Hiring Plans for 2025

Lots of leaders get hiring wrong and it is the most costly mistake you can make. Next year is no different...

Today’s Sponsor: Jellyfish

Jellyfish, the go-to source for software engineering intelligence, wants you to never track down time sheets again.

Are you still struggling with the tedious back-and-forth between engineering and finance when it comes to software capitalization? It doesn’t have to be that way. Download the 4 communication best practices for streamlining cost capitalization…and start speaking the same language with ease.

Building Teams in 2025

How do you build the right team at the right time?

This is the single most important question to answer in order to build a successful company that provides the highest shareholder returns.

Here are my top 3 pieces of advice on building teams in 2025:

Hire based on current needs and not the past

Hire the right people based on YOUR company

Remove mediocre folks

1. Current vs Past Needs

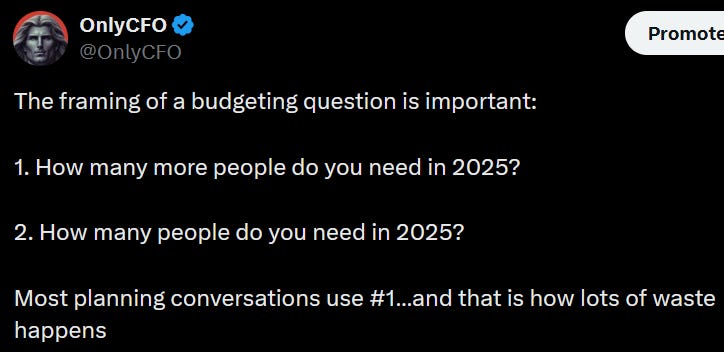

Honestly, this is REALLY hard to do. But it is more important than ever. Let me explain what I mean with the below contrast of framing a budget question:

95%+ of companies budget with the framing of #1 above - how much more $$ do you need? It’s easy and fast - “we had $10M of spend last year and I think we need $2M more to hit our goals so make our budget $12M”.

But do you actually need the full original $10M?

Very little thought goes into the existing base of spend that accounts for 80%+ of the total annual planned spend for the next year.

For many years this approach was probably OK. However, with all the change in the tech industry, you NEED to scrutinize all your spend for 2025 planning (existing and new spend). Finance leaders need to drive this in their planning processes.

This is what is referred to as zero-based budgeting. Don’t just incrementally add spend each year, but rather reevaluate all spend. Zero-based budgeting is much harder, but during times of lots of change then it is even more beneficial (hint: we are in a time of lots of change)

2. Who to Hire and When

The team that got you here might not get you there

The success of an employee can be very dependent on the stage of company that they are best at. Many hiring managers don’t fully appreciate the degree that this is true so they hire people that are A players at one company but turn into B/C players when they join their company.

The degree to which this is true can also be dependent on the following:

Department

Level of employee

Industry

Growth/speed of the company

The Startup CFO Example:

CFOs are a critical hire onto the executive team. Founders know they eventually need one but CFOs can cost a lot (cash and equity). Also, at very early stage companies there often isn’t enough work to actually justify a full-time CFO.

What ends up happening is that companies hire someone as a “CFO”, but what they get is something completely different….

Instead of a CFO they get an overpaid accountant (or inexperienced finance person) that lacks the skills/experience to provide the guidance that a CFO would provide.

The flip side of this scenario is the early stage company hires a very experienced CFO from a well-established company. In this case, the company hired someone with amazing experience but they may lack the skills necessary to run the finance function at the startup scale. This CFO will cost A LOT of money, but either will not know how (been too long since they did the work) or not want to roll up their sleeves and do the work, which is required at a startup.

Both scenarios are *really* expensive because the company either 1) pays too much money for a CFO or 2) the CFO’s inexperience causes lost money/valuation (bad budgeting, wasted resources, not a strategic leader, etc).

What type of CFO does a startup need?

It depends.

Most early startups (<$15M revenue) don’t need a big company experienced CFO. Rather they need someone strong who has seen the next stage of their growth ($25 - $50M revenue). They may not even need someone with a CFO title, but rather a strong Director or VP level might be better.

What about Fractional CFOs?

There has been a rise of fractional executives over the past couple of years. They can often make sense, but the stage they make sense is a critical consideration.

Outsourcing any “head of” function for too long can be dangerous, especially in areas like Engineering (less common), Sales, and Marketing.

The CFO function is one that I generally believe can be outsourced the longest. You can get the various experience levels you need (strategic and in the weeds) without paying for a full-time hire.

If you need a fractional CFO recommendation then contact me 👇. I partner with a firm I trust to handle tech companies’. They are really good!

Bookkeeping - get you books in order and done right

CFO services - forecasting, annual operating plan, metrics, etc

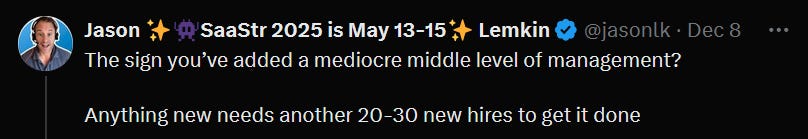

3. Removing Mediocre Folks

Most managers can quickly find and fire the really bad employees, but the mediocre ones can sneakily stick around for too long.

They say the right things, their departments don’t look too terrible, and they basically know what they are doing. BUT…they aren’t making things significantly better. They spend too much and/or don’t help grow sales enough.

Removing mediocre folks will save A LOT of money and make your company more efficient. Fast growing companies need drivers, not passengers. Mediocre folks are almost all passengers just enjoying the ride but not making a difference in the outcome.

Final Thoughts

Being an A player can be relative to each company. Having said that, REALLY great employees figure it out and can become A players almost anywhere. BUT…does your company have the time to wait?

Hiring the right people at the right time is really hard. It takes a lot of patience.

If done right though, your company will not only save a lot of money (secondary benefit) but it will be much more effective in hitting its goals.

2025 hiring plans will be critical for your success. Don’t screw it up :)

Footnotes:

Find a great fractional CFO → fractional CFO form

Sign up for the OnlyCFO webinar series! Our first webinar is next week on annual planning.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire