Today’s Sponsor: NetSuite

CFOs, your best year starts now. Work through 365 small, sustainable steps to keep wellbeing and a positive working life top of mind each day of the year. Download your 2025 daily coaching journal now.

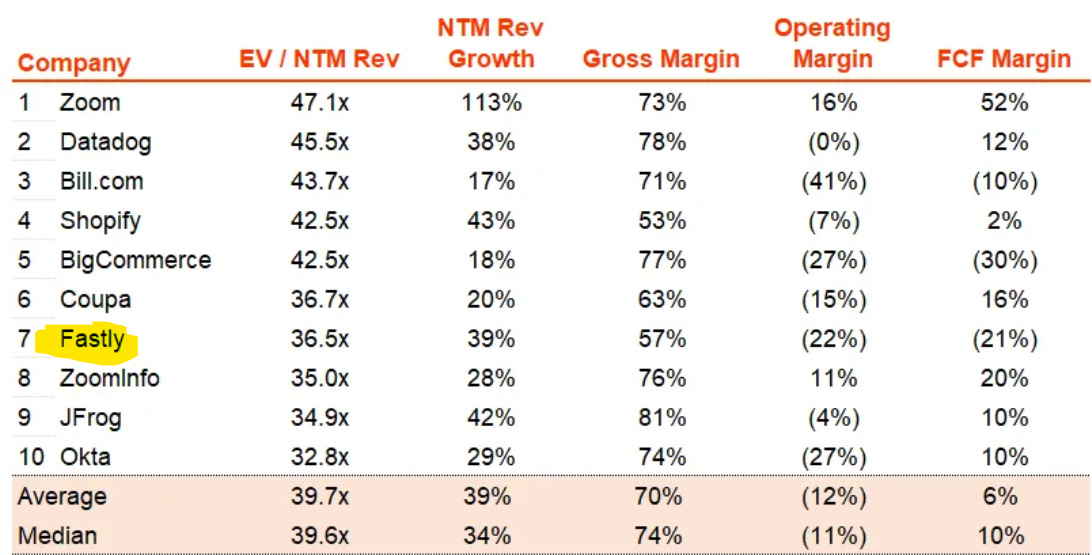

Once upon a time Fastly had the 7th highest revenue multiple and traded at a 36.5x NTM revenue multiple. Fastly was the shining star that would power the internet (or something like that). Unfortunately reality eventually kicked in…

And actually…this could be a story about several of the top 10 companies from October 2020. Several of these companies have fallen quickly out of favor and the reasons seem obvious now.

Fastly released earnings this week and its stock puked on the results/guidance…dropping 21% in a single day. And that is after the stock has already fallen by 90%+ from its high back in 2020.

What happened to Fastly?

Fastly plummeted from the 7th highest revenue multiple to the the 9th worst revenue multiple amongst the ~85 public cloud companies I am tracking.

Here are some lessons on what happened…

Broken Unit Economics

The unit economics at Fastly have always seemed a bit broken, but investors were sold on the growth story which was supposed to fix all of those problems. And if strong revenue growth continued then maybe that would have been right to some degree, but Fastly was never going to be a super high profitable business like other SaaS companies.

Gross Margins

Fastly never had true SaaS gross margins. They have always been < 60%, which is in the bottom decile of public cloud companies that I track. Last week I discussed how Amplitude’s financials were bad and their gross margins (highlighted in yellow below) are nearly 20 percentage points higher than Fastly!

If all other expenses are the same then a company like Fastly will NEVER have the profit potential as other SaaS companies given their much lower gross margins. Gross margins represent a ceiling on profitability.

Gross margins are stubbornly sticky after a certain stage so I wouldn’t expect any big changes anytime soon.

Rule of 40 Score

Fastly commands the 4th worst Rule of 40 Score at just 3%! The Rule of 40 Score is comprised of 1) revenue growth + 2) profitability

#1 Revenue Growth

In Q4 2024 Fastly only saw 2% YoY revenue growth….Fastly is going no where fast!

Fastly is bottom decile of public cloud companies when it comes to revenue growth. And this is particularly bad relative to their profitability (or lack thereof).

#2 FCF Margins

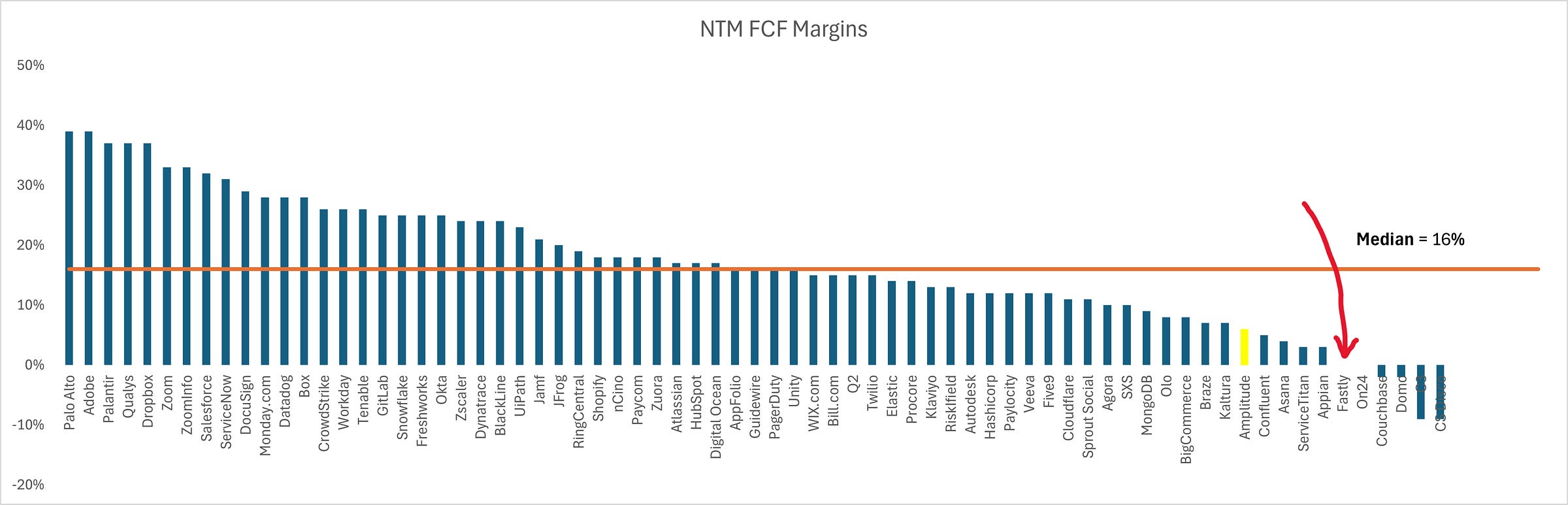

If you can’t show strong profits at just 2% revenue growth, then you probably never will. Fastly had a negative $35.7M in FCF off of just 7% total revenue growth in 2024.

The expectation in SaaS is that as revenue growth slows, profits will skyrocket. Well…Fastly was losing lots of money before, but they are just losing a lot less money now.

A company that can’t generate positive profits is worth approximately $0 in the long-run…

NRR Death Spiral

Fastly is also in a NRR Death Spiral, which helps partially explain Fastly’s issues. NRR is currently at 102%, which down from 105% from last quarter and 113% last year. That is a rapid decline in NRR!

The unit economics were not that great when NRR was much higher so at 102% NRR the unit economics certainly won’t work. Fastly MUST improve its NRR in order to get back to growth and start to become efficient.

Glassdoor Rating

I don’t look at Glassdoor ratings/reviews a lot because most public cloud companies are within a reasonable range where I don’t really care.

But I have personally talked to several people who have worked at Fastly that speak about how toxic the environment is. Fastly’s Glassdoor rating supports that…I don’t know of any other major public SaaS company that has a lower rating.

Fastly is in a culture/people death spiral, which is probably the most important problem to fix. It’s really hard to build great stuff if lots of employees hate the company and are continually leaving.

Below is a fun recent Glassdoor review….If your company has this low of a rating and employees are telling everyone to run away, then you will not get the best people.

Final Thoughts

Seems like a big change would have to happen to turn Fastly around. The type of change often only possible by a PE take-private, but it would be a pretty big gamble that PE might not want to take.

In order of priorities, Fastly needs to fix the people/culture problem first. Then it MAY be able to solve its other issues (starting with NRR).

I really do want every software company to win and think most companies can turn things around if they have the right people in place. Good luck Fastly!

Footnotes:

Check out → 2025 daily coaching journal now.

Sign up for the OnlyCFO webinar series! Our next webinar is on February 19th on the M&A environment in 2025.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

All hail king Cloudflare! I'd be interested in a comparison between Fastly's core competition and if others are going to have a similar fate...is this a leading indicator?

There will never be another mania quite like the SaaS bubble of 2021