Is the IPO Process a Scam?

Did Figma actually leave $3B+ "on the table" with their IPO?

Today’s Sponsor: NetSuite

Building the Finance Org: Building a world-class finance org starts with the people. I collaborated with NetSuite on the best practices for building the finance org — including my framework of when and who to hire on the finance/accounting team.

Figma’s 250% IPO Pop

Every time we have a tech IPO that has a huge day 1 pop we can count on Bill Gurley to remind everyone how much money the company “left on the table”. And why IPOs are terrible.

Bill Gurley makes a lot of valid points on the debate between IPOs vs DPOs, but I think a lot of other people over simplify the decision and miss some key considerations.

Is an IPO perfect? Absolutely not. But I think it’s still the right answer for many companies today.

How much money did Figma “leave on the table”?

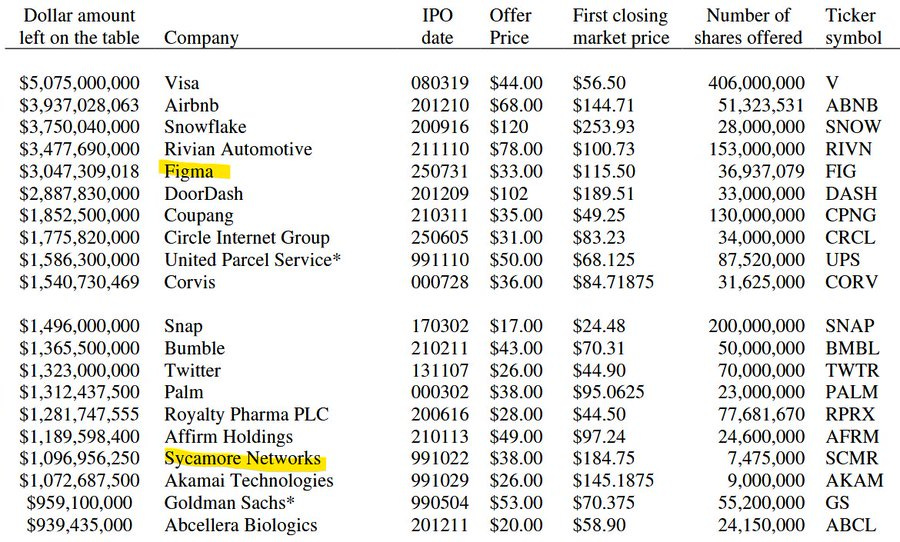

IPO critics claim that enormous amounts of money is “left on the table” because investment bankers are incentivized to materially underprice IPOs so they can then provide IPO allocation to their top clients and keep them happy.

If there is a mispricing then there are winners and losers:

Winners: Investors at the IPO price and the investment bankers who made it rain (in cash) for their top clients

Losers: Figma and shareholders that sold at the IPO price

How much money did Figma “leave on the table” with their IPO?

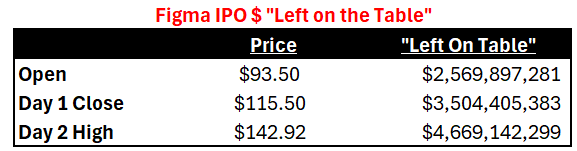

Based on 42.5M shares sold in the IPO (including the greenshoe) at an IPO price of $33, the chart below shows three figures that I have seen be discussed.

I have heard a lot of people use the ranges above to say how much Figma “left on the table” — from $2.6B to nearly $4.7B. That would be a HUGE mispricing and lost money if true.

Figma’s IPO pop of 250% represents the highest pop since 1999…is it a sign of a bubble? Maybe investors are IPO’d starved given the drop off in IPOs and all the traders and gamblers rushed in to bid it up?

Million Dollar Question: How much of the money people claim got “left on the table” is a result of the IPO process versus a mispricing of the underlying stock?

1. Primary vs Secondary

Figma didn’t need the IPO cash. They have plenty. In Figma’s case, roughly two-thirds of the IPO was actually secondary sales (existing shareholders selling) and one-third was primary (new shares issued by Figma). This means only about one-third of the “money left on the table” would have gone to Figma itself — the rest would have been potential upside for the insiders who sold.

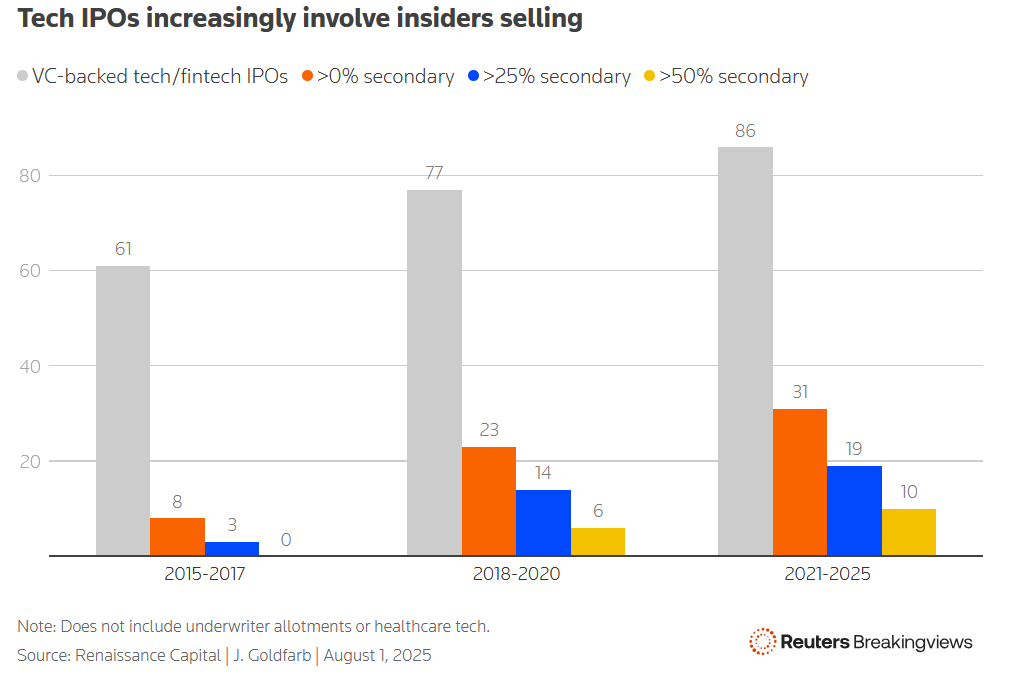

Also worth noting that insiders selling at the IPO (versus it being almost all primary) is increasing.

Figma CFO said the following about the massive stock pop.

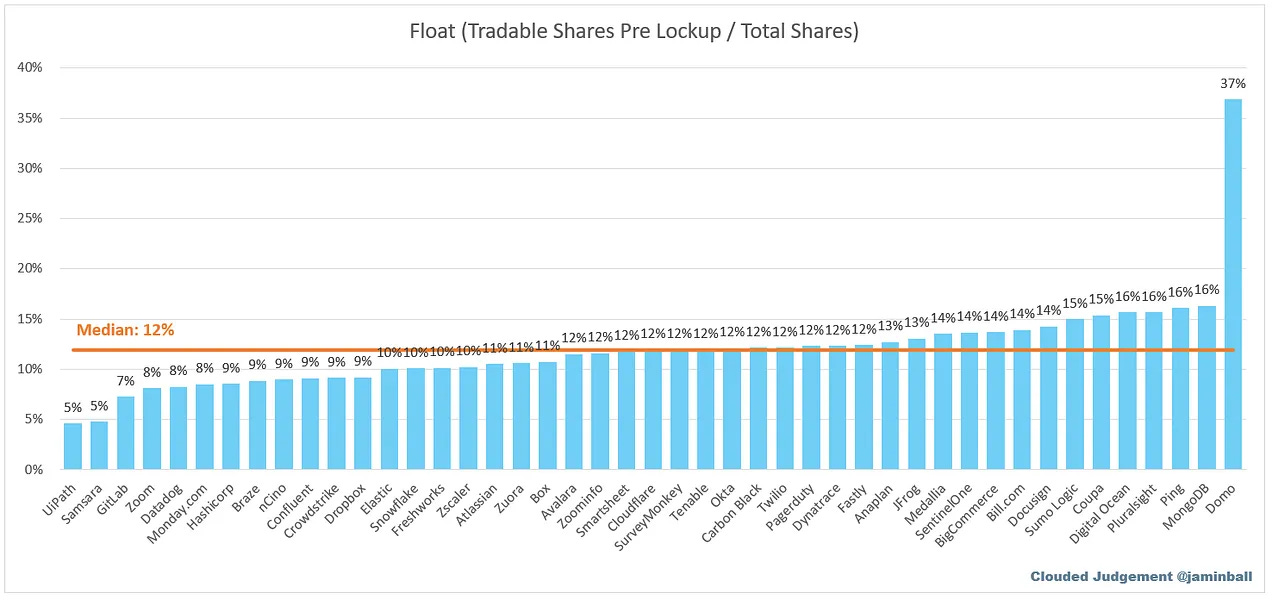

2. The Small Float

The stock price immediately following an IPO can be extremely volatile due to the small float (i.e the number of tradable shares).

Figma’s float is ~8% — 42.5M of IPO shares out of a total of 487M shares. Typical tech IPO floats are already low, but Figma is certainly on the low side at 8%

But even this small float overstates how much Figma stock is actually being traded. What is the “free float”? In other words, how many holders are actually selling?

When determining the IPO allocation, you want a mix between long-term investors and the flippers (like hedge fund folks) so that not all of the float is tied up with the long-term investors. The Figma CEO approved the price to apparently attract certain long-term investors.

Because many IPO shares are allocated to long-term holders who don’t sell quickly, and some are held back for stabilization by the underwriters, the actual tradable supply on day 1 (‘free float’) can be a fraction of the reported float. In Figma’s case, based on typical allocation patterns for hot IPOs, the effective free float may have been under 3%.

Why does float matter?

Supply and demand.

Supply is significantly restricted while the demand is super high for a hot IPO. It’s not uncommon on a day of high volatility, such as the first day of trading for an IPO, to see the total volume of shares be a high multiple of the IPO offering size.

Traders (retail investors, gamblers, etc) are excited about the stock and are flipping it as it rises quickly (trying to make a quick easy buck). We need the gamblers/flippers because they create the actual float by selling. They buy only for the pop. No pop means they don’t invest. If gamblers want the stock then they have to pay the higher price to get it which drives price up.

3. The Promotion

The IPO process drums up a lot of demand through the excitement of a new IPO — with the main company marketing push being the “Roadshow”. The executives travel to a bunch of different states/countries and meet with a ton of potential investors in an exhausting ~10 day period. The investment banks are talking their clients and creating excitement.

Then you see headlines like below that show how much demand there is (and that creates even more demand!).

Again…it’s supply and demand. Large institutional investors are buying large blocks of shares in the IPO process.

Post IPO Performance

Now let’s fast forward a bit.

Figma has now “crashed” nearly 50% since its high on the second day of trading.

The small float means that there can be lots of volatility in the share price. But also…when a stock climbs 300%+ in just a couple of days, there are more investors that are going to be willing to sell. If the price target hit investors’ 3-year price target after 2 days, they are much more likely to take some chips off the table.

The stock is still up ~140% but volatility is extremely high.

This volatility can be VERY distracting for employees…say you had $10M worth of stock at the IPO price. Then at the peak it’s with $40M+ and then a couple days later it’s worth $20M. And there is nothing you can do because you are locked up for 6 months. They are still rich but those are big swings.

Are IPOs a Scam?

Figma did NOT leave $3B+ “on the table”.

Was Figma underpriced at $33? Definitely.

But the question is what would Figma be trading at today if they did a DPO instead. I think there is no question that in a DPO that the “pop” would not have been nearly as large and the stock would be trading lower than it is today. The higher price is at least partially due to the mechanics/process of the IPO.

IPOs are not perfect and maybe not the most efficient, but they are not a scam (usually…).

Footnotes:

The Finance Org Chart (by OnlyCFO): Get my deep-dive I did with NetSuite

Check out the below from Mr. OnlyLawyer

Was waiting for you to hit this topic, my friend! 😉.

So much to say here… and not enough time/space to do it in a comment. Agree with most of your analysis… but as someone who spent many years with a front row seat on this (as a banker), I will tell you that the idea that a large portion of the shares that were sold to institutions are “held” — thus making the float even a lot smaller than 8% — is almost certainly wrong. In fact, most of the institutions do flip — especially when there’s a big pop. The public never gets to see this directly, but the companies (and the bankers) get to see it when they compare the institutional holdings (reported every quarter after IPO) with the allocations at the IPO.

There is no question that these allocations to the large institutions are highly sought after — in effect, gifts. But those promises that the positions will be “held” just generally don’t pan out for most of them, hedge fund or not!