Navan Files to IPO!

IPOs are heating up and the IPO window is wide open

Today's newsletter is brought to you by Brex, the intelligent finance platform.

Your guide to faster AI results.

“So what’s our AI strategy?” Every board asks it, every LinkedIn post oversells it, and CFOs are left to separate hype from reality. Brex’s CFO Guide to AI Strategy gives it to you straight: the real strategy is faster adoption — cutting busywork so finance teams can focus on impact. Learn how to plan, budget, and accelerate AI in finance to automate 71% of expenses and close the books 3x faster.

📊 Navan’s Key Metrics

Revenue

Scale: $688M ARR (based on Q2 FY26 revenue)

Growth: 30% YoY as of Q2 FY26. Down from 34% revenue growth one year ago.

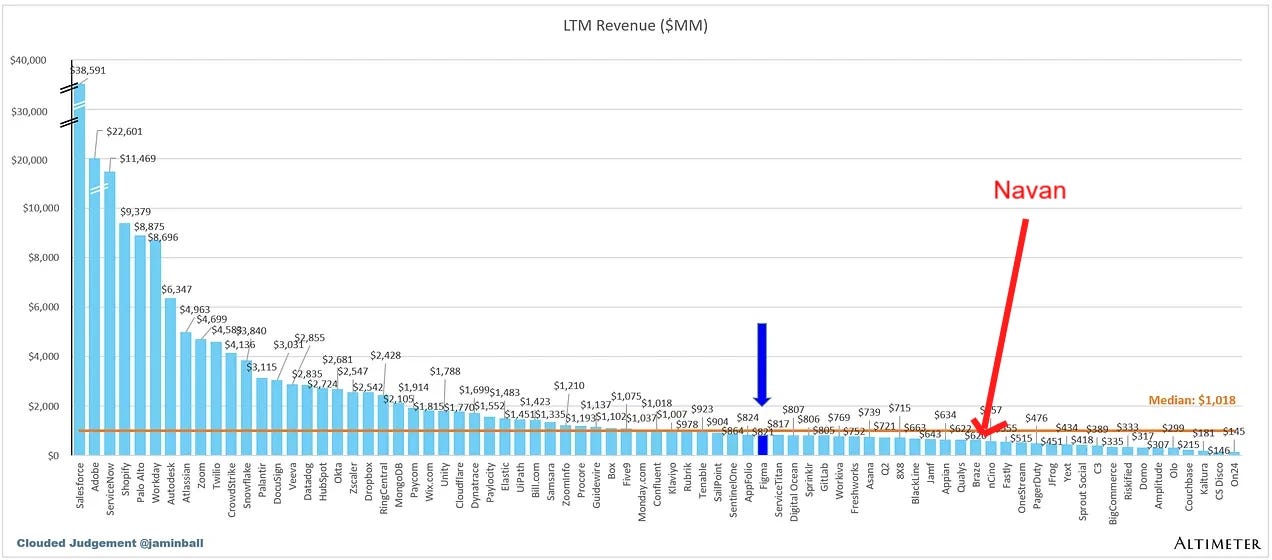

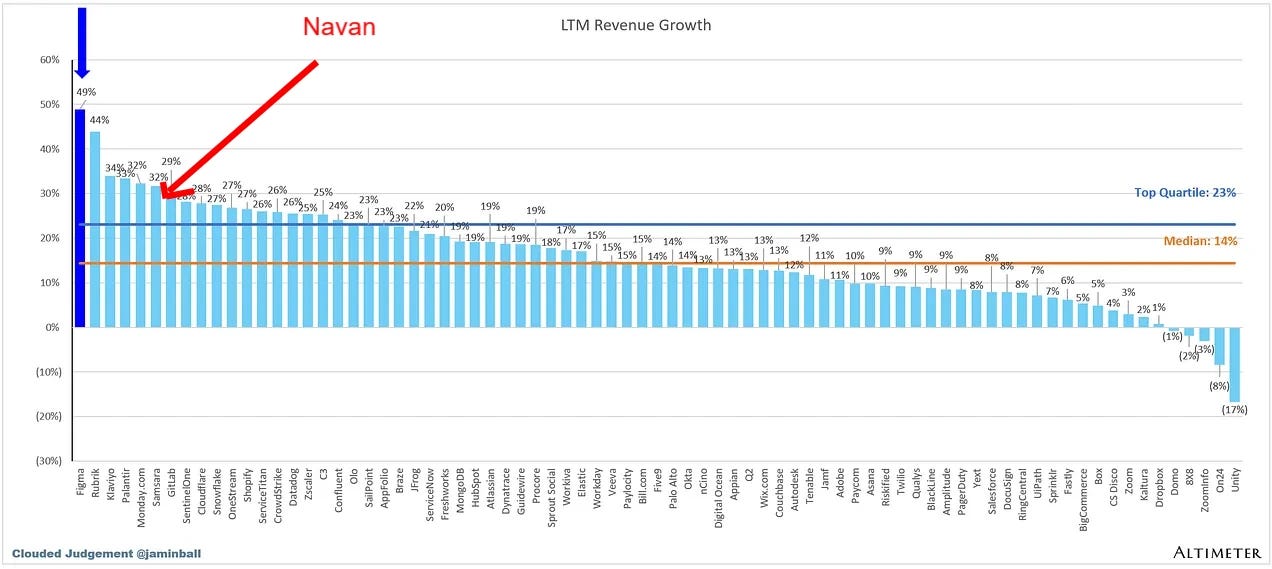

Navan will have a top 10 growth rate of public companies, but…at the low end of revenue scale. Below is public company LTM revenue data from when Figma went public 2 months ago (blue arrow is Figma).

At $613M in LTM revenue, Navan is bottom quartile in terms of scale, which makes its top 10 revenue growth less exciting, but still strong.

Retention

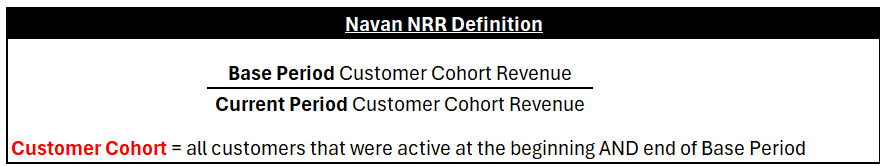

I summarized how Navan calculates NRR below:

The deviation from most definitions is that to be counted as a customer in the base period of the NRR definition the customer must be active for the entire year. I don’t hate this definition for a primarily usage-based company like Navan, it’s just a more lagging way to define NRR.

Net Revenue Retention (NRR): All we know is NRR was above 110% for the periods presented. On the low-end, 110% is fine but not great. Hopefully it is a bit higher than that but I wouldn’t expect it to be much higher given overall growth of just 30%.

You can see the NRR benchmarks below. Navan is at least above the median.

Efficiency

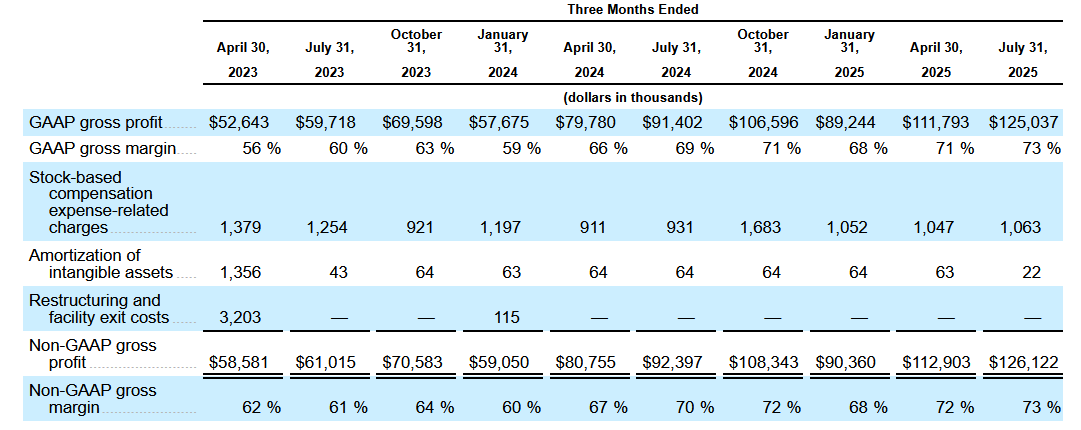

Gross Margins: 73%

Navan certainly doesn’t have the highest gross margins given its fintech and travel management offering is going to be lower gross margin. But…they have made HUGE improvements in the last 2 years and increased gross margins by 11 percentage points.

These gross margins look much more like typical cloud gross margins. So will they get the higher revenue multiple that comes with higher potential FCF margins?

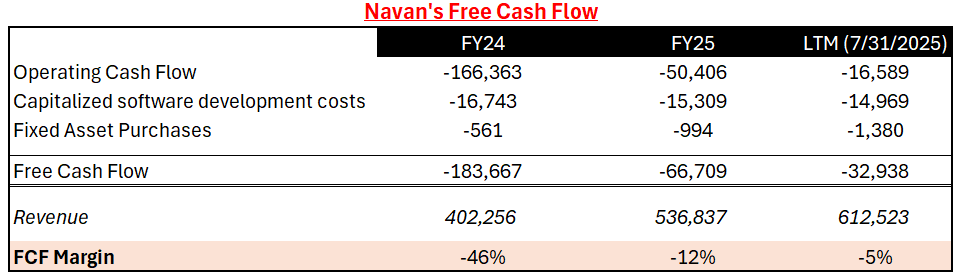

Free Cash Flow: -5% FCF margin

Navan is still burning cash. Unlike most tech companies, Navan doesn’t discuss or report free cash flow in their S-1 which seems a bit odd to me. So I built the table below to show FCF margin.

While they have made great progress toward breakeven, Navan is still burning money.

-5% FCF margins would put Navan in the bottom quartile of public companies (see below), but given their rate of improvement I would expect that will be FCF positive over the next year.

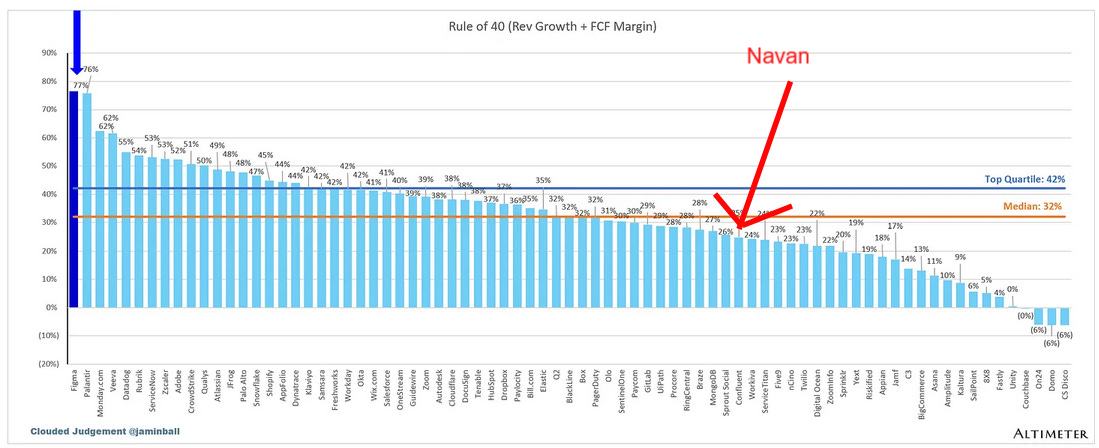

Rule of 40 Score

Rule of 40 Score: 25% (30% growth + -5% FCF margin)

A Rule of 40 Score of 25% is not great. And it’s pretty far below the median of 32% (near bottom quartile).

The story public market investors are going to be looking for is one of VERY strong revenue growth endurance. Can Navan possible reaccelerate growth? And how profitable can a company like Navan become?

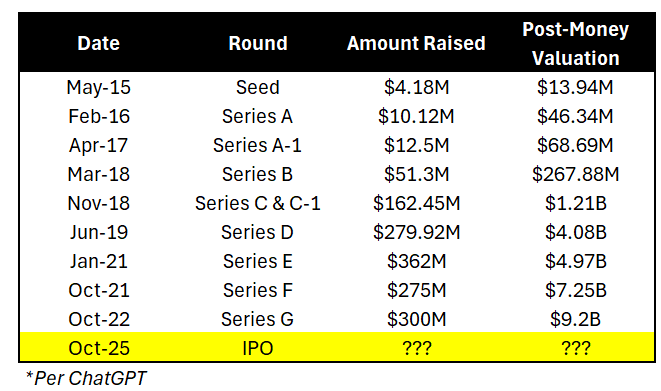

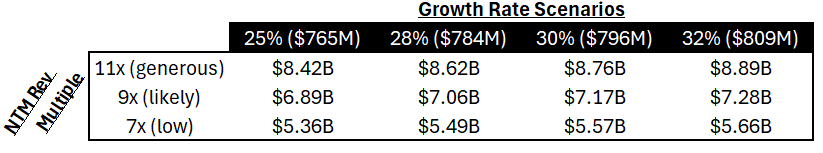

Navan’s Valuation

Per ChatGPT, below is Navan's fundraising and valuation history. They last raised during the good days of ZIRP at a $9.2B so they definitely have this last watermark in mind.

Navan won’t get a high-growth, pure software revenue multiple. Because that is not who they are.

Growth is decent for their scale, but not top decile.

Rule of 40 Score is clearly on the low side (nearly bottom quartile)

Gross margins have improved but will remain lower compared to traditional software

More AI risks to revenue growth than most companies

The IPO valuation is going to come down to the story they tell and how much excitement they can drum up. Longer-term, all eyes will be on revenue growth endurance.

Other Interesting S-1 Stuff

Gross Margin Improvement

Gross margins were clearly a focus area for Navan. They knew they had to improve it before going public. Otherwise they would have taken a major hit on valuation.

Good for them on improving it so much over the past two years.

Navan credits most of the gross margins increase to holding customer support costs flat as their AI-powered customer support is now handling 50% of user interactions while maintaining a CSAT score of 96%. AI is driving real efficiency!

Pretty impressive actually…

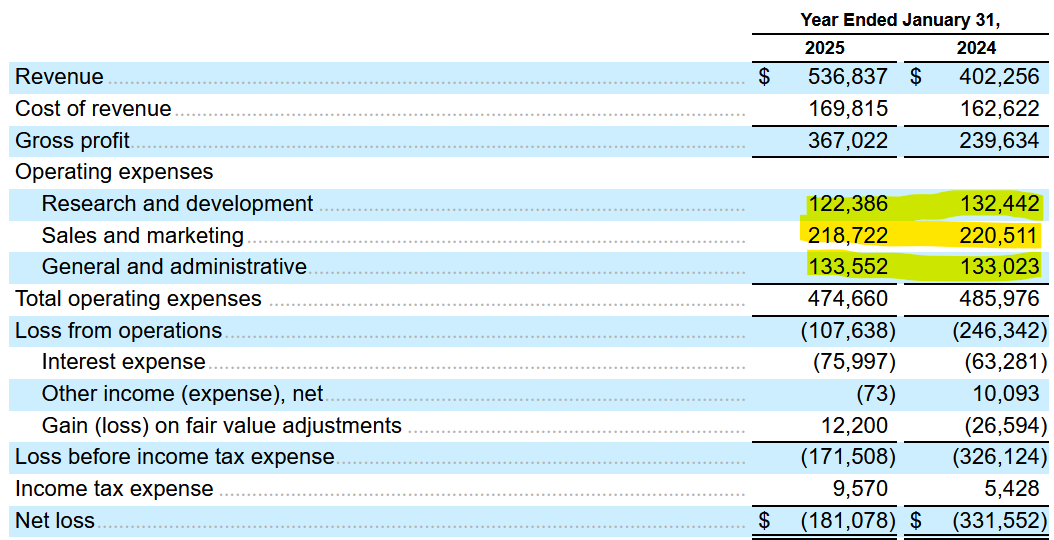

Cost Cutting

Navan needed to get more efficient ahead of an IPO, which I am sure is a big reason for why they put prior IPO plans on hold. Navan performed some layoffs and other restructuring to lower costs.

R&D Cost Cutting

Navan stated that the driver of the $10M decrease in R&D came from a decrease in salaries and related benefits of $13.4 million driven by a reduction in headcount

They cut headcount and maybe moved some more R&D heads overseas to save on costs.

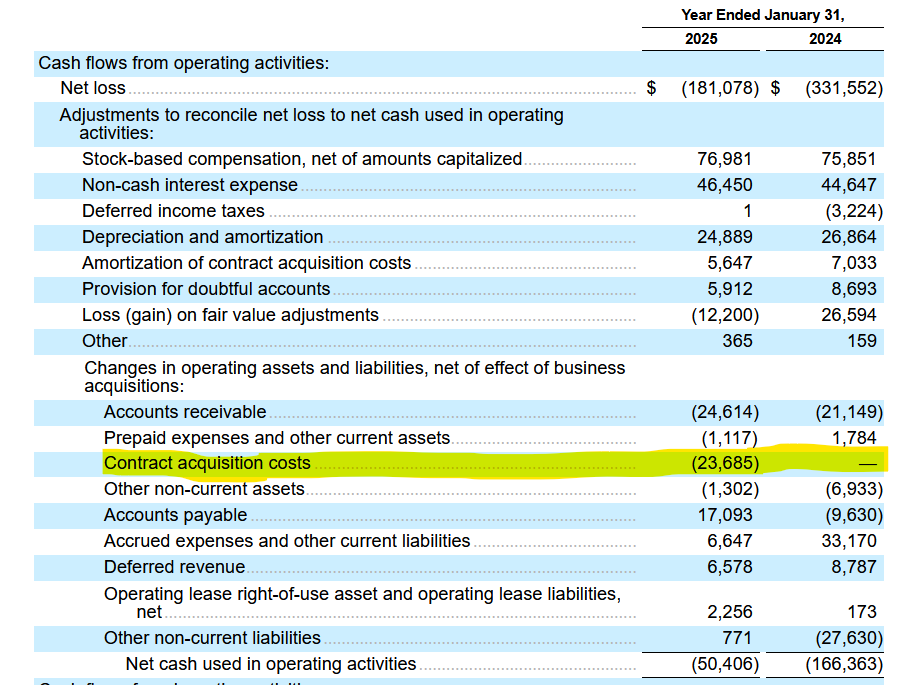

S&M Cost Cutting - Maybe?

The reduction here was mostly an artificial accounting one. Sales commission expense declined by $13.7M because of a change in their sales commission plans that allowed them to capitalize commissions versus expensing it.

You can see this in the statement of cash flows that shows nearly $24M of sales commissions being capitalized in FY25 versus $0 net change in the prior year.

Either way though, Navan decreased S&M true costs as a percentage of revenue.

Navan Stock Option Repricing

Most companies that raised at massive valuations in the ZIRP era have deep underwater stock options (i.e. stock option grants were really high relative to their current valuation)

Most companies at least considered repricing existing stock options to the current 409A valuation to retain talent and give employees more upside.

Navan repriced stock options for over 2K employees in July of 2024 to the new 409A FMV of $16.26. I don’t know how high Navan’s 409A price for after their last $9.2B Series G round, but I would guess that their common stock price came down 40-50%.

That is some major additional upside for employees because of the repricing!

I liked that they did this…

Prior Termination of IPO Plans

Navan wrote-off $3.8M of deferred offering costs in FY24, which means that Navan was prepping for an IPO two years ago but called it off.

The market was obviously not ready back then and Navan wasn’t ready yet either.

Final Thoughts

I am rooting for all tech companies (especially in the finance space :) so I hope they do well! Navan seems like they can benefit from an AI future, but there are some obvious risks as well.

What Navan will need to prove is that they can have strong growth endurance (would like to see 25%+ growth for several years) while continuing their FCF margin improvement trend.

Good luck Navan team!

Footnotes:

Download this free CFO Guide to AI Strategy (from Brex)

*Nothing in this article constitutes legal, tax, or investment advice.

Great analysis. How common is it for software or SaaS companies to capitalize sales commissions? What are the implications of doing it in your opinion?