Employee Stock Options Guide

Stock option basics, insights, benchmarks, and how to negotiate your equity

If you have ever considered joining a private tech company then the dream of making millions of dollars from your stock options at a pre-IPO company has probably crossed your mind.

This company could be the next Snowflake, Amazon, Tesla, etc….and if it is then my stock options will be worth millions!!!

While employee equity is a great way to potentially make a lot of money, there are a few things you really should understand first.

Here is what I will cover in this post:

Stock option basics

How to value pre-IPO equity

Benchmarks and insights

What to know about equity compensation and negotiations

Brought to you by Leapfin

Last chance (!!!) to register for Leapfin’s talk today, The best finance lessons I’ve learned with Strava CFO Lily Yang on May 8 at 10am PT.

Don’t miss Lily (formerly CAO at Pinterest) and Leapfin product leader Caitlin Steel, CPA (and a former CFO too!) share advice you can put to use now. In this 30-minute session, you'll hear what CFOs at high-growth companies like Strava need to prioritize in 2024 to succeed.

Stock Options Basics

Types of Compensation

There are two types of compensation provided to employees:

Cash: base salary + variable compensation (if applicable)

Equity: ownership or right to obtain ownership in a company

The cash piece is immediately valuable (you got money in your bank!) while the value of the equity depends on the company you are at.

Equity given to employees of public companies is immediately valuable (once it vests) because they can easily sell it on the stock market.

But private companies don’t have this access. While the very best private companies might have an active secondary market where investors are willing to buy their shares, it is much harder and more costly.

Types of Equity

There are many types of equity that might be given, but by far the two most common are:

Stock Options

Non-qualified stock options (NQOs or NSOs)

Incentive Stock Options (ISO)

Restricted Stock Units (RSUs)

Earlier stage companies almost always grant stock options, but when a private company becomes more mature with reasonable line of sight to an IPO they may start granting restricted stock units (RSUs) because the upside potential is more limited, which is where stock options get their value.

The focus on this post is on stock options, but many of the same principles apply to RSUs and other forms of equity compensation.

How Stock Options Work

Who gets them?

Companies typically grant options to employees, contractors, and consultants (but mostly reserved for employees).

What is a stock option?

Stock options give you a right to buy (aka exercise) a set number of shares of the company stock at a certain price, also known as the strike price.

Because your purchase price stays the same, if the value of the stock goes up, you can make money on the difference. The dream is you can sell your purchased shares for a lot more than you pay for them.

How is the “strike price” set?

All companies hire a valuation expert to perform a 409A valuation report so they can issue stock options because there are adverse tax consequences if you don’t issue stock options at the fair market value (“FMV”) of the common stock as determined by the report.

The FMV is not the same valuation that the company raised money at primarily because investors get preferred stock (which has more rights than common stock) and because of the lack of marketability (private company stock can’t be sold).

409As are required by the IRS to be done at least annually. But companies will start doing the semi-annually or quarterly once they reach a certain size and closeness to a potential IPO.

When can you buy the shares?

Stock options at tech companies typically “vest” (i.e. are earned) over a 4 year period with a 1-year cliff and then monthly thereafter. Typically the ability to exercise (i.e. buy the shares) follows vesting, but companies sometimes allow employees to “early exercise” and buy the shares before they vest to lock in favorable tax treatments. However, they are subject to repurchase (typically at exercise price) if an employee terminates before vesting.

The cliff means that nothing is vested (i.e. not earned) until you have been employed for one year and then 25% of your options vest. This helps protect the company in case they discover you are terrible after 6 months and want to fire you. So even if you have an early exercise provision, if you are fired before your cliff then you may not be able to keep your shares.

Once your stock options are vested and you have exercised they are legally yours.

When can you sell them and make money?!?!

For public companies, you can buy and then sell right when the options vest (potentially subject to certain blackout windows where trading is restricted).

For private companies, you may be waiting a while…

There are 3 ways that private company equity can turn into cash:

Company goes public (IPO) so the stock is publicly traded. Very few companies make it to an IPO.

There is an active secondary market for the company’s stock (i.e. big investors want your private company stock). Only the very top companies have an active secondary market.

The company gets acquired. Perhaps the best chance, but still not very high.

What to ask about stock options

Whether you are considering a new job’s equity package or trying to figure out if you should exercise your stock options, there are some basic questions you should ask:

What type of stock option is it (ISO vs NSO)?

There are significant tax differences so do some research. If you are a U.S. based employee then ISOs are typical as they have tax advantages to employees. Everyone else gets NSOs.

What is the current strike price?

If they are in the process of fundraising the price might jump up.

When does the current 409A expire? Will they have to refresh it before your grant?

What is the vesting schedule?

Typical is one year cliff and then monthly vesting over the next 36 months (4 years in total vesting).

What was the preferred stock price and valuation?

You want to know how big the spread is between what the last investors valued the company at versus what price you can buy the shares at. There are various factors that can make the spread big or small.

You also need to know how real that valuation is. If they raised their last round in 2021 than it might be way too high.

What is the fully diluted shares outstanding?

Big red flag 🚩 if they won’t tell you this. I have heard many companies tell candidates that it is confidential…

This tells you the size of the pie. Only then will you know how big of a slice you are getting with your stock options.

The fully diluted shares is the total shares of a company including shares that are currently outstanding and also shares that could be claimed through the conversion of convertible preferred stock or through the exercise of outstanding options and warrants.

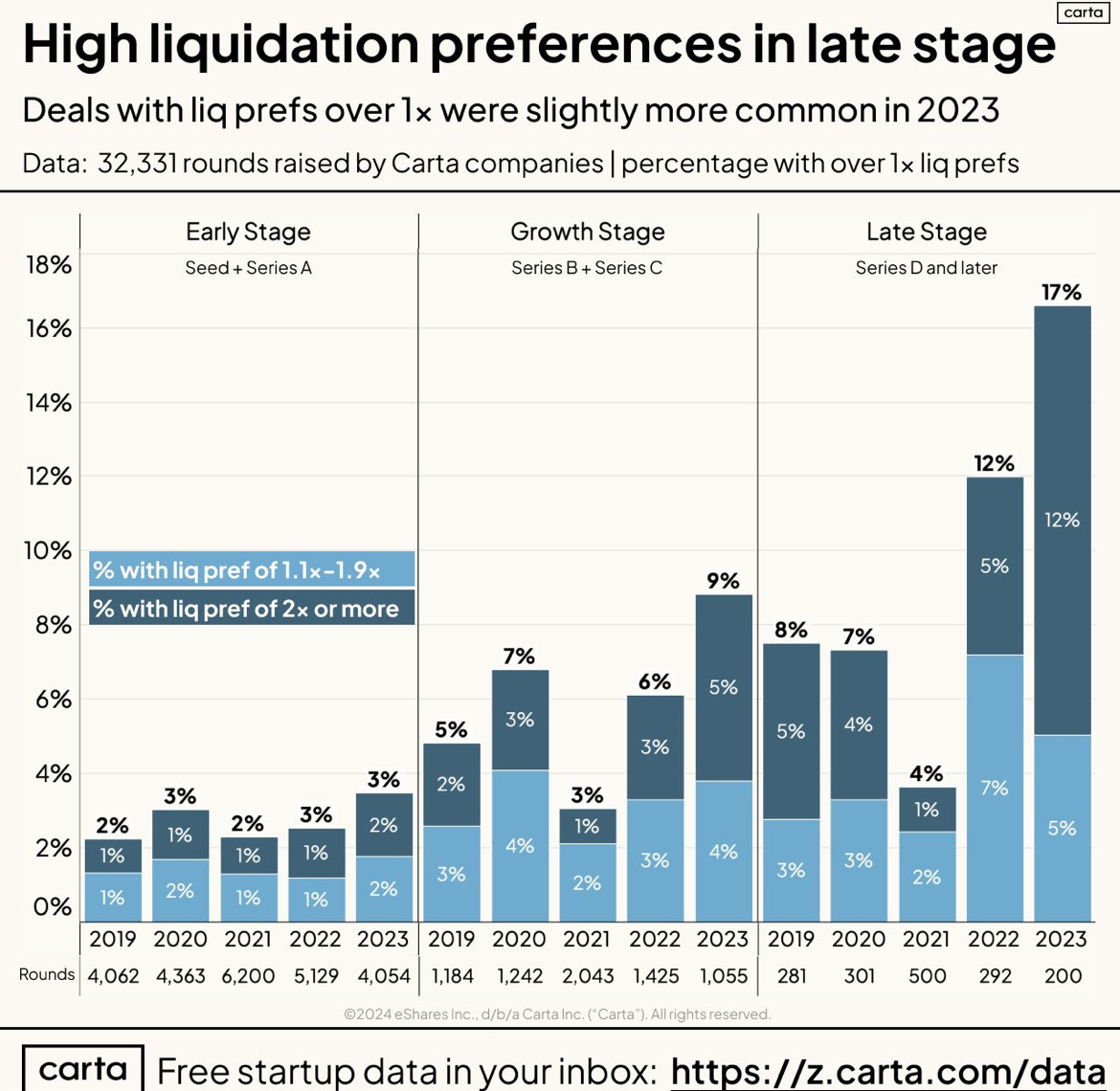

What are the liquidation preferences?

This will cause a lot of stock options to be near worthless for companies that raised huge rounds at crazy valuations.

VCs get preferred stock which means they get preferential payouts in the event the company is sold or has an exit event. In other words, they get paid first before anybody else. And some rounds in 2021 were so large at such high valuations that an exit might be lower than the total amount raised, which means employees get nothing.

While it was much less common during the good times of 2021, “dirty” term sheets have become more popular today. Typically liquidation preferences are 1x which means investors get their money back first but no more. Greater than 1x means they get their money back plus some….

What is the post-termination exercise period (“PTEP”)?

Typically this is 3 months after termination, which means you have 3 months after you leave a company to decide if you want to exercise your shares. If you don’t then the stock options are forfeited (i.e. you lose the right to exercise).

Some companies are more generous and offer longer periods to exercise which can be a great benefit.

Can you early-exercise your stock options?

For a lot of companies this is a benefit reserved for executives, but some companies offer it to all employees. Early exercising of options starts your holding period sooner so you may pay the lower taxes when you sell.

Also, you likely won't owe additional taxes upon exercise if you early exercise your options as soon as they're granted (at the time of exercise) because you're buying them at FMV so there is no gain.

What benchmarking percentile is used for equity grants?

Understanding if an equity grant is “fair” can be hard especially for non-executive roles.

Ask how equity is benchmarked and where your grant falls (25th percentile, 50th percentile, etc)

Unallocated size of the employee stock option pool?

This represents how big the pool is for future employee stock option grants. If it is really small then the pool will have to be increased soon which will increase the fully diluted shares outstanding, which will increase dilution (i.e. shrink your size of the pie).

Other Things to Know

If employees are involuntarily terminated then the company can accelerate vesting.

This is common when executives are terminated and commonly 3 - 6 months are accelerated.

It is also somewhat common in large layoffs as part of separation packages.

It would be unusual for an employee below the VP level to get an acceleration if they were not part of a broad layoff.

Companies can “reprice” stock options if the fair market value (FMV) drops

If you joined a company in 2021 when valuations were crazy high then your options may not be worth nearly as much today.

Your company will have an updated 409A valuation today which determines the FMV. If it’s significantly lower than previous valuations then the company might consider repricing prior stock options. *This is much easier for private companies to do than public companies. Public companies might just issue more equity.

The company can have a longer post-termination exercise period (PTEP).

The PTEP can be extended a few months or a few years. It just can’t be longer than the life of the stock option, which is generally 10 years.

Companies can do this and still grant ISO stock options - the ISOs just turns into an NSOs after 3 months past the termination date

There are tax considerations on the date of exercise and the date of sale.

Do your research

The fair market value (FMV) is determined at least annually for private companies by performing a 409A valuation.

More frequently is required if significant events occur - like a fundraising.

When a company is 12 - 24 months from an IPO it is usually performed quarterly.

Highly valued companies often have 409As performed at least semi-annually even if they are further away from an IPO given the higher risk.

Qualified small business stock (QSBS) is an amazing tax break for folks who acquire shares while a company qualifies as a small business.

The main criteria is gross assets must be <$50M at the time shares are acquired, which means stock options don’t count.

You have to own the shares while the company qualifies.

Other rules apply so check out the criteria.

Will my stock options be worth anything?

Don’t bank on getting rich from stock options. Most people should look at them kind of like a lottery ticket.

I know I am crushing dreams here….but it’s better to have this mindset when you join an early stage company because there is sooo much risk to get to an eventual exit.

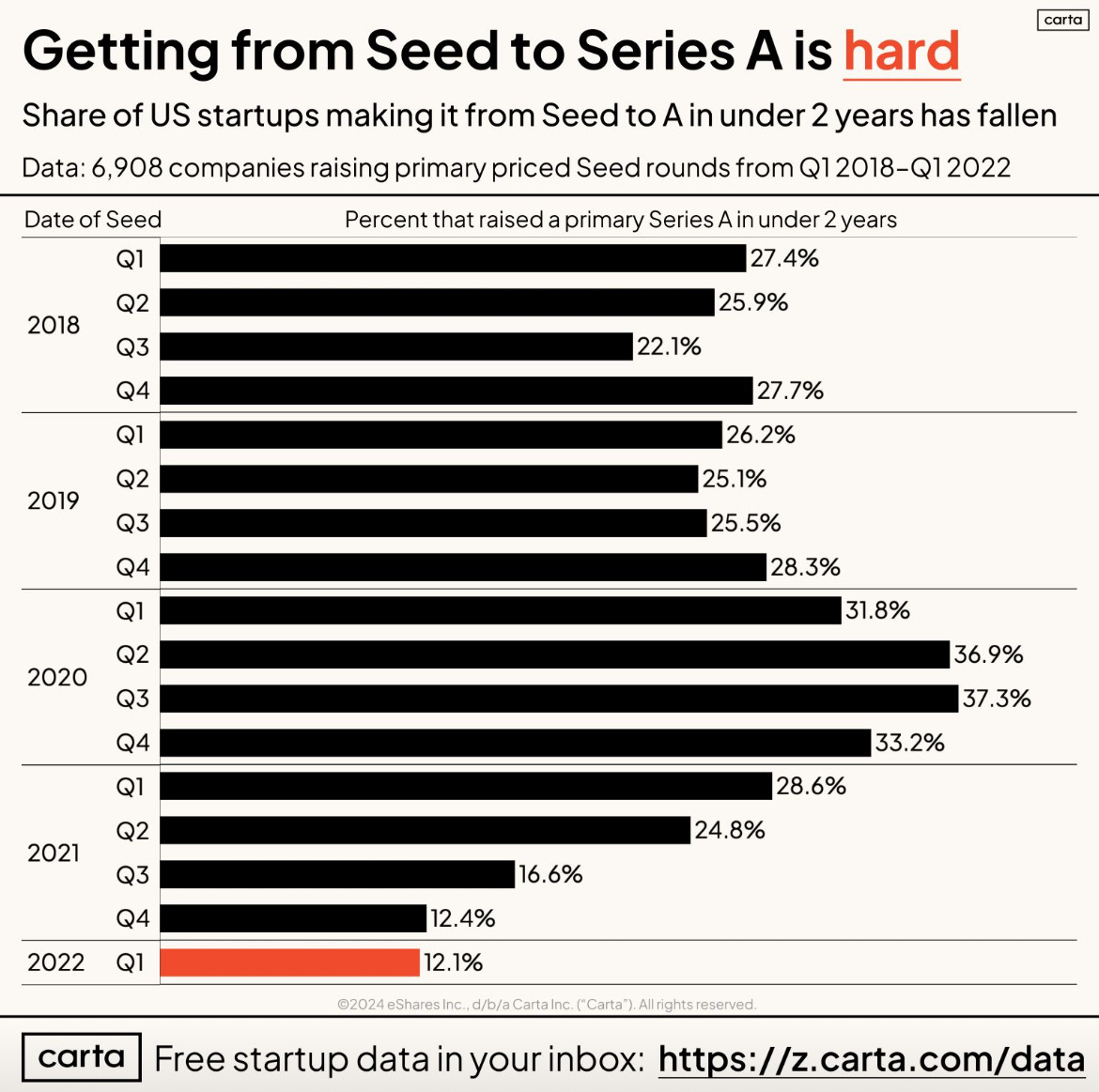

The risk/reward analysis is usually pretty bad for employees joining an early stage company. Especially in today’s environment….

The below data is from CB Insights for companies that raised their seed round between 2008 and 2010. A large portion of companies fail to ever exit. Even the ones that do exit, the financial outcome for employees is often not great because of further dilution, liquidation preferences, fire sales, etc.

For a while (peaked in 2021), the math looked really good for tech companies. Everyone was raising new rounds at incredible speed and at huge premiums to the last round raised. Everyone looked like a genius and was going to be mega rich from their stock options (at least on paper)…Until all the sudden they weren’t.

Private company stock prices don’t get adjusted on a daily basis like the public markets, but down rounds (raising money at a smaller valuation than last time) continue to rise.

There is a significant amount of private cloud companies today that are unfortunately not going to make it (many “zombiecorns” out there). Getting an offer at a top decile company where equity has a much higher chance of being worth anything is huge.

Know your worth and what the benchmarks are so you can negotiate. But don’t just go for the biggest number. Pre-IPO stock options usually end up worth nothing anyways so for a company to have an exit and your options to be worth anything is huge.

Takeaways

It’s important to know the basics for financial planning and negotiating

Beware of employers who won’t give you the information mentioned above

Don’t count on your equity being worth anything - it’s like a lottery ticket. The earlier stage the company the more risk.

Footnotes:

Register for Leapfin’s talk today, The best finance lessons I’ve learned with Strava CFO Lily Yang

I partner with a CFO/Accounting firm focused on software companies. If you are a software startup (less than $15M in revenue), reach out today for a free consultation.

Do your own research. This was meant to spark some questions/ideas about stock options but should not be considered investment or tax advice.

This Employee Stock options guide looks like what every employee should have. 80-90% of staff especially newly employed do not know anything about it. Thanks for sharing

On the shares outstanding, something companies don't volunteer is the SHA... I just had one in hand recently where the management had the right to issue 10% more shares just before an exit. So expect further dilution on the commons at the time of a "possible" liquidity event.