Is ARR Dead?

SaaS may not be dead, but is the definition of ARR dead? Or has it lost some meaning?

Today’s newsletter is brought to you by Brex.

AI is everywhere in finance, but CFOs rarely reveal their playbook: how they secured funding, chose vendors, and maximized ROI. The CFO’s guide to building an AI strategy tells you how to plan and budget for AI today, the key evaluation criteria, and strategies to reap the AI benefits faster.

The North Star Metric: ARR

ARR has been the North Star metric for cloud companies for the past decade because of what ARR has historically implied:

Predictable revenue

High customer retention

Highly profitable revenue stream for cloud companies

But in a world of intense competition, AI, and other changes in SaaS…is “ARR” losing its meaning?

Cloud company valuations and their financial models are built on one critical assumption: high customer retention — i.e. customers stick around for a long time.

Without high customer retention the SaaS business model (and concept of ARR) crumbles.

Defining ARR

Getting everyone in the software industry to agree on how to define ARR is an impossible task. ARR isn’t a metric governed by GAAP (accounting rules) so companies can make up whatever definition they want.

Here is the basic definition:

Annual Recurring Revenue (ARR) - the current annual recurring revenue of subscription agreements from all customers at a point in time.

ARR is more of a leading metric that should in theory establish a baseline for accounting revenue to be recognized over the next 12 months. While accounting revenue recognized is a lagging metric.

The ARR acronym has taken on lots of different forms because companies want more ARR given its importance but the traditional definition doesn’t fit neatly into what they want it to be.

Below are some public company examples of ARR:

True & Pure ARR

The truest form of ARR is when a customer locks into annual (or greater) contracts for a committed amount of spend. When the contract ends the customer will either churn or they will renew for at least another year (with maybe an increase/decrease to their prior ARR).

Definitely NOT ARR

Some things are clearly not ARR despite many people still trying to include them. The clearest example is one-time professional services should never be included in ARR.

My favorite investor slide was an ARR waterfall that had a footnote that said, “*Not all ARR is recurring”🤣

The Messy ARR

Besides these two extremes though there is a lot in between that can be harder to cleanly categorize as ARR or not.

I am not going to try to define exactly what goes into ARR in this post, but whatever companies include in their definition there is one thing that should remain true:

Customer retention must be high.

The Magic of SaaS

A big reason investors loved the SaaS business model was because its revenue was very repeatable and predictable.

Low Churn & High NRR

Customers contractually locked in for 12+ month contracts and then after that period churn was very predictable - <10% annual churn for enterprise software. Despite net revenue retention (NRR) declining over the past couple of years, most companies’ ARR have still continued to increase every year without having to win new customers.

This is what has made SaaS magical — low churn with expansion that can greatly exceed the amount of churn.

Predictable Growth

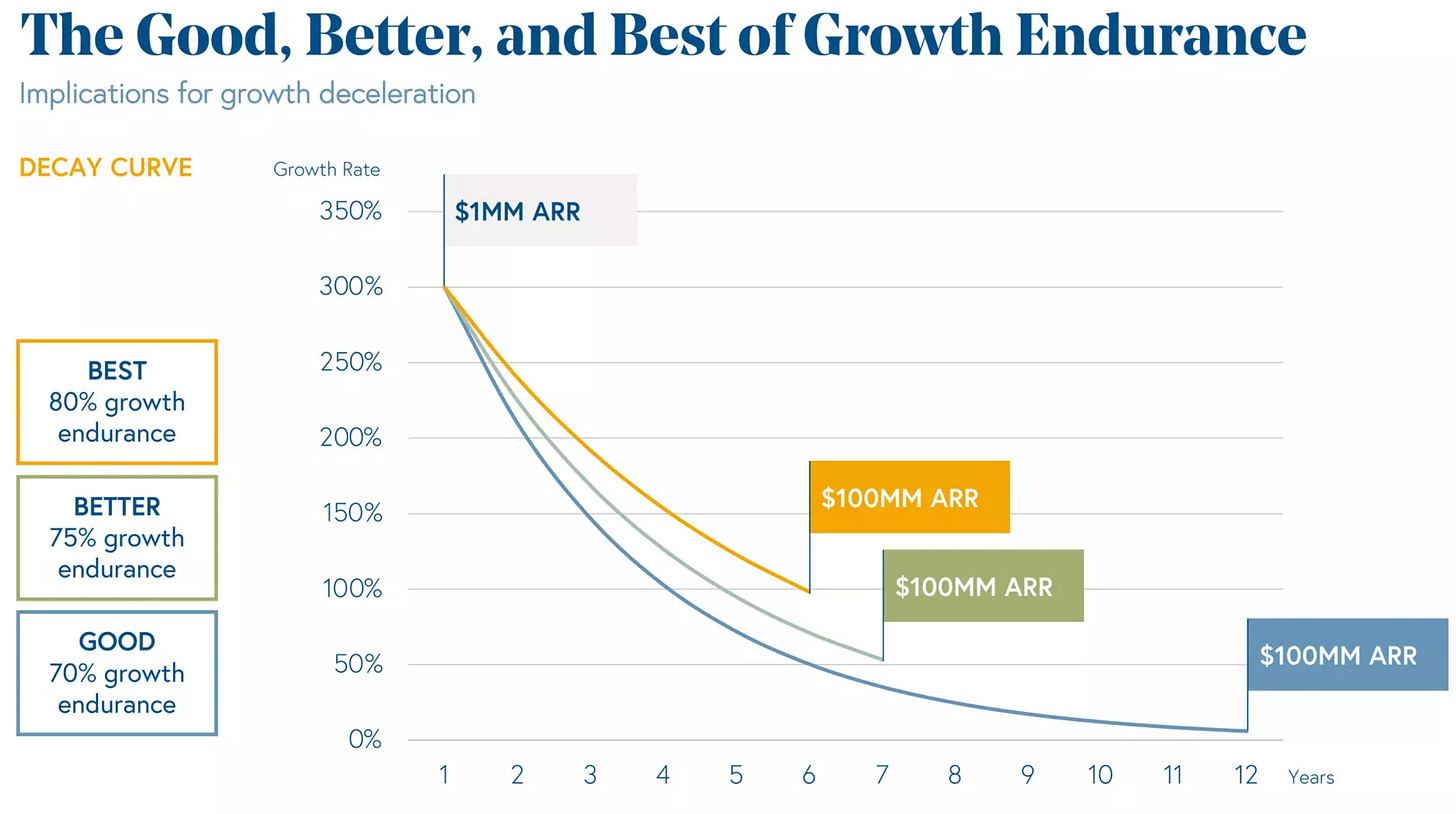

Even the rate of ARR growth deceleration has been fairly predictable (i.e. revenue growth endurance). Investors built models based on assumptions like BVP lays out below for how revenue growth would decay over time.

But will this repeatability and predictability hold true in the future? Things for SaaS have started to change and it may impact how we think about ARR…

ARR is Losing Meaning

There are three primary trends that can be seen as deteriorating the value of ARR. One of them I kind of disagree with though…

Revenue from consumption / usage-based pricing (UBP)

Revenue from AI experiments

Revenue from traditional SaaS that may no longer be as recurring as believed

1. Consumption / Usage-Based Pricing (UBP)

When UBP became popular, many people questioned if it can/should be included within ARR. Some new ways to distinguish the different revenue types was popularized:

Recurring: Guaranteed revenue that repeats and is renewed at regular intervals

Reoccuring: Revenue that occurs more than once but it is not guaranteed and is less predictable.

Many companies have adopted a hybrid model where customers lock in a minimum annual commitment and overages are charged based on usage.

Should usage-based pricing be included in ARR?

Some say that UBP is not ARR because it is reOccuring. But it likely isn’t that black & white. The answer depends…

UBP is a billing model decision. It does not typically impact the actual software being sold. Customers just now have the ability to churn (or expand) whenever they want. Similar to traditional SaaS though, if product-market fit isn’t achieved then retention will be weak.

The problem with UBP is it’s less predictable and harder to forecast, but that doesn’t necessarily mean it shouldn’t be considered ARR.

If it meets the intent of ARR then I have no problem including it. But forecasting which portion truly fits into ARR can be tricky, so investors should understand the volatility of it.

2. Experimental Runrate Revenue

I first heard the term “ERR” from the folks at Altimeter:

ERR = Experimental Runrate Revenue

The argument for needing a new term is that there is lots of “experimental” revenue in AI right now. Companies are purchasing AI to test it out, but there is very little commitment since many companies are just experimenting with AI (so churn will be high). Therefore, calling it ARR is deceiving based on how ARR is traditionally defined.

If annual churn in 40% then it is hard to justify calling it “recurring” revenue.

3. Traditional SaaS Revenue

The contractual guaranteed minimum spend of customer contracts is never what made ARR a valuable metric (unless companies signed 5+ year customer contracts). Annual contracts just decrease the number of opportunities that customers have to churn.

If most customers churn after one (or even two years), do you have ARR?

It is the assumption of high customer retention that made cloud companies valuable and ARR an important metric. Given CAC payback periods, customers have to stick around at least 2-3 years to simply payback the acquisition costs and other costs to run the business (R&D and G&A).

Below are some benchmarks for top quartile CAC payback periods. ARR as a metric is pretty meaningless unless customers stay way past the CAC payback period.

Many traditional SaaS companies are seeing themselves get disrupted by AI first companies or other solutions. If churn ticks up enough, should we even count what they have as ARR? At least ARR losing some of its meaning…

Final Thoughts

A lot is happening to the SaaS industry right now.

Many companies will adapt and figure out how to keep growing and generate meaningful value. But we are in a period of disruption.

Investors and operators need to be honest about whether the same ARR definition holds true to all of a company’s revenue streams.

The entire foundation of what the SaaS model (and ARR) is built is strong customer retention. Without strong retention the SaaS business model breaks.

Footnotes:

AI can bring you more cash flow predictability. Check out how AI can help your business planning for cash and cash runway

Fill out this form if you want to be automatically invited to all future OnlyCFO webinars

Check out OnlyExperts for to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

Dear Only,

I swear I wrote my SaaS Metrics Palooza presentation before you published this. You're asking if ARR is dead. CJ at Mostly is trying to differentiate recurring vs. re-occuring revenue. TheSaaS CFO is calling for a new SaaS P&L. I'm calling ARR the Achilles' Heel of SaaS metrics, which as a statue, should resonate with you.

This is a real issue and a lot of people are identifying it and wondering what to do about it. So great post and thanks for weighing in.

My evolving take is this: for internal analysis, reporting, forecasting, etc., you need to analyze this in depth and it's really a pricing model (and contractual terms) optimization discussion. For SaaS metrics, it's all about finding the right *proxy* for ARR and then just plugging that into the existing formulas.

In the end, I think spend = truth and, to your point, unless you're doing 10-year deals, *all* of it might-recur vs. will-recur. The latter is simply amortization and that's not, originally, IHMO what the second R in ARR meant. Compared to on-premises you might renew your contract which in on-premises was a concept that didn't even exist (except for maintenance).

Great read!

ARR is definitely nuanced especially with early/mid stage startups, it can give a very misleading view of scale.

You mention hybrid UBP - a lot of SaaS startups enforce a UBP with ‘minimum spending commitments’ so essentially that latter portion becomes the RR component. So for businesses that see positive NDR, the ARR is understated and for those that don’t, this will overstate it.

Also, startups tend to give SaaS customers flexible opt outs - it’s surprisingly common for customers to negotiate a price break and no early termination penalty. This + revenue concentration for the low volume, high ACV businesses tend to overstate ARR as well.

Devil is always in the details!