📉Lessons From Amplitude's Fall

Direct listings, extended stock option PTEPs, metric struggles, and other learnings from Amplitude

👋 This is a paid subscriber post🔒. There is also some good stuff before the paywall :). Become a paid-subscriber and get full access to all newsletters and other valuable resources.

Most people can get reimbursed from their company’s education budget. Get 30% off by subscribing now! (I might not do another discount in 2025)

Thank you to the 30k current subscribers! 🚀

Lessons From Amplitude

Amplitude went public in September 2021 via a direct listing (instead of a traditional IPO). Like many cloud companies over the past several years however, Amplitude’s valuation multiple peaked in late 2021 at the top of the SaaS bubble.

Amplitude is currently the 7th worst performing public SaaS stock since the peak of SaaS and has since fallen by 84%.

Today’s Outline:

Relics of ZIRP (FREE)

Direct Listings vs IPO

Extended Post-Termination Exercise Periods

Lessons from Amplitude (PAID) 🔒

Stock performance

Gross margin

Rule of 40

Revenue Growth

Profitability

Amplitude’s NRR issues

What Amplitude needs to do

📜Relics of ZIRP

Amplitude did two fairly unique things that are worth exploring pros/cons. Neither is necessarily bad (they are probably good in some circumstances), but they are discussed less in a non-ZIRP era.

Direct Listing (instead of traditional IPO)

Extended post-termination exercise period (PTEP) of 10 years

1. Direct Listings

Amplitude was the last cloud company to go public via direct listing instead of the traditional IPO path. While not many cloud companies have gone public since 2021….they have all chosen the traditional IPO path.

I don’t think direct listings are bad/dead, but I think they will be even more rare over the next couple of years. Few companies have gone public in the last three years so there is less appetite for taking a riskier path to becoming public

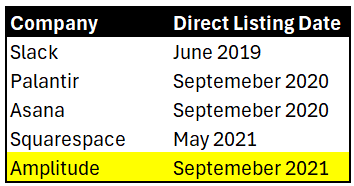

Below are the cloud companies that have gone public via direct listing in the past several years:

Below are the pros/cons of the traditional IPO path and a direct listing is mostly just the opposite.

Pros of IPO

Raise additional capital

Banker expertise and support

Stock price stabilization by enabling banks to sell additional shares to reduce volatility

Roadshow and bankers help create demand for stock which can help valuation

Increased investor confidence by having strong bankers behind them

Disadvantages to IPO

Higher costs (3.5% - 7% of capital raised)

Additional dilution from raising additional capital.

Lock-up period of typically 180 days where insiders (employees, early investors) cannot sell their shares immediately on the open market.

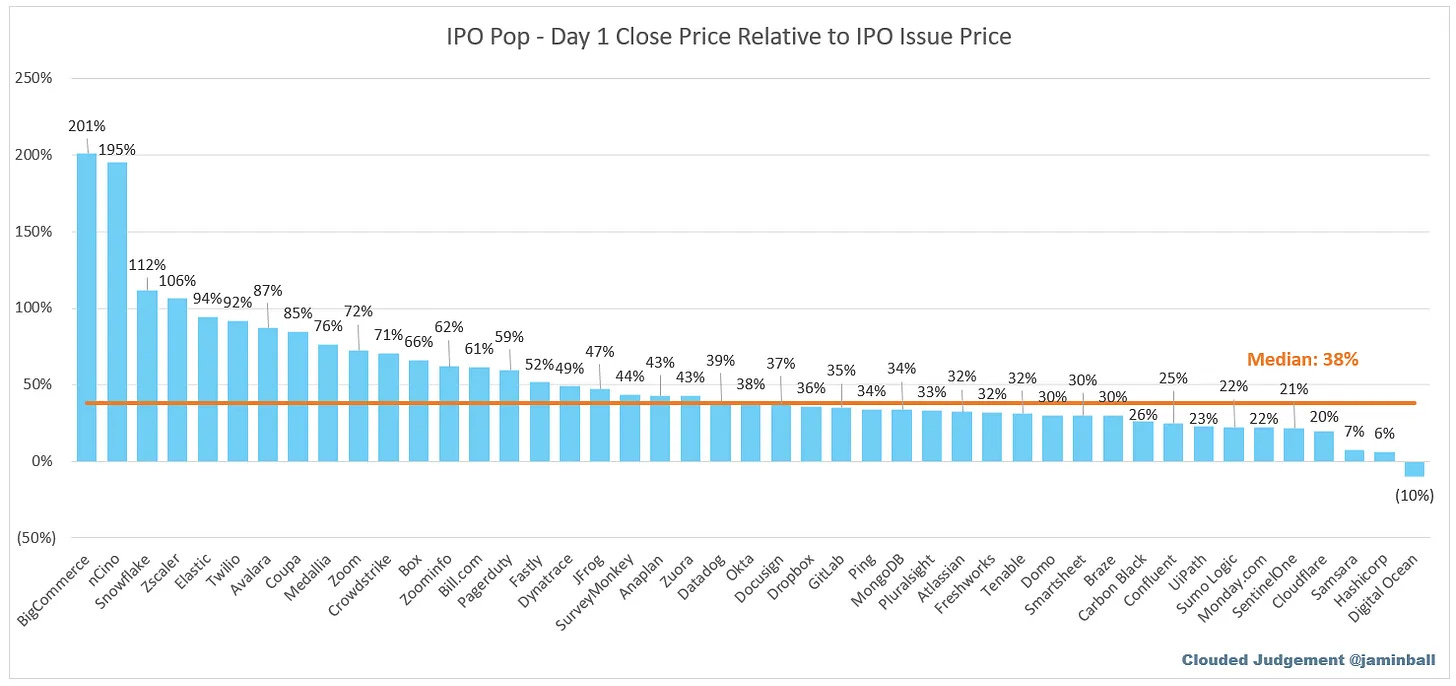

Money Left on the Table: The “IPO Pop” means the company discounted the shares too much.

Amplitude’s CEO said the following on why companies should do direct listings:

You have to do a direct listing as a CEO. If you aren't, you're being a poor fiduciary to your current shareholders. Last year, on average, traditional IPOs underpriced the stock by 50% so you're basically selling a dollar for 50 cents.

I once heard one public company CFO call it "the largest arbitrage opportunity in all of finance"

While he is not wrong on IPO pops, which have been massive (see below), I disagree that the IPO pop exactly equates to “money left on the table”. Some of the pop comes from the fact they are doing a traditional IPO, small float, the types of investors that are brought on to support the IPO, etc.

What would the price have been if a company did a direct listing instead of an IPO? My hypothesis is it would have been quite a bit lower in most cases…

Having said the above, I do think a direct listing makes good sense in some circumstances but it is certainly not the default right decision. In stable conditions where the market has digested a few recent IPOs, then we may see direct listings pick up a bit for top quartile companies. This will be especially true as more companies go public when they are profitable and don’t need to raise money from a traditional IPO.

2. 10 Year PTEP

A 10 year post-termination exercise period (PTEP) is a relic of ZIRP that should die. It is overly employee friendly to the determent of the company. I am pushing all of my portfolio companies that have extended PTEPs to rethink it. — Anonymous Tier-1 VC

Amplitude was one of the early tech companies to radically change the standard stock option PTEP, by giving employees up to a 10 year exercise period after termination.

99% of tech companies give a standard 90 day window for employees to exercise after they are terminated, but Amplitude changed their policy to give the maximum allowable PTEP of 10 years.

Employees of private companies are typically given stock options, which is a right to buy a certain number of shares at the current fair value price. In order to own shares, employees much “exercise” or buy the shares at the defined price. If they don’t exercise within the PTEP window then they lose their stock options.

Amplitude changed their 90 day window to be 10 years. So as long as employees vest (earn) their stock options then they have up to 10 years to exercise.

Pros of extended PTEPs:

Employee Cash For Exercise: The main benefit is employees don’t have to come up with the cash to exercise (and cash for potential tax consequences) when they terminate from the company. The exercise price and tax impact can be huge if the valuation has increased a lot.

Recruiting: Can help with recruiting efforts as an employee perk.

Cons of extended PTEPs:

Employee Retention: Forcing employees to spend their cash to walk away encourages employees to stay at least through a liquidation event. It is much easier to leave a company when you don’t have to make that decision. Some will argue this can also be a pro because you want people that don’t want to be at your company to leave (they are just hanging out until a liquidity event).

Equity Overhand and Dilution: There can be massive amounts of additional dilution resulting from extended PTEPs. A LOT of employees choose not to exercise when they leave a company because of the cash impact, but with an extended PTEP all that dilution hangs around a long time.

Given the change in environment since 2021 (it’s currently an employer’s market), there is a lot less discussion about extended PTEPs. In fact, I have heard from multiple companies that did extended PTEPs that they are eliminating it for new hires.

Was extended PTEPs just a relic of ZIRP?

It is certainly very employee friendly so companies need to at least fully consider the dilution impact. There are lots of ways to potentially structure an extended PTEP that can be more of a middle ground.

And investors need to be aware of their companies that have this huge dilution overhang because I don’t think many understand the potential dilution impact to their investment.

What Happened to Amplitude?

In late 2021, Amplitude sat in the top 10 highest revenue multiples amongst cloud companies but has since been on a steady decline and now trades at just a 4x NTM revenue multiple which is near bottom quartile.