How Companies Use Stablecoins

Finance teams need to understand stablecoins. Real crypto use cases are here.

Today’s sponsor: Brex, the intelligent finance platform.

Stablecoins are coming to Brex!

Want to pay international vendors and contractors 24/7/365? No more missing bank deadlines or navigating bank holidays. Send and receive payments with stablecoins right inside of Brex.

The Stablecoins are Coming!

It’s time for all finance leaders to start understanding cryptocurrency because there are now actual use cases that even the most conservative CFOs will need/want to embrace.

Companies like Brex, Visa, Stripe, etc. announced major stablecoin products/features this week as stablecoins go mainstream and use cases become clear.

23% of CFOs anticipate they will accept cryptocurrency as a payment method or purchase crypto as an investment within the next two years — per a Deloitte survey

Most finance leaders and founders don’t understand stablecoins or how they can be useful.

This post is the guide for companies using stablecoins:

What are stablecoins?

How do they compare to traditional banking?

What are the practical use cases today?

Other stuff you should know about stablecoins

What are Stablecoins?

Stablecoin = a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset (like the U.S. dollar, euro, or gold).

It’s digital money on a blockchain that tracks the value of something stable (like USD). Stablecoins give you the speed, efficiency and programmability of crypto without the volatility of something like Bitcoin or Ethereum.

Most CFOs haven’t touched crypto because of the risk and volatility associated with holding it, but stablecoins can be different…

Benefits of Stablecoins

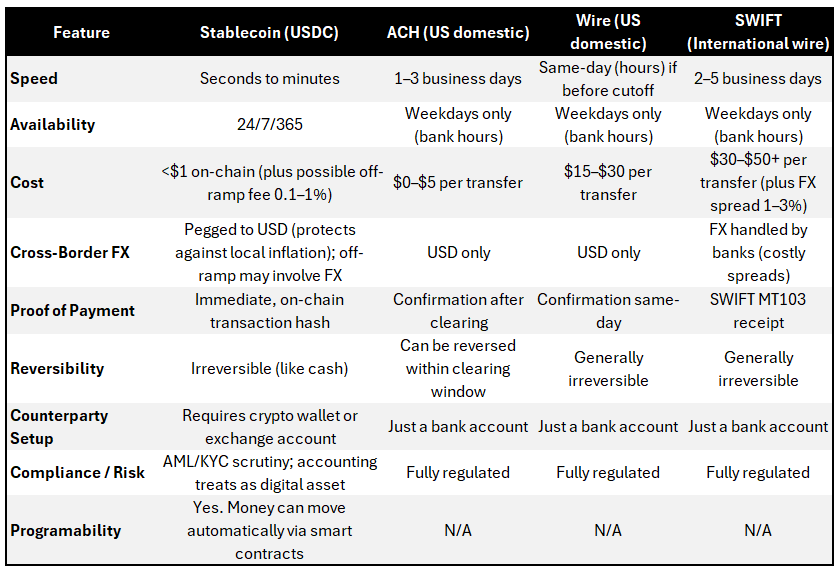

In the below image I break down the differences between stablecoin transfers vs using traditional banking (ACH, wire, SWIFT).

Stablecoins are not a replacement for traditional banking (at least for a while), but an additional payment option that solves some problems. Until recently, they weren’t that practical to use. But that is now changing with fintechs integrating them into their platforms.

When I refer to stablecoins I am mostly referring to USDC as that is the most widely used by companies. The other popular USD stablecoin is USDT, which has a higher market cap but less popular amongst non-crypto companies.

Stablecoin Use Cases

1. Cross-Border Payments (Vendors & Customers)

Cross-border payments are the primary benefit of using stablecoins today. Stablecoins enable faster and less costly cross-border payments by removing intermediary steps of banks.

Benefits:

Pay international vendors/contractors instantly (no more 3-5 business delay). Especially valuable for individual contractors so they don’t have to wait several days for international wires to get paid

Pay 24/7/365 so you can control exactly when people get paid

Avoid international wire fees (SWIFT) and FX spreads

Valuable for vendors/contractors that want to hold USDC because of unstable foreign banking or currency

Easier for some international customers to pay in versus their local currency or credit card

Settlement happens in minutes and there are no bank cut-off times or local holidays you need to keep track of, and no weekends to work around. Your contractors/vendors get paid instantly.

How it works:

The receiver of stablecoins needs to have a crypto wallet in order to accept stablecoins. They need a separate wallet or they need to work with a fintech partner that has a stablecoin platform (which will include a wallet address). A wallet address is like your routing number.

Paying Vendors: Check with vendors if they want to receive stablecoin since you will need their wallet ID. The international ones are going to be the folks potentially interested.

Customer Payments (receiving stablecoins): Check if your customers offer to pay in stablecoins. Most relevant for international customers. You get the money instantly to better manage cash.

2. Treasury & Cash Management

I am also really interested in this use case, but not for the reason some crypto enthusiasts may think…

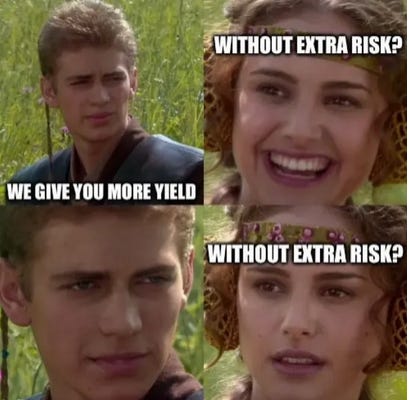

Stablecoin High Yield (not interested): I have seen a lot of discussion amongst folks about the really high yield you can get with stablecoins. They explain why it’s possible with some complicated crypto jargon and then I refer to the below meme…There may be an opportunity for some people here, but for 99% of companies it likely doesn’t make sense today from a risk standpoint.

Treasury management (interested): This is where I am actually interested because now I will have greater control of when money goes out and when money can come in.

Treasury Management Benefits:

More flexibility in cash management. With instant 24/7/365 payments CFOs can better manage/hit cash targets

Customers can pay you on the last day of the quarter that is a Sunday (while banks are closed)

You can pay vendors at 5pm on a Friday (after banking hours) at the end of your fiscal year after you confirm that you are significantly over your cash targets and you want to come in closer to cash targets.

Instantly transfer funds to your international subsidiary

Accounting implication:

Stablecoins are not considered a ‘cash equivalent’ under GAAP, but instead classified as a digital asset, typically reported under “other current assets”. While just an accounting nuance, it may impact how you must report stablecoins. This is all new so its still evolving and some folks are arguing and putting it in cash because its immediately redeemable for cash.

But because of current accounting rules, a lot of companies will want to just immediately convert stablecoins to USD (which is what Brex does) and make the accounting a non-issue.

3. Programmable Money (Smart Contracts)

Unlike bank money, stablecoins are software-based money that can follow rules.

They live on blockchains that support smart contracts

A smart contract is a small program that can say something like “when X happens, automatically send X amount stablecoins to entity ABC.”

This turns money into something that can move without human intervention, middlemen, or manual reconciliation.

A lot of the stablecoin infrastructure for companies is new so I don’t know anyone actually using this yet, but the potential seems pretty interesting…Message me if you are a CFO that is using it!

Example: Automated Revenue Splits

SaaS marketplace: When a customer pays $100 in USDC, a smart contract instantly routes:

$85 to the vendor

$10 to the platform

$5 to affiliates/partners

No need for monthly batch payouts or manual reconciliation.

Other Stuff to Know

1. How does one purchase these “stablecoins”?

You will need a crypto wallet, but that doesn’t mean you have to have a coinbase or other crypto specific account. The fintechs you may already be using are quickly adding them into their offering.

My friends at Brex just announced their stablecoin offering that offers 24/7/365 transfers with zero fees. You can just go in and select “pay with USDC”. Instant purchase and settlements in USD. I expect all fintechs to eventually offer something similar.

2. Help me understand the fees with using stablecoins?

This broke my brain when I started trying to understand this. I don’t ever want to not understand the fees involved.

Fees to buy stablecoins: None usually for corporations buying USDC. But it can vary based on your platform.

Sending Fees: There might be a small blockchain ‘gas’ fee, paid by the sender (like $0.01 for USDC), but confirm with the platform you use. Many corporate fintechs (like Brex) will offer zero transaction fees.

Fees to receive and convert to USD: For many folks there should be none (but confirm with your platform). For example…

Coinbase offers $40M in free conversions to USD per month

Brex is unlimited conversions to USD for banking customers

If you are converting to/from another currency then there will be FX fees and the free conversion that some platforms offer may not apply. So obviously you will want to confirm with whatever platform you are using and your use cases to make sure the fee structure makes sense for your business.

International contractors thinking about accepting USDC will want to consider the same things. How much will it cost to convert to local fiat currency or can they use USDC directly so there is no “off-ramp” fee.

💡The more people using stablecoins the less likely there will be “off-ramp” fees for people because you can use the stablecoins directly versus converting to fiat.

3. What are the risks?

AML/KYC Risk:

There is potentially AML/KYC risk with stablecoins but if you use a platform like Brex, Circle, or Coinbase then they ensure compliance checks are baked in.

Regulatory Clarity (The GENIUS Act):

The GENIUS Act (which passed in July 2025) sets requirements for reserves, disclosures, and licensing. which makes it much safer for CFOs to adopt stablecoins.

Counterparty/issuer risk:

Not all stablecoins are created equal. Most companies should only use fully reserved, regulated issuers. The one that makes sense for most companies is USDC.

Final Thoughts

Is your business going to crash and burn without stablecoins? No.

But stablecoins might be able to lower fees, increase payment speed, have better treasury management, and make some of your international vendors/contractors happier.

Stablecoins should be viewed as another payment option that might be better in some cases (not all). Better to have more options than less…

Footnotes:

Check out what Brex (sponsor) is doing with stablecoins. If you still have questions about how CFOs might leverage stablecoins then they can probably help.

*Nothing in this article constitutes legal, tax, or investment advice. I am not a crypto or stablecoin expert so the above is just for educational purposes. Confirm all fees, legal, and tax stuff with the experts.

Loved this explanation. Thanks. Two quick things.

1. @Beachman recently wrote an interesting take on the potential interplay between stablecoins and the US economy, macro etc. https://open.substack.com/pub/beachman/p/market-whispers-santa-rally-and-stablecoins?r=3mihg6&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

2. I will forward your substack to my son. Freshman in business school who is loving his financial accounting 200 level classes. Perhaps a CFO in the making :-)

Nicely done, reasonable, pragmatic explanation of these things. It's good stuff. I'm really eager to see what stablecoins enable.