GTM Efficiency is Plummeting!

FCF margins are improving...but efficiency is worsening?

Brought to you by Brex, the modern finance platform.

Tired of choosing between tighter spend controls and faster execution? With Brex, you can break the tradeoff. Get the smartest corporate cards, banking, expense management, and travel — all in one place. You’ll save money and automate busywork while your competition is still reconciling last month's expenses. See why 30,000+ companies spend smarter and move faster with Brex.

One of the hard things about being in finance is approving the gigantic commission checks for sales reps — like a $250K sales rep payday for a single deal that was served to them on a silver platter.

I am not jealous I promise…

But honestly, it is great to see reps getting huge paydays because it means the business is thriving and my equity will hopefully be worth a lot more. In theory, each dollar of ARR that a sales rep closes will increase the company’s valuation by 10 - 20x that ARR. So the commissions are worth it, right?!?!

But…what is the current GTM model have breaking unit economics?

In a two part series I am going to cover:

What is happening with GTM efficiency (today)

How to evaluate your GTM unit economics and your sales reps (next newsletter)

GTM Efficiency

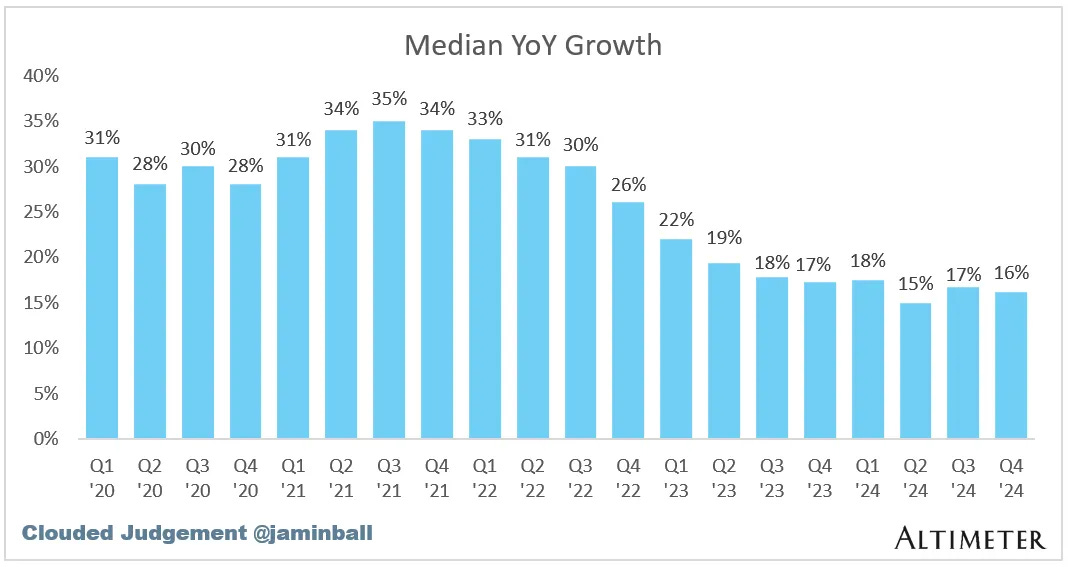

The good news is that public company revenue growth rates seem to have finally stabilized. 🎉

The bad news? The growth rates are NOT great….and they are much lower than before. 👎

Free cash flow (FCF) margins are currently at all-time highs for cloud companies — growing 22 percentage points for the median public cloud company in just 3 years.

That is insane improvement! These cloud companies are becoming cash printing machines.

Mr. OnlyCFO, the title of this post is “GTM Efficiency is Plummeting”, but FCF margins are at all-time highs for public companies….Was your title just clickbait? Seems like efficiency has never been better!

Wrong! You can have weak GTM efficiency today AND improving FCF margins at the same time. Improving FCF margins today are largely a result of strong unit economics from several years ago.

But that’s the danger in not digging deeper into the unit economics….For many of these companies, those juicy FCF margins are not sustainable (or at least won’t go much higher) because of current weak GTM efficiency.

Take a look at the chart below from David Spitz, founder of BenchSights:

Red line: this shows S&M as a % of revenue. And it is showing MASSIVE improvement (declining S&M as a % of revenue). More efficiency yay!!!

Black line: This shows how much S&M costs it takes to acquire $1 of ARR (S&M / net new ARR). This has steadily marched higher for several years.

How does this happen?

You must understand cloud unit economics to understand the dynamics at play here.

CAC Payback Period: How long it takes to recover CAC from your gross profit per customer.

Public company CAC payback periods range from 11 to 100+ months🤯. A lot of expenses go into closing a deal (marketing, AE salary & commission, other GTM staff, etc).

Growing revenue fast generally means accepting lower FCF margins today because of the time it takes to just recoup the initial costs to acquire a customer. But the expectation is that high FCF margins will come later. And public companies typically have longer payback periods than private companies given their access to capital and generally have more cash.

When revenue growth suddenly slowed for these public companies though, FCF margins improved because they now had a much smaller “cash flow trough” from their new customers (since there was fewer new customers.

In other words, slower revenue growth almost guarantees higher FCF margins for most of these companies as long as they don’t way over forecast sales (and spend too much) and churn doesn’t become a huge problem.

The GTM Problem?

The GTM efficiency metrics (unit economics) for new customers is currently atrocious for MANY public companies They either haven’t corrected spend enough yet or they are expecting (hoping?) for a reacceleration of revenue growth.

Here is where the importance of churn also comes in (again).

If you are losing customers that you acquired much more efficiently and filling the “leaky bucket” with very inefficiently obtained customers than eventually your FCF margins will suffer.

Companies can’t get to the 25%+ FCF margins if everything stays the same except customers are acquired much less efficiently.

Your churn rate (and how fast you fill the leaky bucket) will dictate how fast you see the impact to your FCF margins. High churn means all those expensive new customers become a larger portion of your cash flows — and FCF margin potential suffers as a result.

Check out the CAC ratios and payback periods below from BenchSights. MANY companies are replacing efficiently obtained churned customers with very expensive obtained customers.

Final Thoughts

New business sales efficiency has plummeted over the last few years and if companies don’t adapt then it will probably only get worse due to:

Higher churn from the AI platform shift, macro-economic factors, etc

Higher churn/downgrades due to software commoditization, competition, etc

Companies need to make sure their core unit economics are solid and not be blinded by the progress in increasing free cash flows.

Your high FCF margins are largely a result of efficiency from several years ago, while your current unit economics will determine your future FCF margins. Rapidly increasing FCF margins to 10% is great, but….the promise of SaaS was much more (and SaaS valuation multiples are expecting more).

AI is a double-edged sword. It may make some things worse (pricing pressure, increase churn, etc), but we also NEED to use it to be more efficient across the board so our unit economics don’t break.

*In my next post I will cover how I review my GTM team’s efficiency.

Footnotes:

Check out Brex’s guide on how to automate busywork.

Join the next OnlyCFO Webinar on how the definition of ARR is change and how you should adapt. You won’t want to miss it!

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire