How to Read Balance Sheets

How to read and interpret the balance sheet of a software company

Most operators and investors focus on the income statement (aka P&L) because it is what primarily drives valuations — revenue growth and profit margins.

While the balance sheet isn’t as sexy as the income statement, a well-managed balance sheet can be a major strategic advantage and a poorly managed balance sheet can sneakily destroy a company. And I have found that most people don’t really understand balance sheets.

Keep reading so you can become an expert. Share this post to help others.

Today’s Sponsor

What do CEOs want in a CFO?

Today's CFOs need to be more than numbers people, they also need to know how to navigate the business. We talked to a dozen chief executives about what makes a top finance partner.

A balance sheet is a snapshot at a point in time of a company’s financial health while an income statement is for a specific period of time (monthly, quarterly, annually, etc). In other words, when you look at a balance sheet it represents all of the activity from the beginning of time.

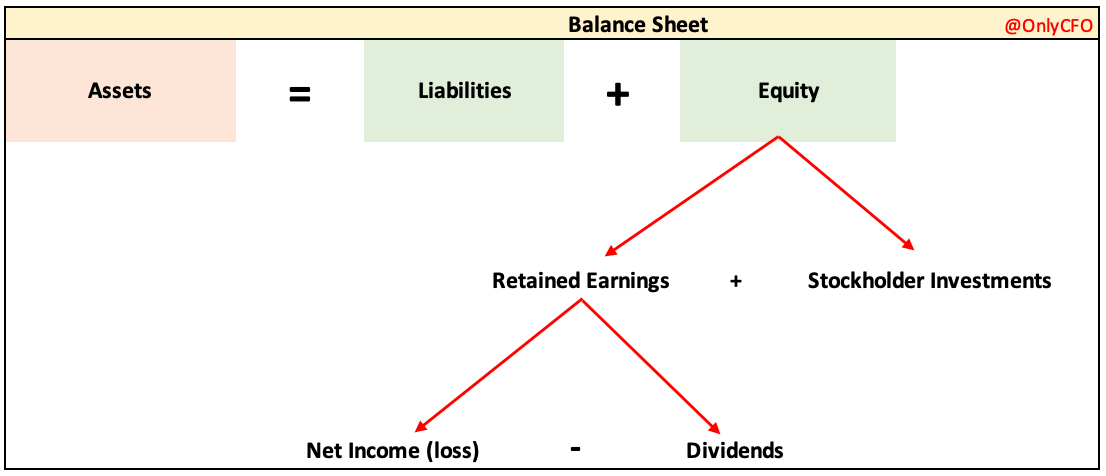

A balance sheet includes three main sections:

Assets: What a company OWNS

Liabilities: What a company OWES

Equity: Value attributable to stockholders

If you have taken an accounting 101 course then you have heard of the formula that assets must equal liabilities plus equity. What many people don’t understand is that the income statement (represented by “net income (loss)” in the below image) is part of the balance sheet.

The income statement activity goes into retained earnings every period. This is how the balance sheet actually balances in order to make the formula above true.

Example: Company spends $10,000 on google ads. That transaction will be recorded as follows:

Debit (increase) to advertising expense for $10,000

Credit (reduction) to cash for $10,000

The advertising expense is on the income statement and the reduction to cash is on the balance sheet, which would mean the balance sheet doesn’t balance! This is why the income statement goes into the balance sheet within the retained earnings section.

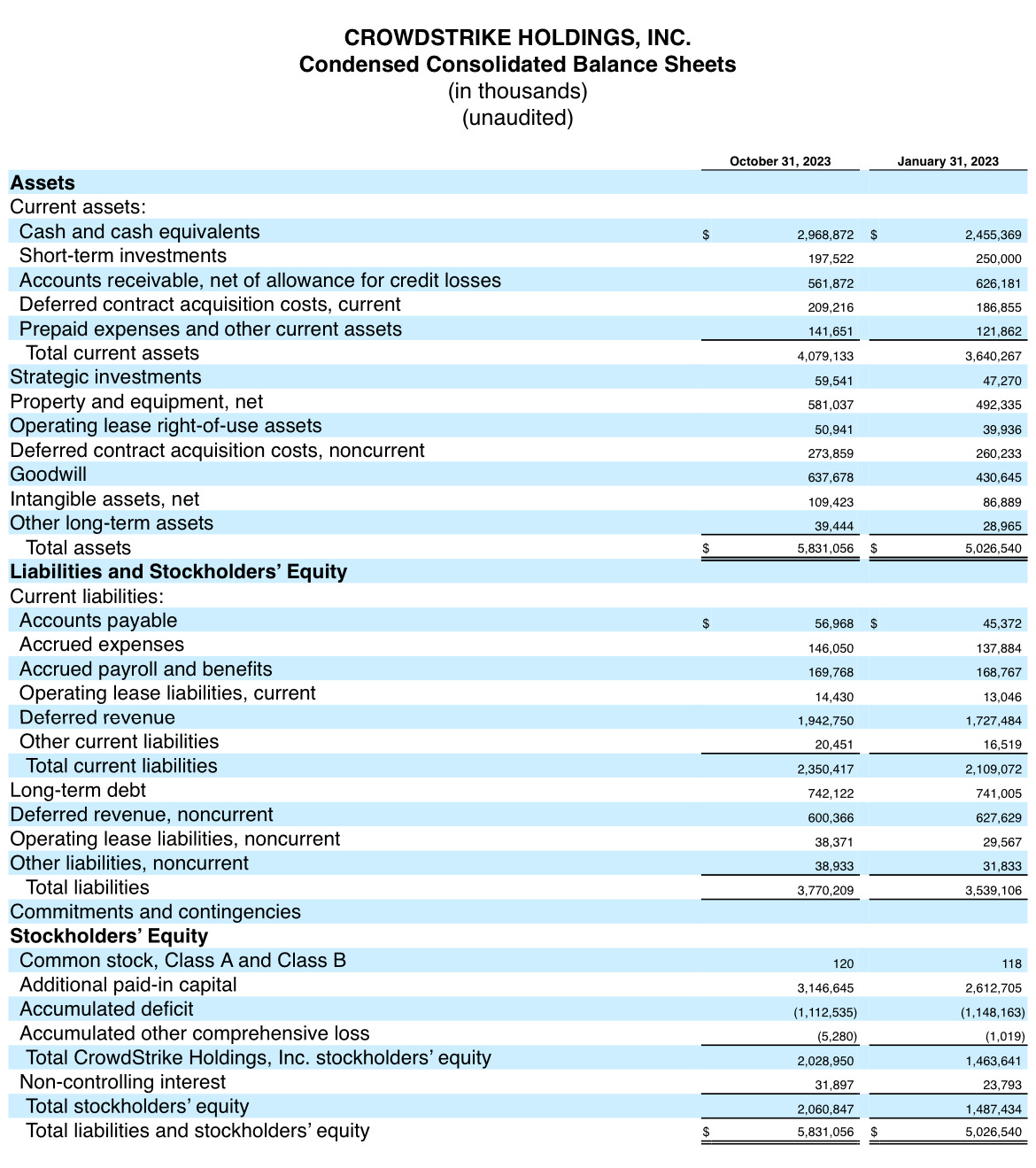

I am going to walk through the sections of a balance sheet using Crowdstrike as an example. Crowdstrike has a very typical software company balance sheet.

Assets

The first section on a balance sheet is the assets section. Assets are what the company OWNS. Assets are things that can be sold for money or used to generate future benefits.

Assets are typically presented in order of liquidity (i.e. how readily they can be converted to cash or used to generate cash).

Below are the main sections of a cloud company’s asset section:

Current Assets - the company expects to be able to convert to cash or consumed within one year. Current assets include things such as the below.

Cash and cash equivalents

Money in the bank or in very short-term (< 90 days) maturity, liquid investments such as T-bills, CDs, and money market funds.

Short-term Investments

Investments in debt securities with maturities greater than 90 days (but typically less than 1 year) when purchased. This also might be called “marketable securities”. Companies think about this asset as part of their cash position because it will turn into cash soon.

Accounts receivable

Money currently owed from customers. This is the amount invoiced to customers or contractually owed based on services performed. Most B2B SaaS companies have annual upfront invoicing terms, which means that immediately when an invoice is issued the entire amount becomes part of accounts receivable (even though it is for future services).

Deferred commissions

Also known as “deferred contract acquisition costs” in the CrowdStrike example.

Accounting rules typically require cloud companies to capitalize a large portion of sales commissions (meaning it goes on the balance sheet) and recognize the expense over time (typically between 3 and 5 years). The accounting rules are complex and nuanced so I won’t go into the detail, but be aware that if you are using accounting commission expense then your unit economic math might be deceiving….you should check how your team is calculating CAC and payback ratios

Prepaid expenses and other current assets

This can include a variety of things but some major items for cloud companies include: software (we love to buy lots of other SaaS products), marketing events & programs, rent, insurance, etc.

Non-Current Assets - not expected to be converted to cash or used within one year. Some items here include:

Long-term investments

These are investments with maturities greater than one year.

Property and equipment

Most cloud companies are not very capital intensive. CrowdStrike, however, has a lot of data center spend and also a lot of “construction in progress”, which the footnote tells us is more data center spend that hasn’t been placed it service yet.

Operating lease right-of-use assets

This represents the company’s right to use a leased item over the lease term. The asset is recognized based on the present value of all lease payments over the lease term. The most common leases included here are office leases, but there could be others.

Goodwill

Premium amount paid over what is determined to be the fair value of an acquired company. Goodwill frequently results when a company buys another company.

Intangible assets

These are assets that are not physical, but frequently very valuable. These assets generally are a result of business/asset acquisitions because under accounting rules a company can’t typically create an intangible asset. There are two types of intangible assets: 1) finite-lived assets and 2) infinite-lived assets.

Deferred commissions, non-current

This is the amount of deferred commissions that will be expensed after one year.

Other assets

There is often some miscellaneous stuff in here, but larger companies like Snowflake may also have equity investments in both public and private companies also included in this section.

Liabilities

Liabilities are what the company OWES.

Liabilities are presented in order of when they are due, with the most current showing first. Similar to assets, liabilities are presented in two main sections (current and non-current).

Current liabilities - obligations expected to be settled in <1 year

Accounts payable

Vendor bills that are due for payment

Accrued expenses and other current liabilities

These occur when expenses are incurred that haven’t been paid. If they relate to vendor expenses then if a vendor bill is received then it is transferred to accounts payable until paid.

Operating lease liabilities

This is the other side of “operating lease right-of-use assets” mentioned above. It is the amount owed over the contract term of the lease.

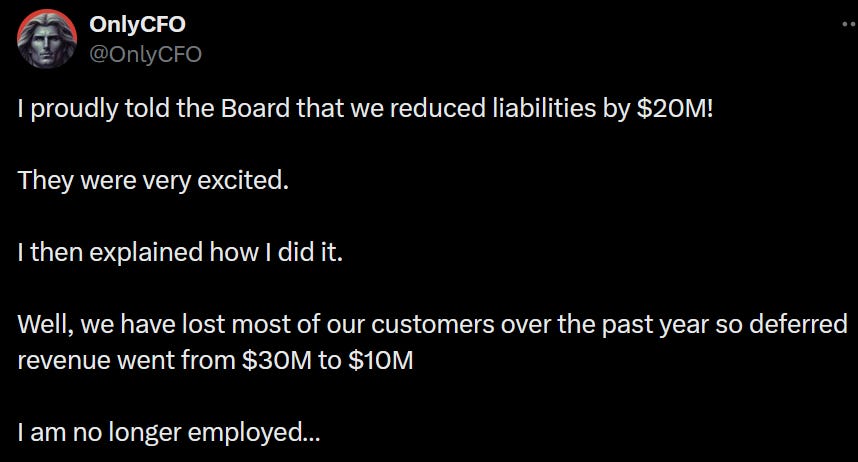

Deferred revenue

For cloud companies, once an invoice is sent to a customer then the amount of the invoice is added to deferred revenue. Deferred revenue is decreased when revenue is recognized.

Cloud companies want their deferred revenue to be continually increasing because that means that customer sales are increasing faster than revenue is being recognized — in other words, sales are increasing. It is a leading indicator of accounting revenue growth. Does the below joke make sense now? Liabilities are generally viewed as a negative, but cloud companies typically want their deferred revenue liability to always be increasing.

Non-current liabilities - obligations expected to be settled in 1+ years

Operating lease liabilities, non-current

This is the long-term portion (1+ years) of the operating lease liabilities noted in the section above.

Deferred revenue, non-current

This represents the portion of deferred revenue that won’t be recognized as revenue for 1+ years.

Debt

While most VC-backed cloud companies are primarily funded via preferred equity from venture capital firms, some companies will also use debt to help finance operations or acquisitions.

Other liabilities

This is for other miscellaneous liabilities that don’t fit into one of the previous buckets. If anything becomes big enough in this section then it will need to be broken out separately.

Stockholders’ Equity

Stockholders’ equity is the value attributable to the business owners (aka stockholders).

Some people think of this section as the company’s net worth after netting the company’s assets and liabilities, but A LOT of a company’s value is not represented on the balance sheet. This is because companies build up significant value in their brand name, customer relationships, technology, etc that accounting rules prevent from being recognized on the balance sheet.

The main sections of stockholders’ equity include:

Common stock & Additional Paid-in Capital

These two sections primarily refer to all the money invested in the company by shareholders.

Retained earnings (or accumulated deficit)

This represents the cumulative net profits/loss from the income statement. There are two things that impact retained earnings:

Net income / (loss) adds or subtracts from it

Dividends paid out decrease it

A lot of cloud companies are not profitable for a long time, so they will typically use the caption “accumulated deficit”. Once a company is profitable and digs itself out of the hole, then the caption will switch to “retained earnings”.

How the Balance Sheet Balances

The balance sheet equation MUST always be true. If it ever doesn’t, then an accountant isn’t doing their job right.

Let’s take an example and see how it flows through the balance sheet.

Example: A SaaS company sells a $100k deal for its SaaS solution with a subscription term of 12 months and upfront payment terms.

As you can see above, at each point in the process assets = liabilities + equity.

Remember that everything that flows through the income statement ends up hitting the equity section.

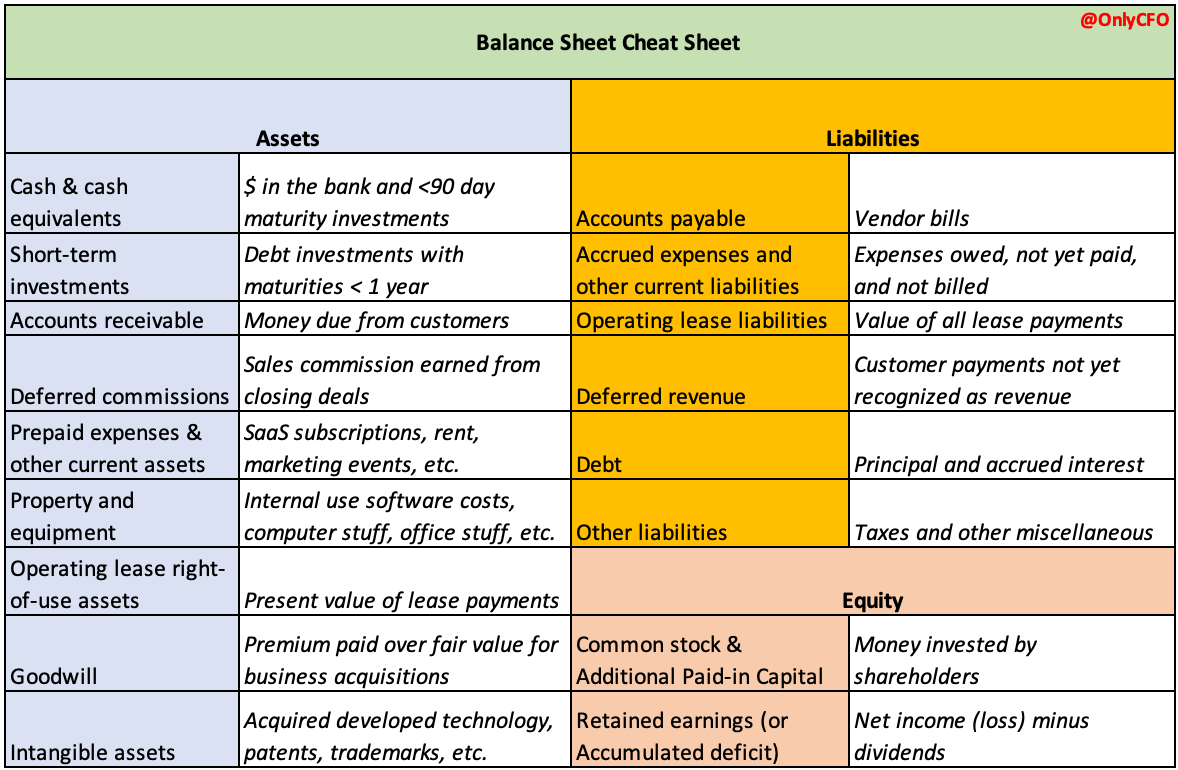

Balance Sheet Cheat Sheet

Here is everything I said above summarized in a nice little image so you can study it in your free time.

Concluding Thoughts

The income statement is more intuitive and more commonly understood, but understanding the balance sheet is critical for understanding the health of a business.

Companies that have a strong, well-managed balance sheet have a major advantage over those that do not.

Footnotes:

Sponsor OnlyCFO Newsletter and reach 17k+ CFOs, CEO, and other leaders in the software industry.

Check out our sponsor’s guide on what makes a great finance partner

Subscribe if you haven’t and share my newsletter with your friends!

In the Balance Sheet Cheat Sheet, I would expect income taxes as a separate line and majority of other taxes as part of "Accrued expenses and other current liabilities" rather than "Other liabilities". And for "Deferred commissions" in assets it sounds like it represents sales commissions "paid" rather than "earned".