How to Maximize Valuation | Public Company "Rule of X" Performance

Lessons from the biggest changes in the Rule of X over the past two years

Today’s Sponsor

Vertice just raised a Series B for its solution to tackle SaaS waste by tracking software spend and negotiating better deals with vendors.

Spend on software represents 14% of a company’s expenses, an increase of 18% in the last 12 months 🤯!

Check out the 2024 SaaS Inflation Index report to see SaaS spend data and how it can be reduced.

Maximize Valuation

Both operators and investors want to understand how a company can best maximize shareholder valuation. In the software industry we are frequently overwhelmed by the number of acronyms and metrics that supposedly tell us how to do this.

The one thing that actually matters for maximizing valuation is to increase profits on a per share basis. This primary objective is accomplished by:

Increasing revenue

Increasing free cash flow (FCF) margins

The relative importance of these two things are not the same throughout the life of a company though. The below chart shows the ARR growth rate of top quartile software companies from $10M in revenue to IPO.

Growth rates move from 2x YoY in the early days to steadily slower as the company matures. Remember that these growth rates are top quartile companies and benchmarked in times that were much better than today.

For VC-backed companies, revenue growth is critical to staying alive due to the VC model. If companies raised a decent amount of money and at a “good” valuation, then the only way for the math to make sense is through revenue growth.

While a margin increase has a linear impact on value, a growth rate increase can have a compounding impact on value. — Byron Deeter

VC math requires significant value compounding for it to work. While being efficient gives companies more time, if the revenue growth compounding doesn’t happen then no one will have a good outcome.

This is why Bessemer said the Rule of 40 was dead wrong and that the Rule of X more appropriately measures value creation:

Rule of X = (Growth Rate * Multiplier) + FCF Margin

The “multiplier” in the equation represents how important growth is relative to FCF margins. Bessemer recommended that public companies should conservatively use a 2x multiplier.

For VC-backed companies, I 100% agree that the Rule of 40 score is wrong because you can get to a strong Rule of 40 score simply through profitability but as I said earlier the VC model relies on sustained compounding revenue.

Example: A $40M ARR company growing at 20% with 30% FCF margins has a Rule of 40 score of 50. Looks good from a metric standpoint, but this company will likely never go public. The likely outcome is a private equity acquisition, but at no where near the type of revenue multiple valuation that would give most VCs a good outcome. In the typical VC model, few people have a really good outcome here because the revenue compounding never really happened — and too much money was raised at too high a valuation.

Note: Similar to the Rule of 40 , I don’t think the Rule of X is appropriate to use for most early stage companies (<$20M in ARR). There are better metrics to run the business like burn multiple and other unit economic metrics.

Public Cloud Rule of X Score

As we are all aware, 2021 was crazy time for revenue growth. While inefficiency was certainly high, with a 2x multiplier applied to growth most companies had a really high Rule of X score. While many companies have been able to improve FCF margins, growth has come down much more (particularly with a 2x weighting).

Of the 77 software companies I am tracking only 7 of them improved their Rule of X score between 2021 and today! Below are the most improved and largest declines in the Rule of X between 2021 and 2023:

On the far bad end of this chart you have Zoom with a 208 percentage point drop in its Rule of X score from 2021. Zoom at the time had 100% growth so if you are multiplying this by 2x then the Rule of X score in 2021 (including its 42% FCF) was a whopping 242%!

Fast forward to today, Zoom’s Rule of X score is only 34% — by far the largest drop amongst public companies. During 2021 Zoom’s valuation multiple was amongst the top 20 of public software companies, but today it’s in the bottom 20 of the 80 companies I track.

As you might expect, the companies with the worst change in the Rule of X score previously had some of the highest revenue growth numbers. The average revenue growth of the above companies was 82% in 2021 versus an average of 35% revenue growth for all other public software companies. So as revenue growth tanked in the past two years, their Rule of X score fell much sharper than other companies (particularly as a result of the 2x multiplier).

But some of these companies have done much better than others. While Snowflake’s revenue growth rate has fallen significantly, it remains one of the fastest growing public software companies. They have also had one of the strongest improvements to FCF margins. Because of these two things, Snowflake still has the highest revenue multiple for public cloud stocks.

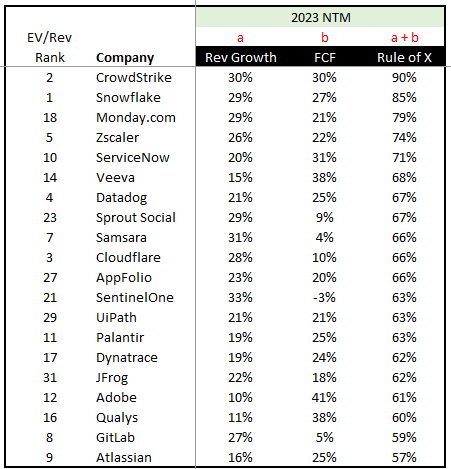

Highest Rule of X Scores

Below is the top 20 highest Rule of X scores. It is intersting to me to then compare this to the EV/Revenue multiple rank. The far left column shows the EV/Revenue rank for public software companies from the most richly valued (highest revenue multiple) to the lowest.

Takeaways

Revenue growth endurance (i.e. how sustaining is revenue growth over time) is not considered in shorthand metrics like the Rule of X. But revenue growth endurance is critical to potential value compounding.

Companies that were able to better balance profitability in the face of declining revenue growth have done significantly better.

These two takeaways are often very correlated. Companies that have to overspend to obtain growth often have the weakest revenue growth endurance. In other words, when those companies attempt to become efficient and generate strong FCF margins, their growth falls much faster.

The best companies that maximize value for shareholders are able to do it with strong unit economics.

Footnotes

Check out our sponsor’s SaaS Inflation report if you are overspending on SaaS (hint: you are)

Sponsor OnlyCFO Newsletter and reach 15k+ CFOs, CEO, and other leaders in the software industry.

Reply to this email with any questions or feedback

This was a really good post

Really valuable insights, thanks for sharing!