Live or Die by Product-Market Fit

Understanding the financial indicators and impact of weak or lost product-market fit

Today’s Sponsor: TigerEye

TigerEye helps go-to-market and finance plan, predict, and measure the performance of their sales team. TigerEye’s AI-powered business simulation engine analyzes every change to a company’s CRM to guide decisions and show where they’re headed.

Learn more at tigereye.com or watch an on-demand webinar with co-founder and CEO Tracy Young.

All companies that go out of business do so for the same reason – they run out of money. —Don Valentine

What causes a software company to run out of money?

They never really find or don’t maintain product-market fit (PMF)

They don’t properly manage expenses and cash runway

Poor execution

#2 and #3 are critical for any business to survive but they require strong management. It is hard to overcome weak management.

Weak PMF is a death sentence. Software companies can appear OK with weak PMF for a short time because they are well-funded, have a well-known founder, killer sales team, etc. But weak PMF eventually catches up to you if no changes are made.

What is product-market fit (PMF)?

Product-market fit (or “PMF”) occurs when a company addresses a good market with a differentiated product that can satisfy a market segment’s needs.

Below are some of my favorite quotes about PMF:

Do any users love our product so much they spontaneously tell other people to use it? —Sam Altman

Product-market fit is when your customers become your salespeople. —Michael Porter

When the customers want your products so badly that you can screw everything up and still succeed. — Don Valentine

A critical point that many folks forget about PMF is that it is NOT a one-time thing. The only thing that matters for companies is finding PMF and then once you have it, fighting everyday to maintain it.

Lots of things can push companies from strong to weak PMF really fast. If companies are not adapting and continually building PMF then things can quickly spiral downward as they lose PMF.

Financial Signs of Weak PMF

Financial signs of weak or deteriorating PMF are usually lagging indicators so when multiple of the below signs are present then the company is likely already in big trouble.

Churn is high and/or increasing

Expansion is hard and/or becoming harder

Highly inefficient, particularly within sales/marketing

Gross margins are bad and/or worsening because the sales team has to discount a ton to convince people to buy

Revenue growth is slowing more than it should

Customer support and engineering teams are over staffed to compensate for lack of PMF (i.e. giving away services)

Some of the above indicators will appear because of deteriorating macroeconomic conditions, changes in competitive landscape, etc. BUT…when a company has multiple indicators over a longer period of time (and above that of their peers) then PMF is likely also an issue.

A major management red flag is when they continually blame macro conditions for all of their issues when in fact it is primarily PMF. If they are only blaming outside factors then they are in denial and not fixing their PMF issues….which will quickly kill the company.

Death By PMF

False indicators/confidence in PMF is a great way for a company to get killed.

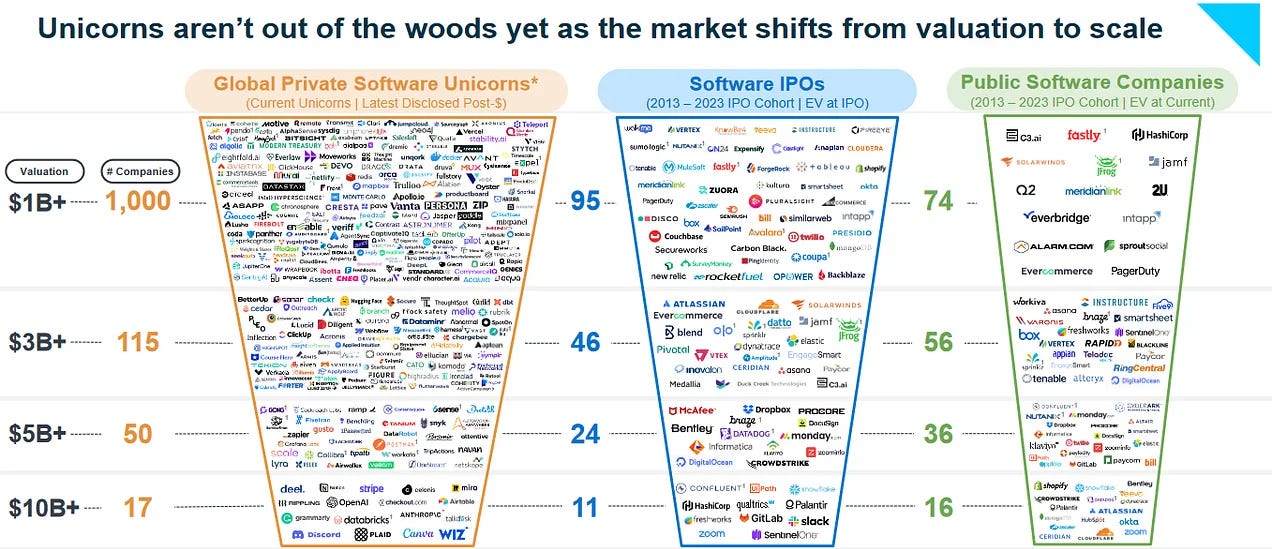

One of these false indicators is raising large amounts of money. We have lots of “unicorns” and aspiring unicorns that have raised lots of money with relatively little revenue.

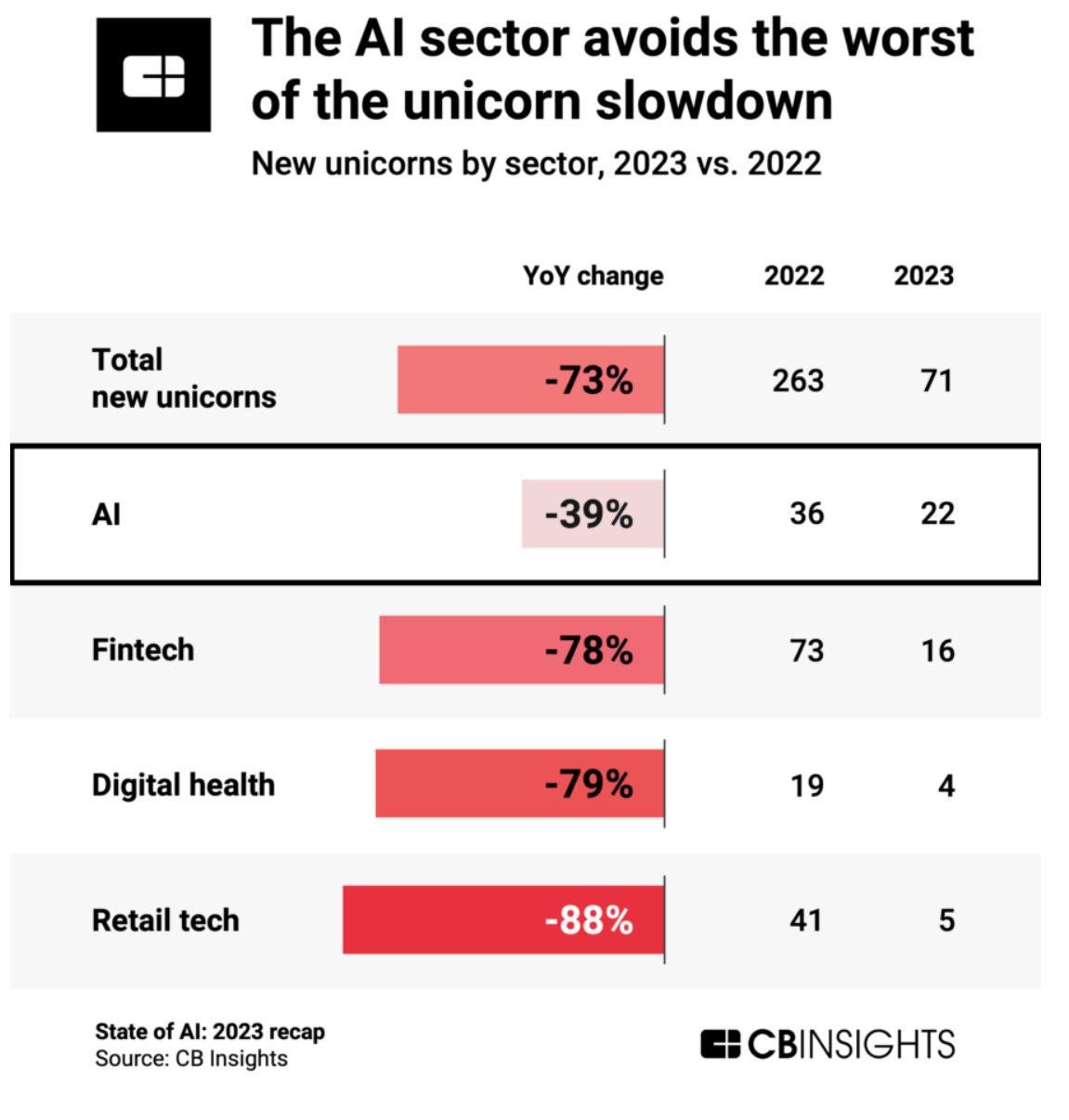

Most of these unicorns raised enormous amounts of money in the good times of 2021. We are seeing the same thing today with AI companies. While newly minted unicorns fell dramatically in 2023, new AI unicorns fell the least and there continues to be huge AI fundraising rounds with really small revenue.

The issue with receiving a ton of money at very little revenue traction is the company’s perception that they have PMF figured out and they just need to scale and sell. Companies start thinking less about ICP (ideal customer profile) and PMF because they received a stamp of approval (via lots of money).

Making these problems worse is the expectations. When you receive a ton of money at a huge valuation relative to your size there is a ton of pressure to grow into that valuation and become a big company.

Death by expectations.

All of the sudden there is no time to pivot, no time to not build the sales team and sell, no time to focus on PMF, etc. The perceived time pressure to be great can kill the company because the focus turns quickly to scaling.

There certainly should be a sense of urgency, but the urgency should prioritize getting to and maintaining PMF first. Everything else should follow that.

Takeways

Product-market fit is not a startup problem, but something every single company needs to be thinking about. This is especially true during the current AI technology shift.

At least it’s easier for startups to know they don’t have it and adjust. Larger, well-funded companies may take a long time before realizing they have a PMF problem (because they lost it). And by the time they realize it the competition is eating their lunch.

When PMF is missing or lost then the financials (unit economics) start to worsen. And if PMF isn’t addressed soon the financials will turn bad really fast as things spiral out of control.

Footnotes:

From our sponsor TigerEye: Watch an on-demand webinar with co-founder and CEO Tracy Young on how sales and finance teams are using TigerEye for planning

Join the community by becoming a paying subscriber and get access to me and other finance leaders in software companies! Ask questions, get answers, and communicate with your peers.

Sponsor OnlyCFO Newsletter and reach 19k+ CFOs, CEO, and other leaders in the software industry.

💯Turning a blind eye to the harsh truth is a recipe for disaster.

This is full of value! So beginner-friendly😎