How To “Juice” Gross Margins

5 tricks to make your gross margins look better in 2026

Today’s Sponsor: NetSuite

CFOs are uniquely positioned to take the reins of strategic leadership. At the heart of this leadership is the ability to make informed and impactful choices.

Packed with actionable frameworks, AI-driven approaches, and insights used by industry leaders, this guide will help you lead confidently and deliver long-term results. Download it today to begin elevating your impact.

Do Gross Margins Matter?

I often feel like an old guy explaining basic financial concepts to young AI founders who think, “OK, Boomer…you don’t understand how things are different today”

Gross margins have been a highly discussed topic in recent months as AI companies and their investors justify lower gross margins.

Gross margins don’t matter when you are growing to $100M ARR in 12 months.

Low/negative gross margins create a barrier to entry where well-capitalized companies have an advantage.

Low gross margins may mean the problem being solved is hard and so it won’t be commoditized like the rest of the software industry.

There is a degree of truth to all of these statements, but what MANY people actually hear when someone says things like the above is “gross margins don’t matter”. Period.

That is NOT true. No smart investor would say gross margins don’t matter with no other context.

Low/negative gross margins are OK temporarily to capture the AI opportunity, but gross margins must increase in the future.

We are OK with lower gross margins because what we are doing is hard. We will sacrifice lower gross margins for much higher revenue growth endurance than our peers (i.e. growth will be high for a lot longer).

But when one of the above things proves not to be true (gross margins don’t improve and/or growth endurance is weak)…then previous valuations will blow up.

And we will see folks try all sorts of things to “juice” (artificially inflate) their gross margins. Beware.

5 Ways to Juice Gross Margins

I have seen extreme mental gymnastics from companies trying to justify moving expenses out of gross margins.

If I was trying to artificially inflate gross margins, here are the top 5 things that I would do:

Don’t allocate stuff to COGS. Every company has stuff that should be allocated across the company, including COGS (usually the allocation is based on headcount). These expenses include things like office space, IT/system stuff, software used by the entire company, company events, etc. You can just not allocate to COGS or just dump it all into G&A (many do the latter).

Put DevOps in R&D even though they maintain product uptime and reliability.

Call the support team “Customer Success” and code them to S&M. Who cares they are just supporting the product and filling product gaps. Your auditors won’t question if “customer success” is in S&M.

Push more hosting and AI inference costs to R&D or S&M. Call it costs for “innovation” or “growth” even though it is costs to run your product. Some of these costs legitimately go to R&D (dev instances and testing) or S&M (trial costs), but try pushing more costs into these buckets.

Recognize revenue that won’t turn into cash and just recognize a lot of bad debt expense. I have seen a lot of companies recognize revenue for WAY too long on bad customers and therefore revenue is high but bad debt expense (G&A) is also way too high. But guess what? If you are recognizing revenue on customers not using the product then gross margins will be amazing!

This one is a bit harder to understand and a lot of people do it by accident…If you don’t expect customers to pay, then based on accounting rules you shouldn’t recognize revenue. This also means if a customer hasn’t paid you in several months then you should usually assume they won’t pay you for future services and therefore you should stop recognizing revenue (even if the contract is not over yet). Then only if the customer pays do you recognize more revenue. For example, you shouldn’t recognize revenue for an entire year contract without ever being paid when you have monthly payment terms.

Now you know what you need to do to inflate your gross margins, you may be wondering

Will my auditor catch these tricks?

Rarely. Most auditors just don’t seem to really care (or don’t really understand) how things should be classified. There are some accounting grey areas so sometimes they are fine as long as it’s disclosed, but you can get away with a lot of expense classification shenanigans if you really want to.

Are Low Gross Margins Bad?

Not necessarily.

But…all else being equal, higher gross margins are better.

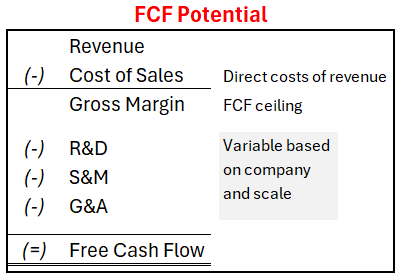

A company’s valuation is ultimately driven by free cash flow per share. Gross margins represent the ceiling of profit potential, which is why investors pay so much attention to it.

But lower gross margins doesn’t mean the math is necessarily broken.

Maybe the ceiling is lower, but if longer-term growth is higher and OpEx is lower then that might be a good tradeoff.

Many hot AI companies have low gross margins (lower ceiling), but they have VERY low S&M expenses because it’s all self-serve and inbound. S&M expenses are historically REALLY high for typical software companies so if these AI companies can keep S&M low then they may see similar FCF margins as SaaS.

Below isn’t exactly how you would calculate FCF because of accounting differences with cash, but essentially you subtract out your operating expenses from gross margin to get FCF.

If your operating expenses can be significantly lower then FCF margins can still be high. And the math still works.

Final Thoughts

I obviously do not want you doing these gross margin “tricks”. My intent is to make fun of the companies doing them and hopefully educate investors about some of these silly games and how gross margins across companies may not be apples-to-apples comparisons.

Companies and investors need to pay attention to how these things are coded in order to make better decisions and comparisons.

If you are honest about your financials then you can have better conversations on how to improve the long-term value of the company.

👉 In my next post I will write about how I would catch/prevent fraud. Every VC has fraud in their portfolio…

Footnotes:

Check out the CFO Playbook to Strategic Leadership. It’s a good read from my friends at NetSuite

Want to sponsor OnlyCFO and reach 35,000 finance and other tech leaders? Email onlycfo@onlycfo.io

I’m really glad you definitely didn’t give all of our secrets away…

Ps - you look even more resplendent on here than twitter

Technically, if a customer doesn’t pay because they are not using the product, the accounts receivable write-off should go against revenue, not bad debt expense. If they don’t pay because of financial difficulties (i.e. bankruptcy) then it could be booked to bad dept expense.