The Power of Investor Updates (when done right)

One investor update added $10M to our valuation…very high ROI

Today’s Sponsor: NetSuite

Upskill Your Finance Team with AI and Soft Skills

As AI takes on more daily tasks, CFOs need advanced soft skills—like storytelling and influence—to gain a competitive edge and make strategic decisions in a changing business landscape.

Download this free guide to learn proven frameworks, real-world examples, and strategies that help your team deliver insights, boost credibility, and drive business growth.

Why Write Investor Updates?

One investor update increased our valuation by ~$10M. The update took 45 minutes to prepare. That is killer ROI.

That never happened. How exactly did an investor update increase your valuation by $10M?

We sent investor updates every quarter. One quarter, we were in a competitive deal with an ACV of $500K that was looking like we might lose. When we sent our investor update that quarter, we asked if anyone knew someone at [ABC Prospect] that could help us win the deal. One of our small, early investors responded that the decision maker was a good friend. He called his friend and talked to him about our company and why we were a good bet. Two days later they signed the contract…

That $500K deal grew to $800K in a couple of years. Soon after, the company was valued at a ~12x revenue multiple.

$800K ARR multiplied by 12x = ~$10M. So in theory… there was a $10M increase in enterprise value from that single investor update.

Investor updates are worth your time. Not sending out regular investor updates is borderline gross negligence by the CEO. You have some of the smartest, well-connected people waiting to help you. Use them!

A great investor update process will ensure you get that help.

How I Write Investor Updates

Investors can help you, but you need to build (and maintain) trust to earn the right for them to actually help you.

It’s similar to your network when you are looking for a job….If you only reach out when you are looking for a job, then they are less likely to actually help.

Below is what I have found most useful for VC-backed companies:

1. Intro:

A few sentences from the CEO on the most important things.

Bonus points for adding a personal touch so investors know you are human. The engagement rate with these emails materially increases when you are connecting at a more personal level and the update doesn’t feel too robotic (like some analyst or AI wrote it for the CEO).

2. Highlights & Lowlights

This section is where trust is built. Be honest with the lowlights. Investors know that it’s not always up and to the right. There are bumps. Be honest about them. Again, investors are much more likely to engage if they feel like they are talking with someone that is human (especially if they trust you).

A lot of investor updates I have seen resemble the below. They feel like they have to say everything is going awesome and list all the wonderful things happening.

It’s great to share the big accomplishments, but being transparent builds the trust. Share the lowlights (things that are going poorly). Plus, investors can usually see through the BS which magnifies the lost trust.

3. Financial Health

The biggest thing I see done wrong in this section is not showing the context. Your investors think about you a handful of times per year….they don’t have your targets and background memorized. Always provide context with your numbers.

At a minimum, share the below actuals compared to Plan.

Cash: Cash balance, cash burn, runway

Sales: New ARR (new and expansion) and other key sales metrics

Retention metrics: NRR, GRR, and specific major churn callouts

Other key metrics: Share other metrics that are key objectives. For example, if there is a goal to materially improve gross margins then share the progress.

4. Team

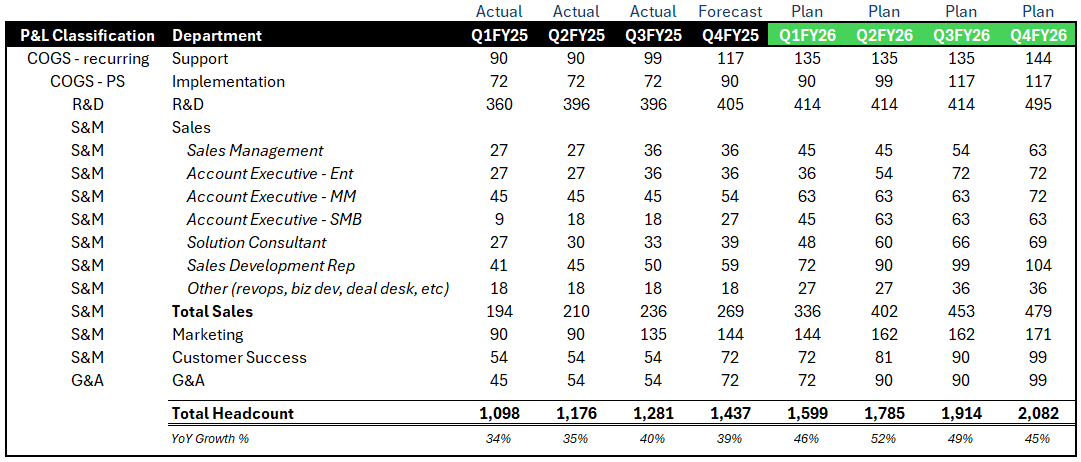

“What is total headcount and where are we hiring?”

Probably more important for early stage vs larger companies, but I find that headcount updates (or at least the key hires) are beneficial to share because there are always questions about it if you don’t.

Below is how I present headcount to the board and I have leveraged something similar for broader investor updates as well. Different company stages may change what groups you breakout.

5. Other Department Updates

You don’t need to send an update on every department every time. It’s often too much and not that interesting. Focus on what’s most important for the company right now. For example, very early stage companies should give a lot more updates on product.

If you have something significant then share it. Otherwise, skip it.

6. How You Can Help

Don’t ask for more than ~2-3 things.

Be thoughtful and specific on your asks. General asks are pretty useless. “Please reach out if you can be helpful with anything.”

Below are a couple of examples:

“We are trying to close a $500K deal at [ABC Prospect]. It’s a competitive deal with [Big XYZ Competitor]. If you know [Prospect Champion], please message me. Would love to get this deal closed!”

“Our CFO just left and I would love to hire his replacement before we go out to raise our Series D later this year. Attached is the job description. Please connect me with folks you think would be a good fit”

You only get the right to ask investors for things if you have earned their trust. A big way to earn their trust is to consistently send these investor updates out.

7. Thank Yous

This isn’t just to stroke investor egos, but that’s a bonus.

If an investor makes you an intro that ends up being your next CFO, then call it out in the next investor update!!

Why?

Because all the other investors see that and have FOMO. “Other people are engaging with these investor updates and helping…I better do the same”. I promise you that after some specific thank you call outs the engagement rate on investor updates skyrockets.

Other Pro Tips

Length: Keep it short and concise (target a ~3 minute read)

Consistent Format: Send it in the same format every time. That builds trust and makes it much easier to read and for them to know what to expect.

Consistent Timing: Again, this builds trust. Get it out in the first few days of the next period. You should have all the information by then. And then send it on the same day every time. Set your calendar. I don’t care too much if it’s business day 1 or day 3, but do it consistently.

Audience: Everyone who has invested in your company. You can/should include advisors and potentially VCs that passed on prior investments (mostly for very early stage companies) because they may participate in your next round.

Update Frequency: I’d go with monthly for early stage companies and then at a certain point quarterly may make sense. But no one is going to complain about too many investor updates. Unless they are long and boring….then they may just stop reading them.

Final Thoughts

I am shocked by the number of companies that don’t send regular investor updates (and by the number that do, but are really bad). I saw a recent survey that over 60% of investors don’t get regular updates from their portfolio companies…straight to jail.

It’s so easy and is one of the highest ROI things a CEO can do.

Don’t wait until you need something before reaching out.

Silence creates uncertainty. When there is uncertainty then you lose the trust of one of the most powerful networks at your disposal. They want to help. It’s your job to get them to help.

Footnotes:

Download this guide for a good breakdown of AI and soft skills that your finance team should have. From my NetSuite friends.

OnlyCFO Sponsorships: I am booked through H1. If you want to be put on the list for H2 then send an email to onlycfo@onlycfo.io