Lies We Tell About Efficiency

Determining if a company will actually generate long-term value

Today’s newsletter is brought to you by Brex.

AI is everywhere in finance, but CFOs rarely reveal their playbook: how they secured funding, chose vendors, and maximized ROI. The CFO’s guide to building an AI strategy tells you how to plan and budget for AI today, the key evaluation criteria, and strategies to reap the AI benefits faster.

Efficiency Metric Lies

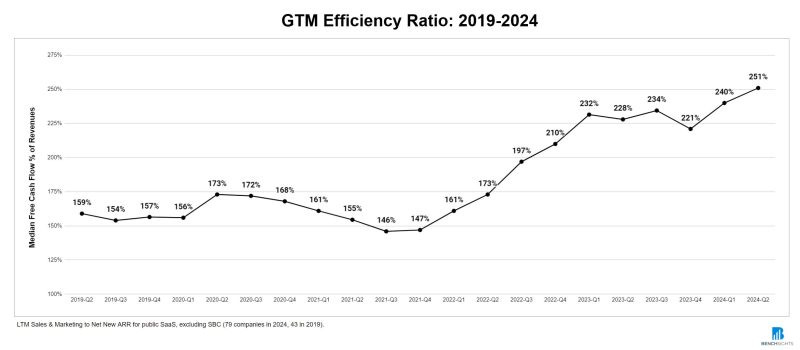

We all know that investors today want to see less cash burn and more profits. And most companies have received the message — as evident by the significant increase in FCF (free cash flow) margins since its low in 2022.

However, many people correlate this chart with higher efficiency - “FCF margin is higher so the company is much more efficient!”

Those people would be wrong though…

A positive change in FCF margins DOES NOT necessarily mean a company is becoming more efficient.

A company that was burning $25M in cash that is now only burning $5M of cash is still burning money. Is this company efficient? It might be, but that depends on several other factors that you don’t know when just looking at cash burn.

The chart below looks at the median S&M (sales & marketing) % of Net New ARR for public cloud companies. In other words, how much S&M spend is required to generate $1 of net new ARR (CAC Ratio).

CAC Ratio = S&M spend / Net New ARR

In Q2 2019 the median cloud company spent $1.59 for $1 of net new ARR. Today it costs $2.51 for every $1 of net new ARR!! That is a 58% increase in cost…

All else being equal, we are much less efficient today than in the past. But I would argue that things have also changed (but not in a good way), so this chart of inefficiency doesn’t even capture the full problem.

Not only are we spending a lot more to capture new revenue but:

Churn rates are increasing

Competitive pressures on price are increasing

AI costs will start eating away gross margins

Expansion opportunities are shrinking (more competition)

To summarize, not only are costs to acquire new customers exploding but the lifetime value of customers are also shrinking. This is a deadly combination.

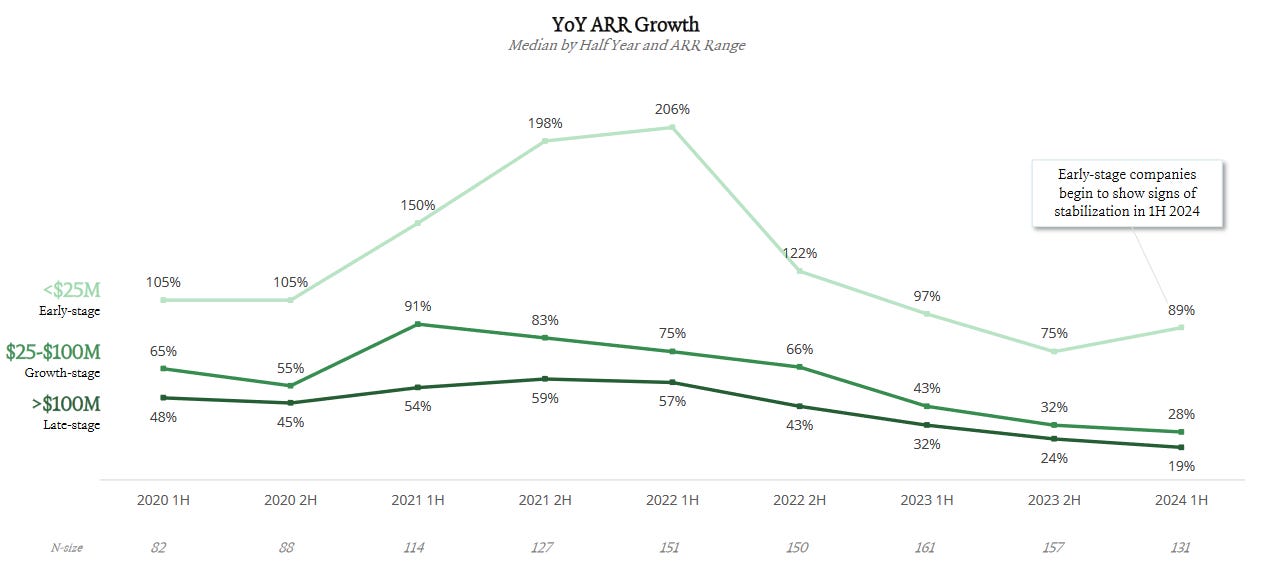

I know there have been a lot of SaaS doomers lately, but the above does not mean SaaS is dead (yet). But rather we need to adjust one (or both) of the following to make the math work:

Revenue growth needs to reaccelerate

Cost to acquire revenue needs to come down

FCF Margins vs GTM Efficiency

How do we reconcile the great improvement in FCF margins but at the same time we are seeing terrible GTM efficiency?

GTM efficiency is based on the relationship between GTM spend versus *net new* ARR. GTM efficiency tells us how efficient we are at adding revenue. So it can be a leading indicator of overall efficiency.

While FCF margins is based on the current total ARR balance. FCF margins simply tells us how profitable we are today.

But a company that improves FCF margins from -50% to 0% still might be in trouble if their GTM efficiency is starting to spiral out of control because it means future profitability will be weak and might never greater than ~0%.

Improving FCF margins from -50% to 0% is meaningless unless you can also improve FCF margin to 20%+.

Building an Efficient GTM Team

GTM efficiency is at an all-time low right now for cloud companies. The quick decline in revenue growth rates and slowness of companies to adjust is mostly to blame.

Companies need to quickly determine what they need to do to build an efficient GTM team. There are two primary things you need:

GTM strategy, strong leaders, building a great team, etc (this is above my pay grade)

An honest discussion about the math (I am decent at adding/subtracting)

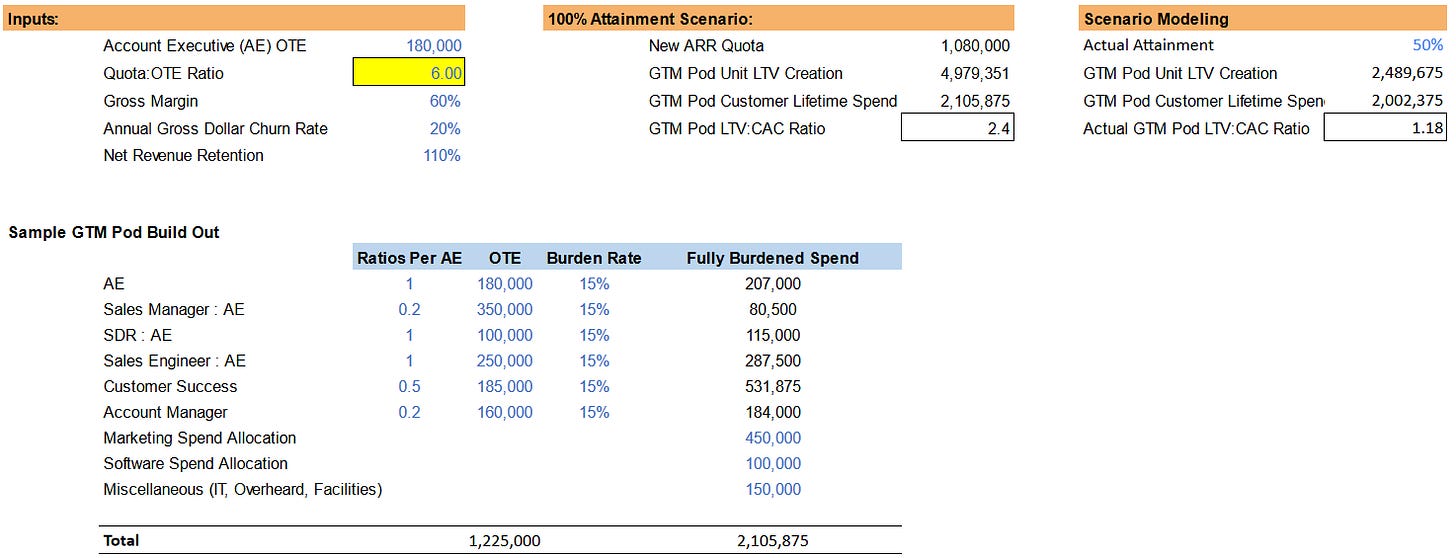

Here is a simple model I created to show GTM Pod efficiency that you can play with.

I like to analyze GTM teams at the atomic unit (GTM Pod) required to sell because it really shines a light on the efficiency of your teams. A GTM pod is all the headcount and spend that surrounds an individual Account Executive (AE).

For example, a sales manager may have 5 AEs report to them so an AE is allocated 0.2 of a sales manager. And maybe every AE gets one SDR, 0.5 SE, and so on.

As you can see, the costs start to build really quick.

During annual planning for 2025, companies need to take a hard look at their GTM efficiency and really understand their GTM pods if they want to be truly efficient.

Final Thoughts

A lot of companies have been able to show improving FCF margins and pass it off as if they are becoming more efficient. But those lies will eventually catch up (and probably soon).

Improving FCF margins from -50% to 0% is meaningless unless you can also improve them to 20%+. Many folks are celebrating the first milestone (breakeven) but will soon wake up to the reality that they can’t get to the next (most important) milestone.

Make sure to understand the current GTM efficiency metrics as that will be one of the best leading indicators of long-term success.

Footnotes:

AI can bring you more cash flow predictability. Check out how AI can help your business planning for cash and cash runway

Reply to this email if you need a fractional CFO and/or bookkeeping for your company.

Check out OnlyExperts for to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

Solid post. Your atomic unit mirrors my approach to forecasting where we agree on a revenue target and then I use some similar heuristics to determine how many people (and how much money) we need to achieve that goal. Only I go one step further and use that same goal to determine how much we need to invest in R&D as well (not just GTM).

Great post!