How to AI (CFO Edition)

And why I "vibe coded" CFOPilot.com

Today’s Sponsor: NetSuite

From supply chain shocks to cash shortfalls, today’s business risks can surface fast—and escalate faster. Blind spots, bad data, and aging systems only make things worse.

Download the C-Suite’s Risk Management Checklist —a quick, high-impact guide to help leaders get ahead of 8 critical risks in 2025.

I have talked to WAY too many finance leaders (50%+) who have no AI strategy for adopting AI into finance/accounting.

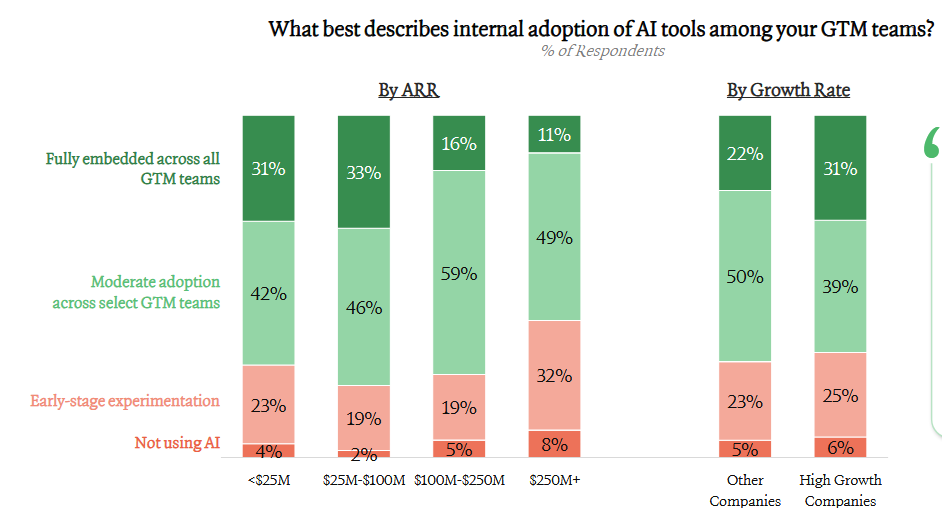

Below is a great chart from ICONIQ that shows AI adoption in GTM teams. I would love to see the same breakdown for G&A, but I can guarantee you that adoption is much lower amongst finance teams…

In this post I will discuss three things:

A project I am “vibe coding” with AI

How finance leaders (and any other leaders) can push AI adoption

How I am actually using AI in my job (actual finance AI use cases)

1. Vibe Coding CFOPilot

Today I am launching CFOPilot! The website is up 😎, but view it on your desktop because the mobile version stinks right now…

CFOPilot will be the finance/accounting resource hub for everything you need to run the “Office of the CFO”. I have A LOT to continue to add over the next few weeks….

I have always wanted to build something like this so I “vibe coded” it myself, which explains why it’s a bit ugly (for now)….but I promise it will get better :)

What is on CFOPilot?

Eventually, everything you need to run a finance & accounting department.

Benchmarks - lists of the best (and current) financial and operational benchmarks

Playbooks & Guides - best practices and recommendations for how to build stuff

Finance Resources - lists of software/AI, consultants, etc for your specific needs

AI Stuff - library of actionable AI use cases, tools, etc

Templates, financial models, accounting workpapers, memos, policies, etc

CFOPilot created apps…yes, we will be cooking!

Subscribe & Bookmark

Bookmark CFOPilot and subscribe to get updates on all the cool things we add. This will be the one-stop shop for resources for the finance/accounting department. I will be adding a lot of stuff in the coming weeks.

Experiment with AI

EVERYONE should be experimenting and learning what they can do with AI. Go vibe code some cool Excel Macros, complex SQL, or something else to do your job better. Figure out what you can do with the help of AI.

2. How to Adopt AI

Below are three simple things I am telling all my leaders to do to ensure that we are leaders in AI adoption. Each month I then hold them accountable to report on what they have done with AI.

Take finance/accounting AI demos. A lot of the problem is not knowing what tools are out there. Don’t take all of the sales calls…but ask a few folks what they recommend. Once you start to see the possibilities you quickly realize more use cases.

Monthly goal of finding an AI use case. Most finance/accountants are happy to keep doing the same thing they have always done so I have a monthly AI check-in call and ask everyone to share something new they are doing with AI. Doesn’t have to be huge, but it forces folks to look where AI can be leveraged.

Talk with other finance leaders. Especially true if you are behind in adopting AI (many of you are). Talk with finance folks who have embedded AI into their workflows and ask them what worked well and what didn’t.

3. What am I actually doing with AI?

Below are a few things that I (or in most instances my team :) are doing with AI today in finance/accounting:

Accounting:

Reconciliations: Bank and other large volume reconciliations can be MUCH faster by using an AI tool. We purchased a tool at the beginning of this year and it cut time spent on bank recons by 70%.

Technical Accounting: My team regularly uses ChatGPT to dive into technical accounting questions and help write memos. Ultimately, we reference that actual GAAP literature but it saves a ton of time finding the right resources and examples.

Flux Analysis: There are specific tools that help do this, but we also just do a lot of Excel AI chat and use it to help write explanations. The explanations AI finds are often pretty good.

T&E Fraud and Abuse: It’s hard to manually sort through all the T&E stuff. AI can help detect anomalies and where there are potential issues that someone needs to look into.

Finance:

ARR to GAAP Revenue Analysis: This is an important analysis we do every month. With AI it takes A LOT less time. We are not using a special tool (just Excel AI), but we have all the data organized and then we ask AI to do some analysis on the data and find out why there are differences between ARR and GAAP revenue based on our model and the detail by customer.

Spend Analysis: Find anomalies and other abnormal trends in spend data. Most of the better spend management tools have this built in. But you can also leverage basic AI within Excel to help do the same thing.

Management/board commentary and decks: Of course we are reviewing this and adjusting, but we have found that AI can do a really good job in certain areas with the first draft. Use AI to help write/review updates to the exec team, board, investors, etc.

Contract review and key term extraction: There are few things I hate more than reviewing contracts. AI helps me summarize key terms and find issues/concerns. Don’t worry…I still review contracts before I sign but AI speeds up my process. Also, my team uses it to summarize all vendor contracts with key details — AI can find if it has an auto-renew clause, contract end date, usage pricing, etc.

Final Thoughts

Just get started with AI.

Set goals, talk to vendors, talk with your peers.

There is no excuse in 2025 to not be adopting AI in every department. Finance/accounting is certainly no exception. Before hiring any additional headcount, you should be asking your team about your AI adoption and strategy.

AI will not (at least yet) fix your crappy data issues or bad processes so get those cleaned up first and then AI can do A LOT.

Footnotes:

Sign up to be on the OnlyCFO recurring webinar series.

Next week we have Peter Walker from Carta

In August we have the former controller of OpenAI to discuss AI use-cases

Get 20% off with OnlyExperts to find offshore accounting resources

This an awesome post. Something I've been hoping someone would write for a while now! Question I wanted to pose for you and the thread:

Given how close you are to the leading edge of adoption / use-cases I was curious to get your thoughts (and anyone else on on the thread) what your thoughts on how AI is changing the nature of the Finance, but specifically in the context of efficiency / automation vs. disruption/transformation:

To me there is a major difference as you go from efficiency / automation ("how" a job gets done) towards actual disruption and transformation ("What" the job is)

Using the taxi industry as an example: In many ways, Uber/Lyft didn't really change the nature of the job of taxi driving. It's more efficiency / automation around various aspects of the job. On the other hand, Waymo/Driverless cars would actually disrupt/transform the job of taxi drivers.

So when I look at the above Finance examples, right now, the change seems more in the nature of "Efficiency / Automation" (do more with less) vs. total transformation. **But can you see a path to a change more like Driverless Cars in the finance function? Do we ever get to a world where Finance can operate without Excel?**

(To be clear: this is not to say the above examples are not substantial improvements (they are), more that the nature of the change seems different than what I think about disruption / transformation. For example, Software Engineering: I'm not a software engineer, so I may be missing many aspects of the job, but when I see what's happening there with AI, there does seem to be more clearly a path to major changes of what that job is.)

Would you mind sharing what tool you have been using for Bank recon?