Interesting Stuff This Week

Brex's $5B acquisition, Zoom's $3B+ Midas touch, Notion's massive secondary, and SaaS is dead...again

👋 Welcome to the OnlyCFO newsletter! Join 36K+ subscribers getting smarter about tech and finance…

Today’s Sponsor: NetSuite

Download my (OnlyCFO) best practices for chart of accounts and department structure in 2026.

Stop using your old, broken chart of accounts! It’s much easier to run accounting if you have a good foundation. It will also make finance (and the CFO’s) job much easier. Grab my chart of accounts template and how I track departments below 👇

I am going to start publishing regular newsletters on current tech, finance, and other stuff that I find interesting.

It’s a way to catch people up on the latest stuff for those who aren’t terminally online like I am. And share my thoughts on the events.

1. Capital One Acquires Brex for $5.15B

Everyone has been talking about Capital One acquiring Brex. The opinions from social media were mixed:

“A $5B acquisition is a top 0.001% outcome!”

But many people tried to push a more negative angle:

“Brex lost to the competition.”

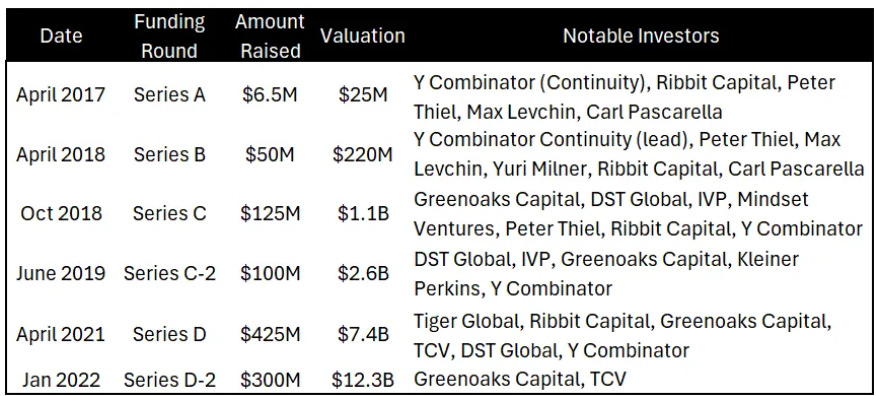

“Brex only sold for $5B. They were valued at $12.3B in 2021.”

“Brex employees didn’t make any money.”

My favorite meme in response to all this is below… Lots of opinions from folks who have never built anything near Brex’s scale. $5B valuation is amazing and Brex built an incredible business. Full stop.

Yes, Brex is down from the crazy valuation days of 2021. But so is almost every other software/fintech company. Cloud stocks are down ~52% on average from their peak.

So was $5.15B a good price for Brex?

Yes. What we currently know is that Brex crossed $700M in ARR at the end of August last year, was growing ~45%, and had 50% gross margins. Assuming some decent growth duration, Brex is probably at ~$800M ARR today and will probably end 2026 at $1.1B-$1.2B. This would mean GAAP revenue of around $1B and ~$500M of gross profit (assuming 50% gross margins).

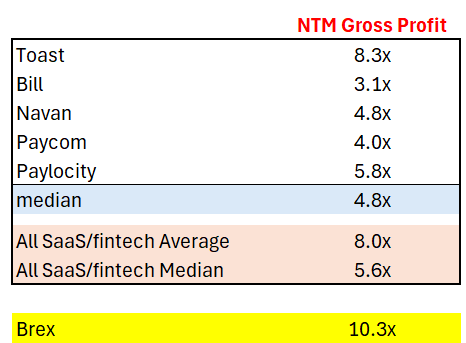

So $5.15B acquisition price translates to a ~10.3x NTM gross profit multiple

Brex had two options: 1) push toward an IPO or 2) strategic acquisition. Public market SaaS/fintech multiples have been hammered lately….below are some companies to comp Brex against. They have a median multiple of 4.8x. The overall SaaS/fintech median is 5.6x.

Brex’s 10.3x gross profit multiple is 2x that…

Did employees even make any money given the valuation drop?

The potential biggest losers in an acquisition like this are employees who got stock options at the Series D or later. If the strike price hurdle of the stock options isn’t met, then you don’t make any money.

The Series D was at a $7.4B valuation so the strike price (determined by the 409A valuation report) was likely in the $5.2B - $5.9B range given a typical 20-30% discount from preferred shares at this stage. This would mean no employees that joined from early 2021 through today would have made any money…

But…Brex did some employee-friendly things and made some equity changes that ensured every employee made some money in this acquisition.

Repriced all equity to a $4B valuation 2 years ago

Everyone who joined after the Series D got RSUs

Some folks say that repricing is really hard, but it really isn’t that hard in most cases. And if the valuation drops significantly, then it is a very employee-friendly thing to do. Glad to hear Brex did it.

My rule of thumb for stock option repricing:

<20% drop, do nothing

20-30% drop, consider repricing

>30% drop, probably should reprice

And for the folks that got RSUs….RSUs guarantee you get some payout because there is no strike price hurdle.

Congrats to my friends at Brex!

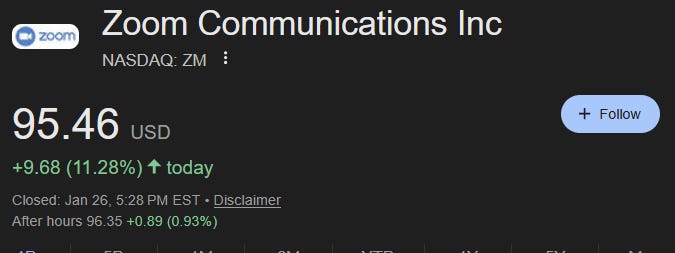

2. Zoom Stock Price Jumps Because of…Anthropic?

Zoom’s stock price hit the highest level since 2022 because an analyst pointed out that Zoom’s 2023 investment in Anthropic could be worth up to $4B today.

In Q1 2023 Zoom said they made $51M of investments in private companies (presumably all in Anthropic)

Anthropic’s valuation in its 2023 fundraise was “only” $4.1B

Zoom probably owns ~1% of Anthropic. Baird estimates Zoom’s $51M strategic investment could now be worth $2B to $4B, based on Anthropic’s rumored ~$350B valuation (depending on dilution).

This would put Zoom’s Anthropic investment at ~10% of Zoom’s market cap 🤯

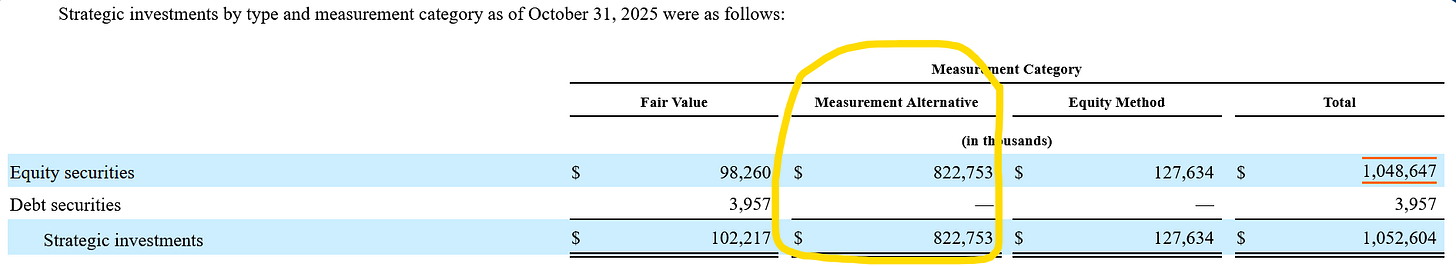

Below is Zoom’s most recent Strategic Investment balance disclosure. The “measurement alternative” column is where private company investments sit. The balance is primarily Anthropic. If/when this $350B valuation round closes, Zoom is going to record another massive unrealized gain and will make a lot of money when it IPOs…

Want to know an even more insane Anthropic investor story?

FTX (infamous crypto firm whose founder went to prison) owned 7.84% of Anthropic in January 2024 but it sold off the entire position by June 2024 for a total of $1.3B in the bankruptcy liquidation process. Today that stake would be worth ~$25B based on the $350B rumored round. SBF would have been one of the greatest investors ever if he didn’t get caught and go to prison…

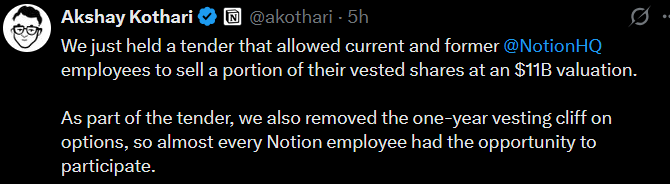

3. Notion and Clay Perform Tender Offers

Notion announced on Monday that they held a tender offer for $270M at an $11B valuation, which included a new investor joining the cap table (GIC). And Notion also did some very employee-friendly things….love to see it.

A few interesting things:

This is above their 2021 Series C valuation of $10B. And is even better than just $1B higher because the investors are buying common stock versus preferred. In theory, preferred shareholders would pay more for their preferential rights.

Generous tender offer rules:

Removed one-year vesting cliff for new hires. Very generous move that will make employees happy and likely won’t change employee turnover.

All current and former employees can sell with the same rules. Many companies only allow it for current employees.

Clay also announced a tender offer of $55M at a $5B valuation. While we don’t know if they did anything like Notion, this is the second tender offer Clay has done in 9 months. That alone is employee-friendly.

Why hasn’t my private company done any tender offers? I want liquidity too!

The primary reason is there is not enough investor demand for your stock. Truth hurts, but that is where 99% of private companies live right now…

Are there any downsides of running tender offers?

A few potential ones:

They can increase 409A price, which hurts future employees and stock option grants. If you run large tender offers, then those have to be factored into the 409A price.

Can be a distraction for the company

Potentially can hurt employee retention because employees no longer have golden handcuffs.

I think tender offers can be a great thing. The 409A impact and potential distraction is real, but usually worth it given how long companies are staying private today. I have mixed feelings on the employee retention risk. You may lose some employees because they got some liquidity, but I think you also get more who stay longer because they know their stock may be liquid in the future. Same thing with hiring.

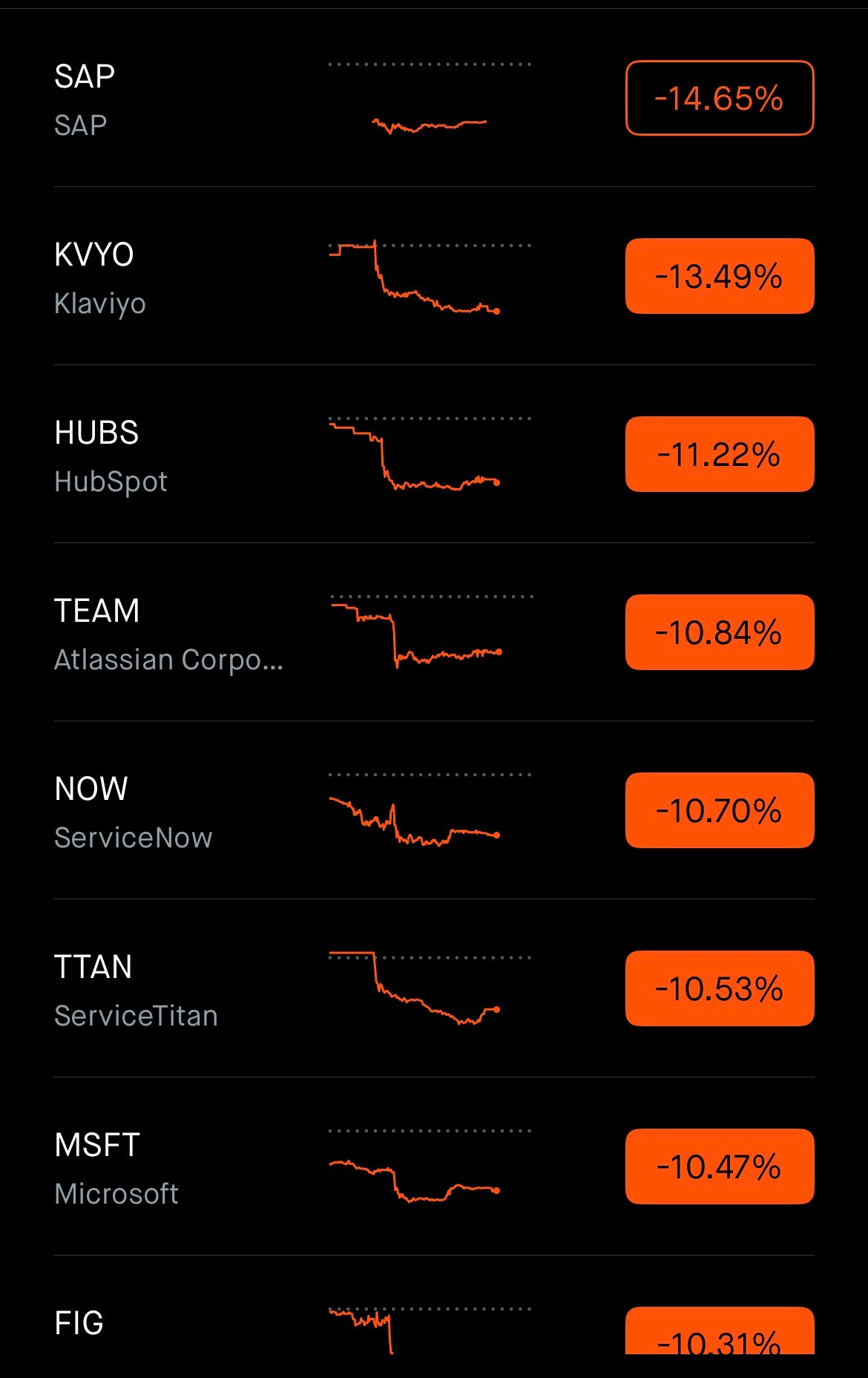

4. Bad Week for SaaS….

Software stocks puked this week. The AI disruption fears are continuing and weaker than expected earning reports are fueling these fears.

SAP was down 15% and ServiceNow was down 11% after reporting disappointing earnings. And it took EVERYONE down with them.

The market is treating all software the same. Like AI is going to wipe everyone out. But that may create some opportunities…Not all software is created equal so I think some will eventually rebound. But some will certainly get destroyed (especially many legacy SaaS unicorns). *Not investment advice obviously

Footnotes:

Download my Chart of Accounts and Department Structure template. I partnered with NetSuite to provide some best practices and also the exact template that I use.

Reply to this email with questions, comments, or anything I can help with.

*nothing should be considered investment, legal, tax, or any other kind of advice.