IPOs Are Terrible Investments! 📉

If you invest $1,000 on the day of an IPO...you will probably have less money in 6 months.

Make every dollar count with Brex, today’s sponsor.

CFOs — meet your AI mandate

AI is transforming finance, and CFOs are under pressure to make it a reality. But how do you get AI initiatives approved, implement them effectively, and ensure they drive real impact? The CFO’s guide to building an AI strategy breaks it all down, helping you fast-track AI adoption and turn expectations into execution — and results.

If you invest in the next hot IPO what are the odds you make money? And how much?

There are a few looming high-profile tech IPOs that are getting some people excited about IPOs in 2025 (such as CoreWeave and Klarna).

But before you rush out to buy the latest IPO in hopes of riches….let’s look at what history tells us about how IPOs perform compared to the rest of the market.

Full disclosure: I might crush your dreams…

Are IPOs a Good Investment?

To answer this question we must consider two primary variables:

The type of investor

The time horizon

1. Investors:

There are three types of investors in a company that goes public:

Pre-IPO investors: VCs, PE, and sometimes institutional investors. These investors generally stand to make the most out of an IPO since they bought the stock when it was private and had less revenue. Although sometimes even they can lose money if they were a late stage investor during an overpriced fundraising round.

Institutional investors - this group gets to buy the stock at the "IPO price”. These are mutual funds, banks, hedge funds, etc.

Retail investors (you and me) - this group of investors typically just gets to buy the IPO stock on the normal stock exchange.

I will cover more on institutional and retail investors below.

2. Time Horizon

What are the stock returns in the short-term versus long-term? If you plan to keep a stock for a decade then the short-term changes may not make a huge difference. But it may change your strategy of when you buy an IPO.

The first milestone I look at is 6 months from IPO because that is the typical “IPO lockup period”.

Lockup period: period after a company's IPO during which insiders, like founders, employees, and early investors, are prohibited from selling their shares. This period is typically 6 months. The purpose is to prevent excessive selling pressure immediately after the IPO, stabilizing the stock price and signaling confidence to public investors. Once the lockup period expires, insiders can sell their shares, which sometimes causes increased trading volume and price volatility.

Because so many shares are locked up, the float (amount of tradable shares) can be REALLY low for the first 6 months, which means the stock might trade an bit unusually until the lockup expires.

The median float of software IPOs for the first 6 months is just 12%!

If the float is small and a lot of investors are excited about the stock then the stock price can get bid up really quickly.

IPO Investor Returns

Headlines of massive “IPO pops” capture a lot of attention from retail investors because it makes you think of all the money you could have made if you invested in the IPO…

Did retail investors really make a 42% one-day gain on ServiceTitan’s IPO?

99%+ of the time the answer is no.

The investors that get allotted IPO price shares are institutional investors. The IPO price is what these investors can purchase the stock at before it is traded on the open market. The common folks like you and me don’t get this price…We get to buy it AFTER the IPO pop.

Bummer, right?

The “IPO pop” these institutional investors get can be huge…The median IPO pop for software companies is 38%.

**Note - A rare exception is that some companies doing an IPO will also allow certain early users or friends/family to participate at the IPO price. But this is extremely rare for the vast majority of retail investors.

Retail IPO Investor Returns

Rushing to buy the latest IPO has not historically been a great stock winning strategy for retail investors…

I analyzed 55 software IPOs since 2018 and here is how they performed:

35 (or 64%) fell below the day 1 closing price after 6 months!🤯 In other words, the majority of retail investors that invest on the day of IPO actually lost money after 6 months.

If you invested an equal amount in all of these 55 IPOs on the day of the IPO and sold after 6 months then your return would be -8%.

BUT…had you invested in QQQ (a broader market ETF) over those exact same time periods from when each company went public and held for 6 months then your return would have been +6% (or 14% better than the IPO investments)!

Only the below 13 companies (out of 55) outperformed QQQ over the 6 months following their IPO.

The remaining 42 IPOs underperformed QQQ over the first 6 months following their IPOs. And there were A LOT of big losers.

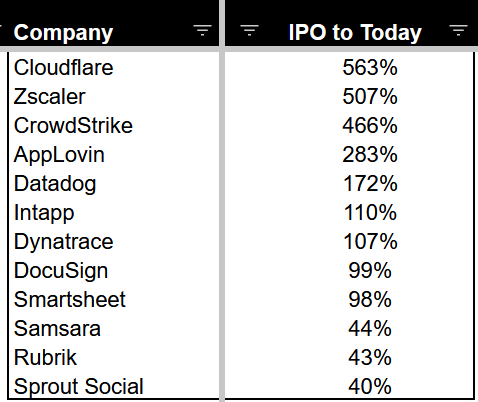

But if you look over a longer time horizon, many software companies have done really well since their day 1 IPO closing price. For example, Cloudflare declined by 12% over its first 6 months, but it now sits as the biggest IPO winner for this cohort of IPOs

The bad news though is that only 18 of these 55 companies have a positive stock return through today (from IPO day 1 close). The median return of these software IPOs is -43%!

You had to invest in the handful of big winners to do well in software IPOs over the past 6 years.

Where are the IPOs?

A couple of things need to happen for more companies to IPO:

Valuation multiples - need to be relatively high (and stable)

Market Volatility - want as low as possible

Valuation multiples need to be stable and relatively high. Multiples won’t come back to 2021 levels, but they need to be at a level that management and the board will accept as their valuation. Alternatively, if multiples are stable and lower for long-enough then maybe more people will accept them. I don’t generally think this should slow companies down from IPO’ing if all the other metrics are there, but it definitely does.

Market volatility has changed a lot over the past few weeks. The stock market has been tanking and software is getting hit more than most sectors. Volatility in the stock market makes investors nervous about investing in a newly public company which will likely be even more volatile than the general market. Volatility and lower stock prices is the biggest factor for the IPO Window. Right now investors are more risk-off than before.

Final Thoughts

If you are an institutional investor, then investing in the IPO price has historically been a great deal if you sell within the first few days of it going public. Or if you get a winner and you hold for a long time.

Retail investors (and institutional investors) will typically see a lower price after 6 months from the day 1 closing price.

The lesson: Retail investors probably shouldn’t rush into a new IPO stock. If it is a good company at IPO then it will be a good company 6 months later. But…if you have a long-term big winner (like Cloudflare) it may not make a huge difference. However, there are only a handful of big winners over the last 6 years.

*If your company is thinking about an IPO in 2025, check out my IPO Preparation Guide

Footnotes:

Do more with less and successfully navigate the accountant shortage with help from Brex

Need Fractional CFO support? Reply to this email with what you need.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Great content!

Makes me long for the late 90's / very early 2000's when $1000 put into an IPO would be $3000 by the end of the week.

RIP Good Times.