The PE Playbook Everyone Should Know

How $90M turned into $6B: ZoomInfo’s PE story and their CEO’s 13-step playbook for working with PE

Today’s Sponsor: NetSuite

Download my (OnlyCFO) best practices for chart of accounts and department structure in 2026.

Accounting and FP&A jobs are much easier when you have the proper accounting data foundation. Don’t neglect your chart of accounts. If you are still using the same one from several years ago, there may be some changes you need to make.

Every VC-backed company dreams of an IPO, but 99% of companies should plan on getting acquired.

Few people understand how to operate under PE ownership better than Henry Schuck (founder/CEO of ZoomInfo). ZoomInfo has been PE-owned for 12 years across 4 different PE firms. Henry also took ZoomInfo public. He has seen it all.

Henry recently shared some of the best advice/lessons for working with PE so I reached out and spoke with Henry to dive deeper on the topic.

Even if you are not currently PE-owned, you should read this. You may consider a PE exit at some point and it’s just good advice for running a company.

Agenda:

ZoomInfo’s PE Journey

Henry’s 13-Step Playbook for working with PE Owners

Some M&A Data

ZoomInfo’s PE Journey

2007 - Founding

Henry started a company called DiscoverOrg (later renamed ZoomInfo) while in college.

He founded the company in Ohio. Back in 2007, location was important for raising VC money, so building a highly efficient, profitable company was Henry’s only option.

They were bootstrapped, so costs were monitored closely…

2012 - Calls from VCs and PEs

After about 5 years of bootstrapping, they had ~$20M in revenue and ~$10M in profits. Fantastic margins…At this point, they started getting calls from VCs and PE firms.

One VC tried to buy ~70% of the business which would have given Henry $40M in secondaries. That’s a lot of money for a founder who grinded for 6 years while bootstrapped. However, the deal fell apart because the VC changed the offer at the last minute.

So they continued to bootstrap for another two years.

2014 - First Outside Capital

Henry picked up the process again to look for outside capital by hiring investment bankers. In 2014, TA Associates (a PE firm) bought 50% of the company at a $275M valuation. At the time, DiscoverOrg was at $35M in revenue, growing at 60% with 50% EBITDA margins.

Henry cashed out approximately $90M in the deal.

2017 - RainKing Acquisition

Soon after founding DiscoverOrg, Henry learned about a company called RainKing that was a direct VC-backed competitor. Henry thought the company he just started would be killed so he reached out to RainKing to see if they wanted to acquire them. But RainKing didn’t think Henry had a real business.…

10 years later…DiscoverOrg acquired RainKing for over $100M.

At the time of acquisition, RainKing had $40M of revenue and $10M in profits. DiscoverOrg was more efficient at $80M in revenue and $40M in profits.

High profitability enabled them to finance large acquisitions through debt and not give away ownership. They also were able to make RainKing much more efficient and profitable. Three months after the acquisition, RainKing was at $45M revenue and $35M in profit run rate.

2018 - The Carlyle Group Investment

Just four years after the TA Associates deal, The Carlyle Group made a minority investment in DiscoverOrg at a $2B valuation (nearly a 14x valuation increase). At this time DiscoverOrg had ~$170M in revenue with continued world-class profit margins.

As part of this deal, TA Associates sold 33% of their holdings for a nice 14x return and employees sold ~50%. Henry also sold 33% of his remaining holdings.

PE investors are shooting for a 3-5x return after 5 years, so 14x is incredible. And they still owned ~1/3 of the company.

2019 - ZoomInfo Acquisition

DiscoverOrg acquired ZoomInfo for $785M. To finance the deal they took $1.2B of debt. The reason they were able to secure that much debt is because they were extremely profitable at $100M in annual profits. But according to Henry, they had essentially maxed out their debt capacity after the deal.

Fun fact: A private equity firm (Great Hill Partners) bought ZoomInfo a year earlier at a $240M valuation so they got a 6x return in just 12 months…

2020 to Present - IPO & Beyond

ZoomInfo was the first software company to IPO after the COVID pandemic so there was lots of interest. ZoomInfo raised ~$1B and then watched its stock price soar 62% in its first day of trading.

The IPO was a huge win for everyone involved. The PE folks were ecstatic…

Two weeks after the IPO, TA Associates’ original $90M investment was valued at $6B of paper gains (after just 5 years). Carlyle (2nd PE investor) also did incredibly well…they owned 31% of ZoomInfo at IPO for a 13x paper gain after just 2 years.

And the stock continued to do well through the peak of software in November 2021. The PE investors sold a significant percentage of their holdings over the two years following the IPO, so their realized gains were quite strong as well.

Like the rest of software, ZoomInfo’s valuation slowly got reset post 2021. There is some uncertainty with SaaS in general in the age of AI, and ZoomInfo has specific AI-related risk factors, so investors have been cautious.

But I wouldn’t bet against Henry. If anyone can adapt to the new technology landscape of AI and make ZoomInfo succeed, Henry can. And his board is betting the same thing.

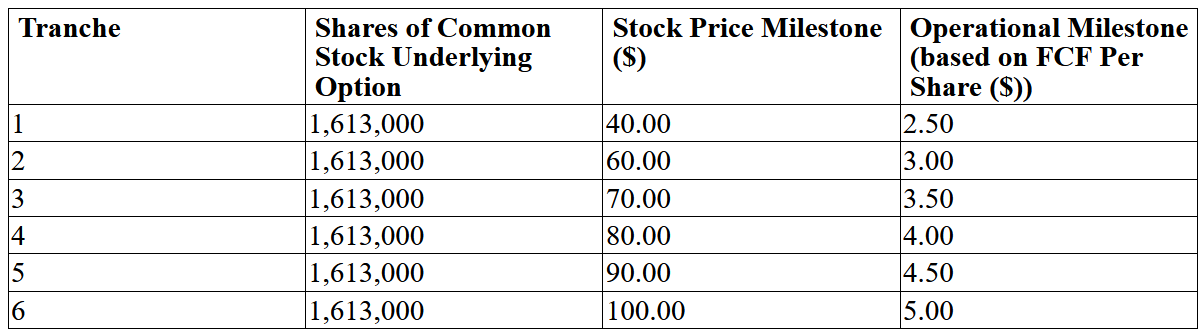

In November of last year, ZoomInfo’s board granted Henry a massive stock option package that had high stock price and FCF/share targets. The stock must increase by 350% for anything to vest and it must increase by 1,000% for the final tranche to vest. Aggressive targets, but if Henry hits the last vesting tranche then this grant would effectively give him a $837M payday and it would be a massive win for investors.

13-Step Playbook for Working with PE Owners

Below is Henry’s lessons from working with PE owners for the past 12 years. And a few random thoughts from me…

If you are PE-owned or are considering selling to PE at some point (basically everyone), then you NEED to read this.

1. Get aligned from Day 1

Ask them what they underwrote the deal to. That’s a fancy way of asking:

What did you tell your investment committee this business would be worth in 4–5 years in the base case?

Then ask about the upside case.

If you want real alignment, ask for the memo. If they get squirrely, just say:

I assume there might be some misgivings about me in there - can we talk about those so I’m aware?

There is no faster way to get aligned than seeing exactly how they described the investment.

[OnlyCFO]: You 100% should do this. I am surprised by how few actually do ask. The same idea applies to VC-backed companies. Ask your existing VC investors what would have to be true for them to invest in another round.

2. Understand the clock

If you want to invest in growth and bring down margins to do it, do it early. As you approach exit, EBITDA becomes a sacred cow.

Want to launch a new product? Great. Show what sales is committing to it and when. If you can’t do that, don’t even bother asking.

[OnlyCFO]: PE folks play a different game than your previous VC investors. Once you have strong EBITDA then you will have to pull it from their cold dead hands…Make investments early on in the relationship and/or bring data that shows it will be valuation additive (and in a relatively short time period).

3. You don’t have to do everything they tell you

After my second board meeting I went to my PE board member and said, “Randy, just tell me what you want me to do and I’ll go do it.”

He laughed and said: “Whoa whoa, that's not how it works. No one here knows your business as well as you do. We’re going to give you advice and pattern match. Your job is to listen and decide.”

That said, you MUST listen to their advice and explain your choice. This doesn't have to happen immediately.

Try phrases like this: “I hadn’t thought about that - it’s a good point, I want to take some time to think it through and get back to you.”

Then actually follow-up.

4. You NEED a strong CFO and FP&A team

Most of your private equity investors’ interactions are with your CFO. A strong CFO and FP&A team build trust. They help you craft strategy around data AND they're endlessly valuable to your PE partners because they can build models and get them the data they need to understand what’s happening in the biz.

This makes life easier for you and them.

[OnlyCFO]: I have worked for a VC-backed company that was acquired by one of the top tier PE firms. This is 100% true. The CFO, VP finance, and Controller’s job can get significantly busier after PE ownership. Many people can’t handle the change. The fastest way to get fired as a CFO in a PE environment is to lose your PE investors’ trust. You will know when this happens because they will start going over you and straight to the CEO for questions.

5. Response time matters

PE employees work all hours. One of the associates on our deal told me that she was sleeping in her car outside their office for ~2 hours and then starting to work again cause she didn’t want to waste 30 mins driving home.

When they email asking for clarification or making a suggestion, respond fast - even if it’s just to say you’ll follow up.

6. Send them swag

This one might sound dumb, but you want them to FEEL like they are on your team. When you get new swag, put it in an envelope and send it with a nice note - you want them to feel the same level of pride you feel in your company.

[OnlyCFO]: I hadn’t really thought of this one before, but it makes sense. The PE folks want to feel part of the team much more than VCs. Making them feel that way can go a long ways.

7. Expect pressure to do M&A

I remember being at a PE conference where they flashed a slide showing that portfolio companies that did M&A far outperformed the ones that didn’t.

Every firm had the same slide, they all believe it and you should expect pressure here.

[OnlyCFO]: M&A is a major part of the PE playbook and the PE folks are good at it. But that doesn’t mean everything that they bring to you is a good idea for the business.

8. Be prepared to offshore

They believe deeply in offshoring because labor offshore can be equally talented at 1/2 to 1/3 the cost. There is an organizational tax that comes with this, you can’t negotiate it away. You just have to prepare the company to manage it.

[OnlyCFO]: The PE model relies on improving efficiency. The biggest cost of a software company is payroll. They can quickly cut significant costs through offshoring. They don’t want to stunt growth and innovation, but they believe a lot of roles can be offshored with no material consequence. Be prepared to have to justify any U.S. hiring. The default assumption will be new hires and backfills will be offshored.

9. When a metric goes sideways, don’t show up like a macho man

If you show up with a confident solution, you’re begging for a fight.

Instead: present the metric, share POTENTIAL hypotheses, explain what you’re testing and ask what they think you might be missing.

Make them partners in solving, otherwise you’ll quickly turn them into adversaries poking holes.

Draft [OnlyCFO]: PE investors are exceptionally strong in finance and data. Most could easily be the CFO of your company. That means when something breaks in the business, they expect the CFO to have a clear, data-backed strategic point of view. If you don’t, then they will think “If I was CFO I would have already done ABC - why hasn’t she/he?”. This is why expectations are so high for CFOs at PE-owned companies and why many CFOs don’t last long in the transition.

10. Cutting costs is easier than driving growth

This is just objectively true.

If your strategy increases costs in the hope of faster growth, you need to answer two questions:

What metrics and checkpoints will tell us this is working. And when do we kill it if it’s not?

Does the additional growth actually change the multiple and valuation of your business?

If you go from 15% to 20% growth in an EBITDA-dilutive way, you may have made the business worth less, not more. Your PE partners will care a lot about this.

[OnlyCFO]: I agree with this to a degree. Cutting costs of a VC-backed company that was recently acquired by PE is significantly easier than driving growth. There is a lot of fat on VC-backed companies. But at a certain point, additional free cash flow must come from growth.

11. They LOVE pedigree

Hiring someone from Stanford or Salesforce is almost never questioned. But take a risk on a state school or a non A-plus company hire and you’ll be defending that person even in good times. Your job is to build the best team you can so the price of doing that is owning those hiring decisions at the board level.

[OnlyCFO]: True for VP and above. Below that, they don’t really see those hires or care too much in my experience.

12. Relationships matter

There were a handful of times where I knew that I got on the wrong side of one of my PE board members. So I would tell my wife, “hey listen, I’m flying to San Francisco or New York on Sunday and I’m going to have breakfast with them and then fly home.” Then I’d call them and just say “Hey, do you have time for breakfast on Sunday? Maybe a workout before.” They always said yes and it gave me 4 hours of time, some relationship building and then we got right into the reasons we were misaligned and what I could do better.

These were super valuable. Don’t EVER underestimate the power of getting in person with your partners. Same rule applies to your team.

The thing I loved about working with Private Equity is that there is no singing kumbaya pretending we are some happy family. It’s a 4-5 year relationship and the expectations are very clear.

13. Leverage operating partners and strategic resource groups

Most PE firms now have a set of operating partners or a strategic resource group that can help you build dashboards, think through marketing budgets, survey customers, do 360s on your leadership team - a McKinsey on demand. You’d be crazy not to put this group to work for you all across your organization.

Some M&A Data

Many folks don’t understand how likely it is that they will eventually work for a PE-owned business. Chances are decently high…

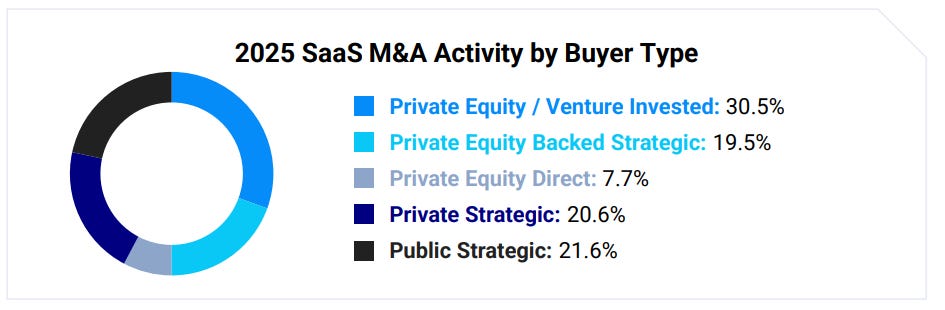

58% of 2025 M&A activity was with private equity.

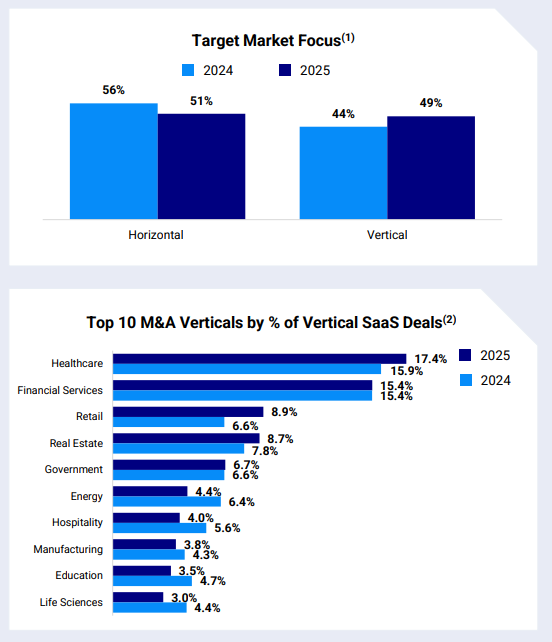

PE M&A has shifted a lot toward vertical software over the last few years. It makes sense. Vertical software is generally stickier and can have higher FCF margins than horizontal. We now have about an equal split between horizontal and vertical software M&A activity (but a lot more horizontal companies).

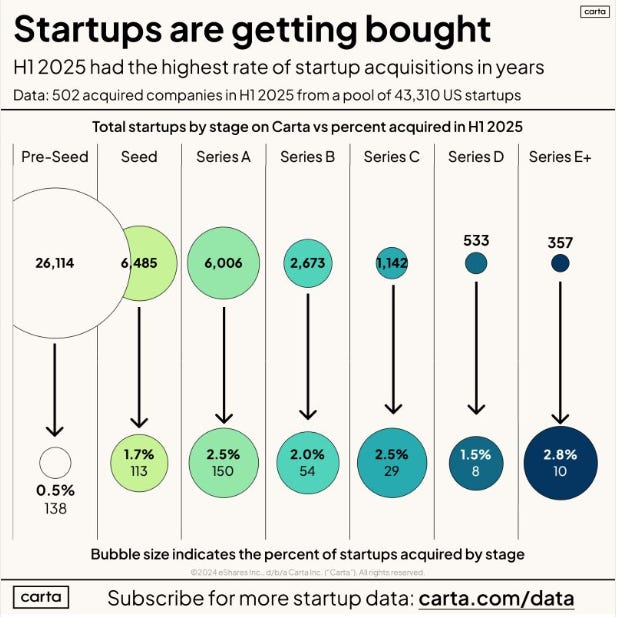

M&A at the very early stages (pre-Seed through Series A) is heavily acquihires from other VC-backed companies. Usually not a lot of interest from PE folks at these stages since there isn’t much EBITDA optimization possible given the lack of revenue. But once revenue hits a certain scale that’s where PE gets interested (for the right price).

An exit to private equity is not what most founders aim for, but it can certainly be a good outcome.

Final Thoughts

Private equity plays a different game to create value. Not bad. Just different. Understanding Henry’s advice will help you sell to and thrive under PE ownership.

But here is the thing…

Selling to PE isn’t a guaranteed (last resort) outcome for SaaS companies anymore. Historically, once a SaaS company got to a certain scale then they could always just sell to PE if things weren’t really working out. Well…there are A LOT of those companies today so PE folks are being a lot more choosy. Understanding what they are looking for gives you a major advantage.

Footnotes:

Download my Chart of Accounts and Department Structure template. I partnered with NetSuite to provide some best practices and also the exact template that I use.

Congrats to my friends at recent large finance acquisitions. Great outcomes for both. One strategic and one PE.

Brex - being acquired by Capital One (strategic) for $5.15B

OneStream - being acquired by Hg (private equity) for $6.4B

*nothing in this post should be considered investment, legal, tax, or any other kind of advice. For educational purposes only.