Figma S-1 | The IPO Bar is High 🚀

Figma is setting the IPO bar REALLY high with incredible metrics

Today’s Sponsor: NetSuite

Today’s most pressing challenges demand more than instinct—they call for modern problem solving and bold, informed leadership.

In his new ebook, MBA for Lunch, Jack McCullough distills the sharpest insights from top MBA programs into actionable strategies for navigating today’s complex landscape—from AI and data science to marketing and leadership.

Figma’s Stellar S-1

The software finance nerds have been waiting for an exciting S-1 and yesterday we finally got one — Figma.

And their metrics do not disappoint.

I know there is about to be tons of S-1 deep-dives on Figma so this isn’t necessarily a full breakdown but rather the most interesting learnings from my perspective.

Maybe the IPO market is opening up a bit given less volatility/uncertainty and the stock market being at all-time highs, but…if Figma is the one to kick the IPO market off then it is setting a really high bar. There are VERY few private companies with metrics as good as Figma.

📊 Key Metrics

Revenue

Scale: $913M ARR (based on Q1’25 revenue)

Growth: Q1 2025 revenue grew 46% YoY

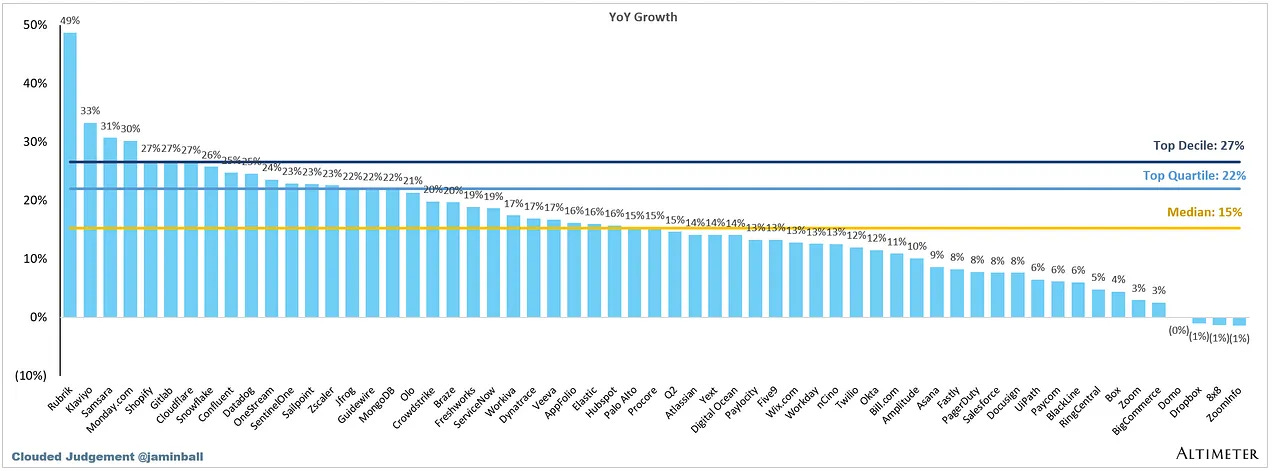

Figma will have the second highest LTM revenue growth amongst public cloud companies.

Retention

Net Revenue Retention (NRR): 132% NRR as of Q1 2025. What makes this also impressive is NRR has only come down 2 percentage points from Q1 2024 which was 134%. High NRR is significantly contributing to Figma’s high growth rate.

Layer Cake: The annual cohort layer cake is always an interesting view. Figma customers grow a lot after the initial deal.

NRR by Year:

Trended down in 2023 because of the pricing impact from FigJam and their new enterprise plan which boosted 2022 NRR

Figma expects NRR to decline once they pass the one-year anniversary of the March 2025 price increase for Figma Design. One more non-durable boost to NRR and overall revenue growth before the IPO. Question is “how much will it drop after one year passes?”

Regardless, Figma will have the very best NRR amongst all public cloud companies. And it’s not even close.

NRR Caveat: Figma is excluding full customer churn from NRR which is very sneaky…but given their high GRR (at least in $10K+ customers) it wouldn’t change it all that much — it would knock down NRR by 4 percentage points (see GRR below)

Gross Revenue Retention (GRR):

Figma has a 96% GRR as of Q1 2025 🤯

Wow!! That is crazy good. Very few public companies report GRR so I am glad to see Figma reporting it. In my view, GRR can be just as important of a metric as NRR.

But…Figma’s definition of GRR comes with some important caveats from the traditional definition.

We calculate our “Gross Retention Rate” as of the applicable period of measurement by starting with the ARR from Paid Customers with more than $10,000 in ARR as of twelve months prior to such period (“Prior Period ARR”). We then deduct from the Prior Period ARR the ARR from Paid Customers with more than $10,000 in ARR who are no longer customers as of the date of measurement, and divide that figure by the Prior Period ARR to arrive at our Gross Retention Rate

GRR Caveat: Figma only counts customers with >$10K ARR in the calculation and it only shows complete customer churns (not downgrades). Those are some pretty big differences with typical GRR definitions.

Efficiency

Gross Margins: 91%, which is certainly best-in-class!

Free Cash Flow: Figma was burning tons of money just a few years ago and today they are generating 28% LTM FCF margins!

Figma’s FCF margins are quickly approaching top quartile. And they are doing that while growing faster than almost everyone!

CAC Payback: Figma has a CAC payback period of ~18 months, which easily puts them in the top decile. This will jump up a bit once they are public and their RSU expense hits S&M but it will still be top quartile.

Rule of 40 Score

Figma Rule of 40: 74 (46% growth + 28% FCF margin)

This is the second highest Rule of 40 Score for all public cloud companies. First place is Palantir with a score of 76, but they trade at 80x NTM revenue…

Cash Position

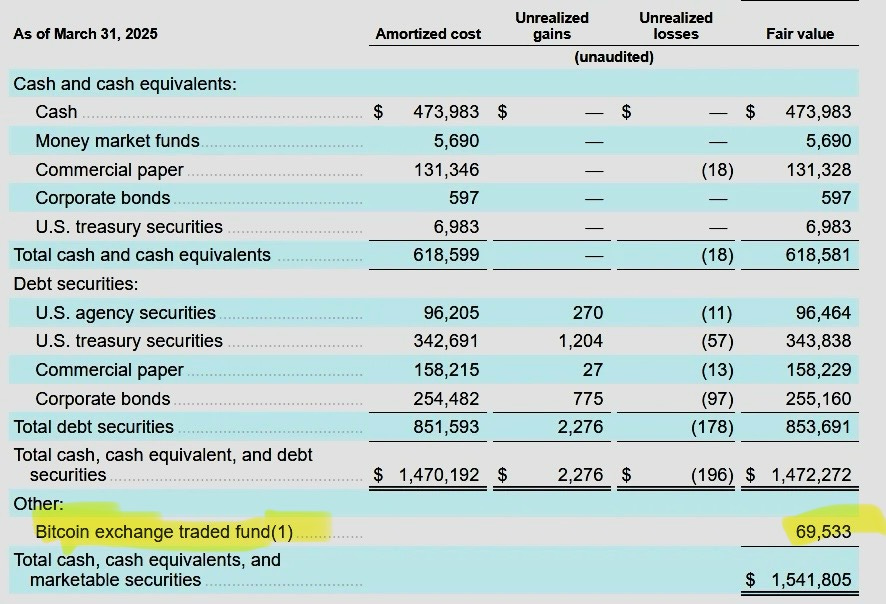

$1.5B+ cash and zero debt.

Figma only raised $749M in primary capital so they have negative net cash burn! Or what some people like to refer to as “profits” 🤣

Yes, they did get a cool $1B breakup fee from Adobe when that acquisition fell apart but even without the breakup fee Figma is obviously efficient.

They will have plenty of cash post IPO to continue to grow fast, acquire companies, buy more bitcoin, etc…

Figma CEO said investors should “expect us to take big swings.” With that much cash (and more coming) I expect M&A to play a major role.

Figma’s Valuation

Adobe tried to buy Figma in 2022 for $20B. About 3 years later it’s going public and will likely be valued well over $20B.

Jason Lemkin put the below valuation framework together for Figma that looks pretty accurate to me.

My guess is that Figma’s IPO price is set between 25 - 30x NTM revenue and then gets bid up on day 1 of the IPO closer to 35x+. Figma will then have the second highest revenue multiple of public cloud companies.

Exec Compensation

Their 35 year old CFO is doing well…

He has been at Figma for 8 years and received lots of equity along the way. He also received a $1M special bonus last year for efforts related to the abandoned merger with Adobe.

He joined as Head of Ops & Finance and then stuck around the rocket ship to get promoted (and obviously worked hard).

If you are on a rocket ship then don’t leave. Work hard and get promoted.

Investing in Bitcoin

Very few software companies hold any material amount of cryptocurrency. Figma purchased $55M of Bitcoin on March 3, 2024. So they are sitting on a 71% gain on their investment in the last 15 months…

And their Board approved them buying another $30M.

Bitcoin shows up in the marketable securities line on the balance sheet.

Figma Tender Offer

Stock-based compensation exploded in 2024 because of a tender offer:

Figma modified RSU that vested based on service and performance-based vesting conditions to remove the requirement of an exit (M&A or IPO). This modification required that for GAAP expensing they had to take the current stock FMV and recognize expense for all vested awards - $801M was expensed as a result.

Employees that elected to not tender all of their common stock received in connection with the RSU release were granted 10.5M stock options. Basically an award for keeping more skin in the game.

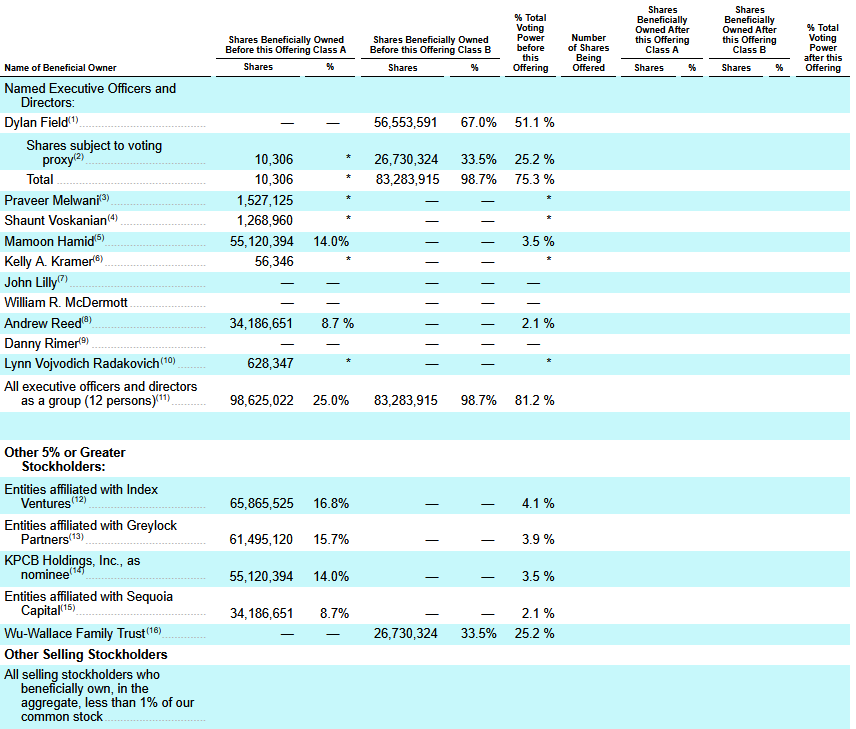

Ownership

There will be many happy VCs, founders, and employees from Figma IPO (i.e. they will make lots of money).

If you are looking for money, these VCs are feeling pretty good right now. Or if you have a long lost friend that joined Figma a few years ago…now might be a good time to reconnect :)

Final Thoughts

Figma will have a great IPO — no question. But it will be a tough act to follow for the mid-tier late stage private companies, which there are plenty of.

My biggest long-term concern with Figma is the durability of their growth (which is my #1 concern for all highly valued software companies). So far Figma has done a great job keeping growth strong, but expansion revenue from price increases and new products is a pretty large % of total revenue growth. When new customer growth slows a lot then it can become really hard to maintain high overall revenue growth for very long.

Figma seems to be executing at a very high level though, so I hope they can keep growth endurance strong.

Good luck to Figma and may this help open the IPO floodgates!

Footnotes:

Download MBA for Lunch — actionable strategies from top MBA programs

Join CFOPilot and get the latest benchmarks, templates and news for finance leaders

Bonus Content:

How Figma Defines ARR

We calculate annual recurring revenue (“ARR”) as the annualized value of our active customer agreements as of the measurement date, assuming any agreement that expires during the next twelve months following the measurement date is renewed on existing terms

A customer agreement is considered active when seats are provisioned to the customer at the start of their subscription. In cases where contracts are signed but not provisioned prior to the measurement date, the customer agreement is counted as active if provisioning takes place no more than 15 days after the measurement date. Additionally, ARR is not adjusted for any terminations or cancellations of customer agreements with an effective date after the measurement date, with the exception of adjustment for invoices that have been determined to be uncollectible

"Good luck to Figma and may this help open the IPO floodgates!"

Amen to this. Too many great companies are staying private. Hopefully, the success of Figma's IPO gets them to go public.

I hate numbers but love your content. You’ve taught me so much. Thank you.