The statement of cash flows (or “cash flow statement”) shows the cash inflows and outflows of a company over a specific period of time. It starts with cash at the beginning of the period, shows the period’s activity, and then the ending cash balance.

Understanding a company’s cash position and how money flows in and out is critical for any business, but software companies have particularly unique issues. Free cash flow (“FCF”) is a key metric for software companies.

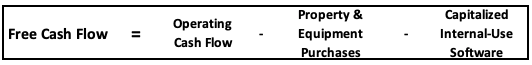

See the definition of FCF below and learn about each part of the formula in this post.

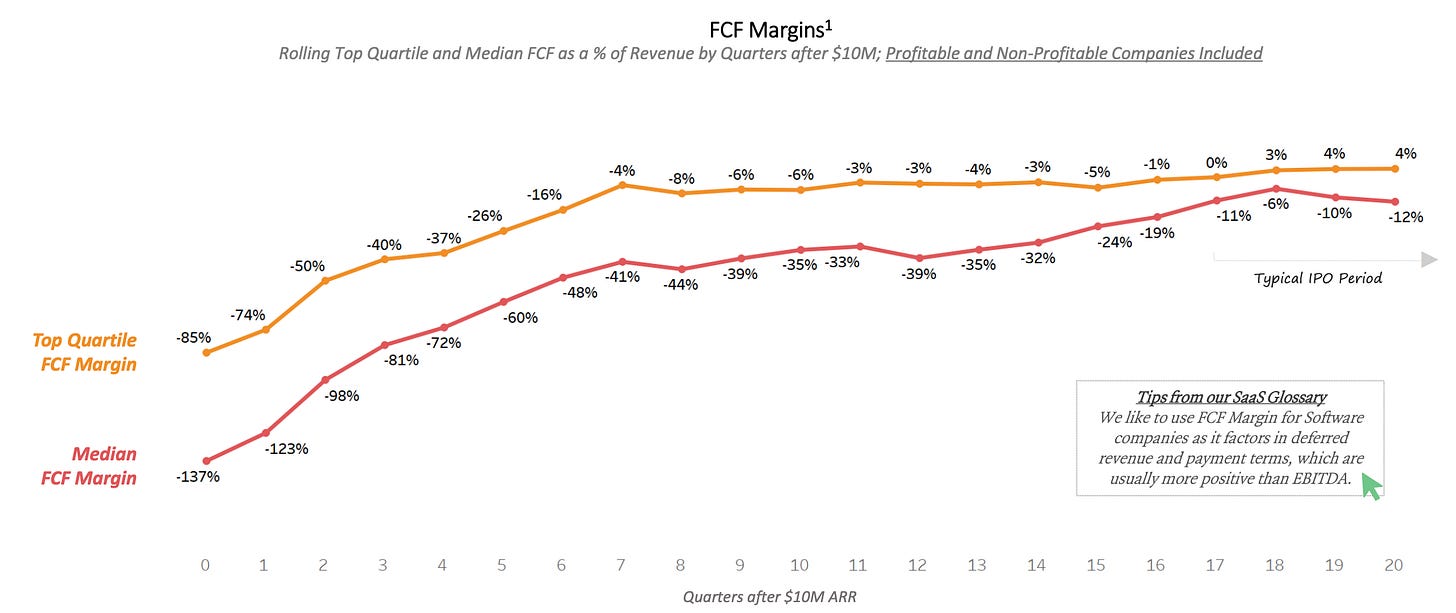

As seen in the ICONIQ chart below, software companies lose money for a *really* long time and their success depends on them being able to obtain more operating leverage as they scale and eventually get to 25-30%+ FCF margins.

During 2021, there were lots of folks who assumed all SaaS companies could eventually get to these deliciously high software FCF margins. But they are now realizing that those margins are out of reach for a ton of software companies and those companies are the companies that are getting crushed the most right now on valuation multiples.

BUT….growth is not dead! Only growth at all costs is dead. Growth is still 1.5x more important than FCF margin in software valuation multiples (see report below from Guggenheim). Companies will need to be able to show a believable path toward strong FCF margins though to obtain top-quartile valuation multiples. Understanding the cash flow statement is critical in this analysis.

Why We Need the Cash Flow Statement

The reason we need a cash flow statement is that the income statement does not reflect the timing of cash payments and receipts.

There are two types of accounting methods:

Cash Accounting: transactions recognized only when cash is received or paid

Accrual Accounting: recognizes revenue when earned and expenses when incurred

Example: Company ABC holds an event on December 31st that cost $10K, but didn’t pay the $10K until January 15th.

Cash basis: The expense is reported in January when paid

Accrual basis: The expense is reported in December when incurredAlmost all software companies larger than $1M in revenue report their financials on an “accrual” basis. This means that a company’s income statement will not be the same as the cash impact.

The cash flow statement is one of three primary financial statements:

Balance Sheet - How to Read Balance Sheets - Software Edition

Income Statement - How to Read Income Statements - Software Edition

Statement of Cash Flow - You are reading my guide!

Think of the cash flow statement as a bridge between the balance sheet and the income statement because it takes the non-cash transactions and shows what is happening on a cash basis.

How it works: The income statement goes into the balance sheet each period (see below). If the balance sheet balances (which it always should!) then all the balance sheet item changes between periods, except for cash, should explain the change in cash.

The Statement of Cash Flows (SoCF)

Below are the sections of the cash flow statement:

Operating Cash Flow - cash in/out from the main business activities

Investing Cash Flow - cash in/out from investments

Financing Cash Flow - cash in/out between owners and creditors

Foreign Exchange & Other - cash impact from foreign currency exchange and other required disclosures

What is cash?

Sounds like a stupid question, but it isn’t as clear as many people think. A lot of times we say “cash” to refer to the title “cash and cash equivalents”.

Cash: money sitting in a company’s bank account that can be used anytime

Cash Equivalents: short-term, highly liquid investments that mature in 3 months or less from the time of purchase. Some common examples include:

Treasury bills

Certificates of deposit

Commercial paper

Money market funds

Everything outside of the above is not within the “cash and cash equivalents” line but included within another line on the asset section of the balance sheet. The cash flow statement only explains the change of the “cash and cash equivalents”. All investments with maturities greater than 3 months is not included in “cash and cash equivalents”.

Companies frequently will refer to “cash, cash equivalents, and investments” when referring to their liquidity because short-term investments with maturities > 90 days is still pretty close to cash.

Cash Flow from Operating Activities

There are two ways that cash flow from operations can be prepared: 1) direct method or 2) indirect method. But literally everyone (particularly within SaaS) uses the indirect method so that’s all I will be talking about.

I will walk through the most typical operating activity items found from the example below of SentinelOne’s 10-K:

Net Income (loss)

The operating activity section shows the cash inflows and outflows from normal business operations and starts with net income/loss (from the income statement). Since the income statement is prepared on an accrual basis it must be adjusted to reflect the actual cash impact.

Non-cash adjustments

These are adjustments to net income/loss to get to the actual cash activity for the period. These adjustments fall into the following buckets:

Never will impact cash

Stock-based compensation (SBC)

SBC is an expense on the income statement related to providing equity awards to employees/consultants but it does not directly impact cash since they just receive equity. While cash is not impacted, remember that SBC does cause dilution to shareholders. An important metric is FCF/share because it tells you how dilution impacts FCF.

Previous/future impact to cash

Depreciation and amortization

This results from prior cash outflows from purchases such as property, equipment, intangible assets, etc., but the expense on the income statement is recognized over time as the assets are used.

Example: If a company buys computer equipment then those assets are paid for in cash when purchased but expensed over 3 years as it is used.

Amortization of deferred contract acquisition costs

The name is confusing but just think of this as expensing commission costs over a longer period of time and not when paid. Software companies are required to capitalize (delay expensing on the income statement) a large percentage of sales commissions and then expense those commissions over some period of time. Most software companies determine that the right period of time to expense these costs is over 3 - 5 years (very judgemental).

So while a sales rep might earn a $100K commission check today, that $100K is expensed on the income statement over 3 - 5 years. This accounting rule can make some SaaS metrics misleading if not properly adjusted.

Other Non-Cash Stuff

There are a bunch of other stuff that might be included in this section, but it follows the same concept as above, cash is paid/received before it is an expense/gain on the income statement so it must be adjusted.

Changes in Operating Assets and Liabilities

The changes in operating assets and liabilities during the period represent the required changes to net income to get to the cash impact. In the below image, you can see how movements in assets and liabilities impact cash. It is somewhat intuitive. For example, if assets increase because you are purchasing assets then cash goes down.

Typical examples of what is included in the operating cash flows section of a software company are seen in the SentinelOne example below.

The concept is the same for all of these adjustments so let’s continue the example of “deferred contract acquisition costs” to illustrate the point.

Example: A sales rep sells a $1M deal on December 31, 2022 and is paid a $100K commission on the same day. That entire $100K is capitalized (the expense is deferred) and will be expensed over 3 years.

Solution:

The $100K expense is not recognized on the income statement in 2022 (it will be expensed over the next 3 years) even though the cash is paid out in 2022. So we need to adjust the income statement which shows $0 of expense in 2022 to $100K of cash outflows.

We do that by looking at the change in "deferred contract acquisition costs" on the balance sheet. If this was the only transaction that happened in 2022, then this asset line would increase from $0 to $100K. If an asset increases then cash is adjusted down and we get to the correct answer of $100K being used.

Cash Flow from Investing Activities

The investing activities section shows how much cash has been generated or spent from various investment-related activities

Some of the most common examples of items in this section are below from Crowdstrike’s 10-K:

Purchases of property and equipment:

office stuff

computer stuff

leasehold improvement stuff

Capitalization of internal-use software

This is the amount of engineering time spent on developing new software functionality. There are subjective accounting rules that govern how much can be capitalized. For SaaS companies, this is usually only a small fraction of overall engineering time (often somewhere close to ~5% of R&D spend). Once capitalized, internal-use software costs are expensed over time (typically over 3-5 years).

Cash paid for strategic investments and acquisitions

This is cash paid to make investments in other companies or to acquire entire companies.

Purchases of intangibles

acquired technology

trademarks

patents

Purchases, sales and maturities of marketable securities

This represents the cash movement of investments that are not considered cash as discussed at the beginning of this post.

Cash Flow from Financing Activities

Cash from financing activities includes the sources and payments of cash with investors and creditors.

Some of the most common examples of items in this section are below from SentinelOne’s 10-K:

Proceeds from preferred stock

Money from equity financing - VC, PE, public markets (IPO)

Debt

Money obtained from debt sources and the repayment of that debt.

Proceeds from exercise of stock options and warrants

When stock options are issued to employees or warrant to banks, they typically have an exercise price amount that must be paid to in order for them to own the shares.

4th Section of Cash Flow Statement

The last section of the statement of cash flows shows:

Any foreign currency exchange impact

Required supplemental information on interest and income taxes paid

Non-cash investing and financing activity disclosures

See the SentinelOne example below:

Concluding Thoughts

Ultimately, a company’s goal is to generate consistently positive and growing cash flows for investors. This is often measured on a per share basis (FCF/share) because if the cash generated isn’t growing faster than dilution from issuing more shares then the company isn’t providing a positive return for investors.

Great capital allocation and cash management is often what separates the amazing companies from the failures. Understanding the statement of cash flows is a critical part in doing both of these well.

Hi!

Thanks for the great explanatory content!

I was wondering if you could provide the link to X where you posted about the changes in accounting rules about capitalizing sales commissions in January 2023? (it says it got deleted when I click on the embed.

Thanks in advance!