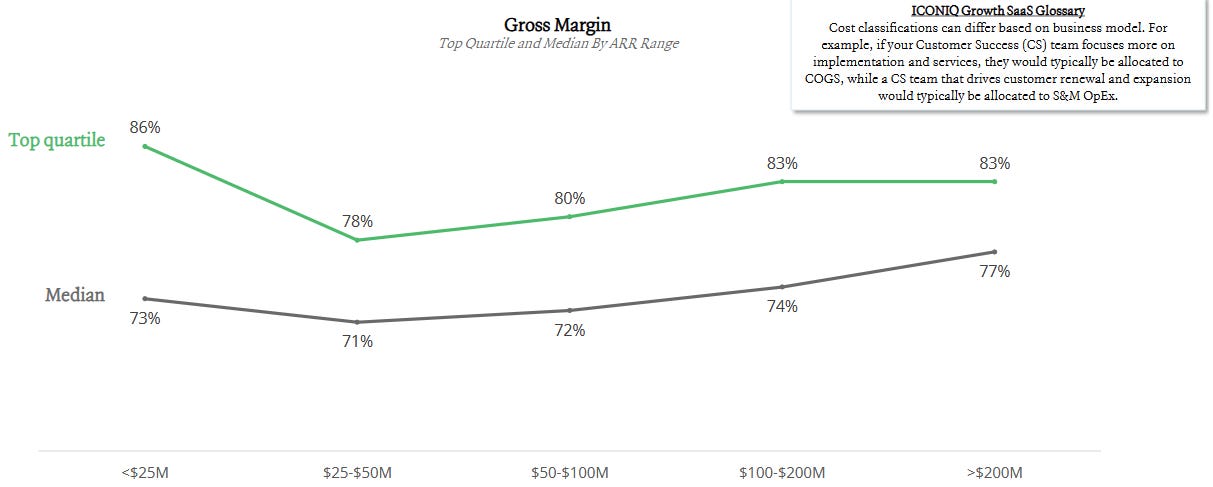

While companies do get some leverage with gross margins as they scale, it is not nearly to the same degree as operating expenses. See the trend of gross margins at different ARR levels below from the same ICONIQ report.

Gross margins actually fall after $25M in ARR in the chart below probably due to:

Adding additional management layers and other roles that didn’t exist in the early days

Bad accounting of not fully burdening gross margins during the startup stage

But the overall improvement in gross margins as a company scales is VERY small.

When do gross margins matter?

This is the right question.

Gross margins definitely matter a lot to long-term valuations, but the question is WHEN should investors and operators focus on it?

The amount of focus placed on gross margins should primarily be a function of:

Scale (level of ARR)

Revenue growth (how fast are you growing)

Degree that gross margins are below standard (how bad are the gross margins)

For instance, a small fast growing company that has slightly lower than standard gross margins probably shouldn’t care much at all. But a large mid growth company with bottom quartile gross margins should probably focus on fixing gross margins.

Regardless of whether gross margins are a focus, if they are bottom quartile, you should at least know why. And maybe you fix the easy things or you at least need a gross margin improvement story if investors ask.

How much time is your team wasting on manual reconciliation?

»Check out Ledge! AI and automation eliminate the busywork, keep your financial records accurate in real time, and cut days off your closeWhat about AI products?

2025 is all about AI-fueled revenue growth. Almost nothing else matters.

Yay! So we are back to the 2021 days of growth at all costs, right?!?!

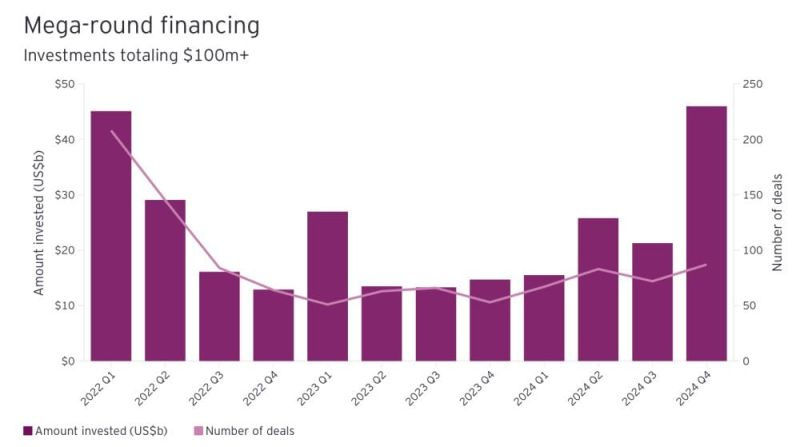

Not for most companies, but for those that are still doing mega-round deals (almost exclusively AI companies) then growth really is all that matters. This has kind of always been true for mega-round fundraising…we just haven’t seen a lot over the past few years.

But efficiency is certainly more in focus today for everyone so even companies doing mega-rounds are a bit more efficient today.

But most of us are not raising mega-rounds today and AI products are still different from a gross margin profile than traditional SaaS (AI gross margins are lower). However, a lot of AI products today are a bet that AI costs will continue to come down in the future. And it’s happening…costs related to AI products are rapidly declining.

This is very different from historical SaaS where gross margins have been very sticky and consistent. We must consider this dynamic as we think about our gross margin profiles today for AI products.

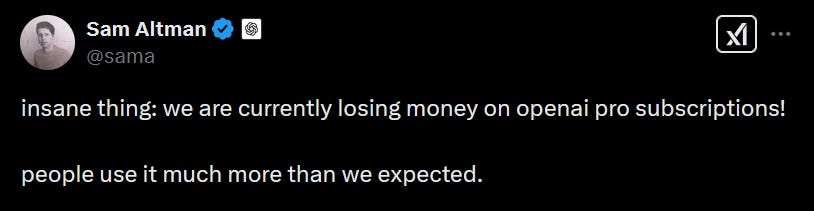

OpenAI’s gross margins on their pro subscription plan probably aren’t great today…but I assume they will be at some point in the near future.

Final Thoughts

Gross margins matter A LOT since it represents the ceiling on profitability but be careful on when and how you focus on it.

Be prepared for more volatile gross margins over the next few years due to AI. There will be short-term and long-term variables that impact gross margins in both a positive and negative direction. Be careful not to just factor in the positive impacts.

Footnotes:

Check out Ledge. Reduce your manual work by more than 90% and keep your financial records updated in real time

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Bonus Content: What goes into gross margins?

In the formula below gross margin is expressed as a percentage of revenue. Viewing gross margin as a percentage of revenue is generally more useful because then it is comparable across benchmarks and other companies.

Below are the typical expenses that are included in COGS (and gross margins):

Professional services

Support

Customer Success Management (diversity in practice)

Infrastructure/hosting costs

Compute (AI stuff for model inference, prompting, etc)

Dev Ops

Unless professional services is immaterial most companies have two separate revenue, COGS, and gross margin lines to show them separately.

Investors want to see that the gross margins associated with software/AI are healthy. And they want to make sure professional services revenue isn’t too large as a percentage of total revenue and that it’s not losing too much money.