Forecasting Tips for AI in 2025

How is AI going to mess up your financial plan? There are a few things that may surprise you in 2025….

Today’s Sponsor: Ramp

Tired of being the policy gatekeeper and chasing down manual expense reports? Ramp's corporate credit card automatically enforces spending rules, allowing employees to snap and go with instant receipt capture. Secure financial visibility and control with an expense management software employees actually love to use.

Planning for AI

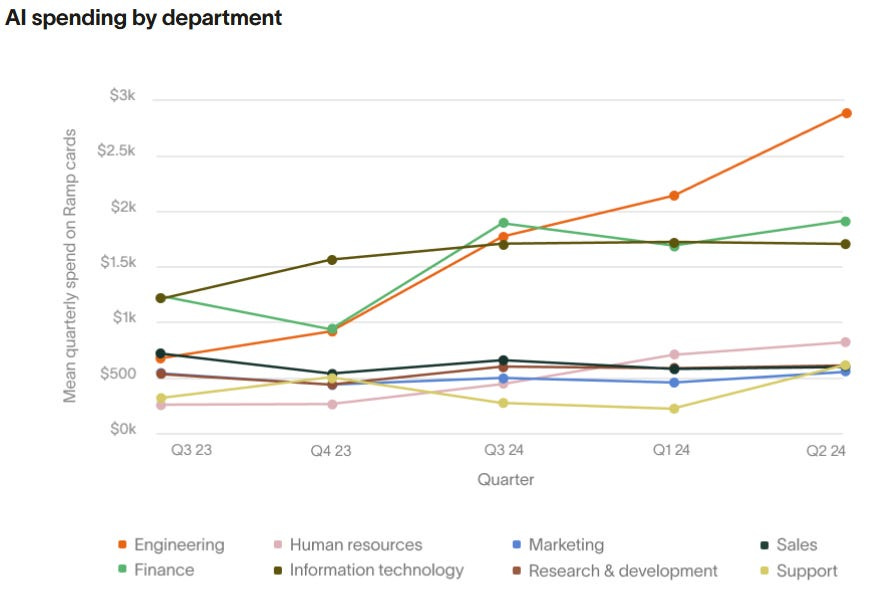

To nobody’s surprise….AI spending has been rapidly increasing!

The fact that AI spending is increasing is not as interesting as how and where it is happening. And these trends will show where AI / cloud spend might be going in 2025 and answer questions like:

Where should my company be investing?

What will our new AI product revenue look like in 2025?

What will be the financial impacts of AI?

The problem is that forecasting accurately during a major technology shift (especially a rapid change) can be incredibly challenging. I think a lot of finance teams will be caught off guard in 2025 because of the size of some of the changes coming (and how fast they are coming).

I agree with Jason👇. Most software products barely began selling/testing AI in 2024. However, AI will be fully mainstream by 2025, and its financial impact will be significant.

Below are some of the top things I am paying attention to in order to have better forecasts going into 2025.

Revenue

1. AI Stickiness

The concern with AI revenue is that it will have much weaker retention rates than traditional cloud companies have historically had. SaaS companies’ value lies in their compounding revenue, as they can grow without acquiring new customers due to high NRR.

Investors even coined a new term for AI revenue since the traditional definition of ARR didn’t make sense — ERR or Experimental Runrate Revenue.

The idea with the term ERR is that AI is still very experimental and therefore churn is really high. So the term annual RECURRING revenue (ARR) doesn’t make sense because the “recurring” part isn’t really true for these AI products.

And the fear of high churn has played out in the data — companies with new AI products have seen a MUCH larger drop off in customers within the first 12 months than traditional SaaS.

AI products were new and exciting so people were experimenting with new tech, but then churn quickly followed.

Experiment budget dollars ran out

Didn’t meet their needs yet

More hype than substance

Found a better / less expensive option

Need to wait for budgets to open again

Waiting for current traditional software contracts to end first

But Ramp’s recent data shows that customers who started spending with top AI vendors in 2023 are much more likely to stick with these vendors than those who started spending in 2022 or 2021. In other words, companies buying AI tools today are staying customers longer.

Churn after 6 months went from 50% to 75% for companies selling AI in 2021 versus 2023...that is huge!

We are starting to see longer term commitments for AI products now that AI is more mainstream with proven value. Companies are moving from experiments to company-wide rollouts of vendors they trust.

Obviously this would be very positive for AI companies, but don’t be too aggressive on retention forecasts yet. In addition to AI being more experimental, competition will continue to heat up with AI, which will also impact your retention/churn forecasts.

I’d suggest baking in some additional churn in your forecast as a result of AI being less sticky and from the increased competition you will face in 2025.

2. Gross Margins

Two big trends that may impact gross margins in 2025:

Competitive pricing pressure

Additional costs related to AI products

Point 1: As software becomes commoditized, prices will inevitably decrease to remain competitive. I think this will come faster than most folks realize. Competition is rapidly increasing and lots of companies are building in an AI-first, efficient way so these new companies don’t have the operating cost burdens that established vendors have built over the ZIRP years. This means the new vendors can price much more competitively. Legacy companies will have to adapt….or die.

Point 2: Costs associated with AI products can be much different and require new pricing models. Many existing software companies are experimenting with usage-based or outcome-based pricing for the first time. This creates cost forecast uncertainty and additional risk in gross margin targets.

Companies need to be careful in their assumptions around gross margins in 2025 and beyond. For most cloud companies gross margins will come down over time (again, faster than most folks realize). Make sure the rest of your business adapts to these changes so your unit economics don’t break.

Many sins (sloppy and inefficient operations) can be hidden in high gross margins. When gross margins fall though, those sins become visible for everyone to see.

3. Do Zero-Based Budgeting!

There are real AI use cases across all departments today, but some departments are better at adopting new technologies than others and some departments have more obvious use cases.

For 2025 budgeting, I told my teams to re-evaluate their tech stack and headcount based on current needs and technologies.

If you were to rebuild the team from scratch today, who would you hire, in what positions, and using what tech stack?

Too many leaders don’t even know what new tools / AI stuff is out there because they haven’t looked at all….

Zero-based budgeting has never been more important. Also, if significant changes happen during the year, companies need to re-evaluate the budget. Don’t let a rigid annual budget control you for the entire year.

If you should update the plan (cut costs or increase investments) based on current circumstances, then DO IT! Don’t wait.

You need REALLY good leaders for zero-based budgeting to work. The mediocre/bad leaders will always spend what they are given and keep what they already have.

4. Forecasting

Forecasting accurately in a usage-based AI market involves a combination of art, science, and some luck. Here are some things that make it much harder:

Moving to usage-based or outcome-based pricing

New technology and products

Figuring out new product-market fit

Figuring out pricing-market fit (how to charge for the product)

Building a new forecasting methodology

The companies that will be able to forecast the best are those with their data in order. Forecasting for AI products is a lot more data science, so you need good data.

Being able to show leaders where they are spending, how much, and trends is critical to eliminating waste on the expense side.

Something I do during planning is take all of our planned non-headcount spend by vendor and sort it from largest to smallest. I then go through it live with all the leaders to find areas we can cut, consolidate, or potentially switch to a lower cost / better alternative. A key part of this exercise is making sure that each tool has a clear owner…often tools get lost in the shuffle (turnover, re-orgs, promotions, etc) and then no one manages it.

Final Thoughts

Companies that don’t take annual planning seriously always overspend AND they miss out on important strategic conversation

Take it seriously. And it’s not too late. Take it seriously now if you didn’t before.

Lastly, change your financial plan during the year as needed. AI is going to rock lots of companies’ financial plans so be adaptable.

Footnotes:

Check out Ramp for the interesting reports on AI trends

Sign up for the OnlyCFO webinar series! Our next webinar is on January 8th on financial metrics to track in 2025.

Check out OnlyExperts to find offshore finance talent (accounting managers, collection specialists, AP accountants, etc). They have amazing talent for 20% the cost of a U.S. hire.