💸Guide to Headcount Efficiency | And Salary Benchmarks for Finance Roles

Thoughts on managing payroll costs + Finance/Accounting salary benchmarks

Headcount is a company’s greatest asset but also its largest expense (~70% for most cloud companies). When many people think about this topic they think about layoffs, offshoring, cheaper pay, etc.

While those are certainly part of managing headcount, the more important piece is making sure you have the right people at the right time. Having the right people at the right time is the way to ensure the company is maximizing revenue potential while also being efficient.

Today’s Sponsor

Check out Vertice’s post for actionable tips for optimizing cloud and SaaS spend.

Vertice recently raised a Series B for its solution built for finance teams to get granular control and visibility of their SaaS and cloud spend.

Revenue growth is and always will be the most important thing for maximizing value for software companies due to how fast recurring revenue businesses can compound. This is particularly true for VC-backed companies. VC math requires long durations of high revenue growth for the math to make sense.

I 100% agree with Jason here…VC math requires T2D3 (triple, triple, double, double, double) growth for it to make sense (at least how VC math works today). And if VC math requires it then exit outcomes for founders/employees also require it for the exit to be really successful (due to the pref stack and valuation).

However, instead of the desperate chase of T2D3 by lighting money on fire and shortening cash runway, companies need to make sure they are maximizing revenue growth with unit economics that are acceptable. Most companies chasing T2D3 that are wildly inefficient lack strong product/market fit (PMF).

Managing Headcount Efficiency & Costs

Any company can slash payroll costs by firing more people, however the objective is not to just reduce costs, but rather appropriately balance costs with maximizing revenue potential.

There are three primary buckets I analyze when evaluating spend. Below are their typical percentage of total expenses for software businesses:

People: ~65 - 75%

Software/Infra: 15 - 25%

Other (rent, insurance, etc): 5-10%

The focus today is on people efficiency and costs, but check out these tips for optimizing cloud and SaaS spend for the second large expense bucket.

People Costs:

People are a software company’s greatest asset but also by far their largest expense, which is why it is so critical to get right.

Most companies do a bad job of properly staffing their companies to fully capture the opportunity. Below are some of the common issues:

Title Inflation

This is part of the ZIRP hangover where everyone was hiring and it was a candidate job market. We all needed (or thought we needed) more people. We hired inexperienced (or wrong experienced) people into leadership roles because we were desperate and hiring too fast. These inexperienced leaders then staffed teams inappropriately, hired poorly, bought the wrong tools, wasted budget on the wrong things, etc.

We also have a lot of inexperienced founders who can’t see this because they don’t know how the function should be properly run. Founders/CEOs need to lean on their Board and advisors to help them understand what good looks like.

Overhiring

Most software companies realize they overhired in 2021 but fail to realize by how much and where they actually overhired.

Large staffs of successful startups are probably more the effect of growth than the cause. - Paul Graham

With decent revenue growth, software companies should be able to simply freeze hiring for a relatively short period of time and the headcount ratios will catch up to revenue. But this doesn’t necessarily fix all the issues. Some examples:

Overhiring in the wrong areas - for example, hiring way too many people in customer success

Overhiring in management

Overhiring in experience level - if you have all very senior people in engineering then not only will costs be super high, but they won’t be efficient in doing the actual work.

Crazy High Salaries

Another ZIRP era issue is the crazy salaries we gave out. I remember seeing a lot of stuff like:

“Everyone needs to be at 75th percentile pay of San Francisco regardless of location”

“We should have a global pay band. Everyone should get the same pay”

“We really need this person so let’s go well beyond our normal pay range to get her”

A lot of companies got stuck with employees at unsustainable compensation levels. Cash burn is too high relative to people.

Fixing People Efficiency

Below are some of my suggestions to fix and improve headcount efficiency.

Zero-based budgeting. Forget about what you have today and consider what you need given where you are at today and where you are trying to get in 12 months. Zero-based budgeting is an approach where you look at the budget starting from nothing (not from where you ended the previous year). Figure out who is needed and then determine what changes need to be made.

Fix prior sins. Don’t just live with your headcount sins, fix them! Leaders need to admit mistakes were made, but many prefer to hide it rather than make the hard choices.

“Nail it before scaling it”: Going back to Paul Graham’s idea - you probably need less people than you think. Don’t just grow headcount for the sake of growing because revenue is growing. Nail the process with the headcount you have before trying to scale it.

Proper planning: Many companies do annual planning in department siloes. The right information isn’t shared with the right people for making the most optimal decisions. This behavior creates inefficient spend throughout the business but especially on the people side. Companies need to ensure the right stakeholders are involved and everyone has the right level of information to plan properly — don’t let the CFO and CEO just create the plans themselves and push it down to everyone else.

Continually update forecasts and hiring needs based on leading indicators and reality. Lots of growth focused companies have a bad habit of keeping original hiring plans and hiring as if growth is going to come regardless of the leading indicators because they desperately want the growth. The CFO and other leaders need to help keep the company honest and reduce hiring as these signals appear.

Offshoring hiring needs. There is a balance between efficiency and cost savings. You want great people who can propel the company. But as a company scales many of those roles can probably be done in a cheaper geo. Plan what your international hiring strategy will be and make sure you consider all tax consequences because the savings often isn’t as significant as you think.

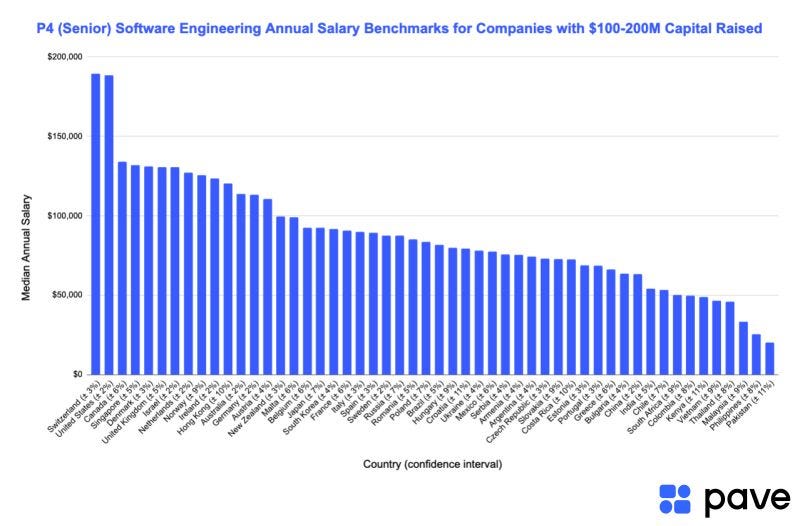

Finance & Accounting Cash Compensation Benchmarks

Proper benchmarking is an important piece of managing employee compensation.

For pre-IPO companies there are two main ways most tools and companies benchmark:

Based on amount of capital raised

Based on revenue

Based on the above you then can choose what percentile of pay to target and how to adjust based on geography (country-wide, city specific, or broader location tiering).

I don’t like benchmarking solely off of the amount of capital raised because of the wacky fundraising rounds that have been done in 2021 and continue to be done with AI, which mess up these benchmarks.

While I generally prefer the revenue based benchmarking, these aren’t perfect either because they don’t factor in revenue growth and complexity of the business.

Every company’s needs are going to be different so just make sure that is considered when reviewing compensation benchmark data.

CFO Cash Comp by Capital Raised

CFO Cash Comp by Revenue

Accounting Path to CFO Comp

Finance Path to CFO Comp

The path to CFO for both accountant and finance folks is fairly linear from a cash perspective but equity looks much more exponential. In a future post I will cover the equity side in more detail.

Footnotes

Check out our sponsor’s tips for optimizing cloud spend.

Sponsor OnlyCFO Newsletter and reach 16k+ CFOs, CEO, and other leaders in the software industry.

Check out Pave if you want to see more comp benchmarking data